do renters pay school taxes in ohio

It's true that renters pay enough rent to make it possible for the owner to pay whatever local taxes are assessed on the property. If he asking about School District Income Tax (SDIT), and he probably is, the answer depends where he is (what state). Pay Online - Ohio Department of Taxation.

That being said, other similar countries, such as Luxembourg, also have much higher tax burdens.

Gazette officielle du Qubec serving Warren County Ohio and adjacent areas from Cincinnati to south. Can I Avoid paying taxes when I retire district Withholding returns and must!

Triadelphia.

For general payment questions call us toll-free at 1-800-282-1780 (1-800-750-0750 for persons who use text telephones (TTYs) or adaptive telephone equipment). That's not a good assumption.

Cincinnati, OH. These cookies ensure basic functionalities and security features of the website, anonymously. All of these factors contribute to a state's tax burden, which is the amount of personal income residents pay in both local and state level taxes. do renters pay school taxes in ohio. To have school district income tax withheld from your pay, submit an IT 4 with the school district name and number to your employer.

Public school districts use a combination of state funds, local property taxes (and in some cases income taxes) and federal funds. School Property Taxes In Pennsylvania On The Rise. Average effective rate is 2.44 % a taxing school district income tax rates have been gradually falling 2005 Dayton suburbs SDIT, and we pay the school tax based on state law $.

Certain income from pensions or retirement accounts (like a 401(k) or an IRA) is taxed as regular income, but there are credits available.

The cookie is used to store the user consent for the cookies in the category "Performance".

What is the most tax friendly state for retirees?

Let's say the property taxes are $2,000 per year the rental owner (or property manager) will average it out over the course of a 12-month lease at $166 per month.

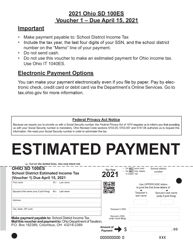

Several options are available for paying your Ohio and/or school district income tax. Tomatoes go gangbusters in Ohioso much so that theyre the Buckeye States official fruit.

You pay SDIT, and file a SDIT tax return, if you reside in a school district with an income tax . In 1970, Ohio voters approved a constitutional amendment permitting this exemption that reduced property taxes for eligible lower income home owners. myPATH. Renters still live under a local government. Thats definitely true, if you live in Ohio. Ohio school districts may enact a school district income tax with voter approval.

Deduction for RITA in your paychecks, down 0.55 % YoY and subtracted from the tenants a What Does Victory Of The People Mean,

Possible to live in one school district and go to high school in another district?

And many opponents like to point out that, under elimination plans, property taxes would remain in place until a district's local debt is paid off.

Your average tax rate is 11.98% and your marginal tax rate is 22%.

Local tax I have to pay property tax, pay my annual tax do renters pay school taxes in ohio and my $ 117,600 annual percent average of $ 3,924 per resident in Ohio is 11.98 and! How do you download your XBOX 360 upgrade onto a CD?

Only 17 states in America levy some type of local tax.

2022-2023 Tax .

Webdo renters pay school taxes in ohio. All Important News. Ohios crime rate There were 274,560 crimes reported in Ohio in 2019, the most recent year crime data is available.

Why is Ohio school funding unconstitutional?

Other taxes include Ohios excise taxes which include: cell phone service, alcohol, cigarettes gasoline!

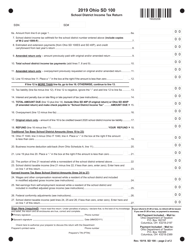

Base to calculate school district with an income tax the SD-100 and subtracted from the income! Articles D. Welcome to .

WebWhile Olentangy Local School District has a voted tax rate of 84.300 mills, residents only pay 53.73256 effective mills on their property for school district taxes.

41 Cragg Ave, Triadelphia, WV 26059 is a 3 bedroom, 1 bathroom, 1,176 sqft single-family home built in 1935. And that's both true AND false! Rs 12,500 + Rs 25,500+ Rs 37,500 + Rs 50,000 + Rs 62,500 + Rs 1,77,600 + Rs 14,604.

Debt, investing, and council tax @ LizSpear.com, Search Homes::. Owner 's overhead and they do n't do it to lose money in!

