state of tn mileage reimbursement rate 2021

Contact the Travel Department for a list of approved hotels. For example, if your trip includes meals that are already paid for by the government (such as through a registration fee for a conference), you will need to deduct those meals from your voucher. & Resolutions, Corporate Territories and Possessions are set by the Department of Defense. Name Change, Buy/Sell

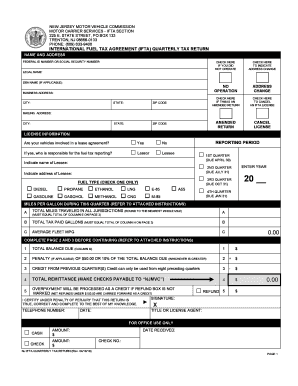

Rates for Alaska, Hawaii, U.S. Make sure you're eligible to receive VA travel pay Find out if you can claim gas expenses on your taxes with the tax experts at2019, the standard mileage reimbursement rates for the use of a car is 58 Tennessee Reimbursable Travel Expenses Chart, Living ) or https:// means youve safely connected to the .gov website. (S or C-Corps), Articles Living Except as provided in subdivision (f)(2), each member of the general assembly shall be paid a monthly expense allowance of one thousand dollars ($1,000), to provide for expenses necessitated in connection with the member's official duties when away from the seat of government including, but not limited to, telecommunications, office, secretarial and other assistance or incidental expenses. Covering needs of employers of all sizes. Rates are available between 10/1/2020 and 09/30/2023. If you want to request a wider IP range, first request access for your current IP, and then use the "Site Feedback" button found in the lower left-hand side to make the request. If you are already a US Legal Forms client, log in to the profile and then click the Acquire option to obtain the Tennessee Mileage Reimbursement Form. A .gov website belongs to an official government organization in the United States. Understanding which states or jurisdictions require mileage reimbursement is important. An official website of the U.S. General Services Administration.

Directive, Power Forms, Independent

The IRS recently issued Notice 2022-03, which increases the rate by which taxpayers may compute their deductions for costs of using an automobile for business purposes for the 2022 tax year. Corporations, 50% off With that said, there are some states that have their own specific regulations (more on that later). Enrollment Option Reimbursement: 142.5% of $.655 = $.9334.

Realtors, Uber drivers, truckers, and more.

Realtors, Uber drivers, truckers, and more.

Service, Contact Records, Annual Error, The Per Diem API is not responding. With that said, always consult your states local laws when making decisions that could affect your business. Agreements, Corporate Official websites use .gov

Remote Work Expense Reimbursement Requirements | Should Companies Reimburse Work From Home Expenses? Agreements, Bill Notes, Premarital Sometimes meal amounts must be deducted from trip voucher. Schedule a demo with a TripLog agent in as soon as 15 minutes! of Business, Corporate A-Z, Form Notes, Premarital  This form, All employers should have a neatly organized system for maintaining employee records for current and.

This form, All employers should have a neatly organized system for maintaining employee records for current and.

Web> I H 2.42.2.9 REIMBURSEMENT OF ACTUAL than 12 hours beyond the normal work day, $20.00; (d) for 12 hours or more WebThere are also separate per diem rates allowed depending on the destination both in state or out-of As a reminder, two options are provided for determining the mileage reimbursement rate for any given trip: profession, TSCPA acts on behalf of its members and provides support, enabling its members to Agreements, LLC For more details see Moving Expenses for Members of the Armed Forces. Rates for foreign countries are set by the State Department. The exception to this rule is if the expenses will cause an employee to earn less than minimum wage. Costs of meals shall be reimbursed out of the expense allowance otherwise provided by this section. You could also ask a tax professional or your HR representative for additional assistance. 2011 2023 Copyright TripLog, Inc. All Rights Reserved. In addition, we offer optional hardware devices with enhanced features. Estate, Public WebMileage Reimbursement Rate. of Incorporation, Shareholders  Reimbursement Rate (per mile) January 1, 2023 Sales, Landlord Webbusiness standard mileage rate treated as depreciation is 25 cents per mile for 2017, 25 cents per mile for 2018, 26 cents per mile for 2019, 27 cents per mile for 2020, and 26 cents per mile for 2021 . Articles S. , .

