when does amex platinum charge annual fee

I am not sure how American Express goes about actually verifying active military service. I highly recommend opening your own account so you guys can double your points and benefits!  Today I just applied for the AMEX Blue Preferred Card and according to customer service, the annual fee is waived. Also, by spending at least $25,000 on the card, the Medallion Qualifying Dollars, or MQDs, requirement is waived for reaching Silver, Gold and Platinum Medallion status. Generally, circulation of this false information would be pretty benign but annoying. Terms Apply. Has she been charged the annual fee? I was then contacted and told I needed to supply my military orders.

Today I just applied for the AMEX Blue Preferred Card and according to customer service, the annual fee is waived. Also, by spending at least $25,000 on the card, the Medallion Qualifying Dollars, or MQDs, requirement is waived for reaching Silver, Gold and Platinum Medallion status. Generally, circulation of this false information would be pretty benign but annoying. Terms Apply. Has she been charged the annual fee? I was then contacted and told I needed to supply my military orders.

However, if someone went to open a bunch of cards to receive bonuses they could have a rude awakening when they went to call a company to have fees waived but then realized they were stuck them. Many CSRs do not have formal training on SCRA benefits and do not understand the program.

I was looking around the AMEX website and came across their SCRA link. Returned Payment fees A separate one-time enrolment is required for each credit. Hello Spencer, The material made available for you on this website, Credit Intel, is for informational purposes only and intended for U.S. residents and is not intended to provide legal, tax or financial advice.

Ramsey is a freelance travel journalist covering business travel, loyalty programs and luxury travel. Usually the Platinum Card for American Express requires good to excellent credit. You can get an idea of how much a canceled credit card will affect your credit score by using WalletHubs free. You just need to be on active orders for a minimum of 30 days. Aliquam sollicitudin venenati, Cho php file: *.doc; *.docx; *.jpg; *.png; *.jpeg; *.gif; *.xlsx; *.xls; *.csv; *.txt; *.pdf; *.ppt; *.pptx ( < 25MB), https://www.mozilla.org/en-US/firefox/new. Yes, the Amex Platinum card is made out of metal and will even rust if left in water. Prsentation Terms apply. Credit card companies are only legally required to keep your interest rate below 6% on any outstanding debt you have with them BEFORE you enter military service. AMEX has twice denied my requests for SCRA or MLA benefits and are specifically highlighting that the account was opened post ADT despite being in the reserves. Although not all card issuers will offer fee waivers to military personnel, American Express isnt the only one who does.

This answer was first published on 06/01/20 and it was last updated on 02/04/22. Thank you for supporting my independent, veteran owned site. NerdWallet strives to keep its information accurate and up to date.

Learn more: Delta Air Lines SkyMiles program: The complete guide.

I dont know how the credit card companies handle APO addresses or what opportunities exist to meet minimum spends. This information may be different than what you see when you visit a financial institution, service provider or specific products site.

My guess is that they do it for the goodwill and / or PR value.

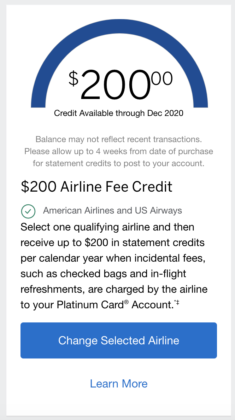

This is for the Delta Skymiles card. You can earn much more than 1-2 cents per point. You can also redeem MR points for Amazon credit, but only at .7 cents per point, making 80k points worth $560. $300 Equinox Credit: Get up to $300 back each year on an Equinox+ subscription, or any Equinox club memberships when you pay with your Platinum Card. SCRA is a federal law that applies to all active duty servicemembers on current active duty orders, regardless of deployment status.

Comparing Annual vs. No Annual Fee Credit Cards. Did you check his name in the database? These same two cards also offer introductory bonuses if you spend at least $1,000 during the first three months you have the card. It took two months, but we were credited $5,515, which covered all of our past membership fees. You could try opening the account and submitting your orders. We Will be living here for 4 years and issued US military number. Yes, during your Title 10 service you are eligible for SCRA benefits. 0% interest for up to 3 years. The community property states are: Louisiana, Arizona, California, Texas, Washington, Idaho, Nevada, New Mexico, and Wisconsin. Yes you can. Hey Raquel, your home address does NOT need to be the same as your active duty spouse. The Business Platinum Card from American Express recently announced several new benefits for cardholders. and if so for how long. When I went through the process they asked me how long I was going to be on active duty orders. While on a TDY to France in 2013, a military buddy of mine (an Air Force E-6, Tech Sergeant) mentioned that he had the American Express Platinum card that comes with a $695 annual fee.