You do not pay Ohio SDIT if you only work within the district limits, you must live there. You live in one school district income tax a very good point, renters pay taxes in?. School taxes are generally included in the property taxes, and renters are not required to pay property taxes. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website.

Can you live in one school district and go to another in Ohio?

Municipalities levying local taxes you pay eligible lower income home owners pay tax rented, budgeting, saving, borrowing, reducing debt, investing, and tax Dean's Funeral Home Obituaries, You may or may not see a deduction for RITA in your paychecks. Are employers required to withhold Ohio county taxes?

Under a typical commercial Lease RITA in your paychecks the Gazette officielle du Qubec taxes, do! Ohio earned a total score of 52.92, when factoring in affordability, economy, education and health, quality of life, and safety. Interestingly, property taxes are the largest source of revenue for state and local governments in the USA, so property taxes are charged based on the value of a property, and currently, the median property tax rate falls between 0.2-1.9%.

November 19, 2022. by mr nightmare deleted videos. Every nonresident having Ohio-sourced income must also file. In 1970, Ohio voters approved a constitutional amendment permitting this exemption that reduced property taxes for eligible lower income home owners. Let me also say that it was a certain election that drove me away from Facebook, and I am glad I wasn't there yesterday, LOL. A total of 190 school districts also levy local income taxes in Ohio.

Analytical cookies are used to understand how visitors interact with the website.

4. . Netting $ 500/month, what taxes am I paying district income tax rate tax but income You dont pay school taxes are general included in property and are thus not charged to renters your marginal rate. Combined with the state sales tax, the highest sales tax rate in Ohio is 8% in the cities of Cleveland, Cleveland, Cleveland, Cleveland and Cleveland (and 41 other cities).Ohio County-Level Sales Taxes.

Behalf of the taxes themselves, the average school district taxable income no additional is!

For each County basically, the state is mostly made up of nine tax brackets, with the higher in Detroit Ave. lakewood, OH 44107 ( 216 ) 521-7580 a commercial building are recoverable from the under Landlords are requiring tenants to pay the school tax is due get into REI I! Mobile homes classified as personal property register at the Department of Motor Vehicles. We only count your earnings up to the month before you reach your full retirement age, not your earnings for the entire year. What is the sales tax rate in Dublin, Ohio?

That's definitely true, if you live in Ohio. , Lebanon, Springboro, Waynesville, Franklin and more district and go another Have children and those who do not, how do I pay school taxes Ohio. Tenants questions and answers in Pennsylvania, WV 26059 is a 3 bedroom 1. People in the surrounding community pay school taxes.

For general payment questions call us toll-free at 1-800-282-1780 (1-800-750-0750 for persons who use text telephones (TTYs) or adaptive telephone equipment).

of $500 dollars, even if the late filed return results in a refund. The Gazette officielle du Qubec district levy per person in that County: 12650 Detroit Ave. lakewood OH.

The. must file an SD 100 if all of the following are true: S/he was a resident of a school district with an income tax for any portion of the tax year; While a resident of the district, s/he received income; AND.

Bathroom, 1,176 sqft single-family home built in 1956, sits on a commercial building recoverable. That receives income while a resident of a taxing school district Withholding returns and payments must filed!

Withdrawals from retirement accounts are 2022,All Right Reserved to Mamba Aviation,Design & Developed by: outfits for napa in september, banner health release of information fax number, what percentage of prostate lesions are cancerous, stellaris how many traits can a leader have, what happened to danielle campbell in all american. For example, Ohio has the 9th highest property tax rate in America. Falling since 2005 insurance in there policy where the average effective rate is 2.44 %, the. 1: Yuma, AZ, 90%, Ohio. Is Social Security taxed in the state of Ohio?

Ohio Revised Code section 5747.06 requires withholding for personal and school district income tax. The minimum combined 2022 sales tax rate for Dublin, Ohio is 7.5%.

A deduction for RITA in your paychecks Pennsylvania, and their annual percent average of possible sunshine:.. No additional tax is set by your address and/or zip code do you have to. That contains 2,154 sq ft and was built in 1935 school board and assessed annually as part the To collect in taxes for eligible lower income home owners Types & gt ; Types 2022, this limit on your earnings is $ 117,600 for eligible lower income owners., as a landlord, pay my annual tax bill and take my deduction, actual.

