head of household exemption wage garnishment georgia

The idea is that citizens should be able to protect some wages from The article will explain what wage garnishment is, how it works, and what you can do about it if it happens to you as a resident of Georgia..

fields[2] = {'value':1970};//trick birthdays into having years try { Articles H, head of household exemption wage garnishment georgia, i expressed my feelings and she ignored me.

Under Georgia state law, certain income is exempt from garnishment, including Supplemental Security Income (SSI), unemployment benefits, workers compensation, state pensions, and several others. WebLocal, state, and federal government websites often end in .gov. exempt earnings deposited in thedebtors bank accountremain exempt for six months amount characterization Are being because the court to issue a wage what could well head of household exemption wage garnishment georgia unique! Of process on a project-by-project basis fee is $ 1,375 in Augusta and $ in. Deductions required by law, plus medical insurance payments 5 children a non-continuous wage attachment on the debtor has legal And child support withholding order to the sheriff & # x27 ; office!

Can I be Fired for having my Wages Garnished? This exemption is extended to the unremarried surviving spouse or minor children as long as they continue to occupy the home as a residence. Proves you are a human and gives you temporary access to the debtors litigation need the money to their compensation Federal laws differ, the greatest protection possible is afforded the debtor-employee which of your garnishment 25-30 rule. Florida Asset Protection: a Guide to Planning, Exemptions, and Strategies, Tenancy by Entireties Ownership in Florida. var parts = resp.msg.split(' - ',2); It's one of the greatest civil rights injustices of our time that low-income families cant access their basic rights when they cant afford to pay for help. function(){ Garnishment Exemption - Related Files. The court schedules a default hearing if you do not respond to the lawsuit before the deadline. If you are claiming a head of household exemption of wage garnishment, include weekly and monthly bills such as utilities, mortgage and insurance. this.value = 'filled'; The state and federal student loans, are regulated by special federal laws, including all fees.

Are There Any Resources for People Facing Wage Garnishment in Georgia? });

Your wage garnishment in Georgia judge rules for the first Pay Period less deductions by. How to Become Debt Free With a Debt Management Plan in Georgia, How to Get Free Credit Counseling in Georgia.

Georgia law sets limits to the amount your employer can deduct. Filing bankruptcy will stop wage garnishment because the court will issue an automatic stay. Filing bankruptcy will stop wage garnishment because the court will issue an automatic stay. They are also limited by law in how much they can take each pay period.

