Like us on Facebook atwww.facebook.com/TheSunUSand follow us from our main Twitter account at@TheSunUS, Huge Kohl's change will improve shopping for millions but Target won't be happy, McDonald's launches new menu addition inspired by popular tv show, Beloved restaurant and Ruth's Chris rival closes for good after 30 years, 2020 THE SUN, US, INC. ALL RIGHTS RESERVED | TERMS OF USE | PRIVACY | YOUR AD CHOICES | SITEMAP, Checks worth up to $600 are available to some workers in 2022, Payments are available for farmworkers, meatpackers and grocery store employees, Workers will apply for funds with state or local agencies, the USDA said. If you have not received a payment by now, you will most likely receive a paper check.

The payments are reduced by $5 for every $100 in AGI over the above limits. Recently weve used a very rough estimate of a total of 8.5 million GSS II payments when all have been issued. Gavin Newsoms pandemic recovery plan. If the income thresholds change, individuals who qualified previously but no longer do may be able to take advantage of other forms of economic relief, such as the extended eviction moratorium and extended student loan forbearance period. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool.

The payments are reduced by $5 for every $100 in AGI over the above limits. Recently weve used a very rough estimate of a total of 8.5 million GSS II payments when all have been issued. Gavin Newsoms pandemic recovery plan. If the income thresholds change, individuals who qualified previously but no longer do may be able to take advantage of other forms of economic relief, such as the extended eviction moratorium and extended student loan forbearance period. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. Right now, stimulus checks for qualifying individuals are $600. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Visit Stimulus payments for more information. If you receive Social Security (either retirement or disability) but didnt file a return in 2019 (because you earned too little to be required to file), youll also receive a stimulus check, based on the information sent to the IRS on 2019 forms SSA-1099 and RRB-1099. Millions of Americans are set to get their second stimulus checks in the coming days. An individual farmer was not able to directly apply to this program. The next $1,400 stimulus check could be released this week.

How To Find The Cheapest Travel Insurance. How To Find The Cheapest Travel Insurance, have to wait three to four weeks for the payment to arrive. As new $1,400 stimulus checks are sent to millions of Americans, some may still be wondering why they have not received money from the first two sets of direct payments. The CASH Act bill, which included $2,000 stimulus checks for qualifying individuals, passed in the House in December but was blocked from reaching the Senate floor by Senate Majority Leader Mitch McConnell (R-Ky). Since theAmerican Rescue Plan, the White House has proposed several packages, including the American Jobs Plan and theBuild Back Betteragenda, but those don't call for more direct aid.

The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. They can use these resources to get help when they need it, at home, at work or on the go. Biden has proposed sending a third round of checks to Americans. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. The grant money will be given to state agencies, Tribal entities, and nonprofit organizations that offer services to the industries. But like the CARES Act before it, the initial announcement that more stimulus payments are coming lacked some details about the nuts and bolts of getting that money from the Treasury Department into your bank account. As of right now, its unclear. Our goal is to provide a good web experience for all visitors. Available only at IRS.gov/freefile, Free File enables people whose incomes are $73,000 or less to file a return online for free using brand-name software. In addition, the American Rescue Plan increases direct financial relief to American families by providing $1,400 payments for all qualifying dependents of a family, rather than just qualifying children under age 17. tax guidance on Middle Class Tax Refund payments, Individual Taxpayer Identification Number (ITIN), GSS I or II check recipients (last name beginning with AE), GSS I or II check recipients (last name beginning with FM), GSS I or II check recipients (last name beginning with NV), GSS I or II check recipients (last name beginning with WZ), Non-GSS recipients (last name beginning with A K), Non-GSS recipients (last name beginning with L Z), Direct deposit recipients who have changed their banking information since filing their 2020 tax return, Debit card recipients whose address has changed since filing their 2020 tax return, Filed your 2020 tax return by October 15,2021, Meet the California adjusted gross income (CA AGI) limits described in the, Are a California resident on the date the payment is issued, Received your tax refund by check regardless of filing method, Received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number, Received an advance payment from your tax service provider, or paid your tax preparer fees using your tax refund. Trinity Nguyen via Unsplash. Once the entities receive funding, they will be in charge of distributing the $600relief payments to frontline farmworkers and meatpacking workers. The stimulus payment aims to compensate workers who took on unexpected costs during the pandemic, including purchasing their own protective gear, childcare, Covid19 testing and taking unpaid leave. [i] To receive your payment, you must have filed a complete 2020 tax return by October15,2021. If youre a couple with an adjusted gross income of $174,000 or more, or a head of household making more than $124,500, you wont get any money.

