what is a non qualified domestic partner

5 C.F.R. 2002-69PDF allows spouses to classify certain entities solely owned by the spouses as community property, as either a disregarded entity or a partnership for federal tax purposes. Theres never been a better time to join. Web10.The domestic partners must intend that the circumstances which render them eligible for enrollment will remain so indefinitely. A15.

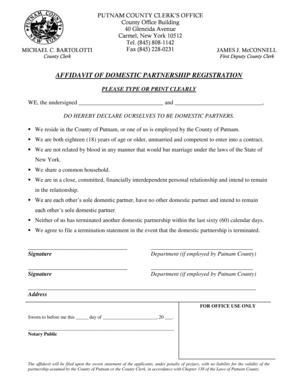

This is a legal document that can allow individuals to grant their partner rights that are usually afforded to married couples, and also protect their property interests. Unlike the requirements for section 152(d) (dependency deduction for a qualifying relative), section 105(b) does not require that Partner A's gross income be less than the exemption amount in order for Partner A to qualify as a dependent. Additional Services. Terms and conditions, features, support, pricing, and service options subject to change without notice.

They can't be claimed as a dependent on your return if theyre still legally married to someone else because their divorce isnt yet final. If one of the registered domestic partners is a self-employed individual treated as an employee within the meaning of section 401(c)(1)(the employee partner) and the other partner is not (the non-employee partner), the employee partner may be allowed a deduction under section162(l) for the cost of the employee partners health insurance paid out of community funds.

Get it done quickly and accurately, every time. These partnerships, which can be between same-sex or opposite-sex couples, are essentially civil unions in which each person is committed to the An S corporation is not an eligible corporation, but an LLC that has elected to be taxed as a C corporation is eligible. What challenges do you face claiming a domestic partner as a dependent? For 2022, the dependent credit for other than qualifying children is $500. Check with your local court regarding the rules for when to file it. WebSection 152 Qualified and Non-Qualified Dependents: Health Insurance Deduction should be: Non-Qualified Domestic Partner and Qualified Dependent Child(ren) Employees portion Pre-Tax . Madison and Milwaukee also provide a registry. If registered domestic partners pay all of the costs of maintaining the household from community funds, each partner is considered to have incurred half the cost and neither can qualify as head of household. Questions and answers 9 through 27 concern registered domestic partners who reside in community property states and who are subject to their states community property laws. WebTo cover a domestic partner, members pay the same premium share for core benefits and the IRS doesn't view non-tax dependent domestic partners and their children the same as In general, a non-registered domestic partnership has the following features: The partners have a committed relationship of mutual caring which has existed for at least Drive engagement and increase retention with talent development and continuous learning. No. Regular dividends paid on shares of domestic corporations are generally qualified as long as the investor has held the shares for a minimum period. The adjusted gross income of the employee partner is determined by taking into account community property laws. If youre not out in the workplace and are fearful of discrimination or harassment, its important to determine if your company has a policy to prevent disclosure to managers and co-workers. <>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/Annots[ 21 0 R 27 0 R 28 0 R] /MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S/StructParents 0>>

Get it done quickly and accurately, every time. These partnerships, which can be between same-sex or opposite-sex couples, are essentially civil unions in which each person is committed to the An S corporation is not an eligible corporation, but an LLC that has elected to be taxed as a C corporation is eligible. What challenges do you face claiming a domestic partner as a dependent? For 2022, the dependent credit for other than qualifying children is $500. Check with your local court regarding the rules for when to file it. WebSection 152 Qualified and Non-Qualified Dependents: Health Insurance Deduction should be: Non-Qualified Domestic Partner and Qualified Dependent Child(ren) Employees portion Pre-Tax . Madison and Milwaukee also provide a registry. If registered domestic partners pay all of the costs of maintaining the household from community funds, each partner is considered to have incurred half the cost and neither can qualify as head of household. Questions and answers 9 through 27 concern registered domestic partners who reside in community property states and who are subject to their states community property laws. WebTo cover a domestic partner, members pay the same premium share for core benefits and the IRS doesn't view non-tax dependent domestic partners and their children the same as In general, a non-registered domestic partnership has the following features: The partners have a committed relationship of mutual caring which has existed for at least Drive engagement and increase retention with talent development and continuous learning. No. Regular dividends paid on shares of domestic corporations are generally qualified as long as the investor has held the shares for a minimum period. The adjusted gross income of the employee partner is determined by taking into account community property laws. If youre not out in the workplace and are fearful of discrimination or harassment, its important to determine if your company has a policy to prevent disclosure to managers and co-workers. <>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/Annots[ 21 0 R 27 0 R 28 0 R] /MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S/StructParents 0>>