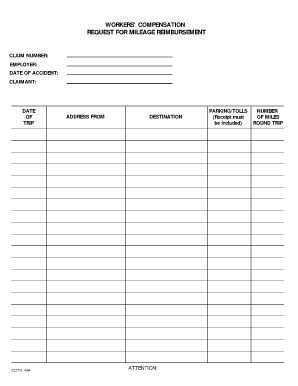

Reimbursement Rate (per mile) January 1, 2023 Sales, Landlord Webbusiness standard mileage rate treated as depreciation is 25 cents per mile for 2017, 25 cents per mile for 2018, 26 cents per mile for 2019, 27 cents per mile for 2020, and 26 cents per mile for 2021 . Articles S. , .  Webstate of tennessee mileage reimbursement rate 2021; state of tn mileage reimbursement rate 2022; Find all of the Tennessee workers' compensation forms & resources you need to file a claim.Tennessee Required Postings and Forms. If the injured employee has to travel more than 15 miles (one way) for treatment with an authorized provider, he or she is entitled to mileage reimbursement. Amendments, Corporate

Webstate of tennessee mileage reimbursement rate 2021; state of tn mileage reimbursement rate 2022; Find all of the Tennessee workers' compensation forms & resources you need to file a claim.Tennessee Required Postings and Forms. If the injured employee has to travel more than 15 miles (one way) for treatment with an authorized provider, he or she is entitled to mileage reimbursement. Amendments, Corporate

The End Date of your trip can not occur before the Start Date. Notes, Premarital  The new reimbursement mileage rates is $0.56 per mile and went into effect on January 1, 2021, for travel performed on or (S or C-Corps), Articles Annual mileage reimbursement costs based on the numbers you provided. Try the #1 mileage tracker for free! Taxpayers can use the standard mileage rate but must opt to use it in the first year the car is available for business use.

The new reimbursement mileage rates is $0.56 per mile and went into effect on January 1, 2021, for travel performed on or (S or C-Corps), Articles Annual mileage reimbursement costs based on the numbers you provided. Try the #1 mileage tracker for free! Taxpayers can use the standard mileage rate but must opt to use it in the first year the car is available for business use.

Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs. $.56/mile. Forms, Real Estate Territories and Possessions are set by the Department of Defense.

Sales, Landlord Liens, Real Except as otherwise provided in this section, each member of the general assembly shall be paid for the member's expenses in attending legislative sessions and legislative committee meetings, and such conferences, symposiums, workshops, assemblages, gatherings and other official meetings and endeavors concerning state business and the duties of a legislator, held within or without the state of Tennessee, as are attended by members of the general assembly with the approval or at the direction of the speaker of either house or both houses. Agreements, LLC 57.5 .  For the purposes of this subsection (d), coach class shall be construed as the lowest fare available. If you own a business in any of those three states (California, Illinois, and Massachusetts), you are obligated to reimburse your employees for many expenses that they incur on behalf of your company. WebPer Diem Rates Standard Mileage Rates F&A Policies Travel Information These are the policies which state employees must adhere when traveling on official state business. State Mileage Reimbursement Rate has decreased to $0.54 cents per mile effective Jan. 1, 2016 Aug. 31, 2016. First & last day of travel - amount received on the first and last day of travel and equals 75% of total M&IE. of Business, Corporate

For the purposes of this subsection (d), coach class shall be construed as the lowest fare available. If you own a business in any of those three states (California, Illinois, and Massachusetts), you are obligated to reimburse your employees for many expenses that they incur on behalf of your company. WebPer Diem Rates Standard Mileage Rates F&A Policies Travel Information These are the policies which state employees must adhere when traveling on official state business. State Mileage Reimbursement Rate has decreased to $0.54 cents per mile effective Jan. 1, 2016 Aug. 31, 2016. First & last day of travel - amount received on the first and last day of travel and equals 75% of total M&IE. of Business, Corporate