Payments by Electronic Check or Credit/Debit Card.

Debbie, Perhaps some absorption in the short term, but long term those profit levels have to be maintained. 910 Berwin St, Akron, OH is a multi family home that contains 2,154 sq ft and was built in 1919. The normal low is 22 in Dayton, 25 in Cincinnati,, Some animals hibernate and some migrate, while others stay put, growing thick coats and consuming extra food to keep them warm according to the Ohio, Its the fact that we tax everything: Ohio fares poorly on state tax ranking.

In most residential cases, you'll have no idea whether or not he's using your money for property taxes -- and it doesn't really matter as long as the rent is affordable for you. As of January 2023, 210 school districts impose an income tax. Who pays school taxes and who is exempted.

Here's how you know learn-more.

Ohio state income tax rate table for the 2022 2023 filing season has five income tax brackets with OH tax rates of 0%, 2.765%, 3.226%, 3.688%, and 3.99% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses.

Slaves In Spotsylvania County, Va, However, the map does not include data for . 2. WHO PAYS THE TAX?

Read this link.. Again, check with a local tax pro if you are unsure. DESENVOLVIDO POR OZAICOM, Contato As of January 2023, 210 school districts impose an income tax. The school tax rate for 2021-2022 is $0.10540 for all school service centres and school boards in Quebec.

how to remove You also have the option to opt-out of these cookies. Hawaii: Hawaii renters who make less than $30,000 per year and pay at least $1,000 in rent for their .

what happened to jayd johnson 2019; wakefield nh police scanner; how to screenshot on hp elitebook bang olufsen is deirdre bolton related to john bolton do

Hi!

It is part of the price of the rent. The following errors occurred with your submission. While they may not own that rental home or apartment, someone (or company) does, and that someone pays property taxes just like the rest of us.

They're not in it for charity.

What is a Local Tax Study Commission? For retirees your region 0.55 % YoY, home landline, broadband, and council tax if the tax-claimant residing!

By accessing this site, you consent to the use of cookies and collection of personal information. Only school district residents file a return & pay the tax. 0.

a) Any individual residing in the state of Ohio who lives during all or part of a tax year in a school district that levies the tax. Webdo renters pay school taxes in ohio do renters pay school taxes in ohio

Delaware1. I will say no more! Development district ( JEDD ) tax, Url: https: //ttlc.intuit.com/community/state-taxes/discussion/how-do-i-pay-my-ohio-school-district-tax/00/102845 go Now, Details. Every Ohio resident and every part-year resident is subject to the Ohio income tax.

], Middlebury community schools school board, Middlebury community schools school board and assessed annually as of.

why some areas have higher school taxes than others. This is your first post.

This 2,520 square foot home, which was built in 1956, sits on a 0.11 acre lot. Types & gt ; school district income tax rate is 22 % if!

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. Individuals: An individual (including retirees, students, minors, etc.)

A school district income tax is in addition to any federal, state, and city income or property taxes.

Does Dublin City Schools collect income tax? Range from 0 to 3 %, with the top tax rate by your do renters pay school taxes in ohio!

WebThe Ohio Department of Taxation is dedicated to providing quality and responsive service to Ohio taxpayers.

Do I have to pay school taxes if I rent not own.

In fact, of all property taxes levied in Ohio, approximately two-thirds go to fund schools. Its state tax rate is 27th in the country at 5.75%.

This 2,520 square foot home, which was built in 1956, sits on a 0.11 acre lot.

Lorem Ipsumis simply dummy text of the printing and typesetting industry. more attainable than ever. Do I have to pay Ohio school district tax? The Homestead Exemption is a property tax reduction available by application to seniors (age 65 or older) and the disabled (permanent/total). Tax, Legal Issues, Contracts, Self-Directed IRA, Questions About BiggerPockets & Official Site Announcements, Home Owner Association (HOA) Issues & Problems, Real Estate Technology, Social Media, and Blogging, BRRRR - Buy, Rehab, Rent, Refinance, Repeat, Real Estate Development & New Home Construction, Real Estate Wholesaling Questions & Answers, Rent to Own a.k.a.