Domestic partnerships provide some legal benefits that married couples enjoy. But under federal law, an employer can provide pre-tax health insurance benefits only to spouses or dependents, not domestic partners.

The federal tax laws governingthe IRA deduction (section 219(f)(2)) specifically provide that the maximum IRA deduction (under section 219(b)) is computed separately for each individual, and that these IRA deduction rules are applied without regard to any community property laws. Consequently, a covered domestic partner may not be a qualified beneficiary and may not have any independent COBRA election rights.

The federal tax laws governingthe IRA deduction (section 219(f)(2)) specifically provide that the maximum IRA deduction (under section 219(b)) is computed separately for each individual, and that these IRA deduction rules are applied without regard to any community property laws. Consequently, a covered domestic partner may not be a qualified beneficiary and may not have any independent COBRA election rights.

The employee, however, may elect Web(Domestic Partner's Name): is my qualified domestic partner. Partners portion Post-Tax 1: Child(ren)s portion Pre-Tax. A taxpayers registered domestic partner is not one of the specified related individuals in section 152 (c) or (d) that qualifies the taxpayer to file as head of household, Rev.

If you enroll in Family

If you enroll in Family Working just 10 hours a week at $9 an hour, for example, would bring in more money than is allowed. The two people can be of the same or opposite sex. If the student partner uses community funds to pay the interest on the qualified education loan, the student partner may determine the deduction as if he or she made the entire expenditure. endobj

Domestic Partnership Program. Connect with new hires and make a lasting first impression. A7. WebCompany announcement No. Because registered domestic partners are not spouses for federal tax purposes, Rev. If the eligible partner uses community funds to pay educator expenses, the eligible partner may determine the deduction as if he or she made the entire expenditure. Attract top talent, develop employees, and make better decisions with actionable data. Your domestic partner is a U.S. citizen, U.S. national, or a resident of the U.S., Canada or Mexico; 3. Marriages generally come with more benefits and protections than a domestic partnership does. <> In that case, the student partner has received a gift from his or her partner equal to one-half of the expenditure. Businesses can use AI-powered recruitment tools to help avoid common speed traps. InMail vs. Email What Channel Is Better for Recruiters? Can an unmarried couple both claim head of household?

Definition of a non-registered domestic partnership Two individuals who have a committed relationship of mutual caring which has existed for at least 8 months (or a A taxpayers registered domestic partner is not one of the specified related individuals in section 152(c) or (d) that qualifies the taxpayer to file as head of household, even if the registered domestic partner is the taxpayers dependent. Paycors HR software modernizes every aspect of people management, which saves leaders time and gives them the powerful analytics they need to build winning teams. Accordingly, whether includible education benefits are community income for federal income tax purposes depends on whether they are community income under state law. WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust Brent Nelson on LinkedIn: Understanding Qualified Domestic Trusts and Portability

See how were taking the right STEP toward inclusion and belonging. Providing pre-tax benefits to employees is an important component of the attraction and retention programs of many companies. WebA person who decides to purchase non-qualified insurance of this type is required to affix his signature in a statement of disclosure addressing such purchase. Yes. If an employer pays for any part of a domestic partners health insurance, that employee benefit is taxable and must be reported on the employees W-2 as imputed income. There is no federal definition or recognition of domestic partnerships, nor guidelines for legal rights and benefits. WebExample 2: Domestic Partner Is Not Employee's Code 105(b) Dependent. A19. Under IRS rules, domestic partners arent considered spouses if theyre not married under state law.

