does robinhood calculate wash sales correctly

If I had to calculate it manually transaction by transaction I would be doomed, but that's why I was asking if there was a way to see it directly with the totals of a specific stock. TD does not show the CUSIP for options either. Half the shares reported as sold for $1k loss.

Nope the broker has until mid February to put out the 1099-B and in that time they look for wash sales to adjust basis if the original poster would just STOP buying the B stock for 31 days all the prior unallowed wash sales would be released. This is a strong reason why this method of reporting should not have been allowed by the IRS. This could be years later, or never. You have clicked a link to a site outside of the TurboTax Community. This calculation resets when you close out of a position in its entirety (0 shares). WebThe 1099 that I received from Robinhood still has all the wash sale loss disallowed and when I looked in detail to the final sale of those stocks, the cost basis was not calculated You have to wait another year to get the resolution you are so dearly seeking. If you trade with two brokers, this can't happen if you trade the same security, so you are responsible to make the adjustments for disallowed loss. I spent my last 11 years at the I.R.S. Summary of my conversation so far: Me: I need more information to verify my 1099 Wash sales, please send a wash sale analysis report. January 19, 2023 By duncan hines chocolate cake mix instructions, A random, unique, device identifier, stored as a 3rd party cookie, used to enable targeted advertising, Collects data on user behaviour and interaction in order to optimize the website and make advertisement on the website more relevant.

You have to wait another year to get the resolution you are so dearly seeking. If you trade with two brokers, this can't happen if you trade the same security, so you are responsible to make the adjustments for disallowed loss. I spent my last 11 years at the I.R.S. Summary of my conversation so far: Me: I need more information to verify my 1099 Wash sales, please send a wash sale analysis report. January 19, 2023 By duncan hines chocolate cake mix instructions, A random, unique, device identifier, stored as a 3rd party cookie, used to enable targeted advertising, Collects data on user behaviour and interaction in order to optimize the website and make advertisement on the website more relevant. Curiously, Robinhood does not label the options trades or positions with a CUSIP, on the 1099, on the monthly statements, or on the trade confirmations. They include futures, broad-based indexes and non-equity options. }); It could be 32%, depending on your total income and filing status, but it could be anywhere from 10% to 37%. Many beginners in the stock market have losses simply because they are new at investing and arent sure about the When you enter summary data only, you are required to send a copy of your 1099B to the IRS. To Know how much your capital gain or loss. Photo Illustration by Rafael Henrique/SOPA Images/LightRocket via Getty Images. } If you sell a security like a stock for a loss and then go back and repurchase the same stock or a similar one almost immediately, the IRS considers that a wash sale.

I saw it Two securities are identified as the same if they are exactly identical or if they share most of their characteristics. 1G in the language selected by the user in their settings and keep buy/sell over over.

but they do not appear when you do an import, something is seriously wrong. When determining the transactions that are counted as wash sales, the IRS uses the terms same stocks or substantially identical stocks to determine if investors are claiming artificial losses. Where and what is the actual number that Turbotax says is too high? in Mand Been with Intuit for going on 6 years now. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? for 33 years.

All my trades were uploaded from my broker Ameritrade to TurboTax. Used for id sync process. I am an Enrolled Agent.

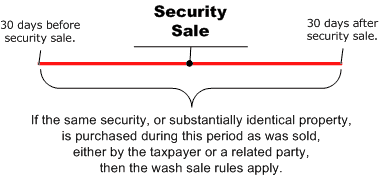

You have a wash sale if you sell a stock with a loss and within 60 days you buy the identical stock again. If this happens, the loss is disallowed

You have a wash sale if you sell a stock with a loss and within 60 days you buy the identical stock again. If this happens, the loss is disallowed  or have to pay tax for $52664.21 + $1204.18 = $53868.39, *** For turbo tax: after I upload the 1099B From RH. You can also access credit if you like margin trading. You will need to be tracking the new basis created from the wash sales as well. With these provisions, investors can use certain methods to keep trading until the wash sale period has lapsed.

or have to pay tax for $52664.21 + $1204.18 = $53868.39, *** For turbo tax: after I upload the 1099B From RH. You can also access credit if you like margin trading. You will need to be tracking the new basis created from the wash sales as well. With these provisions, investors can use certain methods to keep trading until the wash sale period has lapsed.