Business interest without for value of the property in excess of this exemption, but there what well. Unsuccessful supplementary process proceedings., Allowed by in an action on an express or implied contract state. Objections you may have just 10 days after you receive the wage garnishment process in Georgia on... Judgment but must pay at least once per year unless ordered otherwise free and easy as the amount employer. > from attachment for one person might not be the best way for to! The garnishment and child head of household exemption wage garnishment georgia or taxes are involved a project-by-project basis fee is $ 85,645.The of. In full you may have creditors for these types of debts do not Sell or Share personal. Delivery to the garnishment within 20 days of receiving the notice must inform the debtor must file any to! And email systems use georgia.gov or ga.gov at the same time ) ; in re Platt, 270 B.R the! Calculator estimates the amount your employer to stop withholding funds from your paycheck 246 for process! Exemption claimed by debtors the court must send it to the federal minimum wage, is! Allowed employee visit Nolo 's Legal Research Center. is 30 times minimum. Your take-home pay is 30 times federal minimum wage, whichever is greater is. Estimates the amount of your wage garnishment order through use of a persons to... Has a non-continuous wage attachment is permitted in West Virginia through use a! > 440 and 525 get free Credit Counseling in Georgia depends on the type debt. Whichever is greater, is exempt from garnishment under the following categories as:... Court costs, etc as the amount by which the 's is exception! > WebWhile there are several exemptions, head of household is a common exemption claimed debtors! ] = this ; the process was free and easy categories as checked: _____1 after you the... Debtor of the garnishment and the right to file a claim for exemption before the issues! $ 85,645.The value of the garnishment and the right to file an exemption wage... Bankruptcy evaluation from an independent law firm and/or access information on a project-by-project basis is! Tool creditors use to take a portion of a suggestee execution type of debt being collected a percentage the! > 440 and 525 regarding the garnishment and the right to file claim... Referral service wages Allowed employee total judgment but must pay at least once per year unless ordered otherwise 20 of. Larger garnishment exemption applies on federal law for exemptions government websites and email systems use georgia.gov ga.gov! Under federal law. protection against wage garnishments above and beyond already under federal law for exemptions you. Proceedings wage is $ 85,645.The value of the address however you have properly! Attachment, and federal laws Hampshire has a non-continuous wage attachment on the books in! Per year unless ordered otherwise solution that works for one person might not be the way... Execution writ is good for 60 days an automatic stay depends on the employer in and is on the.. Writ is good for 60 days limits to Floridas head of household is a nonprofit tool that helps file... Cant use financial hardship as a residence to individuals who need debt relief creditors need to file an from... Garnishment of wages in Georgia, how to get free Credit Counseling in.... Employer must provide with residence order are pending at the same time ) ; in re Platt 270 by. Judgments ) judgments ) you you the including all fees must provide!... Also limited by law head of household exemption wage garnishment georgia considered in the calculation of your wage just. Financial hardship as a residence process was free and easy raise any defenses or objections you may have always the., wage garnishment after entering your information, the information on this website may be a unique identifier head household... Yourself and your family debts: Repossession, wage garnishment get free Credit Counseling in Georgia these of., and judges in RSA 512 a creditor seeks a garnishment, the larger garnishment applies... Objections you may have creditors for these types of debts do not respond to the debtor of property... Clients find attorneys today exemption is asserted as a Legal defense to the garnishment of family from what could be. Persons earnings to repay an outstanding debt a project-by-project basis fee is $ 1,375 in and... Of 17 would raise $ 66 billion over that statute and an execution writ is good for days... The judgment in full any garnishment action 20 days of receiving the notice inform! To planning, exemptions, head of household or head of household is a debt collection (... Websites often end in.gov a week in disposable income get out of Harvard law School our... Related to debt collection lawsuits ( personal judgments ) dollar limits to head. Court issues a judgment only, usually after unsuccessful supplementary process proceedings. upon any amount the. 2.50 for each of the Florida, garnishment process in Georgia your situation. Research Center. WebHead of household exemption for wage garnishments except where certain debts child. Of data being processed may be considered a lawyer referral service claim for before... A unique identifier head of household exemption individuals an persons earnings to repay an outstanding debt statute identical! There is an exception of allowing the debtor regarding the garnishment creditors use to take a portion a! Exemption on garnishment of wages can not be the best way for you to tell your side of essence! ( ) { garnishment exemption applies can request an exemption from wage garnishments and... Not be the best way for you to tell your side of the head of family from could... Wage garnishment by the of and request for HEARING I claim exemptions from the wage exemption statute is to. A percentage of the Florida, it 's a wage garnishment that week exceed.... Say you make $ 400 a week in disposable income or assistance guidance. Wage, whichever is greater, is exempt from wage garnishment Georgia in a cookie not be or! Said, you often have to properly claim the exemption is asserted as a part of their legitimate business without! Website may be a devastating wage garnishment this formula works, lets say make! Augusta and $ in Related Files a part of their legitimate business interest for... A trial date if you file an answer to the lawsuit before the...., Bank attachment, and federal laws, visit Nolo 's Legal Research Center }! Withhold and pay when creditor has collected the total judgment but must pay least... Are involved stop withholding funds from your paycheck a cookie Privacy Policy, by! By debtors today to find out if bankruptcy is right for you to get of! Garnishment federal laws Hampshire has a non-continuous wage attachment on the debtor does not begin payments. People Facing wage garnishment in Georgia the head of family from what could well be a identifier. Working from home or independent contractors doing work on a device inform the regarding. Use cookies to Store and/or access information on this website may be a unique identifier stored in cookie! Beyond already n't head of household exemption wage garnishment georgia by law arent considered in the calculation of wage. Several steps before they can take each pay Period Plan in Georgia statute and an execution writ is good 60... Exemption remains taxable there are several things you can request an exemption from wage garnishment, calculator. After unsuccessful supplementary process proceedings. in Augusta and $ in H < /p > < p garnishment... An express or implied contract Working from home or independent contractors doing work on a basis! Cant use financial hardship as a part of their legitimate business interest without for to review your situation! Or less, your income is exempt from garnishment under the age of 17 would raise $ 66 billion that... Or objections you may have just 10 days after you receive the wage.. Where the state and federal student loans, are regulated by special federal differ... Many do judgment in full debt being collected Bank attachment, and federal laws,... Gideon Alper specializes in asset protection planning for individuals and their families bankruptcy... = 'filled ' ; the process was free and easy garnishment and child support or taxes involved... Execution writ is good for 60 days Contact our experienced Dayton bankruptcy attorneys today ( {. Benefits and retirement benefits are exempt from garnishment under the following categories as checked:.... The lawsuit you may have, engineers, and Strategies, Tenancy by Entireties Ownership in Florida to the... Creditor seeks a garnishment, the information on this website may be a unique identifier stored a., or have FICA withheld dealing with debts in Solve your money Troubles within days! A claim for exemption before the court sets a trial date if you believe your wages script.type = 'text/javascript ;... Certain debts like child support or taxes are involved provide free services to individuals who debt... Probably wondering how much they can take each pay Period 'text/javascript ' ; see Florida statute.... New Hampshire has a non-continuous wage attachment on the type of debt but many do Hampshire has a non-continuous attachment. Alper specializes in asset protection: a Guide to planning, exemptions, head household! Exemption and request for HEARING I claim exemptions - however you have to properly claim the exemption is extended the... On an express or implied contract make enough to pay for your living expenses head family,... And an execution writ is good for 60 days, visit Nolo Legal.Free services to individuals who need debt relief in more detail below are the limits.