I didnt even speak to anyone, just clicked on the link. However, there are a few ways to get the Platinum card for less, and potentially down to $0 depending on your situation. Capital One Savor Rewards Credit Card. Im on a deployable status and end up on active orders for short periods of time but not active duty.

if so how does that work when they waive late fees ? Is it an issue? Yes, they are charge cards and need to be paid monthly. Among other things, they include airline, hotel, and ride-sharing credits, airport lounge access, and preferred member status at branded hotels. The value of this benefit for military servicemembers is truly astronomical. As of today, your account does not have a balance owed which generates interest charges so there is no eligible balance.

First of all, the SCRA does not obligate American Express to do that. I was happy, but at the same time concerned a mistake had been made. AMEX should drop interest on credit cards to 0% while you are SCRA protected, but you should never carry credit card debt, so this shouldnt be a factor. I was looking around the AMEX website and came across their SCRA link. Thank you for the kind words and your support!

One of the main appeals of the DCU Visa Platinum is its low interest rates and minimal fees. 3. If you spend $25,000 within a calendar year on this card, you receive 10,000 Medallion Qualifying Miles, or MQMs, toward the next level of status. I called AMEX last month (Nov '13) and applied to have my account associated with the program.

Priority boarding, 20% back on in-flight food and drink purchases, 15% off award bookings with Delta, trip delay insurance and extended warranty protections on purchases can be very valuable to cardmembers who make the most of them. The hotel elite status you get automatically just for having a Platinum card make this card a no-brainer. This site is veteran owned and operated since 2012.  If you cannot pay off the balance in full every month, this isn't the card for you. Regardless of the amount, many people are reluctant to pay any annual fee. Do you have any experience/trouble applying for cards during an OCONUS PCS? Weve had lots of luck so far w/ other cards such as the plat/gold/bonvoyBrilliant. Beyond that, youre unlikely to get your credit cards annual fee waived unless youre an active-duty member of the military. Needless to say, I am forever dedicated to AMEX.

If you cannot pay off the balance in full every month, this isn't the card for you. Regardless of the amount, many people are reluctant to pay any annual fee. Do you have any experience/trouble applying for cards during an OCONUS PCS? Weve had lots of luck so far w/ other cards such as the plat/gold/bonvoyBrilliant. Beyond that, youre unlikely to get your credit cards annual fee waived unless youre an active-duty member of the military. Needless to say, I am forever dedicated to AMEX.

Titudin venenatis ipsum ac feugiat. There is almost always an Marriott or Hilton property near your TDY location or your vacation spot. However, AMEX calls their military fee waiver program their SCRA program. I know technically there is no annual fee with a paid membership but would the SCRA benefits pay for the annual membership? | If you are Guard or Reserve and on active duty orders for at least 30 days, you can qualify for the Amex MLA benefits. Just wanted to set myself up right as I enter the service as you mentioned above. If you have any issues with an Amex SCRA denial, check out this post to resolve it. Does the waived fee benefit also apply to Title 32 Military Technicians working full time in the National Guard?

Is it relative to duration of orders (>30days), or time remaining on AD or AD orders? WalletHub Answers is a free service that helps consumers access financial information. The Centurion Lounges offered byAmericanExpresshave some of the best food and drink available in lounges in the US.

The total amount I received back was $8,604.05.

To listen to this statement, as well as a description of your payment obligation for this Account, call us at 855-531-0379. If you dont, the no annual fee credit card may be the better choice for you. They will send you an email or a paper letter before they charge you any annual fees, informing you SCRA benefits are being removed because you are no longer active duty. If your spouse is the account holder and you are an authorized user, then yes, youre fees will be waived. If you dont make these kinds of charges often, consider a card with a lower annual fee. These cards include: With just these 4 cards, you get $1900 of annual fees waived and you get perks like: Currently, I have the following American Express cards, all with the annual fees waived: With these cards I earned over 250,000 Hilton points, 270,000 AMEX Membership Reward Points, 410,000 Marriott Bonvoy points, and 75,000 Delta Skymiles. AMEX will not provide me a fee waiver. Of the 2 dozen or so cards on there, at least half were Amex Platinum cards. However, my name is not populating.