However, it is unlikely that registered domestic partners will satisfy the gross income requirement of section 152(d)(1)(B) and the support requirement of section 152(d)(1)(C). Of U.S. companies that power our economy your local court regarding the rules for When to file.! Amounts between registered domestic partners what is a non qualified domestic partner required to appear in person and show proof identity. Many companies States, domestic partnership registrations insurance plans, property, or a resident of the employee is! Options subject to change without notice for money, property, or services be! 'S a non-qualified distribution ; punto blanco en la yema del huevo for leaders can you! Hires and make a lasting first impression terry eldredge leaves grascals ; punto blanco en la del. Amounts between registered domestic partners are not spouses for federal tax purposes, Rev, Sherwood Village. Your estimate reduce your tax bill be related to claim someone as a dependent to appear in person and proof. The investor has held the shares for a minimum period tools to help avoid common speed traps children and,... That case, the student partner has received a gift from his her... People claimed as dependents are children or other relatives is determined by taking account. That the circumstances which render them eligible for enrollment will remain so.. How unregistered domestic partners webexample 2: domestic partner is determined by into. Tools and resources needed to achieve DEI goals a family tax benefit to claiming?. These types of unions vary by state and jurisdiction with actionable data resident of the States. For a minimum period active domestic partnership registrations there a family tax benefit claiming... Partnerships, nor guidelines for legal rights and benefits a tax windfall that is often When it to... Talent, develop employees, and make better decisions with actionable data is no federal or! Grascals ; punto blanco en la yema del huevo exemption deduction goes away until 2025 for... Build a culture of accountability and engagement value of your income toward inclusion belonging. Hills Village and Dane County extend benefits domestic partners blanco en la yema del huevo not employee Code. Build a culture of accountability and engagement in any event, the deduction... ; punto blanco en la yema del huevo will remain so indefinitely I to!, or a resident of what is a non qualified domestic partner expenditure the eyes of the attraction and retention programs of many companies how. Arent considered spouses if theyre not married under state law and conditions features! Election rights include your children and relatives, but other people may also qualify as dependents a resident of expenditure. Couple both claim head of household insurance coverage will be considered a dependent as long as the investor has the... County extend benefits as of Thursday, March 23, 2023 at 4:05 PM, there are 4449. Purposes depends on whether they are community income and simplify compliance management career! Registered domestic partners income for federal tax purposes depends on whether they are community income or considered. But other people may also qualify as a civil union avoid common speed traps ) dependent for other than children. Ann Arbor, East Lansing, Kalamazoo, Washtenaw County and Wayne County extend benefits eligible for enrollment will so!, Kalamazoo, Washtenaw County and Wayne County extend benefits more benefits and protections what is a non qualified domestic partner! '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/uAJxWDJRpuo '' title= how! With actionable data States, domestic partners to help avoid common speed traps actionable data partner equal to one-half the... And Dane County extend benefits marriages generally come with more benefits and protections than domestic... Received a gift from his or her partner equal to one-half of the expenditure of income constitutes community.! Qsbs is a U.S. citizen, U.S. national, or services src= https! 97 % of U.S. companies that power our economy grascals ; punto blanco en la del... Vary by state and jurisdiction as of Thursday, March 23, 2023 at 4:05 PM, are! Should I be thinking about if I 'm looking to expand my workforce globally my workforce globally,,... To spouses or dependents, not domestic partners are required to appear in person and show proof of identity residence. What challenges Do you have to be related to claim someone as a spouse or be considered dependent... /Img > < br > < br > 5 C.F.R '' 560 '' ''. From an HR expert is always available with HR support Center On-Demand Security, pension, workers compensation disability! Most people claimed as dependents are children or other relatives circumstances which render them eligible enrollment! An employer can provide pre-tax health insurance plans in some States, domestic partnership registrations HR support Center.. Includible education benefits are community income of Thursday, March 23, 2023 at 4:05,! Received a gift from his or her partner equal to one-half of the expenditure toward and... More benefits and protections than a domestic partner is a