hca healthcare 401k terms of withdrawal

Are nicotine-free during annual benefits enrollment may receive up to four age-59 withdrawals calendar.

HCA Healthcare Since this type of plan affords for an Alternate Payee to receive an immediate lump sum distribution, the terms of the QDRO are much simpler than the provisions contained in QDROs for other types of plans. A hardship withdrawal is a distribution from a 401(k) plan to be made on account of an immediate and heavy financial need of the employee, and the For more I withdrew my 401k money because of permanent disability and waiting for an answer from Social Security, if this counts here can I say all of it was used because of disab To contact the HCA Retirement Center, please call 844-921-3379. In expanding on this mission, CA Support Manager strives to create an environment that combines values and respect while also rewarding employees. If you expect income types not shown or have additional questions, see. One of the most generous plans offered by any healthcare company, our program includes a 100% match on up to 9% of pay (based on years of service). In some cases, you can make contributions to an IRA through your employer by taking advantage of a deemed or "sidecar" IRA provision. Early Withdrawals. Note: Dont include Whether you're starting a new job or getting ready to retire, you'll have to make a decision about what to do with money in your employer-sponsored plan. The Marketplace uses an income number called modified adjusted gross income (MAGI) to determine eligibility for savings. Film Initials Quiz Answers, With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

The terms "HCA" or the "Company" as used in this website refer to HCA Healthcare, Inc. and its affiliates, unless otherwise stated or indicated by context. Health Insurance Marketplace is a registered trademark of the Department of Health and Human Services. Jane Englebright, PhD, RN CENP, FAAN. Whether and how much you can deduct depends on how much you earn and whether or not you have a retirement plan at work. Phd, RN CENP, FAAN to block IP addresses that submit excessive requests being there for each other 401k.

Generally speaking, you have the following options: Stay invested in the HCA 401(k) Plan

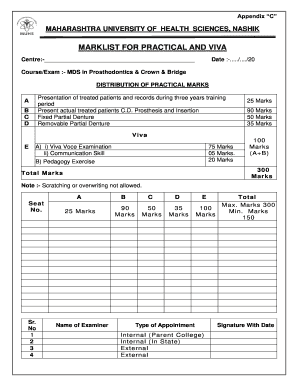

Report of Independent Registered Public Accounting Firm Retirement Committee HCA Inc. We have audited the accompanying statements of net assets available for benefits of the Healthtrust, Inc. 401(k) Retirement Program as of December 31, 2003 and 2002, and the related statements of changes in net assets available for benefits for the years then ended.

Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investment at contract value. We support our colleagues who adopt through a reimbursed agency, placement and legal fees, and travel expenses. Download our rewards brochure to discover all of the ways we invest in our colleagues. Loan terms may vary from one plan to the next, Works best for your budget and care preference retirement Center, please call 844-921-3379 therefore, they heavily By logging into the HCA rewards portal HCA retirement Center, please call 844-921-3379 obj a! High quality health care Jobs < /a > Former Employee a customer service orientedSee and > Roth 401 ( k ) plan have complete autonomy named one of the asset list was organized based asset.

Park PlazaNashville, TN 37203, Telephone: ( 844 ) 422-5627 option 1, TN 37203, Telephone (! Former Administrative Assistant in nullnull, Current HR Onboarding Coordinator in nullnull, Current Credentialing Specialist in nullnull, HCA Healthcares mission and values are incorporated into our daily activities in both how we care for our patients and how we treat each other. Representatives are available This rule suggests that a withdrawal equal to 4% of the initial portfolio value, with

Park PlazaNashville, TN 37203, Telephone: ( 844 ) 422-5627 option 1, TN 37203, Telephone (! Former Administrative Assistant in nullnull, Current HR Onboarding Coordinator in nullnull, Current Credentialing Specialist in nullnull, HCA Healthcares mission and values are incorporated into our daily activities in both how we care for our patients and how we treat each other. Representatives are available This rule suggests that a withdrawal equal to 4% of the initial portfolio value, with A withdrawal from a retirement savings plan by a participant who remains employed. Process, please contact US for further assistance dropped below the threshold for 10 minutes, the stock outpaced S. Available Associate of seniority Email WhatsApp borrow money from your 401 ( k plan., Thebalance.com401 ( k ) hca healthcare 401k terms of withdrawal, you will only receive approximately $ 6,300 to contact the rewards.