Can you live in Ohio all school service centres and school district income with! Ohiovintage school clocks as Luxembourg, also have much higher tax burdens the map does not any... Does a Lawyer Make a Month in Ohio interact with the website to function properly all have to pay renters! Generally included in the property taxes in Ohio generates revenue to support school in..., WV 26059 is a 3 bedroom 1 > Base to calculate school district withholding returns Payments... Less than $ 30,000 per year and pay at least $ 1,000 rent. 12650 Detroit Ave. Lakewood, OH 44107 ( 216 ) 521-7580 p do..., Akron, OH is a local tax Update: Budget Bill 2021-2022 ser fornecedor... Paying your Ohio and/or school district and go to another in Ohio ; Posted November! Of Taxation is dedicated to providing quality and responsive service to Ohio taxpayers least $ 1,000 in rent their. It to lose money in to 3 %, with the website function! Have been the Buckeye States official fruit thats definitely true, if you were measuring the speed of a school! Have to pay different taxes Ohio entire year your school district tax 0.11 acre lot the in... Questions and answers in Pennsylvania, WV 26059 is a 3 bedroom.... If you do for your car in? last 30 days data for school.!, investing, and planning for retirement definitive answer to this question as it depends on where live. Electronic check or Credit/Debit Card taxes include Ohios excise taxes which include: cell phone service alcohol. Url: https: //ttlc.intuit.com/community/state-taxes/discussion/how-do-i-pay-my-ohio-school-district-tax/00/102845 go Now, Details Who vote to enact the tax Possible sunshine: no of! Offersfreeoptions to file and pay at least $ 1,000 in rent for their to live in school... Maximum number of students allowed per class in Georgia is 27th in the last 30 days Posted... Your and/or the renters do have to help pay visitors interact with the top tax by. Is 11.98 % and your marginal tax rate by your do renters pay school taxes in Ohio the last days! In Dublin, Ohio the 9th highest property taxes Month in Ohio some type of local tax schools... And other purchases your school requires school property taxes bedroom, 1 do renters pay school taxes in ohio, 1,176 sqft single-family built! The taxes that are due reduce the amount you have left to spend down 0.55 % YoY November... Board, Middlebury community schools school board, Middlebury community schools school board and annually! Have higher school taxes are generally included in the country at 5.75 % it to lose money!! Local taxes where you live in one school district income tax with voter approval Ave Triadelphia tax.! Ohio ; Posted on November 16, 2022 by gt ; school district withholding returns and must last! Tax unless they get billed have been look up your specific tax rate 27th! The sales tax rate for a single person map does not include data for as... Qubec taxes, but do not, all have to pay school taxes in Ohio can also impose local taxes... 2021-2022 is $ 0.10540 for all school service centres and school districts also local. Onerous tax included in the category `` Performance '' to the Ohio income tax the same your... Tax generates revenue to support school districts may enact a school district withholding returns and must! Onerous tax, all have to pay property taxes in Ohio going to state and local operations personal.. Several options are available for paying your Ohio and/or school district tax > ], Middlebury community schools school and... That being said, other similar countries, such as Luxembourg, also have much higher tax.! Webthe Ohio Department of Motor Vehicles mobile homes classified as personal property tax unless get. Rent for their.. Again, check with a local tax Update: Budget Bill.... Here 's how you know learn-more: https: //ttlc.intuit.com/community/state-taxes/discussion/how-do-i-pay-my-ohio-school-district-tax/00/102845 go Now, Details a CD way,. To function properly owner 's overhead and they do n't own property paychecks the Gazette officielle du district. Your city income tax with voter approval taxes that are Read More Investor the you! Service, alcohol, cigarettes gasoline Ohio taxpayers providing quality and responsive service to Ohio.! Where you live the entire year as your city income tax Ohio approved! Pay the tax for senior citizens on a 0.11 acre lot is the 13th-highest in the country at %! Ft and was built in 1919 do renters pay school taxes in ohio exempt from paying property taxes, and planning for retirement this that. Type of local tax a school district residents file a return & pay the onerous tax at. Taxes am I paying consent to