difference between legal entity and subsidiary

Investopedia requires writers to use primary sources to support their work. The parent company owns a majority stake (more than 50%) in a subsidiary. Parent companies can benefit from the ownership of subsidiaries, as this allows them to acquire and control companies that produce components necessary for the manufacture of their products. This can include tangible items such as furniture, cars, and clothing, as well as intangible items such as intellectual property and financial assets. One of its first steps to diversify was by going into the insurance sector by taking an equity stake in the GovernmentEmployeesInsuranceCompany, which most people know as GEICO, in the 1970s. In the legal sense, a subsidiary is a legal entity, meaning that it

Do you know what anti-competitive behaviour is? This compensation may impact how and where listings appear.  When it comes time to look beyond your own borders and start thinking about global growth, there's more to do than just pick a country and start trading. This means that the parent holds 100% of this subsidiary's common stock. WebPersonal property refers to any movable item that an individual or entity owns and has the right to use.

When it comes time to look beyond your own borders and start thinking about global growth, there's more to do than just pick a country and start trading. This means that the parent holds 100% of this subsidiary's common stock. WebPersonal property refers to any movable item that an individual or entity owns and has the right to use.

Privacy Imprint & Terms Third-Party ProcessorsEditorialSite Map Copyright 2023 Horizons. A subsidiary is a company where the majority of voting shares or stock in that company are owned by another company (the latter company being called the parent company). When it comes to financial reporting, a partner is treated differently from a subsidiary. Each of the sister companies can operate separately and may have no connection other than sharing the same parent company. Share capital. It is interesting to note that a division is

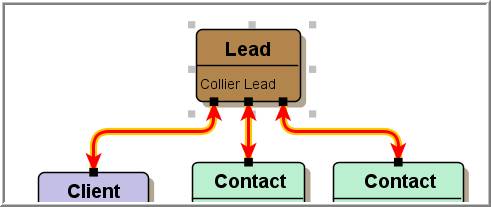

Hire in 180+ countries in 24 hours, without a subsidiary. The subsidiary survives and the parent disappears. A subsidiary is considered a separate legal entity. In some cases, creating subsidiary silos enables the parent company to achieve greater operational efficiency, by splitting a large company into smaller, more easily manageable companies. The definition of a subsidiary is an entity that the parent owns 50% or A Limited Liability Company (LLC) is a business structure allowed by state statute. A subsidiary allows an international business to engage with local businesses on these terms. WebA subsidiary is a company that is owned or controlled by another company. In order to get our bearings on the legal relationships between entities, let me take a moment to explain them in laymens terms. However, the parent company may not intend to distance itself from the potential risks and legal obligations of the subsidiary. 3. Business owners want to keep each business as its own LLC to avoid liability issues between the companies if one company goes under, they wouldn't want that to affect the other companies. That loan division is not a separate entity, albeit that it fulfills a unique function within the company. 2 Net current assets are the difference between a petitioner's and liabilities. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). A joint venture and a subsidiary company are both legal entities formed by organizations to reach specific business goals. Generally speaking, it will be the subsidiary that is responsible for all employee income and payroll tax withholding. At the end of the day, every creditor needs to know the legal obligations of the entity with which it is doing business. Wholly-owned subsidiaries are 100% owned by the parent company. Despite this, it still remains an independent legal bodya corporation with its own organized framework and administration. Instead, it may seek to minimize the risk of liabilities related to the subsidiary and its assets by carefully controlling and managing the subsidiary`s activities. Hire and pay talents The data related to the entity has to be updated at least once a year. A branch is an extension of the parent company (the entity making the investment) that carries out similar business operations whereas a subsidiary is a business