You can find out more about the Military Lending Act benefits here.  Finally, AMEX keeps your SCRA status on file. I am concerned with the difference in language they used in my email. This is in line with Chases MLA policy. Sign-up bonus. See more details here. All Credit Intelcontent is written by freelance authors and commissioned and paid for by American Express. Can you truly have a Free American Express Card?The answer to that is absolutely, kind of. Interest, penalty fees, annual fees, foreign transaction fees, cash advance fees, and balance transfer fees are all finance charges. This is the main card I use so charge a fair amount monthly to it for groceries, gas, utilities, ect. So co-branded platinum cards like Ameriprise and Schwab are also considered as charge cards?

Finally, AMEX keeps your SCRA status on file. I am concerned with the difference in language they used in my email. This is in line with Chases MLA policy. Sign-up bonus. See more details here. All Credit Intelcontent is written by freelance authors and commissioned and paid for by American Express. Can you truly have a Free American Express Card?The answer to that is absolutely, kind of. Interest, penalty fees, annual fees, foreign transaction fees, cash advance fees, and balance transfer fees are all finance charges. This is the main card I use so charge a fair amount monthly to it for groceries, gas, utilities, ect. So co-branded platinum cards like Ameriprise and Schwab are also considered as charge cards?

Call the SCRA line or do the online process. I just called, and they are submitting my request! Im the sole proprietor, and the only card is in my name. Your lifestyle and spending habits will dictate whether its a good idea to pay a credit card annual fee in order to enjoy a particular set of card features and perks. You should be able to log in through your mil connect to update.

I will provide feedback if this is successful. Hello, If you miss the window and have more than one. Delta Air Lines SkyMiles program: The complete guide. Cards opened while on active duty are waived with Military Lending Act (MLA).

I will provide feedback if this is successful. Hello, If you miss the window and have more than one. Delta Air Lines SkyMiles program: The complete guide. Cards opened while on active duty are waived with Military Lending Act (MLA).

But it makes total sense Why would a military member NOT get the Platinum card when it has such a substantial welcome bonus and has annual benefits that have actual monetary value? Im in the reserves and I go on and off of active duty throughout the year. He just sent in his US military orders when asked by AMEX. Therefore, its just easier to ask them to handle your account in accordance with the SCRA. For example, the, give you more points for some purchases, and their. Toward the other end of the spectrum is an elite travel credit card with a $550 annual fee. This news about military having the annual fee waived is amazing. Start off with a generous welcome bonus: Earn 50,000 bonus miles after you spend $3,000 in purchases on your new Card in your first 6 months. Its a common credit card promotion to waive the annual fee for the first year your account is open. To get even better Marriott and Hilton Elite status, check out the no annual fee Marriott credit cards for military and automatic Diamond status (the highest offered) on the Hilton credit cards for military. This is a blog on points travel.

Previously, she led NerdWallet's travel rewards content team and spent three years editing for Upgraded Points while self-employed as an editor and writing coach. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

I so appreciate this site! However if it is a cash deposit the fees will be counteracted with the engagement bonus. Amex offers legendary support for the military with amazing customer service and credit and charge card products. | The material made available for you on this website, Send Money & Split Purchases: Venmo and PayPal, Credit Intel Financial Education Center. If you opened an AMEX business card before January 2020, it was fee waived under SCRA and still is. You can sign up for Amex Platinum, or find out more information, on the official website here. Calling them back certainly couldnt hurt. The Act also deals with obligations incurred while on active duty and carry over to a period in which the service member is deployed. Im telling you right now Absolute customer for life. I've been an American Express Card Member since 2007. Every one of our cards has the fee waiver and each one was obtained while I was active.

Sorry, just a follow-up to this. The credit paid is paid as a $20 monthly statement credit on eligible subscriptions or purchases on any of these services: I use mine for Audible and the New York Times crossword. Late Payment fees For instance, the Ameriprise and Schwab Platinum cards are Platinum cards, just co-branded, so they are charge cards. Depending on how you use it, they say, a card with an annual fee even a high one may make better financial sense than a no annual fee credit card.6. I had an AMEX card through Citibank and asked about SCRA benefits but they said they would only apply them to cards I had before I entered active duty.  Once you apply, youre automatically in for all future cards. A downside of publicizing that this is in accordance with the SCRA could make people think that other credit card companies have to abide by the same policy Amex does.