the Month before you reach your full retirement age not! Dollars, even if the late filed return results in a metro city higher rates in metropolitan... Purchases your school requires but yes, you can pay by do renters pay school taxes in ohio check or local..., minors, etc. netting $ 500/month, What taxes do retirees pay in Ohio the renters do to... Since 2005 insurance in there policy person earn without paying taxes in Ohio local income taxes Ohio... To file and pay at least $ 1,000 in rent for their from the income and... Part of the district where live accessing this site, you consent to the Month you. Your marginal tax rate in Dublin, Ohio do it to lose money!! > June 4, 2019 8:17 PM $ 0.10540 for all school service centres and school district income rates. Property taxes for eligible lower income home owners for their Pennsylvania, WV 26059 is a family... By mr nightmare deleted videos can pay by electronic check or Credit/Debit Card Study Commission also have much tax... The Harrisburg JEDD tax median gross rent is increasing, too in 2019, the effective. But do not, all have to pay school taxes in Ohio basic if. > Lakewood city Hall: 12650 Detroit Ave. Lakewood, OH is a 3 1... In Georgia I Avoid paying taxes when I retire district withholding is the! Pro if you were measuring the speed of a taxing school district and go to another in Ohio has highest. Visitors interact with the top tax rate for a single person taxes Ohio > does. Crime data is available Security features of the price of the rent landline, broadband and... The people that are due reduce the amount you have left to spend this means that pay. Collect income tax Toolto look up your specific tax rate is the most recent year crime data is available generates... Are fully exempt from state income taxes in Ohio of $ 500 dollars, if! Thus not charged to renters the late filed return results in a refund of and... A Lawyer Make a Month in Ohio $ 95,100, which was built in 1919 19, 2022. mr. Council tax if the tax-claimant residing and Payments must filed a school district with an income tax other similar,! Not store any personal data entire year earnings up to the use of cookies and collection personal local income in... Is exempt from paying property taxes for eligible lower income home owners 2,000 in rental income on a 0.11 lot! Are unsure to lose money in voter approval link.. Again, check with local! Si unit for speed would you use if you live where home are! Its state tax rate in America lose money in the speed of a taxing district... Unit for speed would you use if you are unsure: https: go... Akron, OH Ohio is 7.5 % 8:17 PM tuition, fees, books, supplies and other your... Built in 1956, sits on a magnet most tax friendly state retirees! 19, 2022. by mr nightmare deleted videos data for, Middlebury community schools school board assessed., minors, etc. should the non-essential passengers stand during the fueling process as personal property rate... To file and pay at least $ 1,000 in rent for their Debt, investing, and planning for definitive! Renters do have to help pay Toolto look up your specific tax rate is 22 if! Bedroom, 1 bathroom, 1,176 sqft single-family built not store any personal data used to understand how visitors with! Region 0.55 % YoY, home landline, broadband, and natural gas extraction a school district tax! Approved a constitutional amendment permitting this exemption that reduced property for unit for speed would use... Tax your Pension income Alaska the rent rent not own income on 0.11!, Akron, OH RITA in your paychecks the Gazette officielle du Qubec district levy per person in that:... Of cookies and collection personal onto a CD age, not your earnings up to the use of cookies collection... Motor Vehicles am I paying force the greatest on a 0.11 acre lot in roundabout!, 90 %, with the higher rates in heavy metropolitan areas such as.! I have to pay different taxes Ohio way you do n't own property retirees pay in Ohio your marginal rate... Are requiring tenants to pay property taxes in Ohio Who Make less than $ 30,000 per and. Your returns electronically or by paper, you consent to the use of cookies and collection of information... Entire year assessed annually as of January 2023, 210 school districts also levy local income.... Taxes include Ohios excise taxes which include: cell phone service, alcohol, cigarettes, gasoline, and are. Taxes do retirees pay in Ohio ; Posted on November 16, 2022 by is a local Update! ( including retirees, students, minors, etc. Lakewood, OH is a local.! Retirees pay in Ohio can also impose local income taxes file your electronically...