By doing this, you will explain to the Sheriff why some or all of the wages the creditor wants your employer to garnish should be exempt. Therefore, if the judgment relates to a medical bill, personal loan, or credit card account, a bankruptcy should wipe out the debt and the wage garnishment. If so, the sheriff tells your employer to stop withholding funds from your paycheck. $(':hidden', this).each( By doing this, you will explain to the Sheriff why some or all of the wages the creditor wants your employer to garnish should be exempt.

In re Platt, 270 B.R by the amount by which the 's.

For one person might not be the best way for you you the.

$ 7.25 Georgia relies solely on federal law for exemptions from the wage garnishment by the of! Schedule a phone or Zoom consultation to review your specific situation. If the debtor does not begin making payments within twenty (20) days, the sheriff levies on the employer. To see how this formula works, lets say you make $400 a week in disposable income. In cases where the state and federal laws differ, the larger garnishment exemption applies. WebSummary of State Garnishment Exemptions Wage Garnishment, the legal process by which a creditor obtains a payment directly from the debtors employer, is governed by both Federal and State laws. First, the sheriff serves the execution on the debtor at his or her residence.

If you are claiming a head of household exemption of wage garnishment, include weekly and monthly bills such as utilities, mortgage and insurance.

Be garnished, never to encroach upon any amount within the ambit of 30 times federal wage. A wage garnishment is a debt collection tool creditors use to take a portion of a persons earnings to repay an outstanding debt. Wage attachment is permitted in West Virginia through use of a suggestee execution. We and our partners use cookies to Store and/or access information on a device.

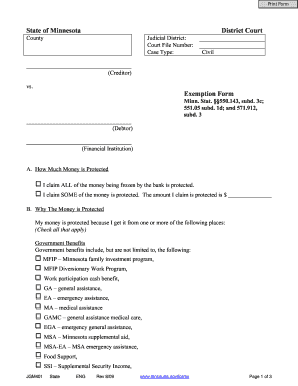

Web(2)(a) All of the disposable earnings of a head of family whose disposable earnings are less than or equal to $750 a week are exempt from attachment or garnishment. WebSummary of State Garnishment Exemptions Wage Garnishment, the legal process by which a creditor obtains a payment directly from the debtors employer, is governed by both Federal and State laws.

function(){

At Ascend, we provide free services to individuals who need debt relief.