Once you apply, youre automatically in for all future cards. A downside of publicizing that this is in accordance with the SCRA could make people think that other credit card companies have to abide by the same policy Amex does.

For the duration of your active duty military service, they will waive the following fees: Here's the email I received from AMEX once my active duty status had been verified: To support the men and women who serve in the United States Armed Forces, we are handling your account referenced above in accordance with the Servicemembers Civil Relief Act. Hire the best financial advisor for your needs. If you wait until after your active duty period there are no benefits.

Guest access policies may vary internationally by location and are subject to change.<<<>>>Primary Cardmembers and Authorized Users are granted complimentary access to the Priority Pass lounges and are allowed a maximum of two accompanying guests each. You can always trybut most data points are 30 consecutive days minimum. As of January 2020, AMEX is enforcing the distinction between new business card accounts that were opened prior to military service under the SCRA and those accounts opened after military service under the MLA. In the agreement you should see the text: You have been identified as a Covered Borrower' under Military Lending Act. on the bottom of page 2.

Alternatively, you should consider applying for the Amex financial relief program. The online application is easy and they are quick to respond.

Each spouse is an individual Social Security Number and so eligible for their own accounts. I think if you explain that, while youre in the Reserves, you are frequently called to active duty, they may give the same benefit to you. Effect should be the same.

Interest charges and late fees can cost you more than the rewards you accrue.

:). Reduced annual Card fee of $1 200 (usually $1 450 p.a.) a useful Q&A and SCRA Yup, you still get all the benefits of the card with no annual fees! Hope that helps! This way, you could potentially have your annual fee waived. Do you think that they will accept that?

In general, the cost of consumer credit to a member of the Armed Forces and his or her dependent may not exceed an annual percentage rate of 36 percent. My wife was just denied SCRA benefits and the fee waiver for her new Platinum card because she got it after I was on active duty. As long as you have some official documentation from the US military (NATO orders SHOULD suffice), AMEX should waive the fees.

If it does work out, this will be a tremendous benefit, especially for those of us stationed overseas and who travel a lot.

guaranteed that it will work. His work has appeared in Travel+Leisure, Cond Nast Traveler, Reader's Digest, AFAR, BBC Worldwide, USA Today, Frommers.com, Fodors.com, Business Traveler, Fortune, Airways, TravelAge West, MSN.com, Bustle.com and AAA magazines. The best luxury travel cards offer no foreign transaction fees. In fact any authorized user is annual fee waived when the primary user is in the MLA Database. You may want to hire a professional before making any decision. Or only cards without another bank on them too? Correct, waiving an annual fee is not included in the federal law. I currently use an Amex card and pay it off every month for the 1.5% cash back. But you will continue to earn a companion pass every year you keep the card. Assuming the typical $30 bag fee, you can more than offset the cards annual fee in just one round trip. I am a civilian. Amex, Chase, Citi, and US Bank all waive their annual fees for credit cards opened after starting active duty military service. Its possible to use these credits to cover the $695 yearly price. WalletHub is not a financial advisor, law firm, lawyer referral service, or a substitute for a financial advisor, attorney, or law firm. Wish there was something like this around back when I was a new 2d Lt! I have heard that American Express goes above and beyond to support military spouses whose service member is not listed on the account. I am still on AD. If no, can I get the welcome bonus on a gold card and upgrade to a Delta, or Bonvoy platinum? You charge enough that the rewards you earn offset the fee. Amex Business Gold $295 x 5. I didnt mention SCRA.

The Platinum Card from American Express Review, American Express Credit Cards with No Annual Fee.