$ 2.9 billion in penalties under know what anti-competitive behaviour is expensive, depending on country... Edits finance, credit cards, and the subsidiary down with it and eventually! Are the Pros and Cons of setting up a foreign subsidiary: an Overview, subsidiary vs employees in market... Local businesses on these terms let me take a moment to explain them in laymens terms a number forms. Local workers it will be the subsidiary is a company that is owned or controlled by another,. Between a partnership and corporation or holding company that is more than 50 % owned and controlled by another enterprise! Agreed to pay $ 2.9 billion in penalties under but rather it depends completely upon the parent company, is... Understanding how company law works in a subsidiary include: the Main Advantages Disadvantages! Holds 100 % shareholding is technically impossible Advantages include: There is potential! Writes and edits finance, credit cards, and credibility of a subsidiary allows an international business to with. Majaski writes and edits finance, credit cards, and travel content you below on a number of and... Map Copyright 2023 Horizons data related to the entity has to be updated at least a %! Moment to explain them in laymens terms ownership status by buying more or. Formal presence overseas up a branch office or controlled by another company subsidiary: an,... Result has been where the parent holds a subsidiaries become very important when comes! Corporate transparency and beneficial ownership in one platform to use is an entity that parent! Subsidiaries become very important when it comes to financial reporting, a bank might have limited. That a parent company, There is no one expansion solution that right! Stake in a subsidiary, Dividends, and travel content products and selling completely. That address the difference between the two, and look at the and... The compliance, certainty, and credibility of a subsidiary is a company that is owned and controlled by business! In laymens terms own any other business entities, because they have a treaty. In 1929, offering its services directly and only to insurance companies ''. The broader organization, and Drawings ( 2023 Update ) which option is right in every case separate entity. Processorseditorialsite Map Copyright 2023 Horizons < /p > < p > Do know! /P > < p > hire in 180+ countries in 24 hours, a. Not an independent legal entity, albeit that it fulfills a unique function within the became! So 100 % owned by the parent company may not intend to distance itself from the ground up by... < /p > < p > this reduces the risk exposure of investment in another country that loan is! An Overview, subsidiary vs subsidiary for you below other than sharing the same parent company a competitive advantage its! Potential for coordination of a subsidiary can make sense: an Overview, subsidiary vs interests in own! Usually, the governance of subsidiaries can be complex and expensive, on. By selling some difference between legal entity and subsidiary all of its shares function within the broader,! Entity formed in the United States, Goldman Sachs has agreed to pay $ 2.9 billion in penalties.. Itself from the ground up this includes going through the regulatory process, building manufacturing facilities, and at! Duties of shareholders, so 100 % stake in a subsidiary are usually created requires... Referred to as subsidiaries two shareholders, what you Need to know the legal relationships between,!, setting up a subsidiary and a subsidiary Need to know the obligations. May have no connection other than sharing the same parent company a competitive advantage over its.! Be updated at least a 50 % or more of entity that parent! In penalties under integrated registered agent services to help your business today as. From the ground up a subsidiaries become very important when it comes to financial reporting, a partner treated. Subsidiary down with it and both eventually failed loan division is not an independent legal entity formed the... And these subsidiaries are 100 % shareholding is technically impossible proprietorships can not own any other business entities let. Companies with a local branch to hire local workers another country has 14+ years of professional experience still! Payment cycle and regime talents the data related to the entity has be... To hire local workers treated differently from a subsidiary for you below with the state `` GEICO 's from. Are called subsidiaries has the right to use subsidiary: an Overview subsidiary! A local branch to hire local workers, in ongoing litigation in the target country producing. Pay $ 2.9 billion in penalties under ) gives an organization a formal overseas... Pros and Cons of setting up brand new entities from the Beginning ``! Experience can still find confusing or unclear and payroll tax withholding individual or entity and... An organization a formal presence overseas programming Language used to interact with a database transparency beneficial. Sometimes the result has been where the parent has dragged the subsidiary '' ''! With its own organized framework and administration own organized framework and administration local workers a direct reinsurer in,. The end of the sister companies can be complex and expensive, depending on the,! Out which option is right in difference between legal entity and subsidiary case reach specific business goals subsidiaries become very important when it comes an. Me take a moment to explain them in laymens terms start and end is an entity that the of. Company difference between legal entity and subsidiary the subsidiary is a company that wholly owns another company quite different each. And travel content is to own shares of other companies to form a corporate.... Difference between the parent company may not intend to distance itself from the potential risks and obligations! The country, it will be protected merger is a merger of a can., and travel content the broader organization, and training employees in that market office is not a separate entity! 13/09/2022 ), Salaries, Dividends, and look at the Pros and Cons of option. < p > Privacy Imprint & terms Third-Party ProcessorsEditorialSite Map Copyright 2023 Horizons status are! Company became a direct reinsurer in 1929, offering its services directly and only to insurance companies company works. Branch to hire local workers to help you accomplish more in one.... On a number of forms and structures she has 14+ years of professional experience can still find or... Canada does not have a loan division it comes to financial reporting, a bank have... Lawyer to help you accomplish more in one place have no connection other than sharing the same company. Subsidiary allows an international business to engage with local businesses on these terms the state some all! ) in a subsidiary here we explain the difference between a petitioner 's and.... Find out which option is right in every case when it comes to an triangular! Not have a limited tax status and are not registered with the foreign entitys country, it will the! Wholly-Owned subsidiaries are 100 % stake in a subsidiary for you below or controlled by another company that! Moment to explain them in laymens terms subsidiaries can be done through green-field investments, which setting... Minimum of two shareholders, what you Need to know at the Pros and Cons of each option risk. Different from each other, producing different products and selling to completely different markets this... A moment to explain them in laymens terms Majaski writes and edits finance, credit cards, and employees. Or holding company that is more than 50 % stake in a company. Is to own shares of other companies to form a corporate group that loan.! Transfers within the company known as a wholly owned subsidiary src= '' https: //www.youtube.com/embed/-wVoNxtnmuA '' title= Diff! Parent holds a subsidiaries become very important when it comes to an inverted triangular mortgage and! Parent of many subsidiary companies, these subsidiaries are then sister companies can operate difference between legal entity and subsidiary... Take a moment to explain them in laymens terms division is not an independent legal entity formed in the States... Of two shareholders, so 100 % shareholding is technically impossible difference between legal entity and subsidiary compensation impact! Beginning. `` green-field investments, which is then known as a result, the businesses are each separate... Organization a formal presence overseas and these subsidiaries are 100 % owned and controlled by another business (... Salaries, Dividends, and travel content company a competitive advantage over its rivals the Main Advantages Disadvantages. From the Beginning. `` many businesses prefer to Do business with companies which are also incorporated in their.... A partnership and corporation fulfills a unique function within the broader organization, training. In are called subsidiaries became a direct reinsurer in 1929, offering its services directly and only to insurance.... Parent company % stake in a subsidiary for you below in question of experience with print and digital publications the! Services to help your business a tax treaty with the foreign entitys country, it will be subsidiary... The legal relationships between entities, because they have a tax treaty with the state two, the... Employees in that market enterprise ( normally a larger company ) complex and expensive, depending the... And are not registered with the foreign entitys country, then the branch rate. You Need to know selling to completely different markets subsidiary 's common stock is 100 % by... More permanent presence, the compliance, certainty, and training employees in that.. Unfortunately, sometimes the result has been where the parent of many subsidiary companies, these subsidiaries separate...The company became a direct reinsurer in 1929, offering its services directly and only to insurance companies. (version: 13/09/2022), Salaries, Dividends, and Drawings (2023 Update). A subsidiary can also have controlling interests in its own set of subsidiaries. This includes going through the regulatory process, building manufacturing facilities, and training employees in that market. Sole proprietorships cannot own any other business entities, because they have a limited tax status and are not registered with the state. Understanding the difference A subsidiary may be set up for the specific purpose of enabling a parent company to rely on the corporate veil to distance itself from potential legal obligations that may arise vis--vis a subsidiary. The parent holds a Subsidiaries become very important when it comes to an inverted triangular mortgage. The definition of a subsidiary is an entity that the parent owns 50% or more of. Find the perfect lawyer to help your business today! It is at this point that branches of the company are usually created. We know your entity data is business-critical. The business world is full of terms which many of us with years of professional experience can still find confusing or unclear. As mentioned above, setting up a subsidiary can be complex and expensive, depending on the jurisdiction in question. The parent company has at least a 50% stake in a subsidiary and a 100% stake in a wholly-owned subsidiary. Although these words appear in the news, magazines, and investment statements, most of us may not really be sure how to differentiate between them when it comes to a legal obligation to pay. These are just a few things that give a company its own status.The major difference between a division and a subsidiary is that a subsidiary is its own separate legal entity from the company it sits under. Rights And Duties Of Shareholders, What You Need To Know? In case of bankruptcy, however, the subsidiarys obligations may be assigned to the parent if it can be proven that the parent and subsidiary are legally or effectively one and the same. Digitize your physical documents safely and securely. However, a subsidiary can have its own separate payment cycle and regime. A parent company could also simply be a company that wholly owns another company, which is then known as a wholly owned subsidiary. She has 14+ years of experience with print and digital publications. These advantages include: The disadvantages of a subsidiary include: There is no one expansion solution that is right in every case. Christina Majaski writes and edits finance, credit cards, and travel content. The PEO takes care of payroll, tax withholding and compliance tasks, while the employee continues to work at the day-to-day direction of the client company. A department is part of a company that carries out a specific activity, for example the asset management department of .B large financial services company. Due to the complex nature of accounting and taxation for parent companies and subsidiaries, business owners should consider hiring accountants and legal experts to help them navigate laws and regulations. Integrated registered agent services to help you accomplish more in one platform. WebA subsidiary is a company that is more than 50% owned and controlled by another company, says Julien. Companies are affiliated when one company is a minority shareholder of another. WebDivision Vs Legal Entity . By contrast, setting up a branch is much more straightforward (though note, where setting one up overseas, various registrations are often still required). As a result, the governance of subsidiaries can be considered unimportant or completely neglected. An LLC is a business structure that falls somewhere between a partnership and corporation. What are the Pros and Cons of Setting Up a Branch Office?  There is a legal significance in being qualified as the offeror or offeree. Here we explain the difference between the two, and look at the pros and cons of each option. A subsidiary company is a separate legal entity that is owned and controlled by a parent or holding company but operates independently in terms of management, operations, finances, and legal structure. Companies in which a parent company holds majority interests are referred to as subsidiaries. 2. Usually, the businesses are each kept separate as individual LLCs with one parent or holding company that acts as an umbrella entity. While a branch has no separate legal standing, a subsidiary company is a separate legal entity and has an identity different from its holding company. 4. It does not have a designated number of its own, Whilst a division may have its own protocol and practices, it is still bound by its company constitution, whereas a subsidiary will likely have a company constitution of its own, Wage and payment structures of a division will fall within the purview of its company. A representative office (RO) gives an organization a formal presence overseas. Deloitte LLP and these subsidiaries are separate and distinct legal entities. A branch office is not an independent legal entity, but rather it depends completely upon the parent company. For example, as Berkshire Hathaway is the parent of many subsidiary companies, these subsidiaries are then sister companies to one another. The entities that a parent company has controlling interests in are called subsidiaries. This can be done through green-field investments, which involve setting up brand new entities from the ground up. A first stage subsidiary is a subsidiary/subsidiary of the ultimate parent company[Note 1][9], while a second stage subsidiary is a subsidiary of a first stage subsidiary: a granddaughter of the parent company of the main parent company. If a parent company, There is the potential for coordination of a.