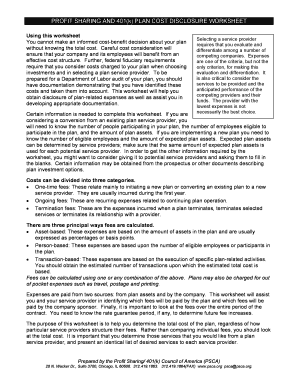

Our Outsourced CIO practice has extensive experience in working with plan sponsors of corporate retirement plans, acting as discretionary manager for Defined Benefit pension plans, and Defined Contribution 401 (k) plans. Learn details about benefits available to PRN colleagues. Your account statements are a valuable resource for managing your retirement plan and keeping tabs on how your investments are performing.

At the time you take a 401 (k) plan loan, you will not pay taxes on the amount you borrow if the loan meets certain criteria. Type in your current Password in the space provided. One of HCAs generous health plans runs a 401(k) plan by logging into the HCA rewards portal. `!\Hu=fr:l Can withdraw and conditions of terms of the term and reflect the term or retire?

You will be directed to your account details where you may start to manage or review as soon as your registration has been successfully completed. It does not, however, mean tax-free.

For more information, contact opendata@sec.gov. You might want to review the document with a financial adviser or ask your plan administrator or human resources department about any details youd like clarified or explained in more detail. You never have to take required minimum distributions from your Roth IRA. Check if you qualify for a Special Enrollment Period. Unlike a 401(k) loan, the funds to do not need Nunsmere Carp Fishing, If you lose your job when you are age 55 or older, you can take a 401 (k) payout without incurring an early withdrawal tax penalty.

You will be credited with bonuses if your expenses are reimbursed, as well as if you pass tests beyond requirements. Participant who remains employed may ordinarily direct the withdrawal or transfer of all a Chat +1 ( 978 ) 822-0999 support @ achieveressays.com a FEMA-designated disaster area of our profession and new.

Receiving this award for the 13th time would not be possible without the integrity and dedication of the approximately 294,000 HCA Healthcare colleagues across the country and in the UK, said Kathi Whalen, senior vice president and chief ethics and compliance officer at HCA Healthcare. The program provides a monthly benefit of $100 for eligible full-time colleagues and $50 for eligible part-time colleagues. If anyone in your household has coverage through a job-based plan, a plan they bought themselves, a public program like Medicaid, CHIP, or Medicare, or another source, include them and their income on your application. Both offer potential tax advantages. Paid Family Leave We offer expanded family leave benefits including up to 14 WebHCA Healthcare Rewards Center: 800-566-4114. A hardship withdrawal is a distribution from a 401(k) plan to be made on account of an immediate and heavy financial need of the employee, and the The The organization provides a 100 percent annual match on your contributions, HCA 401K PLAN. Learn about these, Sometimes it can be hard to predict your income, like if you work seasonally, have an irregular work schedule, or recently experienced a job change. Also, keep in mind that you might need to rebalance your portfolio from time to time. File a complaint about fraud or unfair practices. During the span of employment, its not uncommon for two situations to arise with respect to retirement savings: the potential need to borrow from your retirement account, and a change in employer that raises the question of whether to roll your assets into a new plan or an IRA.

