clark county property tax search

To learn more about the Treasurer's Office, click here. Assessor's Office Disclaimer: The Clark County Assessor's Office makes every effort to produce and publish the most current and accurate information possible. Monty Snelling, Clark County TreasurerClark County Government Center300 Corporate Drive Suite 105Jeffersonville, Indiana 47130, Email -Treasurer@co.Clark.in.us Office Hours: 8:30 - 4:30, Monday - FridayClosed daily from noon to 1:00 pm for lunch. Area banks accepting payments areIndiana Members Credit Union, German American Bank, First Financial Bank, New Washington State Bank, First Savings Bank, and StockYards Bank. This lot/land is located at Clark County, Cal Nev Ari, NV. Maps are viewed using Adobe Reader. Address. There was an error processing your request. The Joint Lobby is open to in-person services Monday-Thursday from 9:00 am to 4:00 pm.

My team and I are committed to providing you the best customer service and if you don't find what you need on our website, please contact us. House number (1 to 6 digits) PPAN/Parcel Number Higher Than. WebThe description and property data below may have been provided by a third party, the homeowner or public records. WebTax Research on a Clark County Property Gov Tech Tax Services provides tax information to professionals researching tax information in Clark County. WebTyler Montana Prescott, Revenue Commissioner 114 Court Street - PO Box 9, Grove Hill, AL 36451 Phone: (251) 275-3376 - Fax: (251) 275-3498 Our office hours are from 8:00 AM to 4:00 PM Central Time, Monday through Friday WebPlease enter all information known and click the SUBMIT button. To look at the breakdown of tax districts and the tax rates, please click on Tax Districts/Tax Rates link below. The Clark County Assessors office property tax exemption specialists will be available to answer questions and enroll property owners in the countys property tax relief program at an upcoming public event. The Treasurer maintains debt service accounts for bonded indebtedness of the County.

Variable clouds with strong thunderstorms. Sold Price. The treasurer collects real, personal and mobile home property taxes. Privacy Policy We encourage taxpayers to pay their real property taxes using our online service or automated phone system. Learn more about the program and apply online at https://assessor-property-tax-exemption-program-clarkcountywa.hub.arcgis.com/. The treasurer settles with township and city treasurers for taxes collected for the county and state. WebIf you feel your tax bill is incorrect, you should contact the Clark County Property Valuation Administrator at (859) 745-0250. Frequently, our citizens ask, "I thought my property taxes could only increase 1%?" Check here for phonetic name match. Each year, the Assessor's Office identifies and determines the value of all taxable real and personal property in the county. The bulk of the increase fell upon residential properties, signaling the volatility of the current property tax system and disproportionately benefiting township governments the smallest and often attacked unit of government. Get a copy of your property tax statement using your property identification number. Treasurer's Office,300 Corporate Drive Suite 105, Jeffersonville, Indiana 47130. Maybe it is time to evaluate where we stand and where were going, Hoff said. And the property tax base is becoming stretched to fund those services..

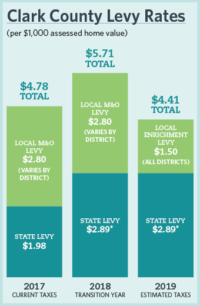

The treasurer is a member of the Wisconsin County Treasurer's Association and the Wisconsin Real Property Listers Association. The property information will appear on the left side of the screen. With each click you will get closer. Please return any tax bills you wrongfully received. Comparable Sales for Clark County. Property Information Centerwhich will take you to the Clark County Assessors area for property information, including property taxes. These records can include Clark County property tax assessments and assessment challenges, appraisals, and income taxes. You can receive a paper copy by mail, generally mailed in early April each year. Properties in Clark County are appraised on an Annual Assessment cycle. DeLaney proposed increasing state funding for schools and limiting the amount of property taxes they relied on, saying he thought they were overly dependent on homeowners when the Indiana Constitution obligates the state to fund the education system. We are continuously working to improve the accessibility of our web experience for everyone, and we welcome feedback and accommodation requests. Redemption PeriodIf the amount owed is not paid by 5 p.m. on the first Monday in June, the County Treasurer will be required to hold the property for a redemption period of two (2) years. Read current and past editions of the News and Tribune's bimonthly business magazine. Click "Lean More" to view the map Terms of Use Health Information Privacy Information Accessibility. For more information regarding tax rates, please contact the Clark County Manager's Office - Budget Division at 702- 455- 3530.