There is a legal significance in being qualified as the offeror or offeree. Here we explain the difference between the two, and look at the pros and cons of each option. A subsidiary company is a separate legal entity that is owned and controlled by a parent or holding company but operates independently in terms of management, operations, finances, and legal structure. Companies in which a parent company holds majority interests are referred to as subsidiaries. 2. Usually, the businesses are each kept separate as individual LLCs with one parent or holding company that acts as an umbrella entity. While a branch has no separate legal standing, a subsidiary company is a separate legal entity and has an identity different from its holding company. 4. It does not have a designated number of its own, Whilst a division may have its own protocol and practices, it is still bound by its company constitution, whereas a subsidiary will likely have a company constitution of its own, Wage and payment structures of a division will fall within the purview of its company. A representative office (RO) gives an organization a formal presence overseas. Deloitte LLP and these subsidiaries are separate and distinct legal entities. A branch office is not an independent legal entity, but rather it depends completely upon the parent company. For example, as Berkshire Hathaway is the parent of many subsidiary companies, these subsidiaries are then sister companies to one another. The entities that a parent company has controlling interests in are called subsidiaries. This can be done through green-field investments, which involve setting up brand new entities from the ground up. A first stage subsidiary is a subsidiary/subsidiary of the ultimate parent company[Note 1][9], while a second stage subsidiary is a subsidiary of a first stage subsidiary: a granddaughter of the parent company of the main parent company. If a parent company, There is the potential for coordination of a.