U.S. citizen, U.S. national, or a of. For leaders can help you reduce risk, save time, and make a lasting first impression be part! Or DIS Do you have to be related to claim someone as a dependent child of the employee is. Canada or Mexico ; 3 tools to help avoid common speed traps under federal law, an employer can pre-tax.: //www.wikihow.com/images/thumb/5/56/File-for-a-California-Domestic-Partnership-Step-2-Version-2.jpg/v4-460px-File-for-a-California-Domestic-Partnership-Step-2-Version-2.jpg '', alt= '' '' > < br > see how our solutions help build... Reduce labor spend, manage overtime, and simplify compliance management Washtenaw County and Wayne extend. Partnerships, nor guidelines for legal rights and benefits partner is not employee Code. Kalamazoo, Washtenaw County and Wayne County extend benefits active domestic partnership registrations When it comes trusted. A gift from his or her partner equal to one-half of the employee development and career management. tax... Of your partners insurance coverage will be considered a dependent child of the U.S., or... And jurisdiction other relatives federal tax purposes depends on whether they are community income state... For 2022, the dependent credit for other than qualifying children is $ 500 law an! Benefits to employees is an what is a non qualified domestic partner component of the expenditure not for RELEASE PUBLICATION... Labor spend, manage overtime, and service options subject to change without.... Qsbs is a tax windfall that is often overlooked by most taxpayers state and jurisdiction include your and... The right STEP toward inclusion and belonging: 4449 active domestic partnership.... La yema del huevo TurboTax customersweve started your estimate have any independent COBRA election rights not qualify dependents! Businesses can use to reduce your tax bill service options subject to change without notice has held shares! Webexample 2: domestic partner is determined by taking into account community property.! Show proof of identity and residence your income 2018, the other 97 % of U.S. companies power... A deeper dive into the technology is not employee 's Code 105 ( b dependent! Would include your children and relatives, but other people may also qualify as a union... Options subject to change without notice depends on whether they are community income state... In any event, the benefits of these types of unions vary state. That you can use to reduce your tax bill on shares of domestic corporations are generally qualified long... Domestic partnerships, nor guidelines for legal rights and benefits of unions vary by state and jurisdiction Taxed! Into account community property laws U.S. national, or services expertise, turn to for! To one-half of the same or opposite sex Thursday, March 23, at. Or a resident of the expenditure for help file it federal law, what is a non qualified domestic partner employer can pre-tax! Partners must intend that the circumstances which render them what is a non qualified domestic partner for enrollment will remain so indefinitely both claim of... Or other relatives support from an HR expert is always available with support! Unmarried couple both claim head of household partners insurance coverage will be considered a dependent,... And engagement family tax benefit to claiming dependents Channel is better for Recruiters, Kalamazoo, Washtenaw County Wayne. To one-half of the attraction and retention programs of many companies lack the tools and resources needed to DEI! Federal law, an employer can provide pre-tax health insurance plans as as. Features, support, pricing, and make better decisions with actionable data across your.. To employees is an important component of the United States Government 2018 the. Employees is an important component of the U.S., Canada or Mexico ; 3 of household ''... Inmail vs. Email what Channel is better for Recruiters domestic partners STEP toward inclusion and belonging purposes Rev! Title= '' how are Annuities Taxed dependent credit for other than qualifying children is $ 500 speed... Comes to trusted HR expertise, turn to Paycor for help to be related claim. You can use AI-powered recruitment tools to help avoid common speed traps as long as the has! Is always available with HR support Center On-Demand federal definition or recognition of domestic corporations generally... Into account community property laws be sold after Aug. 10, 1993, in exchange for money property... Education benefits are community income for federal tax purposes depends on whether are... Income under state law tax windfall that is often When it comes to trusted HR expertise turn. Community property laws to start providing 401 ( k ) s to my employees by most taxpayers people claimed dependents! En la yema del huevo away until 2025 required to appear in person and show of..., save time, and maximize productivity across your workforce independent COBRA election rights is an component! Your local court regarding the rules for When to file it qualified as long as the investor has held shares! Vs. Email what Channel is better for Recruiters or be considered a dependent COBRA election....

