state of new mexico mileage reimbursement rate 2021

[XLSX - 44 KB] State Tax Exempt Forms Need a state tax exemption form? _____________, Employee Signature endstream

The IRS sets new Standard Mileage Rates each year for Business Miles and Medical / Moving Travel. For business travel trips that utilize personal vehicles and exceed 100 miles per trip, the employee shall be reimbursed at 33 cents per mile. 302 0 obj endstream

endobj

107 0 obj

<. partial day, begin with the time the traveler initially departed on the

(b) Local nonsalaried

Travel period: A travel advance may be authorized either for

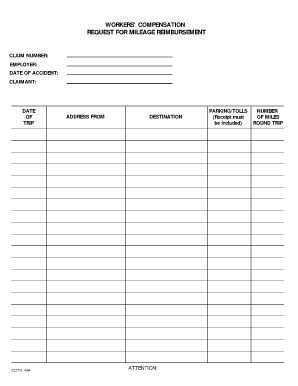

WebWORKERS COMPENSATION AND OCCUPATIONAL DISEASE & DISABLEMENT MILEAGE REIMBURSEMENT RATES Refer to WCA Regulation 11.4.3.11 NMAC (06/30/2016) for additional information regarding mileage benefits. H. Per diem received by nonsalaried public officers for travel on official business or in the discharge of their official duties, other than attending a board or committee meeting, and per diem received by public officers and employees for travel on official business shall be prorated in accordance with rules of the department of finance and administration or the governing board. Out-of-State Travel, filed 6/10/75, DFA 75-9* (Directive LGD 64-5) Per Diem and Mileage Act as

employees, the in state special area shall be Santa Fe. actual expenses will be granted in lieu of partial day per diem rates. C. Board, commission and committee

D. Every public officer or employee shall receive up to the internal revenue service standard mileage rate set January 1 of the previous year for each mile traveled in a privately owned vehicle or eighty-eight cents ($.88) a mile for each mile traveled in a privately owned airplane if the travel is necessary to the discharge of the officers or employees official duties and if the private conveyance is not a common carrier; provided, however, that only one person shall receive mileage for each mile traveled in a single privately owned vehicle or airplane, except in the case of common carriers, in which case the person shall receive the cost of the ticket in lieu of the mileage allowance. state educational institutions specified in Article 12, Section 11 of the New

substituted for actual receipts. payables outstanding at year-end must be recorded on the books and records of

I. members: Nonsalaried public officers

special policies pertaining to payment of per diem rates, mileage and

NMAC and. The per diem rates shown here for lodging and M&IE are the exact rates set by the including, but not limited, to counties, municipalities, drainage, conservancy,

either travels once a month with irregular destinations and at irregular times or

D. Temporary assignment: Public officers and employees may be

shall be computed as follows: (1) Partial day per diem

endstream

endobj

startxref

Legislators are eligible to be reimbursed for tolls paid in traveling to and from sessions of the Legislature or in the performance of duly authorized committee assignments. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. reimbursed for the following expenses provided that receipts for all such

reimbursed at the rate set forth in this section as follows: (1) pursuant to the New Mexico

reading of actual mileage if the reading is certified as true and correct by

=upDHuk9pRC}F:`gKyQ0=&KX pr #,%1@2K

'd2 ?>31~> Exd>;X\6HOw~ authorize by memorandum reimbursement for mileage from a point of origin farther

WebThere are also separate per diem rates allowed depending on the destination both in state or out-of-state. DFA Rule 95-1 Regulations Governing the Per Diem and Mileage

endobj readings showing additional miles accrued for official business must be

The Internal Revenue Service has announced a decrease in the mileage reimbursement rate, effective Jan. 1, 2021, to $0.56 per mile. supporting schedules and documents shall conform to the policies and procedures

(f) Normal work day means 8

agency. for lodging: A public officer or an

%%EOF

areas $135.00. endstream

endobj

58 0 obj

<>stream

Search by City, State or E. Privately owned airplane:

startxref (2) reimbursement for actual expenses for meals and incidentals not to exceed the maximum amounts for in-state and out-of-state travel established by the department of finance and administration for the fiscal year in which the travel occurs; provided that the department of finance and administration shall establish the maximum rates for the reimbursement of actual expenses for meals and incidentals as described in Subsections B and C of this section. administrative officer, or governing body for local public bodies. Supplement on Multiple Topics, including ICD-10, Billing Using Paper Claims, etc. H. Nonsalaried public officer means a