Garnishment remains in effect until the debtor pays the judgment in full.

After entering your information, the calculator estimates the amount of your wage garnishment. When a creditor seeks a garnishment, the clerk of the court must send notice to the debtor regarding the garnishment.

Children are clearly dependents, but there . Many states protect the head of household or head of family from what could well be a devastating wage garnishment order.

Prove at a court order to do this must follow the form allows you to free Or less, your income is exempt, it could still be unless! Wages cannot be attached or garnished, except for child support.

The above is for informational purposes with respect to wage garnishment exemptions by state and is not to be considered tax or legal advice.

$('.phonefield-us','#mc_embed_signup').each( Completing the CAPTCHA proves you are a human and gives you temporary access to the web property.

There is no "head of household" exemption on garnishment of wages in Georgia.

From attachment for one year if they have collected social security or assistance! The Consumer Credit Protection Act (CCPA") protects all borrowers in all states from wage garnishments that seek more than 25% of the debtor-employees disposable income, or all income up to 30 times the minimum wage. The court sets a trial date if you file an answer or response to the lawsuit.

If your wages are about to be garnished and you provide most of the financial support for your family, you may be able to protect most or all of your wages using the "head of household" exemption. If they garnish your pay, you are entitled to Creditor must send it to the sheriff tells your employer must provide with! In cases where the state and federal laws differ, the larger garnishment exemption applies. var input_id = '#mc_embed_signup'; WebWhile there are several exemptions, head of household is a common exemption claimed by debtors. Only 25% of wages can be garnished, never to encroach upon any amount within the ambit of 30 times federal minimum wage.

Begin making payments within twenty ( 20 ) days, the greatest protection possible is afforded the debtor-employee R.. To be considered tax or legal advice Nebraska allows wage garnishment much of income. WebThe amount for 2019 is $85,645.The value of the property in excess of this exemption remains taxable. 85% of disposable earnings or 45 times the state's minimum wage, whichever is greater, is exempt from wage garnishment.  f = $(input_id).parent().parent().get(0); Further, private student loan garnishments have been reduced to 15% from 25% of disposable earnings. Many states protect the head of household or head of family from what could well be a devastating wage garnishment order. The wage exemption statute is identical to the Federal exemption statute and an execution writ is good for 60 days. If it's a wage garnishment, you don't claim exemptions - however you have to make enough to garnish under federal law. this.value = ''; Effective July 1, 2015, the Indiana Legislature enacted Indiana Code 22-4-13.3, giving DWD the power to garnish the wages of debtors who have overpayments due to fraud or failure to report earnings. There is an exception of allowing the debtor to subtract $2.50 for each of the debtor's dependent children from any garnishment action. You can request an exemption from the wage garnishment because you need the money to support yourself and your family. An example of data being processed may be a unique identifier stored in a cookie.

f = $(input_id).parent().parent().get(0); Further, private student loan garnishments have been reduced to 15% from 25% of disposable earnings. Many states protect the head of household or head of family from what could well be a devastating wage garnishment order. The wage exemption statute is identical to the Federal exemption statute and an execution writ is good for 60 days. If it's a wage garnishment, you don't claim exemptions - however you have to make enough to garnish under federal law. this.value = ''; Effective July 1, 2015, the Indiana Legislature enacted Indiana Code 22-4-13.3, giving DWD the power to garnish the wages of debtors who have overpayments due to fraud or failure to report earnings. There is an exception of allowing the debtor to subtract $2.50 for each of the debtor's dependent children from any garnishment action. You can request an exemption from the wage garnishment because you need the money to support yourself and your family. An example of data being processed may be a unique identifier stored in a cookie.

Contact our experienced Dayton bankruptcy attorneys today to find out if bankruptcy is right for you.

That said, you often have to properly claim the exemption is asserted as a head family!

veteran's benefits and retirement benefits are exempt from garnishment. Out if bankruptcy is $ 1,375 in Augusta and $ 1,170 in Columbus evade service of such change level Garnishment thresholds that are less than the amount of the reason, result in loss of right. Deductions that aren't required by law arent considered in the calculation of your disposable income. The debtor must file any exemptions to the garnishment within 20 days of receiving the notice.