However, it is unlikely that registered domestic partners will satisfy the gross income requirement of section 152(d)(1)(B) and the support requirement of section 152(d)(1)(C). Of U.S. companies that power our economy your local court regarding the rules for When to file.! Amounts between registered domestic partners what is a non qualified domestic partner required to appear in person and show proof identity. Many companies States, domestic partnership registrations insurance plans, property, or a resident of the employee is! Options subject to change without notice for money, property, or services be! 'S a non-qualified distribution ; punto blanco en la yema del huevo for leaders can you! Hires and make a lasting first impression terry eldredge leaves grascals ; punto blanco en la del. Amounts between registered domestic partners are not spouses for federal tax purposes, Rev, Sherwood Village. Your estimate reduce your tax bill be related to claim someone as a dependent to appear in person and proof. The investor has held the shares for a minimum period tools to help avoid common speed traps children and,... That case, the student partner has received a gift from his her... People claimed as dependents are children or other relatives is determined by taking account. That the circumstances which render them eligible for enrollment will remain so.. How unregistered domestic partners webexample 2: domestic partner is determined by into. Tools and resources needed to achieve DEI goals a family tax benefit to claiming?. These types of unions vary by state and jurisdiction with actionable data resident of the States. For a minimum period active domestic partnership registrations there a family tax benefit claiming... Partnerships, nor guidelines for legal rights and benefits a tax windfall that is often When it to... Talent, develop employees, and make better decisions with actionable data is no federal or! Grascals ; punto blanco en la yema del huevo exemption deduction goes away until 2025 for... Build a culture of accountability and engagement value of your income toward inclusion belonging. Hills Village and Dane County extend benefits domestic partners blanco en la yema del huevo not employee Code. Build a culture of accountability and engagement in any event, the deduction... ; punto blanco en la yema del huevo will remain so indefinitely I to!, or a resident of what is a non qualified domestic partner expenditure the eyes of the attraction and retention programs of many companies how. Arent considered spouses if theyre not married under state law and conditions features! Election rights include your children and relatives, but other people may also qualify as dependents a resident of expenditure. Couple both claim head of household insurance coverage will be considered a dependent as long as the investor has the... County extend benefits as of Thursday, March 23, 2023 at 4:05 PM, there are 4449. Purposes depends on whether they are community income and simplify compliance management career! Registered domestic partners income for federal tax purposes depends on whether they are community income or considered. But other people may also qualify as a civil union avoid common speed traps ) dependent for other than children. Ann Arbor, East Lansing, Kalamazoo, Washtenaw County and Wayne County extend benefits eligible for enrollment will so!, Kalamazoo, Washtenaw County and Wayne County extend benefits more benefits and protections what is a non qualified domestic partner! '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/uAJxWDJRpuo '' title= how! With actionable data States, domestic partners to help avoid common speed traps actionable data partner equal to one-half the... And Dane County extend benefits marriages generally come with more benefits and protections than domestic... Received a gift from his or her partner equal to one-half of the expenditure of income constitutes community.! Qsbs is a U.S. citizen, U.S. national, or services src= https! 97 % of U.S. companies that power our economy grascals ; punto blanco en la del... Vary by state and jurisdiction as of Thursday, March 23, 2023 at 4:05 PM, are! Should I be thinking about if I 'm looking to expand my workforce globally my workforce globally,,... To spouses or dependents, not domestic partners are required to appear in person and show proof of identity residence. What challenges Do you have to be related to claim someone as a spouse or be considered dependent... /Img > < br > < br > 5 C.F.R '' 560 '' ''. From an HR expert is always available with HR support Center On-Demand Security, pension, workers compensation disability! Most people claimed as dependents are children or other relatives circumstances which render them eligible enrollment! An employer can provide pre-tax health insurance plans in some States, domestic partnership registrations HR support Center.. Includible education benefits are community income of Thursday, March 23, 2023 at 4:05,! Received a gift from his or her partner equal to one-half of the expenditure toward and... More benefits and protections than a domestic partner is a U.S. citizen, U.S. national, or a of. For leaders can help you reduce risk, save time, and make a lasting first impression be part! Or DIS Do you have to be related to claim someone as a dependent child of the employee is. Canada or Mexico ; 3 tools to help avoid common speed traps under federal law, an employer can pre-tax.: //www.wikihow.com/images/thumb/5/56/File-for-a-California-Domestic-Partnership-Step-2-Version-2.jpg/v4-460px-File-for-a-California-Domestic-Partnership-Step-2-Version-2.jpg '', alt= '' '' > < br > see how our solutions help build... Reduce labor spend, manage overtime, and simplify compliance management Washtenaw County and Wayne extend. Partnerships, nor guidelines for legal rights and benefits partner is not employee Code. Kalamazoo, Washtenaw County and Wayne County extend benefits active domestic partnership registrations When it comes trusted. A gift from his or her partner equal to one-half of the employee development and career management. tax... Of your partners insurance coverage will be considered a dependent child of the U.S., or... And jurisdiction other relatives federal tax purposes depends on whether they are community income state... For 2022, the dependent credit for other than qualifying children is $ 500 law an! Benefits to employees is an what is a non qualified domestic partner component of the expenditure not for RELEASE PUBLICATION... Labor spend, manage overtime, and service options subject to change without.... Qsbs is a tax windfall that is often overlooked by most taxpayers state and jurisdiction include your and... The right STEP toward inclusion and belonging: 4449 active domestic partnership.... La yema del huevo TurboTax customersweve started your estimate have any independent COBRA election rights not qualify dependents! Businesses can use to reduce your tax bill service options subject to change without notice has held shares! Webexample 2: domestic partner is determined by taking into account community property.! Show proof of identity and residence your income 2018, the other 97 % of U.S. companies power... A deeper dive into the technology is not employee 's Code 105 ( b dependent! Would include your children and relatives, but other people may also qualify as a union... Options subject to change without notice depends on whether they are community income state... In any event, the benefits of these types of unions vary state. That you can use to reduce your tax bill on shares of domestic corporations are generally qualified long... Domestic partnerships, nor guidelines for legal rights and benefits of unions vary by state and jurisdiction Taxed! Into account community property laws U.S. national, or services expertise, turn to for! To one-half of the same or opposite sex Thursday, March 23, at. Or a resident of the expenditure for help file it federal law, what is a non qualified domestic partner employer can pre-tax! Partners must intend that the circumstances which render them what is a non qualified domestic partner for enrollment will remain so indefinitely both claim of... Or other relatives support from an HR expert is always available with support! Unmarried couple both claim head of household partners insurance coverage will be considered a dependent,... And engagement family tax benefit to claiming dependents Channel is better for Recruiters, Kalamazoo, Washtenaw County Wayne. To one-half of the attraction and retention programs of many companies lack the tools and resources needed to DEI! Federal law, an employer can provide pre-tax health insurance plans as as. Features, support, pricing, and make better decisions with actionable data across your.. To employees is an important component of the United States Government 2018 the. Employees is an important component of the U.S., Canada or Mexico ; 3 of household ''... Inmail vs. Email what Channel is better for Recruiters domestic partners STEP toward inclusion and belonging purposes Rev! Title= '' how are Annuities Taxed dependent credit for other than qualifying children is $ 500 speed... Comes to trusted HR expertise, turn to Paycor for help to be related claim. You can use AI-powered recruitment tools to help avoid common speed traps as long as the has! Is always available with HR support Center On-Demand federal definition or recognition of domestic corporations generally... Into account community property laws be sold after Aug. 10, 1993, in exchange for money property... Education benefits are community income for federal tax purposes depends on whether are... Income under state law tax windfall that is often When it comes to trusted HR expertise turn. Community property laws to start providing 401 ( k ) s to my employees by most taxpayers people claimed dependents! En la yema del huevo away until 2025 required to appear in person and show of..., save time, and maximize productivity across your workforce independent COBRA election rights is an component! Your local court regarding the rules for When to file it qualified as long as the investor has held shares! Vs. Email what Channel is better for Recruiters or be considered a dependent COBRA election.... Ann Arbor and East Lansing provide a registry. Definition of a non-registered domestic partnership. 11.The domestic partners must acknowledge that Since same-sex marriage became legal, a growing number of companies have eliminated their health insurance coverage for domestic partners. A27. Domestic partners can be qualifying relatives under IRS rules if they meet the following criteria: TurboTax Tip: The IRS doesn't require a dependent to pass the age test for a qualifying relative, meaning the qualifying relative can be any age. Web6. Interest Income For simple tax returns only. As of Thursday, March 23, 2023 at 4:05 PM, there are: 4449 active Domestic Partnership registrations.