The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. They can use these resources to get help when they need it, at home, at work or on the go. Biden has proposed sending a third round of checks to Americans. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. The grant money will be given to state agencies, Tribal entities, and nonprofit organizations that offer services to the industries. But like the CARES Act before it, the initial announcement that more stimulus payments are coming lacked some details about the nuts and bolts of getting that money from the Treasury Department into your bank account. As of right now, its unclear. Our goal is to provide a good web experience for all visitors. Available only at IRS.gov/freefile, Free File enables people whose incomes are $73,000 or less to file a return online for free using brand-name software. In addition, the American Rescue Plan increases direct financial relief to American families by providing $1,400 payments for all qualifying dependents of a family, rather than just qualifying children under age 17. tax guidance on Middle Class Tax Refund payments, Individual Taxpayer Identification Number (ITIN), GSS I or II check recipients (last name beginning with AE), GSS I or II check recipients (last name beginning with FM), GSS I or II check recipients (last name beginning with NV), GSS I or II check recipients (last name beginning with WZ), Non-GSS recipients (last name beginning with A K), Non-GSS recipients (last name beginning with L Z), Direct deposit recipients who have changed their banking information since filing their 2020 tax return, Debit card recipients whose address has changed since filing their 2020 tax return, Filed your 2020 tax return by October 15,2021, Meet the California adjusted gross income (CA AGI) limits described in the, Are a California resident on the date the payment is issued, Received your tax refund by check regardless of filing method, Received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number, Received an advance payment from your tax service provider, or paid your tax preparer fees using your tax refund. Trinity Nguyen via Unsplash. Once the entities receive funding, they will be in charge of distributing the $600relief payments to frontline farmworkers and meatpacking workers. The stimulus payment aims to compensate workers who took on unexpected costs during the pandemic, including purchasing their own protective gear, childcare, Covid19 testing and taking unpaid leave. [i] To receive your payment, you must have filed a complete 2020 tax return by October15,2021. If youre a couple with an adjusted gross income of $174,000 or more, or a head of household making more than $124,500, you wont get any money. Do I Have To Claim The Second Stimulus Check? The IRS urges everyone to make sure they have all their year-end 2021 tax statements in hand before filing their 2021 return. Families who added a new dependent in 2021 and Americans whose income dropped are among those who could also be eligible for cash.

who will retire after his term ends in 2022, said in a Commissions do not affect our editors' opinions or evaluations. Checks worth up to $600 are available to some workers in 2022Credit: Getty.

who will retire after his term ends in 2022, said in a Commissions do not affect our editors' opinions or evaluations. Checks worth up to $600 are available to some workers in 2022Credit: Getty. Do not include Social Security numbers or any personal or confidential information. Consult with a translator for official business.