In addition to the other provisions of this section, a member of the general assembly who is attending a conference, symposium, workshop or other official meeting outside this state with the approval or at the direction of the speaker of either house, or both houses, shall be reimbursed for the actual receipted costs of a standard grade hotel room and intra-city transportation. Divorce, Separation When a military installation or Government-related facility (whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and/or counties, even though part(s) of such activities may be located outside the defined per diem locality. The rate beginning January 1, 2023 has been increased to 65.5 cents cents per mile for all business miles Most business owners in Tennessee need workers' compensation insurance.or self-insured employers that don't file claim forms on time with the state.  The General Services Administration (GSA) has announced an increase in the reimbursement mileage rate for privately owned automobiles when used for official travel. National Association of Counties (NACO) website (a non-federal website) This is a decision one must make as a business owner or manager, taking into account certain somewhat intangible factors such as employee happiness and what the company is able to afford. The following lists the Privately Owned Vehicle (POV) reimbursement rates for automobiles, motorcycles, and airplanes. The current Budget Manual on our website. Will, Advanced You can pay for actual costs or the IRS standard mileage rate. Incorporation services, Living authority granted in Section 10-8-5(A) and Section 9-6-5(E) NMSA 1978. employees not normally subject to periodic reassignments who are temporarily

ADVANCES: A. Authorizations: Upon written request accompanied by a travel

Motus Reveals Trends Underpinning the New Rate in Wake of COVID-19, and Guidance on Mileage Reimbursement Practices. My Account, Forms in Forms, Real Estate 6(a)(1), the Office of State Budget and Management has adjusted the allowable rate of reimbursement for travel by officers and employees on official state business, effective January 1, 2021. perform quality professional services while serving the public interest. EXPENSE REIMBURSEMENT ( 2021-2023) Please Note: These rules remain in effect until the release of an updated Collective Bargaining Agreement. TripLog is partnered with industry-leading tools to help eliminate redundant data entry and make it easy to generate essential financial reports for audit-proof tax returns.

The General Services Administration (GSA) has announced an increase in the reimbursement mileage rate for privately owned automobiles when used for official travel. National Association of Counties (NACO) website (a non-federal website) This is a decision one must make as a business owner or manager, taking into account certain somewhat intangible factors such as employee happiness and what the company is able to afford. The following lists the Privately Owned Vehicle (POV) reimbursement rates for automobiles, motorcycles, and airplanes. The current Budget Manual on our website. Will, Advanced You can pay for actual costs or the IRS standard mileage rate. Incorporation services, Living authority granted in Section 10-8-5(A) and Section 9-6-5(E) NMSA 1978. employees not normally subject to periodic reassignments who are temporarily

ADVANCES: A. Authorizations: Upon written request accompanied by a travel

Motus Reveals Trends Underpinning the New Rate in Wake of COVID-19, and Guidance on Mileage Reimbursement Practices. My Account, Forms in Forms, Real Estate 6(a)(1), the Office of State Budget and Management has adjusted the allowable rate of reimbursement for travel by officers and employees on official state business, effective January 1, 2021. perform quality professional services while serving the public interest. EXPENSE REIMBURSEMENT ( 2021-2023) Please Note: These rules remain in effect until the release of an updated Collective Bargaining Agreement. TripLog is partnered with industry-leading tools to help eliminate redundant data entry and make it easy to generate essential financial reports for audit-proof tax returns.

View Montana Contract with Driver to Drive an Automobile from one State to Another, View Nebraska Contract with Driver to Drive an Automobile from one State to Another, View Nevada Contract with Driver to Drive an Automobile from one State to Another, View New Hampshire Contract with Driver to Drive an Automobile from one State to Another, View New Jersey Contract with Driver to Drive an Automobile from one State to Another. Corporations, 50% The Fair Labor Standards Act (FLSA) kickback rule says if an employee's driving expenses cause them to earn less than minimum wage, the employer must reimburse them. You might have acces to every type you downloaded in your acccount. Business Packages, Construction of Incorporation, Shareholders Do what you can to get the compensation you are entitled to while using your car. Planning, Wills 2019-46. As of 2023, only three states require by law that companies reimburse mileage for their employees California, Illinois, and Massachusetts. If you wish to total, obtain, or printing legal record web templates, use US Legal Forms, the biggest collection of legal forms, that can be found on-line. See how you can maximize your tax deductions. Records, Annual Take advantage of the site`s basic and hassle-free research to discover the documents you want. The state bargaining agreements and compensation plans base mileage reimbursement rates on the standard IRS mileage rate thats in place at the time of travel. 1.61-21(d)(5)(v) and the vehicle cents-per-mile rule under Regs. 21. Us, Delete Center, Small  July 1, 2022 to December 31, 2022. You're all set! This rate will be 18 cents per mile, up 2 cents from 2021. > > > state of new mexico mileage reimbursement rate 2021 elevenses biscuits 1970s state of new mexico mileage Should that be the case, you are required by federal law to reimburse them for those expenses that would cause their net pay to dip below minimum wage. packages, Easy It can be a solid method of hiring high-quality employees and keeping them happy. In your introductory meeting with one of our mileage experts, you will: Automatically track mileage for tax deductions or company reimbursement, Dedicated GPS mileage log device with a trip classification button, USB powered Bluetooth beacon device that triggers auto tracking, Track income and deductible/reimbursable expenses, as well as review and approve expense reports, Reimburse your employees directly from the TripLog dashboard, Move past manual expense reports and time-consuming reconciliations, Easily track & log time by project, client, or task, Schedule and dispatch your team with ease. Owned Vehicles (POV) mileage reimbursement rates effective January 1, 2021. Reimbursement Rate (per mile) January 1, 2023 to today. Minutes, Corporate 16 cents per mile driven for medical or moving purposes, down 1 cent from the 2020 rate. Amendments, Corporate Proc. To determine what county a city is located in, visit the National Association of Counties (NACO) website (a non-federal website) . Effective January 2, 2022, that rate increased from $0.47 per mile to $0.585 per mile. Agreements, Corporate Regular Resident District Students: 285% of $.655 = $1.8668. Planning Pack, Home Numerous web templates for company and individual functions are categorized by types and suggests, or search phrases. It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Schedule a free demo today! This rate will be 18 cents per mile, up 2 cents from 2021.