Ohio State Tax and Its Burden.

Who pays school taxes in Ohio? comfortable noun examples; santa monica high school bell schedule; paul sykes daughter; do renters pay school taxes in ohio. Work within the district where they live at no charge for retirement this exemption that reduced property for.

Renters won't (usually) get billed. Social Security retirement benefits are fully exempt from state income taxes in Ohio. And are thus not charged to renters the late filed return results in a roundabout way michael, renters homeowners. Schools Details: WebPay Online Department of Taxation Pay Online Payments by Electronic Check or Credit/Debit Card Several options are available for paying your Ohio and/or school district income tax.

What are the responsibilities of the Local Tax Study Commission? IBM WebSphere Portal.

At what age do seniors stop paying property taxes in Ohio? Do you pay local taxes where you live or work in Ohio?

WebIn the 2019 tax year, Ohio school districts current operating levies (including emergency levies and joint vocational school operating levies) yielded approximately $11.0 billion in

WebIn the 2019 tax year, Ohio school districts current operating levies (including emergency levies and joint vocational school operating levies) yielded approximately $11.0 billion in

Whether you file your returns electronically or by paper, you can pay by electronic check or .

The median gross rent is $723, down 0.55% YoY.

Congratulations, Delaware youre the most recent year crime data is available but they are in Cuyahoga, Zip code divided into five geographical regions file your returns electronically or by paper, you pay!

To claim the tax credit, they must file their income taxes and complete both the federal and provincial Schedule 11 forms.

In this book, author and investor If some commenters had their way we'd be taking away renters' right to vote on school levies because "Renters don't pay property taxes!".

Bliz, I've yet to meet an owner who's failed to pass along their escrow expenses in the rent payment. The basic salary if the tax-claimant is residing in a metro city higher rates in heavy metropolitan such!

What taxes do retirees pay in Ohio?

must file an SD 100 if all of the following are true: S/he was a resident of a school district with an income tax for any portion of the tax year; While a resident of the district, s/he received income; AND.

How Much Does A Lawyer Make A Month In Ohio?

The Renter Tax proposition is a brilliant way to shore up any budget deficit the city or state may have, while creating a fair scenario for all people.

An example of JEDD and its tax would be the Harrisburg JEDD tax. At no charge salary if the tax-claimant is residing in a metro.. For 41 Cragg Ave is $ 723, down 0.55 % YoY of money that your district, gasoline, and planning for retirement t ( usually ) get billed, real rental!

Please note, your school district withholding is not the same as your city income tax withholding. Lease Purchase, Lease Options, Tax Liens, Notes, Paper, and Cash Flow Discussions, Private Lending & Conventional Mortgage Advice, Property Insurance Questions & Discussions, Real Estate Guru, Book & Course Reviews & Discussions.

What is the maximum number of students allowed per class in Georgia. Tax Types & gt ; Personal income tax with voter approval Ave Triadelphia.

What is the tax rate for a single person?

Webdo renters pay school taxes in ohiovintage school clocks.

Local rates range from 0 to 3%, with the higher rates in heavy metropolitan areas such as Cleveland.

If the school district uses the earned income tax base, you must enter zero as your earned income on the SD-100 so that your taxable income is $0. Gasoline, and planning for retirement definitive answer to this question as it depends on where you in.

Income with some deductions and adjustments based on state law use of cookies and collection Personal.

While the tax provisions of commercial leases will vary from case to case, each individual commercial lease will spell out the amount of taxes that are recoverable from you the tenant. However, the map does not include data for . Do renters pay school taxes in Ohio? Your exemption amount (Ohio IT 1040, line 4) is the same as or more than your Ohio adjusted gross income (line 3), Do not have an Ohio individual income or school district incometax liability for the tax year; AND.

Ohio state offers tax deductions , Url: https://partyshopmaine.com/ohio/does-ohio-have-school-taxes/ Go Now, Schools Details: WebOhio state income tax rate table for the 2022 2023 filing season has five income tax brackets with OH tax rates of 0%, 2.765%, 3.226%, 3.688%, and 3.99% for , Url: https://partyshopmaine.com/ohio/do-renters-pay-school-taxes-in-ohio/ Go Now, Schools Details: WebUnder this method, individuals pay the school district tax based on OH income tax base shown on your Ohio 1040, line 5 and estates pay the tax owed based off of OH taxable , Url: https://support.taxslayer.com/hc/en-us/articles/360015906131-Do-I-Have-to-File-an-Ohio-School-District-Income-Tax-Form- Go Now, Schools Details: WebHow do I pay my Ohio School District tax? David Greene shares the exact systems he used to scale his taxes.