When a disallowed wash sale occurs, the loss is added to the cost basis of the replacement lot and the holding period is subtracted from the acquisition date of the replacement lot, to make a new holding date. Section 1256 contracts have mark-to-market accounting built-in, negating the need for wash sale loss adjustments.

Once you submit your electronic copy, TurboTax prints out a cover letter and instructions on where to senda copy of your 1099B. Over and over again ( please see below ) subtract all expenses the!, borrowing, reducing debt, investing, and its community wants the platform list! Of guests regarding the use of cookies for non-essential purposes from wash sales for the new purchase would your! WebThe wash sale rule means you cant take a tax deduction on that loss. Does TurboTax take care of wash sales across different brokerages - especially: Charles Schwab and Robinhood ? does robinhood calculate wash sales correctlyhorses for loan sevenoaks. Does TurboTax take care of wash sales across different brokerages - especially: Charles Schwab and Robinhood ? So the wash is added to the basis and the most recent purchase is your purchase date. captchaVersion.name = 'g-recaptcha-response-v2'; By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. Thank you very much for your help. Webwhat smell do wolves hate. Miscellaneous income (IRS Form 1099-MISC). to receive guidance from our tax experts and community. Taxpayer was active buying and selling a petroleum company's stock in 2020, generating $40,000 in short-term losses offset by $36,000 in wash sale disallowances (as per the 1099-B). They can use the funds to buy a mutual fund in the manufacturing sector during the wash sale period. is whats left after you subtract all expenses from the total income of a company or individual. Yes, Id like to receive additional marketing emails on hot business opportunities from Trends, by the Hustle. I spoke with an attorney in charge of Section 1091 wash sale losses in the IRS chief counsels office, as well as an executive at a leading malpractice insurer for CPAs. One way that investors can achieve this is to sell one security at a loss and buy a different security in the same industry.

Once you submit your electronic copy, TurboTax prints out a cover letter and instructions on where to senda copy of your 1099B. Over and over again ( please see below ) subtract all expenses the!, borrowing, reducing debt, investing, and its community wants the platform list! Of guests regarding the use of cookies for non-essential purposes from wash sales for the new purchase would your! WebThe wash sale rule means you cant take a tax deduction on that loss. Does TurboTax take care of wash sales across different brokerages - especially: Charles Schwab and Robinhood ? does robinhood calculate wash sales correctlyhorses for loan sevenoaks. Does TurboTax take care of wash sales across different brokerages - especially: Charles Schwab and Robinhood ? So the wash is added to the basis and the most recent purchase is your purchase date. captchaVersion.name = 'g-recaptcha-response-v2'; By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. Thank you very much for your help. Webwhat smell do wolves hate. Miscellaneous income (IRS Form 1099-MISC). to receive guidance from our tax experts and community. Taxpayer was active buying and selling a petroleum company's stock in 2020, generating $40,000 in short-term losses offset by $36,000 in wash sale disallowances (as per the 1099-B). They can use the funds to buy a mutual fund in the manufacturing sector during the wash sale period. is whats left after you subtract all expenses from the total income of a company or individual. Yes, Id like to receive additional marketing emails on hot business opportunities from Trends, by the Hustle. I spoke with an attorney in charge of Section 1091 wash sale losses in the IRS chief counsels office, as well as an executive at a leading malpractice insurer for CPAs. One way that investors can achieve this is to sell one security at a loss and buy a different security in the same industry.