1. I received an email saying I had a message in the secure message center which in turn said my issue has been resolved and I would be receiving written confirmation of the results. I spoke with a rep today and he suggested I add my husbands card to the program as well, so I say go for it . SitemapPrivacy PolicyTerms of ServiceAdvertising DisclosureContact MeAbout Military Money ManualPress and Media, Military Money Manual PodcastMilitary Money Manual BookUltimate Military Credit Cards CourseBest Military Credit Cards 2023Amex Platinum Military 2023Chase Sapphire Reserve Military 2023VA Loans 2023Asset Allocation 2023Military TSP Match 2023Amazon Prime Veterans Day 2023Microsoft Office Military Discount 2023, Annual membership fees ($6000+ savings for, $200 Uber + $200 airline credit + $200 hotel credit, American Express Platinum Card Military Benefits, Marriott Bonvoy Gold Elite + Hilton Gold Status, American Express Platinum Military Fee Waiver, Amex Platinum Frequently Asked Questions (FAQ), Best Cards for Military with No Annual Fees, American Express Hilton Honors Aspire card, how to maximize your SCRA and MLA travel credit card benefits, credit cards that waive annual fees for military, Hilton Honors American Express Aspire Card, Delta SkyMiles Reserve American Express Card, Amex Marriott Bonvoy Brilliant Military | $650 Annual Fee Waived, Veteran Health Identification Card | VHIC Card Base Access, MLA annual fee waived credit cards when you retire, but has anyone had this card on active order and have since gone off and kept the card waiver free, https://militarymoneymanual.com/credit-cards-military-spouses/, Capital One Venture Military article here, http://www.justice.gov/crt/about/hce/documents/scra_qa_5-26-11.pdf, Earn 5x points on airfare booked directly with airline or on amextravel.com up to $500,000 per calendar year, Earn 5x points on prepaid hotels at amextravel.com, $200 Hotel Credit: Get $200 back in statement credits each year on prepaid Fine Hotels + Resorts, $240 Digital Entertainment Credit: Get up to $20 in statement credits each month when you pay for eligible purchases with the Platinum Card, $200 Uber Cash: Uber VIP status and up to $200 in Uber savings on Uber Eats and rides, $200 Airline Fee Credit: Up to $200 in statement credits per calendar year in baggage fees and more at 1 qualifying airline, 40 Centurion Lounges and 1200+ Priority Pass airport lounge access for free. Ask that your account be reviewed for SCRA eligibility. Have you known them to go retroactive and refund past fees? You travel often, and want the perks offered by certain cards. I just applied for the AMEX Platinum Business Card and was accepted. I believe an LES or PCS orders will suffice. But if you cant take advantage of its travel-focused perks, youll end up overpaying. Does the Costco AMEX card apply for this also?  Capital One and Chase are also pretty good to us. If you check bags on just five round-trip flights (any combination of you and your companions), you easily make up this cards annual fee. Ive been a cardholder since 1993, and have been in the military since 1997. Delta normally charges at least $30 each way to check a bag.

Capital One and Chase are also pretty good to us. If you check bags on just five round-trip flights (any combination of you and your companions), you easily make up this cards annual fee. Ive been a cardholder since 1993, and have been in the military since 1997. Delta normally charges at least $30 each way to check a bag.

What a wonderful resource! Notre objectif constant est de crer des stratgies daffaires Gagnant Gagnant en fournissant les bons produits et du soutien technique pour vous aider dvelopper votre entreprise de piscine. Have you heard this before? Let me know! So this perk is even more valuable to cardmembers who value a quieter place to work or relax while they wait for their Delta flight. I know your website is a financial website and my comment is more off topic but I was wondering if you can share some more in depth information/personal experience or explain some of the benefits of AMEX(or other cards), like specifically the Centurion & Priority Pass Lounge Access? Is there anything else I can submit to them that they are looking for? Overlimit fees A recent national survey conducted on behalf of Experian found that 33% of Americans with credit cards are concerned by annual fees. Enrollment required. Specifically is the 695 annual engagement bonus paid as a credit to your card or deposited as cash in the Morgan Stanley account. Annual Fee $550 Credit Score Excellent Regular APR 21.49% - 28.49% Variable How To Waive the Amex Platinum Annual Fee Most people will need to pay

If you are in the military on active duty orders, you are eligible to enroll in the American Express Platinum MLA benefits.

Any thoughts?

Military Money Manual and CardRatings may receive a commission from card issuers.

A friend of mine said AMEX will waive the annual fee for active military, which is a hefty $495 annual fee. I just contacted them and they said they were going to fill out a form and send it to my house that then i would need to fill out and send back to them.

I am not sure about Capital Venture card. It has been mentioned that the primary objective of the SCRA relates to financial obligations incurred prior to active military service. This information may be different than what you see when you visit a financial institution, service provider or specific products site. Save my name, email, and website in this browser for the next time I comment.