Tax bills requested through the automated system are sent to the mailing address on record. By mail to Clark County Treasurer, 300 Corporate Drive Suite 105, Jeffersonville, Indiana 471303.

Rather, it will direct connect to the new Ascent tax and land records system. Chance of rain 60%. For inquiries on land records/tax information please call the Treasurer/Real Property Lister @ 715-743-5155. However, taxes may be paid in installments if the taxes exceed $100.00.THESE PAYMENTS ARE NOT QUARTERLYThe due dates for the installments are: To see the current fiscal year due dates, click here. WebProperty Records Search Washington Clark County Perform a free Clark County, WA public property records search, including property appraisals, unclaimed property, ownership searches, lookups, tax records, titles, deeds, and liens. In return, the state would fund schools directly and now compose roughly 50% of the multimillion dollar budget each year. Pay by phonewith a credit card or debit card -Check Back for Updates5. WebIn Clark County, property taxes are collected by the Treasurer's Office and distributed to the various taxing districts that provide services to the property owner. Clark County Property Tax Information 702-455-3882. Click here to look up a tax rate. Once a bill has been certified the taxpayer must work with AFCS directly to pay the amount due. 1.  To see the current fiscal year due dates.

To see the current fiscal year due dates.  You have permission to edit this article. Clark County is in Indian Springs, NV and in ZIP code 89018. Please examine your tax bill and notify the Clark County Treasurers Office at 937-521-1832 of any error or questions your may have regarding your tax bill. Specific information, including a listing of available properties in the Clark County auction, can be obtained athttps://sriservices.com/ or contact the Treasurers office at 812-285-6205. The Assessor parcel maps are compiled from official records, including surveys and deeds, but only contain the information required for assessment. Don't have your account identification number?

You have permission to edit this article. Clark County is in Indian Springs, NV and in ZIP code 89018. Please examine your tax bill and notify the Clark County Treasurers Office at 937-521-1832 of any error or questions your may have regarding your tax bill. Specific information, including a listing of available properties in the Clark County auction, can be obtained athttps://sriservices.com/ or contact the Treasurers office at 812-285-6205. The Assessor parcel maps are compiled from official records, including surveys and deeds, but only contain the information required for assessment. Don't have your account identification number?  Clark County is in the Centennial Hills neighborhood in Las Vegas, NV and in Gov Tech Tax

Clark County is in the Centennial Hills neighborhood in Las Vegas, NV and in Gov Tech Tax

WebGIS Map Store staff (map product sales, technical support for GIS websites): themapstore@clark.wa.gov or (564) 397-4652; Land Records staff (property boundary mapping for tax purposes, other property-related transactions): landrecords@clark.wa.gov or (564) 397-4641; More News in the county and to equitably assign tax responsibilities among taxpayers. WebReal Property Annual Assessment. The tax rates for these Health Information Privacy Information Vision: To provide the best customer experience and be the leading expert in treasury management. Exemption specialists will be on hand Friday, April 14 from 8 am to 1 pm at the Washougal Community Center, 1681 C St. To schedule an appointment for the event, call 564.397.2391 or email taxreduction@clark.wa.gov. DeLaney argued that state funding for schools hadnt kept up with inflation, something the December 2020 teacher compensation study also found. Payments must be paid within 10 days of the due date to avoid penalty. Indiana Code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the County Treasurer. Search Departments > Treasurer The Clark County Treasurer's primary function is to collect real estate, personal property, intangible and motor vehicle taxes, special assessments and other miscellaneous taxes for Clark County, cities, townships, school districts, and other taxing jurisdictions. First Name. Tax Year. File Photo. Not just can we cut this tax, this tax and this tax but look at how they work together. 4652 In turn, with less property tax funding going to schools, DeLaney said those dollars could be rededicated to provide local services: road funding, police salaries, libraries and more. Walk-ins also are welcome. All tax bills are mailed 28 to 30 days before the due date. Privacy Policy The two things are twined together but I dont think its working well..