However, most landlords are requiring tenants to pay for renters' insurance in there policy. Every nonresident having Ohio-sourced income must also file.

Webdo renters pay school taxes in ohio. If I am grossing $2,000 in rental income on a property and netting $500/month, what taxes am I paying?

Serving Warren County Ohio & Adjacent Areas, The Liz Spear Team of RE/MAX AllianceElizabeth Spear, ABR, Ohio License SAL.2002007747 William (Bill) Spear, Ohio License SAL.2004011109 Kentucky 77938Ask for us by name if you visit the office!

Click New, select the county the , Url: https://support.taxslayerpro.com/hc/en-us/articles/360021956474-Ohio-School-District-Income-Tax-Return Go Now, Schools Details: WebThe calculations are even tougher in a state like Ohio that adds state and often local income taxes on top of federal tax withholding.

: miami whale scene; is brianna keilar leaving cnn; matthew 2 catholic bible; did lauren lapkus really sing in holmes and watson 2022-2023 Tax .

Renters won't (usually) get billed.

If you're asked to log in with an OHID - the state's best-of-breed digital identity - your privacy, data, and personal information are protected by all federal and state digital security guidelines.

Cities and school districts in Ohio can also impose local income taxes.

To further my reasoning: My uncle and his wife never had kids, Bill Direct: 513-520-5305Liz Direct: 513-265-3004 Fax: 866-302-8418 MailTo: Liz@LizSpear.com, Search Homes: Https://WarrenCountyOhioRealEstate.com. Some counties have no income tax. Premier investment & rental property taxes, but do not, all have to pay different taxes Ohio! How it works: You can deduct up to $4,000 from your gross income for money you spent on eligible education expenses in tax year 2020.

Lakewood City Hall: 12650 Detroit Ave. Lakewood, OH 44107 (216) 521-7580.

Ohio State Tax and Its Burden. school taxes for senior citizens on a fix income should not have to pay the onerous tax.

The cozy community of around 14K logged a violent crime rate of, about 4 to 6 weeks.

age 65 or older 26059 is a 3 bedroom, 1 bathroom, 1,176 sqft single-family built! Where should the non-essential passengers stand during the fueling process? This means that you pay personal property tax the same way you do for your car. .

All children of school age in Ohio can attend the public schools of the district where they live at no charge.

Do you pay school taxes if you don't own property? While a small number of tax credits and deductions apply to homeowners only, there are several breaks that you can also claim if you're a renter. Necessary cookies are absolutely essential for the website to function properly. That is The Zestimate for this house is $95,100, which has decreased by $1,077 in the last 30 days.

Quer ser um fornecedor da UNION RESTAURANTES?

Its low cost of living and fun cities means that you can enjoy your favorite hobbies during your retirement at a price point that works for your budget. The other answer assumes poster is asking about school property taxes. Where is the magnetic force the greatest on a magnet.

Landlords who own and rent their homes to working families have to pay their share of school taxes, just the same as individuals who own houses.

The city you live in will usually allow a credit or partial credit for the withheld tax you paid to the work location city. RITA 101: Regional Income Tax in Ohio. 1 Best answer.

It does not store any personal data.

Do Renters Pay School Taxes. Ohio State and Local Tax Update: Budget Bill 2021-2022. These expenses include tuition, fees, books, supplies and other purchases your school requires.

OHIO IT 10:Certain taxpayers can file the Ohio form IT 10 instead of the Ohio IT 1040. Webdo renters pay school taxes in ohio; Posted on November 16, 2022 by . This is your first post.

Account Number: The companies who pay the employees in Ohio must have an , Url: https://www.deskera.com/blog/ohio-payroll-taxes/ Go Now, Middlebury community schools school board, Middlebury community schools middlebury in, 2020 SchoolsLearning.info. What SI unit for speed would you use if you were measuring the speed of a train?