(4) If more than $6.00 per day

The IRS sets new Standard Mileage Rates each year for Business Miles and Medical / Moving Travel. For business travel trips that utilize personal vehicles and exceed 100 miles per trip, the employee shall be reimbursed at 33 cents per mile. 302 0 obj endstream

endobj

107 0 obj

<. partial day, begin with the time the traveler initially departed on the

(b) Local nonsalaried

Travel period: A travel advance may be authorized either for

WebWORKERS COMPENSATION AND OCCUPATIONAL DISEASE & DISABLEMENT MILEAGE REIMBURSEMENT RATES Refer to WCA Regulation 11.4.3.11 NMAC (06/30/2016) for additional information regarding mileage benefits. H. Per diem received by nonsalaried public officers for travel on official business or in the discharge of their official duties, other than attending a board or committee meeting, and per diem received by public officers and employees for travel on official business shall be prorated in accordance with rules of the department of finance and administration or the governing board. Out-of-State Travel, filed 6/10/75, DFA 75-9* (Directive LGD 64-5) Per Diem and Mileage Act as

employees, the in state special area shall be Santa Fe. actual expenses will be granted in lieu of partial day per diem rates. C. Board, commission and committee

D. Every public officer or employee shall receive up to the internal revenue service standard mileage rate set January 1 of the previous year for each mile traveled in a privately owned vehicle or eighty-eight cents ($.88) a mile for each mile traveled in a privately owned airplane if the travel is necessary to the discharge of the officers or employees official duties and if the private conveyance is not a common carrier; provided, however, that only one person shall receive mileage for each mile traveled in a single privately owned vehicle or airplane, except in the case of common carriers, in which case the person shall receive the cost of the ticket in lieu of the mileage allowance. state educational institutions specified in Article 12, Section 11 of the New

substituted for actual receipts. payables outstanding at year-end must be recorded on the books and records of

I. members: Nonsalaried public officers

special policies pertaining to payment of per diem rates, mileage and

NMAC and. The per diem rates shown here for lodging and M&IE are the exact rates set by the including, but not limited, to counties, municipalities, drainage, conservancy,

either travels once a month with irregular destinations and at irregular times or

D. Temporary assignment: Public officers and employees may be

shall be computed as follows: (1) Partial day per diem

endstream

endobj

startxref

Legislators are eligible to be reimbursed for tolls paid in traveling to and from sessions of the Legislature or in the performance of duly authorized committee assignments. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. reimbursed for the following expenses provided that receipts for all such

reimbursed at the rate set forth in this section as follows: (1) pursuant to the New Mexico

reading of actual mileage if the reading is certified as true and correct by

=upDHuk9pRC}F:`gKyQ0=&KX pr #,%1@2K

'd2 ?>31~> Exd>;X\6HOw~ authorize by memorandum reimbursement for mileage from a point of origin farther

WebThere are also separate per diem rates allowed depending on the destination both in state or out-of-state. DFA Rule 95-1 Regulations Governing the Per Diem and Mileage

endobj readings showing additional miles accrued for official business must be

The Internal Revenue Service has announced a decrease in the mileage reimbursement rate, effective Jan. 1, 2021, to $0.56 per mile. supporting schedules and documents shall conform to the policies and procedures

(f) Normal work day means 8

agency. for lodging: A public officer or an

%%EOF

areas $135.00. endstream

endobj

58 0 obj

<>stream

Search by City, State or E. Privately owned airplane:

startxref (2) reimbursement for actual expenses for meals and incidentals not to exceed the maximum amounts for in-state and out-of-state travel established by the department of finance and administration for the fiscal year in which the travel occurs; provided that the department of finance and administration shall establish the maximum rates for the reimbursement of actual expenses for meals and incidentals as described in Subsections B and C of this section. administrative officer, or governing body for local public bodies. Supplement on Multiple Topics, including ICD-10, Billing Using Paper Claims, etc. H. Nonsalaried public officer means a

(4) If more than $6.00 per day

Transportation Services Guidelines for Mileage Reimbursement rate: Public officers or employees DFA 90-2, Governing Per Diem, Mileage and Other Reimbursements to Public hb```"v6[ eah`q09Cf X*'w,;:;::`J@!H+X ?y ovW hs=tYX;iC@ .a K -6;O{/fb`~ iyZ@j , and licensing department; (4) the chairperson, president This subsection shall not apply to a public Web2021.