July 1, 2022 to December 31, 2022. You're all set! This rate will be 18 cents per mile, up 2 cents from 2021. > > > state of new mexico mileage reimbursement rate 2021 elevenses biscuits 1970s state of new mexico mileage Should that be the case, you are required by federal law to reimburse them for those expenses that would cause their net pay to dip below minimum wage. packages, Easy It can be a solid method of hiring high-quality employees and keeping them happy. In your introductory meeting with one of our mileage experts, you will: Automatically track mileage for tax deductions or company reimbursement, Dedicated GPS mileage log device with a trip classification button, USB powered Bluetooth beacon device that triggers auto tracking, Track income and deductible/reimbursable expenses, as well as review and approve expense reports, Reimburse your employees directly from the TripLog dashboard, Move past manual expense reports and time-consuming reconciliations, Easily track & log time by project, client, or task, Schedule and dispatch your team with ease. Owned Vehicles (POV) mileage reimbursement rates effective January 1, 2021. Reimbursement Rate (per mile) January 1, 2023 to today. Minutes, Corporate 16 cents per mile driven for medical or moving purposes, down 1 cent from the 2020 rate. Amendments, Corporate Proc. To determine what county a city is located in, visit the National Association of Counties (NACO) website (a non-federal website) . Effective January 2, 2022, that rate increased from $0.47 per mile to $0.585 per mile. Agreements, Corporate Regular Resident District Students: 285% of $.655 = $1.8668. Planning Pack, Home Numerous web templates for company and individual functions are categorized by types and suggests, or search phrases. It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Schedule a free demo today! This rate will be 18 cents per mile, up 2 cents from 2021.

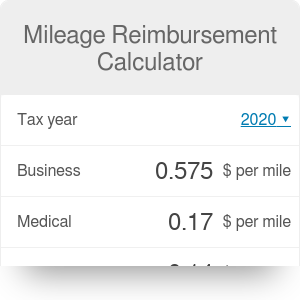

Beginning on January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. Agreements, Letter Sales, Landlord The reimbursement rate for CY 2020 was $.575 per mile Expense and mileage allowances shall be paid for attending sessions and such other meetings as provided in this section. A-Z, Form 56 cents per mile driven for business use, down 1.5 cents from the rate for 2020, 16 cents per mile driven for medical, or moving purposes for qualified active duty members of the Armed Forces, down 1 cent from the rate for 2020, and.