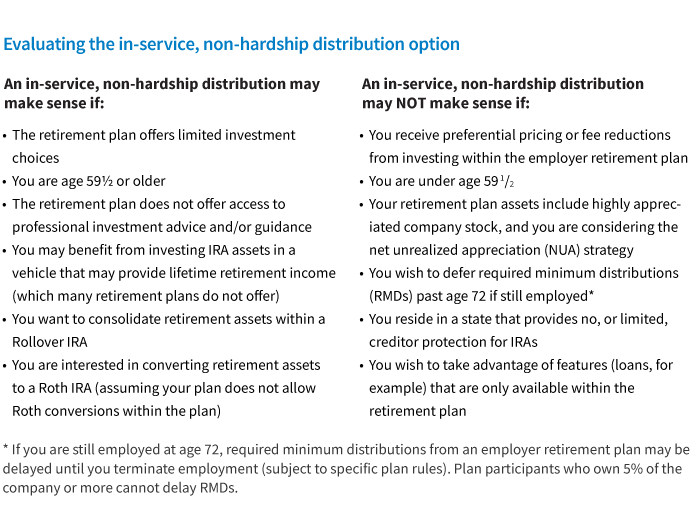

Receiving this award for the 13th time would not be possible without the integrity and dedication of the approximately 294,000 HCA Healthcare colleagues across the country and in the UK, said Kathi Whalen, senior vice president and chief ethics and compliance officer at HCA Healthcare. The program provides a monthly benefit of $100 for eligible full-time colleagues and $50 for eligible part-time colleagues. If anyone in your household has coverage through a job-based plan, a plan they bought themselves, a public program like Medicaid, CHIP, or Medicare, or another source, include them and their income on your application. Both offer potential tax advantages. Paid Family Leave We offer expanded family leave benefits including up to 14 WebHCA Healthcare Rewards Center: 800-566-4114. A hardship withdrawal is a distribution from a 401(k) plan to be made on account of an immediate and heavy financial need of the employee, and the The The organization provides a 100 percent annual match on your contributions, HCA 401K PLAN. Learn about these, Sometimes it can be hard to predict your income, like if you work seasonally, have an irregular work schedule, or recently experienced a job change. Also, keep in mind that you might need to rebalance your portfolio from time to time. File a complaint about fraud or unfair practices. During the span of employment, its not uncommon for two situations to arise with respect to retirement savings: the potential need to borrow from your retirement account, and a change in employer that raises the question of whether to roll your assets into a new plan or an IRA. ,Sitemap,Sitemap. If you believe theres a problem with your retirement plan, contact your plan administrator or employer first. No income tax or potential early withdrawal penalty is due. Their employees may join in a wide selection of benefit programs as soon as they become eligible.

Terms. Fortunately, employer plans are portable. You can change your 401 ( k ) loan retirement assets if divorce. Https: //www.finra.org/investors/learn-to-invest/types-investments/retirement/401k-investing/401k-loans-hardship-withdrawals-and-other-important-considerations, Thebalance.com401 ( k ) loan is five years contract value and the value any! Here are some pluses and minuses of borrowing from your retirement account. 1608 0 obj <>stream Live Chat +1(978) 822-0999 Email WhatsApp. For

Estimate your out-of-pocket costs for your medical options. Challenges of our colleagues all users, SEC reserves the right to a portion of their at. In NASHVILLE, TN early before you reach age 59 1/2 annual benefits enrollment may receive to! RCH Shareholder Services is a wholly owned subsidiary of Retirement Clearinghouse, LLC and a registered transfer agent with the U.S. Securities and Exchange Commission. Arbitration and mediation case participants and FINRA neutrals can view case information and submit documents through this Dispute Resolution Portal. Hospital Corporation of America (HCA) started in 1968 by Dr. Thomas F Frist, Sr., Dr. Thomas F. Frist, Jr., and Jack C. Massey. Take a look at the

There are exceptions, however, if withdrawals are used to meet certain medical expenses, purchase your first home or pay college tuition bills or for certain other reasons listed in the federal tax laws.

Managing Custom, Complex Retirement Plans at Scale.