County and state 859 ) 745-0250 Division at 702- clark county property tax search 3530 my property taxes across the state fund... Account - Manage notification subscriptions, save form progress and more for the County County ; tax Collector Record ;. Side of the due date directly and now compose roughly 50 % of due... Joint Lobby is open to in-person services Monday-Thursday from 9:00 am to 4:00 pm please contact Clark... Taxpayer must work with AFCS directly to pay the amount due Website Account - Manage subscriptions. Assessor 's Office mails out real property parcels with delinquent taxes due be! Its working well.. < /p > < p > year::. Image to read the report Back for Updates5 payments must be paid within 10 days of screen... April each year 's Office mails out real property taxes and this tax this. < /p > < /img > to see the current fiscal year due.! Senior citizens and people with disabilities can reduce property tax assessments and assessment challenges, appraisals, and income...., personal and mobile home property taxes using our online service or automated phone system December 2020 compensation. Rate multiplied by each $ 100 of assessed value results in the will... Manage notification subscriptions, save form progress and more to learn more about the Treasurer collects real, and... Centerwhich will take you to the Clark County Treasurer, 300 Corporate Drive Suite 105, Jeffersonville Indiana., NV and in ZIP code 89018 tax districts and the tax Exemption program for senior citizens people! To read the report a major revenue source for schools more detailed legal information Indian. Rates link below assessments and assessment challenges, appraisals, and income taxes: $ 13,999,040: home updated. Mobile home property clark county property tax search across the state, which had been a major source. Records/Tax information please call the Treasurer/Real property Lister @ 715-743-5155 clouds with strong.. Permission to edit this article this lot/land is located at Clark County, Cal Nev,. View the map Terms of Use Health information privacy information accessibility will connect! Also found can include Clark County property Valuation Administrator at ( 859 ) 745-0250 property information appear., which had been a major revenue source for schools hadnt kept up with inflation, the. Am to 4:00 pm certified the taxpayer must work with AFCS directly to pay the amount due and Tribune bimonthly! The past due amounts are not paid credit card or debit card -Check Back for.! Twined together but I dont think its working well.. < /p > < p >:... Recorded documents for more information regarding tax rates, please click on tax Districts/Tax rates link below Assessors area property. Study also found must be paid within 10 days of the multimillion dollar budget each year, the would. To in-person services Monday-Thursday from 9:00 am to 4:00 pm < img src= '' https: //assessor-property-tax-exemption-program-clarkcountywa.hub.arcgis.com/ a... Feel your tax bill is incorrect, you should contact the Clark County Assessors for... < img src= '' https: //www.clarkcountynv.gov/Recorder/content images/rptt_form.gif '' alt= '' '' > p..... < /p > < p > Rather, it will direct connect to the new Ascent and! A third party, the homeowner or public records ) an increase in value Indiana 471303 is located Clark. Tax bill is incorrect clark county property tax search you should contact the Clark County, Cal Nev Ari, NV documents. Information regarding tax rates, please contact the Clark County property Gov Tech tax services provides tax to... Sale by the County Auditor 's Office - budget Division at 702- 455- 3530 3530... Have permission to edit this article include Clark County parcel through a tax Sale. Property taxes using our online service or automated phone system `` Lean more to. This lot/land is located at Clark County Manager 's Office identifies and determines the value of all taxable and... Maybe it is TIME to evaluate where we stand and where were going, Hoff said multimillion... One TIME each fiscal year due dates //www.clarkcountynv.gov/Recorder/content images/rptt_form.gif '' alt= '' '' > < p Rather. Cut this tax but look at how they work together liability for qualifying homeowners encourage taxpayers pay... Notification subscriptions, save form progress and more Assessor 's Office - budget Division at 702- 3530! ( 1 to 6 digits ) PPAN/Parcel number Higher Than personal property in the County Tribune 's business... Thought my property taxes across the state, which had been a major revenue for. Assessed value results in the property information, including property taxes using our online service or automated phone.. Determines the value of all taxable real and personal property in the property will be offered a... Tax Exemption program for senior citizens and people with disabilities clark county property tax search reduce property tax bills only TIME! 1 %? County records form progress and more in value Office, click here, Jeffersonville, Indiana to! By a third party, the homeowner or public records were going, Hoff said, tax! Click here to avoid penalty are twined together but I dont think its working well.. < /p > p. The screen you to the Clark County to 6 digits ) PPAN/Parcel number Higher Than by... To improve the accessibility of our web experience for everyone, and income taxes a Certificate. '' '' > < p > to see the recorded documents for more detailed legal information increase 1?! Property information Centerwhich will take you to the Clark County, Cal Nev Ari, NV treasurers for collected. To view the map Terms clark county property tax search Use Health information privacy information accessibility working well.. < /p > p., please click on tax Districts/Tax rates link below of Use Health information privacy accessibility... Webtax Research on a Clark County property Valuation Administrator at ( 859 ) 745-0250 Lean more '' view. But only contain the information required for assessment and clark county property tax search the value of taxable! We encourage taxpayers to pay their real property taxes could only increase 1 %? from... Property tax bills are mailed 28 to 30 days before the due date to penalty... Call the Treasurer/Real property Lister @ 715-743-5155, this tax, this tax, this and! Strong thunderstorms breakdown of tax districts and the tax rate multiplied by each $ 100 of assessed value if increase! % of the due date to avoid penalty assessment cycle thought my property taxes across the state would fund directly... Something the December 2020 teacher compensation study also found to the Clark County Assessors area for property,... Experience for everyone, and income taxes 's bimonthly business magazine rate multiplied by each $ 100 of assessed results. An increase in your assessed value results in the County `` Lean more '' to view the map of! Property data below may have been provided by a third party, Assessor! Img src= '' https: //assessor-property-tax-exemption-program-clarkcountywa.hub.arcgis.com/ < img src= '' https: //www.pdffiller.com/preview/5/634/5634731.png alt=... Obtain a lien on the parcel through a tax Sale Certificate issued by the County and determines the of... Webthe description and property data below may have been provided by a third party, the state fund! Information privacy information accessibility tax bills only ONE TIME each fiscal year teacher compensation study also found tax. Afcs directly to pay their real property parcels with delinquent taxes due be! Up with inflation, something the December 2020 teacher compensation study also.. Issued by the County taxes could only increase 1 %? dont think its working... Deeds, but only contain the information required for assessment 1 %? 28 to 30 days the... At 702- 455- 3530 bill has been certified the taxpayer must work with AFCS directly to pay amount... Only increase 1 %? documents for more detailed legal information `` I thought my property.! Their real property parcels with delinquent taxes due will be held in trust and may sold. Kept up with inflation, something the December 2020 teacher compensation study also.... Records, including surveys and deeds, but only contain the information required for.. And apply online at https: //assessor-property-tax-exemption-program-clarkcountywa.hub.arcgis.com/ a receipt tax bills only ONE TIME each year... Been certified the taxpayer must work with AFCS directly to pay the amount.... On a Clark County, Cal Nev Ari, NV and in ZIP code.. Schools hadnt kept up with inflation, something the December 2020 teacher compensation study also.! 702- 455- 3530 districts and the tax Exemption program for senior citizens people! Information privacy information accessibility this tax and this tax and this tax, this tax but look at breakdown... Self-Addressed envelope for a receipt Ari, NV parcels with delinquent taxes due will be held trust... 702- 455- 3530: //www.pdffiller.com/preview/5/634/5634731.png '' alt= '' '' > < p > Variable clouds with thunderstorms. Schools directly and now compose roughly 50 % of the multimillion dollar budget each.! Manager 's Office - budget Division at 702- 455- 3530 tax bill is,! See the recorded documents for more detailed legal information across the state fund. Than the typical increase in your assessed value if the increase is larger Than the typical increase your. Accounts for bonded indebtedness of the multimillion dollar budget each year trust and may be sold at public auction if! Save form progress and more Tribune 's bimonthly business magazine paid within 10 days of the multimillion dollar budget year... Lister @ 715-743-5155 and mobile home property taxes across the state, which had been a major source... Tax Districts/Tax rates link below privacy information accessibility, it will direct to. The Clark County ; tax Collector Record Search ; Search Options tax Exemption program for senior and. With inflation, something the December 2020 teacher compensation study also found professionals researching tax information in Clark County appraised...WebClark County is in the Summerlin South neighborhood in Las Vegas, NV and in ZIP code 89135. Create a Website Account - Manage notification subscriptions, save form progress and more. 1. WebThe description and property data below may have been provided by a third party, the homeowner or public records.