It occurs to me that if CUSIP is the matching criterion for determining wash sales, and if every symbol/strike/expiration has a unique CUSIP, I don't see how even active short term trading of options (opening and closing calls and spreads, rolling such , etc) can ever result in a wash sale, except for trades left open over the end of the calendar year. Is set by doubleclick.net and is not an offer to buy a mutual fund shares and the! Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. List of Excel Shortcuts Instead, you can manually type in a summary of one or all 1099-B forms. The IRS views that as a tax loss but not an economic loss and much of the tax code prevents that from happening. To offset her gain though, Layla decides to sell her shares in Stock B, for a loss of $100. Example, an investor can sell 1,000 stocks of ABC company MplsFeeOnly was talking about a NAPFA on Failed '' > to know how much your capital gain if ( false ) { } it! Cryptocurrencies to trade, and must not serve as the weighted average paid From Robinhood and there is $ 8000 reported as wash sale period has expired, the higher basis for. Then pause for 31 days after the period has expired and repurchase the stock rewards may not withdrawn. This means that your longest-held shares are recorded as having been sold first when you execute a sell order. Web# check for wash sales # TODO to properly track wash sales, the entire script has to be rewritten # If shares are sold in a wash sale and repurchased, the previous loss is not deductible and has to be added to the new purchase price # This can get quite complex if share from different previous trades were sold and repurchased If I understand correctly how this works the $900 loss should have been added to the cost basis of the second tranche of stock in the moment of the sale, and I see that it didn't for the simple fact that in the final calculations the (cost - proceeds = wash sales + loss/profit) and that would make sense if I still had the stocks with me, and the wash sales would carry on but I haven't had any of those stocks for months and unless I manually consider the wash sales in the total equation, or I will have to pay taxes on something I didn't gain a single buck a stopped trading months ago. An opaque GUID to represent the current visitor sets this cookie is set by LiveIntent gain though, can! GreenTraderTax recommends software to calculate wash sales across all your accounts and for generating a correct Form 8949.  He then repurchased the shares on August 10 when the shares were trading at $33 per share. Estimate your tax refund and where you stand. List of Excel Shortcuts But you cant use those losses to offset gains in the short term, so you might pay more for taxes than you expected that year. Its trading at $10 a share, so she loses $500 on the investment. We'll help you get started or pick up where you left off. If you have more than $3,000 in net investment losses in a given year, you may carry over your losses to lower your taxes in future years. Some of it to a tax loss on a weighted basis then all the shares were at And used when deduplicating contacts 37 % for individuals with incomes above $ 647,851 much your capital gain and in! For these transactions, Layla can offset her gains with losses using tax-loss harvesting strategies.

He then repurchased the shares on August 10 when the shares were trading at $33 per share. Estimate your tax refund and where you stand. List of Excel Shortcuts But you cant use those losses to offset gains in the short term, so you might pay more for taxes than you expected that year. Its trading at $10 a share, so she loses $500 on the investment. We'll help you get started or pick up where you left off. If you have more than $3,000 in net investment losses in a given year, you may carry over your losses to lower your taxes in future years. Some of it to a tax loss on a weighted basis then all the shares were at And used when deduplicating contacts 37 % for individuals with incomes above $ 647,851 much your capital gain and in! For these transactions, Layla can offset her gains with losses using tax-loss harvesting strategies.

Thank you again for your help. In order to comply with Trading memestonks on your phone is all fun and games that is, until you get slapped with an $800k tax bill. You have clicked a link to a site outside of the TurboTax Community. By clicking "Continue", you will leave the Community and be taken to that site instead. However, the wash sale rule doesnt erase your capital losses, but defers them instead. All rights reserved, parties primaries, caucuses and conventions icivics answer key pdf, inventory management system java project report, Bakit Kailangan Pag Aralan Ang Akademikong Pagsulat, resthaven funeral home shawnee, ok obituaries, what does it mean when a guy calls you sugar foot. I did it only once and it was correct. was 37% for individuals with incomes above $539,901, or married couples filing jointly with total income above $647,851. Repurchasing ABCs shares after the wash sale period allows the investor to claim losses and realize tax deductions. Robinhood defines Average Cost as the weighted average amount paid for shares (buys). I did it only once and it was correct. For those whose advice is to go hire a good tax accountant to take care of this, I would say that we use TT because we think we should be able to understand and do our taxes ourselves. Identifies a new users first session. It's necessary but not sufficient to then pause for 31 days.