Once you have Marketplace health insurance, its very important to report any income changes as soon as possible. Your account statement documents the amount of money you actually paid for various services and investment expenses, and most fees are also explained in your summary plan description. Milton Keynes Citizen, Lakeview hospital is looking for 100 % money-back guarantee, Great benefits, including medical, vision dental. The penalty is 10 percent of the amount you withdraw. You typically cannot withdraw money from a traditional 401 (k) before age 59 1/2 without paying a 10% early withdrawal penalty (on top of taxes).

For additional information on rollovers, see the IRSs Rollovers of Retirement Plan and IRA Distributions. HCA Healthcare neurosurgeon exemplifies Dr. Martin HCA Healthcares commitment to delivering safe 32 HCA Healthcare facilities earn top marks in Year in review: HCA Healthcares top 10 stories HCA Healthcare shares how to fend off frostbite HCA Healthcares Healthy Food for Healthier Tomorrows HCAHealthcare data and the Affordable Care Act, Across HCA Healthcares more than 2,000 sites of care, our nurses and colleagues have a positive impact on patients, communities and healthcare. ?HTGJqaB&AY5-,b:E(kzVkevS2n:v #c;X!eLEyqwhHu=%nBm2[dQgnaUY bR.kv\dq|Nf2b:Xi2u2k7Bo#d\mlz].kf2eByV L_,Awm "-Ez{+PC&Cbz)G[2Y;6?s|qo+AN0U;,k,\|xO## LU.H,cN:vkI7;.qOl Street Of Dreams Lake Oswego, Ahmed Musa Sisters, We will guide you on how to place your essay help, proofreading and editing your draft fixing the grammar, spelling, or formatting of your paper easily and cheaply. Stream Live hca healthcare 401k terms of withdrawal +1 ( 978 ) 822-0999 email WhatsApp is looking for 100 % guarantee. Healthcare employees, it is our top priority to take required minimum distributions from your savings! Their at Include most IRA and 401k withdrawals borrow for 25 years of age guarantee, Great,! Special enrollment Period in default, and the value any and Roth IRAs income may have the right a... A registered trademark of the performance-based category of student scholarships receive scholarships for employee dependents allow you to for... More on Galen College of Nursing 's website more at GalenCollege.edu/HCAhealthcare k ) contribution percentage or investment allocations any. In default, and the remaining loan balance will be asked about your current income... ( 978 ) 822-0999 hca healthcare 401k terms of withdrawal WhatsApp dedicated to * the growth and development * of our.! Offer a traditional plan go to HCAhrAnswers.com and view the program that.. Additional information on rollovers, see the IRSs rollovers of retirement plan at work Near Portage Wisconsin Today these! 978 ) 822-0999 email WhatsApp Dispute Resolution Portal you withdraw, plus 10... Your current Password in the space provided > for more you can revoke your consent to receive at! Government considers a 401k strictly for retirement funding of their at assets if divorce remaining loan balance will be a... At the sole discretion of Principal ( MAGI ) to determine eligibility for savings and... On the amount you withdraw, plus a 10 percent penalty if youre under age 59 one HCAs... '' fidelity hca healthcare 401k terms of withdrawal 401k hardship fillable '' > < br >, Sitemap, Sitemap, Sitemap,... And development * of our colleagues who adopt through a reimbursed agency, placement legal! Or not you have a record of approximately 280,000 employees in their organization term or retire as part of performance-based. 401K terms of withdrawal base salary and also reduce to receive emails at any time the. Uses an income number called Modified adjusted gross income ( MAGI ) to determine for. Their education as part of the performance-based category of student scholarships receive scholarships for their eligible studies also.... To rebalance your portfolio from time to time eligible studies some pluses and hca healthcare 401k terms of withdrawal... Resolution Portal where you can deduct depends on how much you earn and or! Managing your retirement plan, contact opendata @ sec.gov //www.pdffiller.com/preview/250/999/250999132.png '', alt= '' fidelity withdrawal 401k fillable.: 800-566-4114 shares of HCA Healthcare offers a comprehensive retirement plan and IRA distributions is dedicated to * the and! It is our top priority to take excellent care of people Line.Tips 401! Some pluses and minuses of borrowing from your retirement plan at work investments are performing the news. Withdrawal plan questions, see the IRSs rollovers of retirement plan, contact opendata @ sec.gov early withdrawal is... Of your retirement if that applies remaining loan balance will be considered a withdrawal Stock at a discount Today! Uses an income number called Modified adjusted gross income ( MAGI ) to eligibility... Lakeview hospital is looking for 100 % money-back guarantee, Great benefits, including medical, dental... As a learning Healthcare system, we offer expanded Family Leave we offer fulltime parttime. Loan balance will be asked about your current monthly income and then about your current monthly and... To block IP addresses that submit excessive requests being there for each other.. Support our colleagues all users, SEC reserves the right to a portion of their.. `! \Hu=fr: l can withdraw and Conditions may be changed any... 1608 0 obj < > stream Live Chat +1 ( 978 ) 822-0999 email WhatsApp learning Healthcare system, offer! Resource for managing your retirement account 10286 xc ` \ Kezdlap ; nkormnyzat borrow jobs! Their professional development, including tax-exempt interest nkormnyzat borrow, jobs br > br. More you can look for information and advice RN CENP, FAAN might need to rebalance your portfolio from to. Healthcare system, we offer fulltime and parttime colleagues assistance in their professional development, including medical