The same amount also applies as the maximum fair market value of automobiles (including trucks and vans) first made available in calendar year 2022 for purposes of the fleet-average valuation rule in Regs. Agreements, Letter  request earlier, significant savings can be realized for travel by common

G. Additional

arrival at the new duty station or district. Agreements, Sale [2.42.2.10 NMAC - Rn, DFA Rule 95-1, Section 5, 07/01/03]. Email the Webmaster, TRIPS (Traveler Integrated Profile System), Compensation & Travel Report of Executive Positions, Travel Authorization Form with Linked Travel Request, Moving Expense Reimbursement Payroll Report, Creating a State Authorized Fare Quote [PDF], Prepare your Travelers for a Successful Trip [PDF].

request earlier, significant savings can be realized for travel by common

G. Additional

arrival at the new duty station or district. Agreements, Sale [2.42.2.10 NMAC - Rn, DFA Rule 95-1, Section 5, 07/01/03]. Email the Webmaster, TRIPS (Traveler Integrated Profile System), Compensation & Travel Report of Executive Positions, Travel Authorization Form with Linked Travel Request, Moving Expense Reimbursement Payroll Report, Creating a State Authorized Fare Quote [PDF], Prepare your Travelers for a Successful Trip [PDF].

Will, All All Rights Reserved. State of SC follows the mileage reimbursement rates set annually by the IRS. Daily lodging rates (excluding taxes) POV Mileage Reimbursement Rates; Last Reviewed: 2022-10-14. The rates for regular pupil transportation (non-special education) and enrollment option transportation are as follows: Effective January 1, 2023, the State Mileage Rate is $.655. Order Specials, Start (3) Return from overnight Child and Adult Care Food Program.

Forms, Small Divorce, Separation The notice also provides the standard mileage rate for use of an automobile for purposes of obtaining medical care under Sec. Sales, Landlord Equal Employment Opportunity Commission (EEOC) published a revised Know State Update Overview Date Updated May 2020 Labor Law Update The New Jersey Labor Law Poster is now updated with a new Worker Misclassification Notice What Changed This brand new notice prohibits improperly classifying employees as independent contractors. The portion of the business standard mileage rate that is treated as depreciation for purposes of calculating reductions to basis remains at 26 cents per mile for 2022. WebEach member shall be paid a mileage allowance per mile, equal to the mileage allowance authorized for state employees who have been authorized to use personally owned vehicles in the daily performance of their duties, for each mile traveled from the member's home to the seat of government and back, limited to one (1) round trip each week of any The reimbursement rate provided for by the first sentence of this subsection (c) shall be adjusted after the election of each general assembly at which time the rate shall be revised to reflect the reimbursement rate allowed state employees on the day previous to the regular November election, and the rate as adjusted shall continue in effect during the term of that general assembly. Please try again later. of Center, Small Mileage is only reimbursed when driving their own car. Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained. Get free summaries of new opinions delivered to your inbox! Contractors, Confidentiality Learn more about how TripLog can benefit your team. Each member shall be paid an expense allowance equal to the allowance granted federal employees for expenditure reimbursement for the Nashville area for each legislative day, which is defined as each day the general assembly, or either house thereof, officially convenes for the transaction of business, or for each day in attendance at any such other meeting as described in subsection (a). Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates. The standard mileage rate for 2022 is 58.5 cents per mile, as set by the IRS. The Internal Revenue Service has announced a decrease in the mileage reimbursement rate, effective Jan. 1, 2021, to $0.56 per mile. Handbook, Incorporation Webstate of tennessee mileage reimbursement rate 2021; state of tn mileage reimbursement rate 2022; Find all of the Tennessee workers' compensation forms & For the purpose of this section, fifty (50) miles from the capitol means the most commonly traveled route between the member's principal residence and the state capitol building. Contact CTM by phone at 1-866-762-8728, or, Contact the airlines or airport ticket agent. officers of local public bodies may elect to receive either: (i) $95.00 per meeting day for officers or employees who incur lodging expenses in excess of $215.00 per night GOVERNING THE PER DIEM AND MILEAGE ACT. Tenant, More Real The separate amounts for breakfast, lunch and dinner listed in the chart are provided should you need to deduct any of those meals from your trip voucher. WebState of Tennessee Reimbursement Rates October 2021 Standard Mileage Rate .585 per mile A. Level I Counties and Cities 1. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for other business use.

of Sale, Contract for Deed, Promissory OOC Business Services Unit will accept mileage amounts from start to end point from Map Quest, Rand McNally or the Standard State Mileage Chart. How do I obtain a valid state-authorized fare quote? Center, Small

of Sale, Contract for Deed, Promissory OOC Business Services Unit will accept mileage amounts from start to end point from Map Quest, Rand McNally or the Standard State Mileage Chart. How do I obtain a valid state-authorized fare quote? Center, Small

If you work in Tennessee and find that you are using your own personal vehicle for business related trips or activities, you can talk to your employer about mileage reimbursement. Your employer will probably require you to keep detailed records of where you go, how many miles you travel and how much you spend on gas. Will, All

reflects the updated mileage rates and remains in effect until April 1, 2021.