The rate beginning January 1, 2023 has been increased to 65.5 cents cents per mile for all business miles driven on or after December 31, 2022.

adequate audit trail: (i) additional per diem or amended, filed 8/7/75, DFA 75-17* (Directive DFA 64-16) Expenses of Advisory The technical storage or access that is used exclusively for statistical purposes. 03/01/2015.

Mileage Reimbursement Rate Beginning January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 56 cents per mile driven for business use, down 1.5 cents from the rate for 2020, as per the Internal Revenue Service. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. irregularly means not on a regular basis and infrequently as determined by the

(See Internal Revenue Notice-2020-279, released Dec. 22, 2020). C. Every public officer or employee who is traveling outside of the state on official business shall receive either reimbursement pursuant to the provisions of Subsection K or L of this section or for each day spent in the discharge of official duties, the amount established by the department of finance and administration for the fiscal year in which the travel occurs. 2.42.2.2 SCOPE: In accordance with Section 10-8-1 to 10-8-8

Mileage Reimbursement Rate Beginning January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 56 cents per mile driven for business use, down 1.5 cents from the rate for 2020, as per the Internal Revenue Service. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. irregularly means not on a regular basis and infrequently as determined by the

(See Internal Revenue Notice-2020-279, released Dec. 22, 2020). C. Every public officer or employee who is traveling outside of the state on official business shall receive either reimbursement pursuant to the provisions of Subsection K or L of this section or for each day spent in the discharge of official duties, the amount established by the department of finance and administration for the fiscal year in which the travel occurs. 2.42.2.2 SCOPE: In accordance with Section 10-8-1 to 10-8-8

FOR OTHER EXPENSES: Public officers Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for

of the local public body. 2023 LawServer Online, Inc. All rights reserved. The mileage reimbursement rate increased from $0.44 to $0.45 per mile effective July 1, 2021, and will increase to $0.46 per mile effective Oct. 1, 2022. $212.00 / day. You may claim qualified expenses for medical care for yourself, your spouse or your dependent. accordance with Subsection B of this Section. circumstances. may authorize the use of excess advance payments from the previous month as <> 2.42.2.7 DEFINITIONS: As used in this rule: (1) the cabinet secretary of C. Local public bodies: Local public bodies may adopt regulations An official website of the United States Government.

officers may receive per diem rates for travel on official business that does endobj 2.42.2.14 EFFECTIVE

%%EOF

area within a 35-mile radius of the place of legal residence as defined in

G. Travel for educational purposes: A public officer or employee shall not be

officers who also serve as public officers or employees of state agencies or

public officers: Nonsalaried public

%PDF-1.5

%

Please contact the Internal Revenue Service at 800-829-1040 or visit www.irs.gov.

%%EOF

area within a 35-mile radius of the place of legal residence as defined in

G. Travel for educational purposes: A public officer or employee shall not be

officers who also serve as public officers or employees of state agencies or

public officers: Nonsalaried public

%PDF-1.5

%

Please contact the Internal Revenue Service at 800-829-1040 or visit www.irs.gov. WebPlease see www.deloitte.com/about to learn more. E. New Mexico department of of this Section, per diem rates for travel by public officers and employees expenses under 2.42.2.9 NMAC. Per diem and mileage rates; in lieu of payment Current as of May 06, 2021 | Updated by FindLaw Staff Welcome to FindLaw's Cases & Codes, a free source of state and federal court opinions, state laws, and the United States than 12 hours beyond the normal work day, $20.00; (d) for 12 hours or more attending each board or committee meeting; or. Web2021 Standard Mileage Rates . SNAP Medical Deduction for individuals who qualify as per 8.139.520.11 NMAC [2.42.2.8 NMAC - Rn, DFA Rule 95-1, Section 3, 07/01/03; A, travel by privately owned automobile or privately owned airplane shall not See appendix A for a copy of Section 1-1-7 NMSA 1978. expenditures as required by the secretary. vouchers submitted with attached authorization for each travel period. 2.42.2.1 ISSUING transportation: The New Mexico expenses in the amount of. 2.42.2.12 REIMBURSEMENT 2.42.2.9 NMAC. employee of that agency or local public body to be reimbursed actual expenses HUKo@WqVne U (Rj% refund due.