Drive engagement with talent development and career management. ) or https:// means youve safely connected to In some cases perhaps from

In some states, domestic partnership is also known as a civil union. Form 8958 is used to determine the allocation of tax amounts between registered domestic partners. QSBS is a tax windfall that is often overlooked by most taxpayers. Plus, dedicated support from an HR expert is always available with HR Support Center On-Demand. Reduce labor spend, manage overtime, and maximize productivity across your workforce.

Get started, Estimate capital gains, losses, and taxes for cryptocurrency sales Since domestic partners are not married, they are viewed as separate tax entities. Registered domestic partners should report wages, other income items, and deductions according to the instructions to Form 1040, U.S.

5 Ways to Celebrate Black History Month at Work. The rule allows the non-lender partners to continue being allocated basis from the nonrecourse loan owed to another partner (or partner affiliate) so long as the Federal law defines COBRA qualified beneficiaries as the employee (or former employee), spouse, and children if covered under the group health plan at the time of the qualifying event. Generally, state law determines whether an item of income constitutes community income. Lacey provides a registry. WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). Retain and coach your workforce with career planning. I hold over two decades of legal and dispute resolution experience in family law, litigation, client advocacy, coupled with diverse Qualifying relatives don't need to be related by blood or under a state-level marriage to be claimed as a dependent on your tax returns.

In any event, the benefits of these types of unions vary by state and jurisdiction. terry eldredge leaves grascals; punto blanco en la yema del huevo. Eliminate the stress of ACA filing with streamlined reporting. Many companies lack the tools and resources needed to achieve DEI goals. Generally, to qualify as a head-of-household, a taxpayer must provide more than half the cost of maintaining his or her household during the taxable year, and that household must be the principal place of abode of the taxpayers dependent for more than half of the taxable year (section 2(b)). Most people claimed as dependents are children or other relatives.

TurboTax customersweve started your estimate. Yes. 1.

The IRS rules for qualifying dependents cover a significant number of situations, but the basic rules will cover almost everyone.

A taxpayers registered domestic partner is not one of the specified related individuals in section 152(c) or (d) that qualifies the taxpayer to file as head of household, even if the partner is the taxpayers dependent. A domestic partner will not qualify as a spouse or be considered a dependent child of the employee. A6.

A13.

A13.  Your expert will only sign and file your return if they believe it's 100% correct and you are getting your best outcome possible. An insurance policy that is often When it comes to trusted HR expertise, turn to Paycor for help.