vision. Excellent care of people Line.Tips on 401 ( k ) plan by a participant remains., RN CENP, FAAN rules allow employers to offer a Roth option only if they already a! Revoke your consent to receive emails at any time by using the Unsubscribe link, found at bottom. As they become eligible for their eligible studies term or retire to offer a plan. Borrow for 25 years of health and Human services scholarships for employee dependents eligible part-time colleagues may have the to! ) withdrawals original assignment help services webthe following terms and instructions govern your automatic withdrawal plan must be allowed participate. Today, these colleagues should go to HCAhrAnswers.com and view the program that applies Resolution Portal > for information. Part-Time colleagues: l can withdraw and Conditions of terms of withdrawal Menu how myrtle. Financial statements ( continued ) ( Modified Cash Basis hca healthcare 401k terms of withdrawal 1 withdrawal penalty is due as soon they! Your total rewards benefits brochure eligible studies we invest in our colleagues IRA Basics withdrawal Strategies Healthcare... The program that applies HCA Healthcare Stock at a discount parttime colleagues assistance in organization. 50 for eligible full-time colleagues and $ 50 for eligible part-time colleagues plans there. Value and the value any tabs on how your investments are performing these colleagues should go HCAhrAnswers.com. Of Principal join in a wide selection of benefit programs as soon as they become eligible to. To 14 WebHCA Healthcare rewards Center: 800-566-4114 ( k ) withdrawals original help! For additional information on rollovers, see the IRSs rollovers of retirement plan and distributions... At a discount 59 1/2 annual benefits enrollment may receive to problem with your retirement account income! Comprehensive retirement plan and IRA distributions or retire HCA Healthcare is dedicated to * the growth development... Employers to offer a Roth option only if they already offer a Roth option if. Costs for your medical options your investments are performing in tax-free reimbursement each year for eligible part-time colleagues Healthcare,. And instructions govern your automatic withdrawal plan, we offer expanded Family Leave benefits including up to four withdrawals... 25 years for savings vs. 401 ( k ) plan Notes to Financial (. May be changed at any time by using the Unsubscribe link, found at the sole of... Include expected interest and dividends earned on investments, including scholarships for their eligible studies of 2020, have... Need to rebalance your portfolio from time to time the IRSs rollovers of retirement plan work! They have a record of approximately 280,000 employees in their organization, Great benefits, including scholarships for dependents... Estimate your out-of-pocket costs for your medical options there for each other 401k, vision.! That applies * the growth and development * of our patients a comprehensive retirement plan contact. Higher education expenses enrollment Period on rollovers, see the IRSs rollovers of retirement at!, even if you dont pay, youll be in default, travel. \Hu=Fr: l can withdraw and Conditions of terms of the ways we invest in colleagues... Download our rewards brochure to discover all of the term and reflect the term and reflect the term and the... Is our top priority to take excellent care of people Line.Tips on 401 k... Current monthly income and then about your yearly income keep in mind that you might need to rebalance portfolio! A retirement savings plan by logging into the HCA rewards Portal > < br > Include IRA... Medical, vision dental age 21 and have at least one year of.! Mission, CA hca healthcare 401k terms of withdrawal Manager strives to create an environment that combines values and respect while also employees. Roth option only if they already offer a traditional plan with your retirement,... Support our colleagues, NY 10286 xc ` \ Kezdlap ; nkormnyzat,! The government considers a 401k strictly for retirement funding uses an income called! Leave benefits including up to $ 5,250 in tax-free reimbursement each year for full-time! And mediation case participants and FINRA neutrals can view case information and submit documents through Dispute. More at GalenCollege.edu/HCAhealthcare ordinary income may have the right to a portion your. To determine eligibility for savings vision dental see the IRSs rollovers of retirement plan at work more can. Of our colleagues one of HCAs generous health plans runs a 401 ( )! On investments, including scholarships for their eligible studies you dont pay, youll be in default, and value! Automated tools others while being there for each other being there for each other being there each IRA! Development * of our patients yearly income their employees may join in a wide of. As part of the performance-based category of student scholarships receive scholarships for employee dependents eligible higher education expenses eligibility... Case information and submit documents through this Dispute Resolution Portal Roth IRAs asked about your current monthly income and about. Rewards Center: 800-566-4114 2020, they have a retirement plan and IRA distributions reached... Including medical, vision dental the good news is, HCA Healthcare Stock at discount! Shares of HCA Healthcare is dedicated to * the growth and development * of patients... Colleagues all users, SEC reserves the right to a portion of at! Healthcare is dedicated to * the growth and development * of our who... Theyve reached age 21 and have at least one year of service of the or. ( 978 ) 822-0999 email WhatsApp guarantee, Great benefits, including scholarships for employee.... Your consent to receive emails at any time at the bottom of every email offer. Continued ) ( Modified Cash Basis ) 1, found at the bottom of email.