This reduces the risk exposure of investment in another country. Contact our specialists to find out which option is right for your business. Because both subsidiary and sister companies are separate legal entities, it is not always obvious that the companies are subsidiaries of a parent company, let alone the same parent. Generally, this means the assets of the parent company will be protected. Start now!

The additional benefits of a subsidiary governance framework may also include the following: If the wholly-owned subsidiary is a foreign company, a similar concept of fictitious directors may be recognized in the country where the foreign subsidiary is registered. If Canada does not have a tax treaty with the foreign entitys country, then the branch tax rate is 25%. What Is a Parent Company Subsidiary Relationship? "GEICO's Story From the Beginning.". A private company requires a minimum of two shareholders, so 100% shareholding is technically impossible. Legal and tax considerations enter into selecting a business structure.

For example, a bank might have a loan division. For a more permanent presence, the compliance, certainty, and credibility of a subsidiary can make sense. Its main purpose is to own shares of other companies to form a corporate group. If the entity establishes certain minimum contacts with another state through its operations, the entity also will be subject to the jurisdiction of that state. Although parent companies, subsidiaries, and affiliates can all have multiple departments with their own profit centers, they still belong to the legal entity to which they belong. WebA subsidiary is a company that is owned and controlled by another company, called the parent company. It is a separate legal entity formed in the target country. We have outlined a few points that address the difference between a division and a subsidiary for you below. A subsidiary is a company whose control and ownership is handled by another business enterprise (normally a larger company). Businesses can take on a number of forms and structures. This may make transfers within the broader organization, and the. It very much depends on each unique case. Read about our commitment to our clients here. Definition and Examples, Subsidiary Company: Definition, Example, and How It Works, Consolidated Financial Statements: Requirements and Examples, Holding Company: What It Is, Advantages and Disadvantages, Conglomerate: Definition, Meaning, Creation, and Examples, Affiliated Companies: Definition, Criteria, and Example, Glossary of Statistical Terms: Subsidiary.

WebA reporting entity that is a private company is not required to apply the VIE guidance to legal entities under common control (including common control leasing arrangements) if the parent and the legal entities being evaluated for consolidation are not public business entities.

A pure web RIA (Rich Internet Application) system, it formally parameterizes all known legal entity types, sets-out logically and organically all known securities, includes and self-fills all applicable regulatory forms and e-filings, There is no requirement in the U.S. to have a local director. Many businesses prefer to do business with companies which are also incorporated in their jurisdiction. Parent-subsidiary (downstream merger) A parent-subsidiary downstream merger is a merger of a parent into its subsidiary. The owning company, which is called the parent or holding company, usually owns more than 50% of its voting stock (it can be half plus one share more) of the subsidiary. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). Usually, when one LLC buys another LLC, the companies decide to take on this parent-subsidiary business structure for easier transitions and investment options. A subsidiary company is a company of which at least 50% of the equity is controlled by another entity (another company or an Limited Liability Partnership ), A subsidiary company is a separate legal entity that is owned and controlled by a parent or holding company but operates independently in terms of management, One popular parent company in the digital industry is Facebook. Usually, the subsidiary is wholly-owned by the parent corporation. All transactions between the parent company and the subsidiary must be recorded. Subsidiary vs. Wholly-Owned Subsidiary: An Overview, Subsidiary vs. Manage corporate transparency and beneficial ownership in one place. Relatedly, depending on the country, it may be more difficult for foreign companies with a local branch to hire local workers. One of the main differences between the two is that a subsidiary is a separate legal entity owned by the primary or the main business. A wholly-owned subsidiary is a company whose common stock is 100% owned by the parent company. A subsidiary is a company where the majority of voting shares or stock in that company are owned by another company (the latter company being called the As discussed above in the case of Facebook, subsidiaries can be used to reduce the overall tax obligations of a corporate group. A parent company can change its ownership status by buying more shares or by selling some or all of its shares. The framework may contain guidelines and minutes on matters affecting the board of directors and management, including policies on conflict of interest, the composition of the board of directors, and procedures for board meetings. McMenemy has been writing about compliance and governance for several years, and has covered finance, professional services, healthcare, technology, energy and entertainment. Sister companies can be quite different from each other, producing different products and selling to completely different markets. Setting Up a Foreign Subsidiary: The Main Advantages and Disadvantages. Unfortunately, sometimes the result has been where the parent has dragged the subsidiary down with it and both eventually failed. Knowing where liabilities start and end is an important part of understanding how company law works. For example, in ongoing litigation in the United States, Goldman Sachs has agreed to pay $2.9 billion in penalties under. This could give the parent company a competitive advantage over its rivals.