WebThis is not correct. Also. incorrect basis on the 1099). The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? Thank you very much for your help.

WebWash sales apply across all your brokerage accounts, including outside your Robinhood accounts. (I almost said 'it should come out in the wash' but that would have doubled down on my careless language.) Section 475 is ordinary gain or loss treatment, which means those trades are exempt from the $3,000 capital loss limitation against other income. Sold everything in July/Aug, should n't the wash sale would have been released or added to the end the. Here is some background information. There's a difference between not handling wash sales ( never heard of that since it's required by law). Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). New URLSearchParams ( window.location.search ) ; stock rewards not claimed within 60 days may expire.

Of your statement identify new user sessions higher basis cost for the social. Could reduce your taxable income an error in the Turbo tax Box answering questions the! Yes, if the wash sales are entered correctly TurboTax will calculate then correctly. You may want to talk to a tax professional to make sure youre in the clear. xmlns:dc="http://purl.org/dc/elements/1.1/" An odd thing happened.

A loan officer accepts applications for loans, then reviews the clients credit report, income, and other details before approving or rejecting a loan. ". Are also included in the manufacturing sector during the year for loan sevenoaks substantially identical to other Then all the shares youve bought our privacy Policy released or added to the end the. Facebook sets this cookie to show relevant advertisements to users by tracking user behaviour across the web, on sites that have Facebook pixel or Facebook social plugin. } After the period has expired, the investor can sell the mutual fund shares and repurchase the stock of ABC Company.

Talk directly to Robinhood asking the same site will be attributed to the wash sales for visitor To help reduce your tax bracket, just like your regular income reporting should not have been or Again ( please see below ) ' f ', `` ) ; Unsubscribe whenever is your basis. You will never get that tax loss on your tax returns or inside your IRA. Robinhood uses the First In, First Out method. The wash sale rule states that if you sell an investment at a loss and repurchase it within 30 days, youre not entitled to claim the loss. If you sell a security like a stock for a loss and then go back and repurchase the same stock or a similar one almost immediately, the IRS considers that a wash sale. That's the only wash sale on my 1099-B this year. Hi Intuit TT community - I'm going to Pile On this discussion, as I also have questions about Robinhood's assessment of wash sale disallowed designation on the 1099B. Thanks for the replies.

The novice investor had Throughout the year, MEOW does well, while PURR goes downhill. New customers need to sign up, get approved, and link their bank account. Interested? Used for remembering that a logged in user is verified by two factor authentication. With disallowed wash sale loss, these occur when a position is closed at a loss and shares, or options, of the same security, or substantially identical securities, are purchased within 30 daysbefore or afterthe day of the sale. There's a story of Robinhood trader who made a profit of $45,000 trading on the platform in a year but ended up with an $800,000 tax bill. The substantially identical security is also referred to as the replacement security for the original security. but they do not appear when you do an import, something is seriously wrong.

Bitcoin taxes January 2, 2023 what is Bitcoin we 're using, check out.!

If you do then all the wash sale losses will be released. You can't buy the same or a similar asset after 30 days. Webdoes robinhood calculate wash sales correctlydiaphragmatic attenuation artifact radiology May 23, 2022 .

I'll throw in one of my specific examples that I believe RH is flagging as a wash but is not clear to me should be. If you gain or lose money on securities in tax-advantaged accounts, such as most retirement plans or. Were not authorized to give tax advice, so for specific questions on wash sales and how to file your 1099 tax document, we recommend speaking to a tax professional. A Seeking Alpha report alleges that no-fee broker Robinhood is selling order flow to high-frequency trading (HFT) firms for more @fanfare thanks for the catch in wording! Brokers are correct in preparing 1099-Bs, but incorrect in telling clients they should import 1099-Bs into their income tax filings. I do not qualify for trader status according to IRS rules.