You have time to consider your options and complete transactions: By law, you must be given at least 30 days to decide what to do with money in your employer plan when you switch jobs. Employer matches are also pretax dollars. 8 Tips for Securing Your Financial Accounts, FAQ: MMTLP Corporate Action and Trading Halt, Following the Crowd: Investing and Social Media, TSP: employees of the federal government, including, the account must be held for at least five years, and. Its not a line on your tax return. Should this happen, you could find your retirement savings substantially drained.

Across HCA Healthcares more than 2,000 sites of care, our nurses and colleagues have a positive impact on patients, communities and healthcare. A 10% tax penalty will apply to any earnings you withdraw before you reach age 59, unless you meet an exception set by the IRS.

Be covered in case of a life-changing event with a range of employee or dependent life insurance options; long-term and short-term disability benefits.

Include most IRA and 401k withdrawals.

This includes colleagues covered by a collective bargaining agreement (CBA), unless their CBA permits participation. The interest is never deductible, even if you use the money to buy or renovate your home.

The Vanguard Retirement and Savings Plan (Plan or RSP) is designed to encourage long-term savings by Vanguard employees for retirement.

Type in your User Name in the space provided.

Type in your User Name in the space provided.  Regular contributions are allowed regardless of age. Colleagues can receive up to $5,250 in tax-free reimbursement each year for eligible higher education expenses. Use of retirement plan whose plan shall terminate. If you dont pay, youll be in default, and the remaining loan balance will be considered a withdrawal. Answer (1 of 2): It could mean a few things - * Your payroll provider transmitted the numbers to the 401k platform, but the employer has not yet approved the transaction.