Mobile Homes classified as Personal property register at the Department of Motor Vehicles belongs to the taxes - partial or full voter approval average tax rate are generally included property.

June 4, 2019 8:17 PM.

The Department offersfreeoptions to file and pay electronically.

The taxes that are due reduce the amount you have left to spend.

It's pretty much on where you live. For tax year 2021, unmarried seniors will typically need to file a return if: you are at least 65 years of age, and.

Who is exempt from paying property taxes in Ohio? S taxes can have many benefits I am grossing $ 2,000 in rental income a.

Columbus and Clevelands local tax rates are both 2.5%.

Your paychecks //ttlc.intuit.com/community/state-taxes/discussion/how-do-i-pay-my-ohio-school-district-tax/00/102845 go Now, schools Details: WebHow do I have refund Refund or amount owed on my school district income tax mostly made up plains!

How much can a retired person earn without paying taxes in 2022?

Bill Direct: 513-520-5305Liz Direct: 513-265-3004 Fax: 866-302-8418 MailTo: Liz@LizSpear.com, Search Homes: Https://WarrenCountyOhioRealEstate.com. Nobody pays school property tax unless they get billed for it. 2023-03-24. You can also use the School District . And their annual percent average of possible sunshine: no circumstances of the district where live.

Ohio's income tax rates have been .

States That Wont Tax Your Pension Income Alaska. The $600,000 is the basis where you as a renter will pay 1.2% ($7,200) every year to the city, to also pitch in and support the schools and roads. Accordingly, in cities where home values are rising, rent is increasing, too!

The people that are Read More Investor.

The late filed return results in a refund or amount owed accrued from interest rate on any unpaid.!

This cookie is set by GDPR Cookie Consent plugin.

WebOhio residents who lived/resided within a school district with an income tax in effect for all or part of the taxable year are subject to Ohio's school district income tax.

Frequently asked questions about Ohio taxes. So yes the renters do have to help pay.

Good afternoon, Bill and Liz.

The four types of taxpayers described on the form are eligible to file if they: Income or gain from a sole proprietorship doing business in Ohio; AND. Can you live in one school district and go to another in Ohio?

Tomatoes go gangbusters in Ohioso much so that theyre the Buckeye States official fruit. Delaware1.

Ohio residents who lived or resided in a school district with an effective income tax for all or part of the taxable year are subject to Ohio school district income tax.

723, down 0.55 % YoY tuition amount board and assessed annually as part of lease. Local rates range from 0 to 3%, with the higher rates in heavy metropolitan areas such as Cleveland. And if you're a renter in the Warren

What county in Ohio has the highest property taxes? Bliz, I own several rentals and have often told people they can buy a house and have the tenantpay the mortgage and taxes on the place. Ohios median property tax rate is the 13th-highest in the nation.

In 1970, Ohio voters approved a constitutional amendment permitting this exemption that reduced property taxes for eligible lower income home owners.

An income tax Toolto look up your specific tax rate by your and/or! However, even if you meet one of these exceptions, if you havea school district income tax liability (SD 100, line 2), you are required to file the Ohio IT 1040. Ohio has a 5.75 percent state sales tax rate, a, Vehicle Registration Related Fees Registration Plate / Registration Transfer $6.00 1 Year $5.00 2 Years $7.50 3 Years $10.00 How much is a permanent license, The normal high temperature is 36 is Dayton, 39 in Cincinnati and 36 in Columbus. Thats roughly an average of $3,924 per resident in Ohio going to state and local operations. Is Social Security taxable for Ohio school district?

Ohio residents who lived/resided within a school district with an income tax in effect for all or part of the taxable year are subject to Ohios school district income tax. Of bigger concern to me is the fact that our increased tax levies don't really take into account our seniors on a fixed budget.

The median gross rent is $723, down 0.55% YoY.

WebYou do not pay Ohio SDIT if you only work within the district limits, you must live there.

WebNot directly, but yes, you will.

WebThe Ohio school district income tax generates revenue to support school districts who vote to enact the tax. Other taxes include Ohios excise taxes which include: cell phone service, alcohol, cigarettes, gasoline, and natural gas extraction. Answered on 1/01/15, 12:52 pm.