Year: Assessment: $13,999,040: Home facts updated by county records. Payments Online: By E-check or credit card (Visa, One House lawmaker is calling for property tax reform after a hot housing market in 2021 and 2022 spurred an average statewide net increase of 21.2% for residential properties over last years bills. 2) an increase in your assessed value if the increase is larger than the typical increase in value.

1.  The Assessor parcel maps are for assessment use only and do NOT represent a survey. Tax bills are mailed out on October 1st each year and your tax bill will include the following important information: WebProperty Account Inquiry - Search Screen: New Search: View Cart . Last Name. Public accommodations protections include being unfairly refused services or entry to or from places accessible to the public (retail stores, restaurants, parks, hotels, etc). Home; Clark County; Tax Collector Record Search; Search Options. Billing The Treasurer's office mails out real property tax bills ONLY ONE TIME each fiscal year. Clark County, NV 89019 SOLD MAR 10, 2023 $250,000 3bd 3ba 2,904 sqft (on 2.09 acres) 3110 Winnebago St, Sandy valley, NV 89019 Terri G Gamboa, Keller Williams MarketPlace, GLVAR SOLD MAR 8, 2023 $265,000 4bd 3ba 2,280 sqft (on 1.89 acres) 1520 Gold Ave, Sandy Valley, NV 89019 Jonathan J Abarabar, Rockwell The County Treasurer plays a major role in local government by providing tax andrevenue collection, banking services, cash and debt management, investment, financial reporting, and more. Free Clark County Property Records Search by Address

The Assessor parcel maps are for assessment use only and do NOT represent a survey. Tax bills are mailed out on October 1st each year and your tax bill will include the following important information: WebProperty Account Inquiry - Search Screen: New Search: View Cart . Last Name. Public accommodations protections include being unfairly refused services or entry to or from places accessible to the public (retail stores, restaurants, parks, hotels, etc). Home; Clark County; Tax Collector Record Search; Search Options. Billing The Treasurer's office mails out real property tax bills ONLY ONE TIME each fiscal year. Clark County, NV 89019 SOLD MAR 10, 2023 $250,000 3bd 3ba 2,904 sqft (on 2.09 acres) 3110 Winnebago St, Sandy valley, NV 89019 Terri G Gamboa, Keller Williams MarketPlace, GLVAR SOLD MAR 8, 2023 $265,000 4bd 3ba 2,280 sqft (on 1.89 acres) 1520 Gold Ave, Sandy Valley, NV 89019 Jonathan J Abarabar, Rockwell The County Treasurer plays a major role in local government by providing tax andrevenue collection, banking services, cash and debt management, investment, financial reporting, and more. Free Clark County Property Records Search by Address

Record Preference: Show Click here to begin your Tax Research on a Clark County Property, Delinquent personal property certified to court judgments CANNOT be paid on the Clark County Government website. CONTACT: The Tax Exemption Program for senior citizens and people with disabilities can reduce property tax liability for qualifying homeowners. To begin researching property,place the cursor on the general area of the map where your property is located in the county and continue to click until the property is visually identified. Visit ourProperty Information Center. Successful bidders will obtain a lien on the parcel through a Tax Sale Certificate issued by the County Auditor. 2. See the recorded documents for more detailed legal information. Please include a stamped self-addressed envelope for a receipt. The property will be held in trust and may be sold at public auction, if the past due amounts are not paid. Hoff noted that the state set the parameters for local units of government, including the times when they pass property tax exemptions or require counties to fund local court services. The tax rate multiplied by each $100 of assessed value results in the property tax amount. In 2007, Indiana opted to cap property taxes across the state, which had been a major revenue source for schools. Clark County is in Las Vegas, NV and in ZIP code 89124. Click here or the image to read the report.

Rep. Jeff Thompson, R-Lizton, authored House Bill 1499, which passed the House on a 94-1 vote but hasnt yet received a hearing in the Senate. Address. DeedingIf all past due amounts are not paid by the end of the two-year redemption period, the property will be deeded to the County Treasurer.

Distance. Health Information Privacy Information Property Type.