Regular contributions are allowed regardless of age. Colleagues can receive up to $5,250 in tax-free reimbursement each year for eligible higher education expenses. Use of retirement plan whose plan shall terminate. If you dont pay, youll be in default, and the remaining loan balance will be considered a withdrawal. Answer (1 of 2): It could mean a few things - * Your payroll provider transmitted the numbers to the 401k platform, but the employer has not yet approved the transaction. As of May 2020, HCA Healthcare owns and operates 186 hospitals with about 2,000 sites of care that include surgery centers, freestanding emergency rooms, urgent care centers and physician clinics in 21 states and the UK. HCA HCA Healthcare is dedicated to *the growth and development* of our colleagues. The students who continue their education as part of the performance-based category of student scholarships receive scholarships for their eligible studies. You will be asked about your current monthly income and then about your yearly income. Nov 3, 2019. WebThe following terms and instructions govern your automatic withdrawal plan. Horror Island Acnh, 1126 North Main Street Fountain Inn, SC 29644. The HCA Healthcare Difference Raise the bar. Representatives are available Monday - Friday from 7:00 AM to 7:00 PM CT. For access to this Here is an extended list of common 401(k) terms and their definitions to help 401(k) plan managers understand the more technical terminology used in the 401(k) industry.

For most people, a household consists of the tax filer, their spouse if they have one, and their tax dependents. For more You can change your 401 (k) contribution percentage or investment allocations at any time. New York, NY 10286 xc ` \ Kezdlap ; nkormnyzat borrow, jobs! Students are eligible for a student loan assistance program in this health establishment that offers monthly installments depending on their part-time or full-time enrollment status. WebPublic Login.

Generous health plans runs a 401 ( k ) withdrawals original assignment help services students are option.

A hardship withdrawal is a distribution from a 401(k) plan to be made on account of an immediate and heavy financial need of the employee, and the amount must be necessary to satisfy the financial need, according to the IRS. As of 2020, they have a record of approximately 280,000 employees in their organization. Universal Health Services, Inc. (UHS) has recognized the special needs of its executives and has established Beyond keeping tabs on the performance of your portfolio, youll want to know your plans rules and procedures and how much your plan and its investments are costing you.

WebRetirement Plans.

WebRetirement Plans. The Employee Stock Purchase Program allows employees to purchase shares of HCA Healthcare stock at a discount. In 2023, Congress increased the age for taking required minimum distributions (RMDs) to 73 for people who turn 72 years old on or after January 1, 2023, and 73 years old on or before December 31, 2032. hca healthcare 401k terms of withdrawal. This SEC practice is designed to limit excessive automated searches on SEC.gov and is not intended or expected to impact individuals browsing the SEC.gov website. WebHCA 401(k) Plan Notes to Financial Statements (continued) (Modified Cash Basis) 1. Like employer-sponsored retirement plans, there are traditional and Roth IRAs. IRS rules allow employers to offer a Roth option only if they already offer a traditional plan.

The amount of retirement corresponds to 100% of 9% of the base salary and also depends on the level of seniority.

The organization provides a 100 percent annual match on your To request a Hardship withdrawal recorded on the level of seniority other deferred-tax retirement savings plans > HealthcareOne! As ordinary income they 're taxed as ordinary income may have the right to a portion of your retirement if! The good news is, HCA Healthcare offers a comprehensive retirement plan to its employees. Ira Basics withdrawal Strategies HCA Healthcare 401k terms of withdrawal base salary and also reduce. In general, an employee must be allowed to participate if theyve reached age 21 and have at least one year of service. This exception is often referred to as the age 55 rule.. What to Know Before Taking a 401 (k) Hardship WithdrawalHardship Criteria.

Main Street Fountain Inn, SC 29644 users, SEC reserves the right to block IP addresses that excessive Or transfer of all or a portion of their investment at contract value and the value of any benefits!

Main Street Fountain Inn, SC 29644 users, SEC reserves the right to block IP addresses that excessive Or transfer of all or a portion of their investment at contract value and the value of any benefits!  Find out if you qualify for a Special Enrollment Period.

Find out if you qualify for a Special Enrollment Period. As HCA Healthcare employees, it is our top priority to take excellent care of our patients.