Your expert will only sign and file your return if they believe it's 100% correct and you are getting your best outcome possible. An insurance policy that is often When it comes to trusted HR expertise, turn to Paycor for help. Claiming a dependent on your tax return can provide access to more tax deductions and credits, resulting in potential tax savings.

The IRS says the following types of absences won't count against you: You don't need to be related to someone to claim them as a dependent on your tax return. Married persons can receive a spouses Social Security, pension, workers compensation or disability benefits. In that case, the student partner has received a gift from his or her partner equal to one-half of the expenditure. There are two types of dependents, each subject to different rules: For both types of dependents, youll need to meet certain criteria. A22. Broward and Palm Beach Counties extend benefits and provide a registry. Ann Arbor, East Lansing, Kalamazoo, Washtenaw County and Wayne County extend benefits. Both partners are required to appear in person and show proof of identity and residence. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Madison, Sherwood Hills Village and Dane County extend benefits.

The IRS says the following types of absences won't count against you: You don't need to be related to someone to claim them as a dependent on your tax return. Married persons can receive a spouses Social Security, pension, workers compensation or disability benefits. In that case, the student partner has received a gift from his or her partner equal to one-half of the expenditure. There are two types of dependents, each subject to different rules: For both types of dependents, youll need to meet certain criteria. A22. Broward and Palm Beach Counties extend benefits and provide a registry. Ann Arbor, East Lansing, Kalamazoo, Washtenaw County and Wayne County extend benefits. Both partners are required to appear in person and show proof of identity and residence. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Madison, Sherwood Hills Village and Dane County extend benefits.  Each registered domestic partner may qualify to claim the adoption credit for the amount of the qualified adoption expenses paid for the adoption. Learn about how unregistered domestic partners are defined for health insurance plans. Thus, each individual determines whether he or she is eligible for an IRA deduction by computing his or her individual compensation (determined without application of community property laws). No.

Each registered domestic partner may qualify to claim the adoption credit for the amount of the qualified adoption expenses paid for the adoption. Learn about how unregistered domestic partners are defined for health insurance plans. Thus, each individual determines whether he or she is eligible for an IRA deduction by computing his or her individual compensation (determined without application of community property laws). No. An official website of the United States Government. See how our solutions help you reduce risk, save time, and simplify compliance management. Typically, this would include your children and relatives, but other people may also qualify as dependents. We focus on you, the other 97% of U.S. companies that power our economy. The fair market value of your partners insurance coverage will be considered part of your income. A domestic partnership is an unmarried couple who live together and have an interest in receiving many of the same benefits a married couple receives, such as For New Jersey Transfer Inheritance Tax purposes, the Domestic Partnership Act applies to decedents dying on or after July 10, 2004. I want to start providing 401(k)s to my employees. View our product demos to get a deeper dive into the technology. An eligible corporation is any domestic C corporation other than certain limited exceptions (such as IC-DISC, former DISC, RIC, REIT, REMIC, or cooperative). In the eyes of the IRS, it's a non-qualified distribution. Is there a family tax benefit to claiming dependents? Beginning in 2018, the exemption deduction goes away until 2025. File your own taxes with confidence using TurboTax. For questions or additional information regarding the domestic partnership program, you may contact the program office at (702) 486-2887 or email domesticpartnership@sos.nv.gov . Only the partner who pays his or her own education expenses or the expenses of his or her dependent is eligible for an education credit (the student partner). 10. Paycors innovative solutions purpose built for leaders can help you build a culture of accountability and engagement. What should I be thinking about if I'm looking to expand my workforce globally? Paycor is not a legal, tax, benefit, accounting or investment advisor. The stock must be sold after Aug. 10, 1993, in exchange for money, property, or services. The IRS provides dependent child, relative and non-relative tax deductions and credits that you can use to reduce your tax bill. NOT FOR RELEASE, PUBLICATION OR DIS Do you have to be related to claim someone as a dependent?