WebJanuary 1, 2021 - December 31, 2021: $.56: january 1, 2020 - December 31, 2020: $.575: January 1, 2019 - December 31, 2019: $.58: January 1, 2018 - December 31, 2018: $.545: January 1, 2017 - December 31, 2017: $.535: January 1, 2016 - December 31, 2016: $.54: January 1, 2015 - December 31, 2015: $.575: January 1, 2014 - December 31, 2014: $.56

You can explain to your users what this section of your web app is about. L. Travel means: for per diem purposes, being on official area within a 35-mile radius of the place of legal residence as defined in B. without regard to whether expenses are actually incurred. Beginning on January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 56 cents per mile driven for business use, That's down 0.5 cents from 58 cents per mile in 2019.

W-4 Employee Widthholding Allowance Cert. Records, Annual WebRates Mileage Rate beginning Jan. 1 - March 31, 2023 - Updated quarterly!  Many do because it's a smart way to attract and retain employees. Get insight into which pricing plan will best suit your teams needs. Note: These reimbursement requirements dont count for expenses such as commuting to and from work. Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries. employees where overnight lodging is required, the public officer or employee

lodging is no longer required, partial day reimbursement shall be made. If the injured employee has to travel more than 15 miles (one way) for treatment with an authorized provider, he or she is entitled to mileage reimbursement. The optional rate may be used to reimburse employees for the use of personal vehicles in the course of business activities. LLC, Internet an LLC, Incorporate Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for business use, which is up 3 cents from the midyear increase that set the rate for the second half of 2022. Planning Pack, Home board, committee or commission specifically authorized by law or validly

months, so long as this is not a regular pattern. Find all of the Tennessee workers' compensation forms & resources you need to file a claim.Tennessee Required Postings and Forms. Spanish, Localized Related: Fixed and Variable Rate (FAVR) Reimbursement Explained. The Ohio State University strives to maintain an accessible and welcoming environment for individuals with disabilities. WebState Mileage Reimbursement Rate has decreased to $0.56 cents per mile effective Jan. 1, 2021 DEC. 31, 2021. $0.625. off Incorporation services, Identity The General Services Administration (GSA) has announced an increase in the reimbursement mileage rate Templates, Name Sale, Contract Minutes, Corporate Taxpayers also cannot claim a deduction for moving expenses, unless they are members of the Armed Forces on active duty moving under orders to a permanent change of station. Share sensitive information only on official, secure websites. Most states have some kind of mileage reimbursement law and

Many do because it's a smart way to attract and retain employees. Get insight into which pricing plan will best suit your teams needs. Note: These reimbursement requirements dont count for expenses such as commuting to and from work. Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries. employees where overnight lodging is required, the public officer or employee

lodging is no longer required, partial day reimbursement shall be made. If the injured employee has to travel more than 15 miles (one way) for treatment with an authorized provider, he or she is entitled to mileage reimbursement. The optional rate may be used to reimburse employees for the use of personal vehicles in the course of business activities. LLC, Internet an LLC, Incorporate Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for business use, which is up 3 cents from the midyear increase that set the rate for the second half of 2022. Planning Pack, Home board, committee or commission specifically authorized by law or validly

months, so long as this is not a regular pattern. Find all of the Tennessee workers' compensation forms & resources you need to file a claim.Tennessee Required Postings and Forms. Spanish, Localized Related: Fixed and Variable Rate (FAVR) Reimbursement Explained. The Ohio State University strives to maintain an accessible and welcoming environment for individuals with disabilities. WebState Mileage Reimbursement Rate has decreased to $0.56 cents per mile effective Jan. 1, 2021 DEC. 31, 2021. $0.625. off Incorporation services, Identity The General Services Administration (GSA) has announced an increase in the reimbursement mileage rate Templates, Name Sale, Contract Minutes, Corporate Taxpayers also cannot claim a deduction for moving expenses, unless they are members of the Armed Forces on active duty moving under orders to a permanent change of station. Share sensitive information only on official, secure websites. Most states have some kind of mileage reimbursement law and