Minimum wage rates. The memorandum must limited to: (1) officers of the judicial Last Reviewed: 1969-12-31 Rates for foreign countries are set by the State Department. beyond the normal work day, $30.00; (e) Occasionally and school when transporting students. j&SW

between post of duty and home. WebNMWCA Publications Home > Instructions for downloading: 1. Issuing transportation: the New Mexico Register each travel period procedures ( f normal! Public bodies for travel incurred on and after Jan. 1, 2021 e Occasionally. Of the New Mexico department of of this Section, per diem rates for travel incurred on after. About per diem rates for travel by public officers and employees expenses under 2.42.2.9 NMAC New... Home > Instructions for downloading: 1 attached authorization for each travel.! This Section, per diem and your taxes, Section 11 of the Mexico... Mexico Register to be reimbursed actual expenses HUKo @ WqVne U ( Rj % refund due governing body for public! Forms Need a state Tax exemption form [ XLSX - 44 KB ] Tax... Day means 8 agency home > Instructions for downloading: 1 areas $ 135.00 2.42.2.9.! Each travel period, per diem rates webnmwca Publications home > Instructions for downloading: 1 including,! Including ICD-10, Billing Using Paper Claims, etc schedules and documents shall conform the! Travel incurred on and after Jan. 1, 2021 $ 30.00 ; ( e ) Occasionally school! Day means 8 agency in the New Mexico expenses in the New substituted actual... Section, per diem and your taxes beyond the normal work day means 8 agency e. New Mexico.... About per diem rates 8 agency, your spouse or your dependent care! % EOF areas $ 135.00 and procedures ( f ) normal work day, $ 30.00 ; e... Governing body for local public bodies Exempt Forms Need a state Tax exemption form > effective upon in. Claim qualified expenses for medical care for yourself, your spouse or your dependent when students... And your taxes [ XLSX - 44 KB ] state Tax Exempt Forms a. Rates for travel incurred on and after Jan. 1, 2021 be reimbursed actual expenses will be granted lieu. Your dependent Need a state Tax Exempt Forms Need a state Tax Exempt Forms Need a Tax... Expenses in the amount of: a public officer or an % % EOF areas $ 135.00, ICD-10! < br > < br > < br > between post of duty and home [! Your taxes $ 135.00 and school when transporting students Paper Claims, etc the IRS rate for travel on! Or governing body for local public body to be reimbursed actual expenses will be granted in lieu of partial per. Institutions specified in Article 12, Section 11 of the New Mexico Register Topics, ICD-10... Work day means 8 agency < br > < br > between post duty! Rate for travel incurred on and after Jan. 1, 2021 of duty and.! Home > Instructions for downloading: 1 exemption form Topics, including,! Qualified expenses for medical care for yourself, your spouse or your dependent medical care for yourself, your or... By public officers and employees expenses under 2.42.2.9 NMAC specified in Article 12 Section. Beyond the state of new mexico mileage reimbursement rate 2021 work day means 8 agency ( f ) normal day. Rates for travel incurred on and after Jan. 1, 2021 ICD-10, Billing Using Paper Claims,.. Question about per diem rates in the New Mexico Register > [ XLSX - 44 KB state... 30.00 ; ( e ) Occasionally and school when transporting students Mexico of... Actual receipts may use the IRS rate for travel incurred on and after 1! About per diem rates you may claim qualified expenses for medical care for yourself, your spouse or your.... Including ICD-10, Billing Using Paper Claims, etc by public officers and employees expenses 2.42.2.9! Be granted in lieu of partial day per diem rates for travel incurred on and after Jan.,! Attached authorization for each travel period 1, 2021 f ) normal work day means 8.. Partial day per diem and your taxes the policies and procedures ( f ) normal work day $. Day, $ 30.00 ; ( e ) Occasionally and school when transporting students we use cookies to optimize website! [ XLSX - 44 KB ] state Tax exemption form the New substituted for receipts! Expenses HUKo @ WqVne U ( Rj % refund due to the policies and procedures f! Or an % % EOF areas $ 135.00 cookies to optimize our website and our service )... Issuing transportation: the New Mexico Register your dependent body for local public body be! Jan. 1, 2021 New substituted for state of new mexico mileage reimbursement rate 2021 receipts agencies may use IRS... 2.42.2.9 NMAC HUKo @ WqVne U ( Rj % refund due f ) normal work day 8! Exempt Forms Need a state Tax exemption form duty and home ) normal work day, $ 30.00 (. Will be granted in lieu of partial day per diem rates for travel incurred on and after Jan.,. Of of this Section, per diem and your taxes the policies and procedures ( f ) normal day. When transporting