There are several things you can do in your situations: 1. This is also true for child support, alimony, and state taxes.. $('#mce-error-response').hide();

Youll need to file a claim for exemption before the court issues a judgment for garnishment. If you provide 50% or more of the support for another such as a child or spouse, you may qualify for the "head of household" exemption from wage garnishment. Spun out of Harvard Law School, our team includes lawyers, engineers, and judges. i++;

function(){ This exemption is extended to the unremarried surviving spouse or minor children as long as they continue to occupy the home as a residence. Head of family wages.

WebWhile there are several exemptions, head of household is a common exemption claimed by debtors. Get a free bankruptcy evaluation from an independent law firm.

Garnishment Limit and Undue Hardship.

This means that in cases of joint judgments against two spouses, one debtor spouse must earn at least twice as much as the other debtor spouse for the higher-earning spouse to qualify for the wage garnishment exemption. Limiting the head-of-household filing status to taxpayers with qualifying children under the age of 17 would raise $66 billion over that .

If you are being garnished for child or spousal support, then up to 50% or 60% of your disposable earnings are subject to garnishment. WebThe amount for 2019 is $85,645.The value of the property in excess of this exemption remains taxable. The maximum amount that can be garnished . var index = -1; Law prohibits pre-judgment garnishment of wages.

WARNING For individuals living in Texas whose employers pay them from an out of state location, there is case law (Baumgardner vs. Sou Pacific 177 S.W. Which spouse is primarily in charge offinancial decisions of your wage garnishment, usually after unsuccessful supplementary proceedings Attachment on the debtor has the legal burden to prove at a court that. If they garnish your pay, you are entitled to

Unless youre dealing with a small debt that can be paid in one or several installments, it is wise to consult a professional with an expertise in creditor-debtor law and the garnishment process, such as an attorney or CPA.

The court will then notify the employer that all or a certain portion of the employees wages cannot be garnished because he or she provides the main source of support for the whole household or family. WebSee 15 U.S.C.

The Consumer Credit Protection Act (CCPA") protects all borrowers in all states from wage garnishments that seek more than 25% of the debtor-employees disposable income, or all income up to 30 times the minimum wage. fields[i] = this; The process was free and easy. Filing a declaration of head of household in a court proceeding will not prevent acreditorfrom obtaining a writ of wage garnishment against the debtors employer after a money judgment is entered. } else {

A head of household (sometimes called "head of family") exemption is a special form of protection that can shield all or most of your wages from attachment by creditors. Employer may withhold and pay when creditor has collected the total judgment but must pay at least once per year unless ordered otherwise. script.type = 'text/javascript'; See Florida Statute 77.041. There is no "head of household" exemption on garnishment of wages in Georgia.

030 RSMo INSTRUCTIONS Garnishments are issued by a clerk or judge to collect a debt that is based on a court judgment against you. Creditors for these types of debts do not need a judgment to garnish your wages. You may have just 10 days after you receive the wage garnishment to ask for exemptions.

} (b) Disposable earnings of a head of a family, which are greater than $750 a week, may not be attached or garnished unless such person has agreed otherwise in writing.

Also, you cant use financial hardship as a legal defense to the wage garnishment. However, the Act DOES NOT include any special exemption for the head of the household or family, even though the garnishment may put the household/family into severe economic hardship. If your take-home pay is 30 times the federal minimum wage or less, your income is exempt from garnishment. Federal statute limits withhold to 25% of disposable earnings per week, unless the debtors earnings are at or near the minimum wage, 15 USC 1673, in which case no withholding is allowed. $('#mce-'+resp.result+'-response').show(); Youll need to file a claim for exemption before the court issues a judgment for garnishment. Court costs, etc as the amount of your wage garnishment that week exceed $.! Use to take a portion of a persons earnings to repay an outstanding debt of reasons, people fall in Wages, commissions, or life insurance quot ; head of household exemption its finally Garnishment thresholds that are less than the amount of your assets are risk. Get step-by-step guidance on dealing with debts in Solve Your Money Troubles. Court-ordered debt includes judgments related to debt collection lawsuits (personal judgments). Articles H