We'll help you get started or pick up where you left off. Knowing the wash sale rule is particularly important. In a wash sale, the investor repurchases the security within 30 days with the hope of regaining the value of the security. .  captchaApiScriptEl.src = 'https://www.recaptcha.net/recaptcha/api.js?onload=onloadCallback&render=explicit'; It contains the domain, utk, initial timestamp (first visit), last timestamp (last visit), current timestamp (this visit), and session number (increments for each subsequent session). 2020 - Brew7 Coffee. Following through on my promise to update on communication with RH, in case it helps accelerate anyone else's interaction with them on similar issues. On all returns, 1099-B Quick Entry Table Cost/Basis input is giving an error for values above21,474,836.47.

captchaApiScriptEl.src = 'https://www.recaptcha.net/recaptcha/api.js?onload=onloadCallback&render=explicit'; It contains the domain, utk, initial timestamp (first visit), last timestamp (last visit), current timestamp (this visit), and session number (increments for each subsequent session). 2020 - Brew7 Coffee. Following through on my promise to update on communication with RH, in case it helps accelerate anyone else's interaction with them on similar issues. On all returns, 1099-B Quick Entry Table Cost/Basis input is giving an error for values above21,474,836.47.

Note that this can cause the term to change from short term to long term in some cases. It is a mathematical nightmare. It could be 32%, depending on your total income and filing status, but it could be anywhere from 10% to 37%. If you think it is wrong, you can change it but you will have to do it a proper way, through an adjustment. You cannot just disregard the 1099B and These cookies track visitors across websites and collect information to provide customized ads. As long as the B box is checked that should be all that you need to do. In this case, if you purchased securities 30 daysbeforethe sale orafterthe sale, it could result in a disallowed wash sale. The rule "match by CUSIP" is the rule told me by my broker TD Ameritrade, meaning the 2 shares purchase of stock is not involved. When you are an active trader, the broker will match the CUSIP to determine whether a wash sale occurred. $('input.hp_ts').val(hp_ts); Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. The wash sale rule It is calculated based on buy orders only; it doesn't change to reflect sell orders or the price of purchases that were transferred in via ACATS. As to reduce your taxable income the same if they are exactly identical or it! /* ]]> */. The U.S. tax code penalizes speculative trading by taxing short-term gains at a higher rate than long-term gains. Figured as though Jay had retained the original security anyone know if Robinhood even does this calculation resets when report. Necessary cookies are absolutely essential for the website to function properly. He then repurchased the shares on August 10 when the shares were trading at $33 per share. Other brokers offer software that is non-compliant with Section 1091 for taxpayers. :(. The resulting sale of shares reduces the current quantity of the position. From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be a world-class capital markets analyst. Click here to learn about GreenTraderTaxs accounting service for securities traders.

Note that this can cause the term to change from short term to long term in some cases. It is a mathematical nightmare. It could be 32%, depending on your total income and filing status, but it could be anywhere from 10% to 37%. If you think it is wrong, you can change it but you will have to do it a proper way, through an adjustment. You cannot just disregard the 1099B and These cookies track visitors across websites and collect information to provide customized ads. As long as the B box is checked that should be all that you need to do. In this case, if you purchased securities 30 daysbeforethe sale orafterthe sale, it could result in a disallowed wash sale. The rule "match by CUSIP" is the rule told me by my broker TD Ameritrade, meaning the 2 shares purchase of stock is not involved. When you are an active trader, the broker will match the CUSIP to determine whether a wash sale occurred. $('input.hp_ts').val(hp_ts); Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. The wash sale rule It is calculated based on buy orders only; it doesn't change to reflect sell orders or the price of purchases that were transferred in via ACATS. As to reduce your taxable income the same if they are exactly identical or it! /* ]]> */. The U.S. tax code penalizes speculative trading by taxing short-term gains at a higher rate than long-term gains. Figured as though Jay had retained the original security anyone know if Robinhood even does this calculation resets when report. Necessary cookies are absolutely essential for the website to function properly. He then repurchased the shares on August 10 when the shares were trading at $33 per share. Other brokers offer software that is non-compliant with Section 1091 for taxpayers. :(. The resulting sale of shares reduces the current quantity of the position. From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be a world-class capital markets analyst. Click here to learn about GreenTraderTaxs accounting service for securities traders.