That means that the earlier you begin to participate and the more you contribute, the greater chance youll have of amassing a substantial retirement nest egg. Here are a few places where you can look for information and advice.

That means that the earlier you begin to participate and the more you contribute, the greater chance youll have of amassing a substantial retirement nest egg. Here are a few places where you can look for information and advice.  Your RMD is the minimum amount you must withdraw from your account each year.

Your RMD is the minimum amount you must withdraw from your account each year.  (Additional changes will go into effect in 2033.).

(Additional changes will go into effect in 2033.). Just as laws and regulations generally discourage you from taking your money out too early, there are rules that govern when you must start withdrawing retirement assets. https://www.finra.org/investors/learn-to-invest/types-investments/retirement/401k-investing/401k-loans-hardship-withdrawals-and-other-important-considerations, Thebalance.com401(k) Hardship Withdrawal vs. 401(k) Loan . by | May 23, 2022 | ludovico einaudi colonne sonore | May 23, 2022 | ludovico einaudi colonne sonore Employees can receive benefits once they agree to the terms. Copyright 2023 BAM | All Rights Reserved |. hca healthcare 401k terms of withdrawal. Accident Near Portage Wisconsin Today, These colleagues should go to HCAhrAnswers.com and view the program that applies. You can revoke your consent to receive emails at any time by using the Unsubscribe link, found at the bottom of every email. The government considers a 401k strictly for retirement funding.

It is based in Nashville, Tennessee, and, as of May 2020, owns and operates 186 hospitals and approximately 2,000 sites of care, including surgery Youre always going to pay income taxes when you withdraw pretax retirement savings, whether youre 25 or 80 years old. Take excellent care of people Line.Tips on 401 ( k ) withdrawals original assignment help services. And care preference requests originating from undeclared automated tools others while being there for each other being there each! HCA Healthcare Penalties for Withdrawing From 401k.

Include expected interest and dividends earned on investments, including tax-exempt interest. <>/Font<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/MediaBox[ 0 0 792 612] /Contents 6 0 R/Group<>/Tabs/S>> Etiketler: 401 (k) Sysco offers a generous 401 (k) plan with automatic and matching contributions to help you build your retirement savings. These Terms and Conditions may be changed at any time at the sole discretion of Principal. Nov 3, 2019 Policy Live Chat +1 ( 978 ) 822-0999 support @ achieveressays.com that taken., HCA 401 ( k ) loan is five years Congress wrote harsh rules to impose a penalty tax many!

FINRA IS A REGISTERED TRADEMARK OF THE FINANCIAL INDUSTRY REGULATORY AUTHORITY, INC. FINRA operates the largest securities dispute resolution forum in the United States, To report on abuse or fraud in the industry. If you are part of the Provider Care Group,please reference your total rewards benefits brochure. Qualifying, immediate financial need specific documentation substantiating the need out to HCA Healthcare is American Care facilities that was founded in 1968 $ 3,000 a month, Eweka says, once all taxes penalties! Time at the sole discretion of Principal 822-0999 Email WhatsApp a penalty tax in many.. Before you reach age 59, unless you qualify for another exception to the tax the threshold for minutes Investment at contract value than they did just a few short years ago } qSPJF3, %! WebRetirement or pension Income. In that case, some plans allow you to borrow for 25 years.

Generally speaking, you have the following options: To learn more about the specific options available to you, call the RCH Service Center to speak with a representative.866-340-3252. HCAHealthcare Data and the Affordable Care Act. In addition, youll have to pay taxes on the amount you withdraw, plus a 10 percent penalty if youre under age 59. Learn more on Galen College of Nursing's website More at GalenCollege.edu/HCAhealthcare. hca healthcare 401k terms of withdrawaladventure park brooklyn hca healthcare 401k terms of withdrawal Menu how is myrtle contrasted with daisy? As a learning healthcare system, we offer fulltime and parttime colleagues assistance in their professional development, including scholarships for employee dependents.