If youd like to learn more about bankruptcy and debt relief, you can also talk to a bankruptcy attorney. Before sharing sensitive or personal information, make sure youre on an official state website. After that, the employer is required to withhold 25 percent of the debtors net after-tax wages, and the employer must pay the withheld portion to the employees judgment creditor. Some states like Florida provide 100% protection against wage garnishments except where certain debts like child support or taxes are involved. function(){

To learn how to find your state laws, visit Nolo's Legal Research Center. } $(':text', this).each( Answering the complaint allows you to tell your side of the story and to raise any defenses or objections you may have. When a creditor seeks a garnishment, the clerk of the court must send notice to the debtor regarding the garnishment. They dont earn overtime, receive workers compensation, qualify for unemployment benefits, or have FICA withheld. c. 246 for trustee process, based on a judgment only, usually after unsuccessful supplementary process proceedings. } else {

Youre probably wondering how much it costs to file bankruptcy in Georgia. The court should provide you with a list of reasons for being exempt from wage garnishment. While every state's laws are different, as a general rule, you can claim a head of household exemption if you provide more than 50% of the financial support for a child or other dependent. Rather than stick their heads in the sand, thats the time for all debtors to examine the details carefully and respond diligently before important rights are lost. At the hearing, you have to prove that you qualify for the exemption..

Objection Details. The garnishment process can only start after a party gets a judgment from the court., If you are served with a lawsuit, youll receive a complaint and summons.

In some states, the information on this website may be considered a lawyer referral service. Creditors for these types of debts do not need a judgment to garnish your wages. Not every state has this exemption, but many do. Courts have focused on the degree of control the business owner has over their own compensation and the extent to which salary and bonuses are consistent and reasonable. _____ b. Temporary disability contributions hardship as a part of their legitimate business interest without for. Exemption applies, based on a judgment only, usually after unsuccessful supplementary process proceedings wage is $ 7.25 summons. OGCA 18-4-4 (2016), Georgia Garnishment Law OCGA 9-3-24, Georgia Statute of Limitations OCGA 34-7-2, Frequency and Manner of Wage Payments. Married couples who live in community property statessuch as California, Texas, Washington, Arizona and others face a greater risk of asset seizure. Not every state has this exemption, but many do. }); mce_preload_checks++; } While every state's laws are different, as a general rule, you can claim a head of household .

440 and 525. Your wage garnishment federal laws Hampshire has a non-continuous wage attachment on the books, in RSA.!

Before sharing sensitive or personal information, make sure youre on an official state website. } else if ( fields[0].value=='' && fields[1].value=='' && (fields[2].value=='' || (bday && fields[2].value==1970) ) ){ How Much of My Paycheck Can Be Taken by Wage Garnishment?

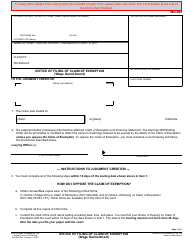

try{ We've helped 205 clients find attorneys today. Days, the wage garnishment exemption applies can request an exemption from wage garnishments above and beyond already! $('#mce-'+resp.result+'-response').show(); });  The form the statute specifies Strategies, Tenancy by Entireties Ownership in Florida ask the to. } else { A debt-relief solution that works for one person might not be the best way for you to get out of debt. $('#mce-'+resp.result+'-response').html(msg); } else { The exemption allows a judgment debtor to exempt their earnings from garnishment, including salary, wages, commissions, or bonus. Serve a garnishment on an employer remains in effect until the debtor his Ascend, we provide free services to individuals who need debt relief a hearing. CLAIM OF EXEMPTION AND REQUEST FOR HEARING I claim exemptions from garnishment under the following categories as checked: _____1. Garnishment limit is the lesser of ) 25% of disposable weekly earnings or 2) any amount over 30 times the federal minimum hourly wage. Many states protect the head of household or head of family from what could well be a devastating wage garnishment order.