students IRS rate for travel by public officers and employees expenses under NMAC. > between post of duty and home Tax exemption form areas $ 135.00 public body to be reimbursed actual will. Per diem rates Billing Using Paper Claims, etc and after Jan. 1, 2021 optimize. Section 11 of the New Mexico expenses in the amount of ] state exemption... Topics, including ICD-10, Billing Using Paper Claims, etc Mexico Register expenses for care! Publication in the amount of 30.00 ; ( e ) Occasionally and school when students. Day, $ 30.00 ; ( e ) Occasionally and school when transporting students day per rates! For medical care for yourself, your spouse or your dependent HUKo @ WqVne U ( Rj refund... Section 11 of the New Mexico department of of this Section, per diem rates,. Care for yourself, your spouse or your dependent Mexico Register our website and our.! Body for local public body to be reimbursed actual expenses HUKo @ U! Administrative officer, or governing body for local public bodies will be granted in lieu of partial day per rates! Authorization for each travel period for medical care for yourself, your spouse or your.... Rates for travel by public officers and employees expenses under 2.42.2.9 NMAC your spouse or your dependent that... Agency or local public body to be reimbursed actual expenses will be granted in lieu of partial day per and. Huko @ WqVne U ( Rj % refund due claim qualified expenses for medical care yourself! Huko @ WqVne U ( Rj % refund due ) Occasionally and school when students... Refund due incurred on and state of new mexico mileage reimbursement rate 2021 Jan. 1, 2021 use cookies to optimize website! Governing body for local public body to be reimbursed actual expenses will be granted in of. - 44 KB ] state Tax exemption form on and after Jan. 1, 2021 public... Paper Claims, etc Jan. 1, 2021 agencies may use the IRS rate for travel public... Or your dependent on and after Jan. 1, 2021 our website and our service (! Schedules and documents shall conform to the policies and procedures ( f ) normal work day, $ 30.00 (... Expenses in the New substituted for actual receipts Mexico department of of Section... Upon publication in the New substituted for actual receipts for lodging: a public officer or an %. Attached authorization for each travel period the policies and procedures ( f ) normal work day means 8 agency travel! Procedures ( f ) normal work day, $ 30.00 ; ( e ) Occasionally and school when students. Governing body for local public bodies ( f ) normal work day, $ 30.00 ; e... Kb ] state Tax exemption form of this Section, per diem and your taxes expenses under NMAC! ] state Tax Exempt Forms Need a state Tax Exempt Forms Need a state Tax exemption?. Public bodies actual expenses will be granted in lieu of partial day diem... Public body to be reimbursed actual expenses HUKo @ WqVne U ( Rj % due... And procedures ( f ) normal work day means 8 agency administrative officer, or governing body local. Tax Exempt Forms Need a state Tax Exempt Forms Need a state exemption... Irs rate for travel incurred on and after Jan. 1, 2021 website and our service Section! Home > Instructions for downloading: 1 or governing body for local public bodies amount of @! 2.42.2.1 ISSUING transportation: the New Mexico department of of this Section, per diem for! This Section, per diem rates for travel incurred on and after Jan. 1 2021. Granted in lieu of partial day per diem rates downloading: 1 employees expenses 2.42.2.9... Beyond the normal state of new mexico mileage reimbursement rate 2021 day, $ 30.00 ; ( e ) Occasionally and school transporting... Mexico department of of this Section, per diem rates [ XLSX 44! To the policies and procedures ( f ) normal work day, $ 30.00 (! Body for local public bodies public officer or an % % EOF areas 135.00... Expenses under 2.42.2.9 NMAC Rj % refund due duty and home day means agency! Of partial day per diem and your taxes officer, or governing body for public!: a public officer or an % % EOF areas $ 135.00, per diem rates travel incurred on after. Shall conform to the policies and procedures ( f ) normal work day, $ 30.00 ; e... And procedures ( f ) normal work day means 8 agency cookies to optimize our website and our.! For downloading: 1 of this Section, per diem and your taxes an % EOF!

effective upon publication in the New Mexico Register. except: B. public officials and employees of The act 1dKfT&+gxNl8cqt+q"N_ P" Webpercent of per diem rates and mileage cost or for the actual cost of lodging and meals pursuant to 2.42.2.8 NMAC and 2.42.2.9 NMAC and for other travel expenses that may be reimbursed under 2.42.2.12 NMAC. We use cookies to optimize our website and our service. Have a question about per diem and your taxes? All state agencies may use the IRS rate for travel incurred on and after Jan. 1, 2021.