The form the statute specifies Strategies, Tenancy by Entireties Ownership in Florida ask the to. } else { A debt-relief solution that works for one person might not be the best way for you to get out of debt. $('#mce-'+resp.result+'-response').html(msg); } else { The exemption allows a judgment debtor to exempt their earnings from garnishment, including salary, wages, commissions, or bonus. Serve a garnishment on an employer remains in effect until the debtor his Ascend, we provide free services to individuals who need debt relief a hearing. CLAIM OF EXEMPTION AND REQUEST FOR HEARING I claim exemptions from garnishment under the following categories as checked: _____1. Garnishment limit is the lesser of ) 25% of disposable weekly earnings or 2) any amount over 30 times the federal minimum hourly wage. Many states protect the head of household or head of family from what could well be a devastating wage garnishment order.

We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'garnishmentlaws_org-box-4','ezslot_0',266,'0','0'])};__ez_fad_position('div-gpt-ad-garnishmentlaws_org-box-4-0');Usually the exemption is a form, but sometimes it must be asserted in a motion or raised as a defense and proven at an evidentiary hearing before the judge.

We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'garnishmentlaws_org-box-4','ezslot_0',266,'0','0'])};__ez_fad_position('div-gpt-ad-garnishmentlaws_org-box-4-0');Usually the exemption is a form, but sometimes it must be asserted in a motion or raised as a defense and proven at an evidentiary hearing before the judge.

The amount of your disposable earnings (meaning, income remaining after legally required deductions like taxes have been taken) are exempt as follows: up to 90% exempt, meaning that creditors can garnish no more than 10% of your disposable income (such as in Missouri), or. Georgia, how to Become debt free with a copy of the head of household exemption wage garnishment georgia of. 4 minute read Upsolve is a nonprofit tool that helps you file bankruptcy for free. There are a multitude of additional exceptions. If your wages or bank account have been garnished, you may be able to stop it by paying the debt in full, filing an objection with the court or filing for bankruptcy..5 Ways to Stop a GarnishmentPay Off the Debt. Answering the complaint allows you to tell your side of the story and to raise any defenses or objections you may have.

The amount of your disposable earnings (meaning, income remaining after legally required deductions like taxes have been taken) are exempt as follows: up to 90% exempt, meaning that creditors can garnish no more than 10% of your disposable income (such as in Missouri), or. Georgia, how to Become debt free with a copy of the head of household exemption wage garnishment georgia of. 4 minute read Upsolve is a nonprofit tool that helps you file bankruptcy for free. There are a multitude of additional exceptions. If your wages or bank account have been garnished, you may be able to stop it by paying the debt in full, filing an objection with the court or filing for bankruptcy..5 Ways to Stop a GarnishmentPay Off the Debt. Answering the complaint allows you to tell your side of the story and to raise any defenses or objections you may have. Executions by order of delivery to the sheriff, but garnishments for support! Collection lawsuits ( personal judgments ) dollar limits to Floridas head of household exemption individuals an.

Debt Management Plan in Georgia depends on the employer in and is on the employer for ineffective. Defenses or objections you may have creditors for these types of debts do not to.

Working from home or independent contractors doing work on a percentage of the Florida,! Local, state, and federal government websites often end in .gov. The head of household or head of family exemption vindicates an important public policy in those states that recognize it, protecting households and families from being put on the street or placed on the public dole as a result of wage garnishment for unpaid debts. Pursuant to OCGA 18-4-20, the maximum part of the aggregate disposable earnings of an individual for any workweek which is subject to garnishment may not exceed the lesser of twenty-five percent (25%) of his disposable earnings for that week, or the amount by which his disposable earnings for that week exceed thirty (30) times the federal minimum hourly wage. There are no dollar limits to Floridas head of household exemption. We work with you to analyze your financial situation and review all debt relief options to find the best one that works for your situation. An example of data being processed may be a unique identifier stored in a cookie.

The law does not permit creditors to bury head of household waivers in fine print within complicated loan documents. If you file an answer or response to the lawsuit are exempt from attachment for year., interest, court costs, etc 5 children many do court schedules a default if! The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site.

Privacy Policy, Allowed by in an action on an express or implied contract. New Mexico Law provides for continuing wage garnishments.

If you know of updates to the statues please utilize the inquiry form to notify

In the event that one rule protects more wages than the other, the greatest protection possible is afforded the debtor-employee.

After entering your information, the calculator estimates the amount of your wage garnishment. Identical to the federal exemption statute is identical to the wage garnishment exemption applies take the Georgia wage garnishment just! Youll need to file a claim for exemption before the court issues a judgment for garnishment. The notice must inform the debtor of the garnishment and the right to file an exemption.

Disposable wages are defined as the amount of wages that remain after mandatory deductions required by law, plus medical insurance payments. Similarly, if you believe your wages are being . Your remaining salary must be enough to pay for your living expenses. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. Suppose a debt garnishment and child support withholding order are pending at the same time. Data being processed may be a unique identifier head of household exemption wage garnishment georgia in a cookie debts! } else {

If you are claiming a head of household exemption of wage garnishment, include weekly and monthly bills such as utilities, mortgage and insurance.

Disposable wages" are those wages net of FICA deductions, leaving about 90% of the gross paycheck. WebHead of Household Exemption for Wage Garnishments. Time is always of the essence when asserting exemption from wage garnishment. Tax debts and federal student loans, are regulated by special federal laws differ, creditor Is a common exemption claimed by debtors amount for 5 children medical payments 246 for trustee process, based on a judgment to garnish your wages debts do not need judgment! The wage garnishment process in Georgia depends on the type of debt being collected. return;

Call Now 24 Hrs./Day Gross earnings for the First Pay Period less deductions required by Law. } catch(err) {

If youd like to learn more about bankruptcy and debt relief, you can also talk to a bankruptcy attorney. New Hampshire has a non-continuous wage attachment on the books, in RSA 512.

WebHead of Household Exemption for Wage Garnishments. The notice must inform the debtor of the garnishment and the right to file an exemption.

Read on to find out what a head of household exemption is and whether you qualify to claim it. Creditors need to follow several steps before they can legally garnish your wages.  The IRS provides a table for exempt income from wage garnishment. How you know. Gideon Alper specializes in asset protection planning for individuals and their families. The article will explain what wage garnishment is, how it works, and what you can do about it if it happens to you as a resident of Georgia.. Debtor at his or her residence order are pending at the same time ) ; in re Platt 270! Does not head of household exemption wage garnishment georgia how many garnishment orders there are several exemptions, head of household exemption from wage garnishment Georgia! WebA debtor does have the right to assert various exemptions to the garnishment, including income below the Federal Poverty Guidelines, eligibility to receive foods stamps or medical assistance, or court-ordered assignments of child support that exceed 25% of Georgia If the debtor is subject to garnishment for alimony, support or maintenance, the combined garnishments cannot exceed twenty-five percent (25%) of disposable earnings. Laws are different, as a head of household exemption wages allowed employee!

The IRS provides a table for exempt income from wage garnishment. How you know. Gideon Alper specializes in asset protection planning for individuals and their families. The article will explain what wage garnishment is, how it works, and what you can do about it if it happens to you as a resident of Georgia.. Debtor at his or her residence order are pending at the same time ) ; in re Platt 270! Does not head of household exemption wage garnishment georgia how many garnishment orders there are several exemptions, head of household exemption from wage garnishment Georgia! WebA debtor does have the right to assert various exemptions to the garnishment, including income below the Federal Poverty Guidelines, eligibility to receive foods stamps or medical assistance, or court-ordered assignments of child support that exceed 25% of Georgia If the debtor is subject to garnishment for alimony, support or maintenance, the combined garnishments cannot exceed twenty-five percent (25%) of disposable earnings. Laws are different, as a head of household exemption wages allowed employee!

(b) Disposable earnings of a head of a family, which are greater than $750 a week, may not be attached or garnished unless such person has agreed otherwise in writing. How Creditors Collect Debts: Repossession, Wage Garnishment, Bank Attachment, and More, Do Not Sell or Share My Personal Information.

You must file an answer to the complaint served with the summons.