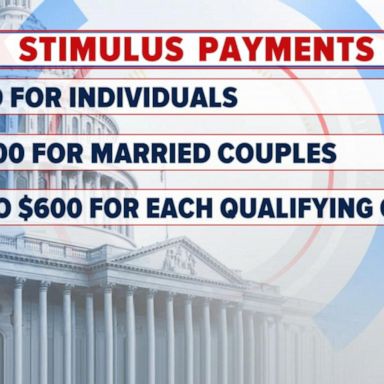

In May, several members of theHouse Ways and Means Committee(PDF) made a similar request. Adults with AGIs up to $75,000 per year and couples earning up to $150,000 per year will receive $600 per person. All Rights Reserved. Single taxpayers earning $250,000 or above and couples earning a combined $500,000 were ineligible for the payments. 2023 www.recordnet.com. Individuals whose incomes are below $12,500 and couples whose incomes are below $25,000 may be able to file a simple tax return to claim the 2021 Recovery Rebate Creditwhich covers any stimulus payment amounts from 2021 they may have missedand the Child Tax Credit. We want to hear from you. If you want to find out the status of your check, you can use the IRS Get My Payment portal. Customer support is available in English, Spanish, Mandarin, Hindi, Vietnamese, Korean, and Punjabi. The AGI thresholds at which the payments began to be reduced were identical to those under the CARES Act. Third Stimulus Check Calculator: How Much Might You Get? President Donald Trump signed a pandemic relief bill in late December, which means a second round of Economic Impact Payments (aka stimulus checks) is rolling out to Americans. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Payment amounts are reduced for eligible individuals with AGI above those levels. The last round of $600 payments issued by California will conclude the states pandemic stimulus before Jan. 1, 2022?

In May, several members of theHouse Ways and Means Committee(PDF) made a similar request. Adults with AGIs up to $75,000 per year and couples earning up to $150,000 per year will receive $600 per person. All Rights Reserved. Single taxpayers earning $250,000 or above and couples earning a combined $500,000 were ineligible for the payments. 2023 www.recordnet.com. Individuals whose incomes are below $12,500 and couples whose incomes are below $25,000 may be able to file a simple tax return to claim the 2021 Recovery Rebate Creditwhich covers any stimulus payment amounts from 2021 they may have missedand the Child Tax Credit. We want to hear from you. If you want to find out the status of your check, you can use the IRS Get My Payment portal. Customer support is available in English, Spanish, Mandarin, Hindi, Vietnamese, Korean, and Punjabi. The AGI thresholds at which the payments began to be reduced were identical to those under the CARES Act. Third Stimulus Check Calculator: How Much Might You Get? President Donald Trump signed a pandemic relief bill in late December, which means a second round of Economic Impact Payments (aka stimulus checks) is rolling out to Americans. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Payment amounts are reduced for eligible individuals with AGI above those levels. The last round of $600 payments issued by California will conclude the states pandemic stimulus before Jan. 1, 2022?

Had a California Adjusted Gross Income (CA AGI) of $1 to $75,000 for the 2020 tax year. Got a confidential news tip? Qualifying families got an additional $500 for dependents. To determine your adjusted gross income (AGI) for 2019, look at line 8b of Form 1040 on your 2019 U.S. To get an estimate on your California stimulus payment, go toftb.ca.gov. Had a California Adjusted Gross Income (CA AGI) of $1 to $75,000 for the 2020 tax year.

The income cap for heads of households to get the full $600 is $112,500. The IRS has said it may potentially send follow-on payments to those people after their 2020 tax returns are processed. Email us atexclusive@the-sun.comor call212 416 4552. Claiming these credits has no effect on the ability of someone to be eligible for federal benefits like Supplemental Security Income (SSI), Supplemental Nutrition Assistance Program (SNAP), Temporary Assistance for Needy Families (TANF), and the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC). In order to qualify, you must have been a California resident for most of 2020 and still live there, filed a 2020 tax return, earned less than $75,000 (adjusted gross income and wages), have a Social Security number or an individual taxpayer identification number, and your children can't be claimed as a dependent by another taxpayer. First and foremost, there were no stimulus checks last year, were there? In California, For Example, The State Has Started Sending Out More Golden State Stimulus Checks For $600. To get a payment, you must claim the Recovery Rebate Credit on yourtax return. WebCheck if you qualify for the Golden State Stimulus II. Today in Covid Economics we discuss the progress or lack there of from Democrats and Republicans to get the next stimulus package passed. If you have any issues or technical problems, contact that site for assistance.

The income cap for heads of households to get the full $600 is $112,500. The IRS has said it may potentially send follow-on payments to those people after their 2020 tax returns are processed. Email us atexclusive@the-sun.comor call212 416 4552. Claiming these credits has no effect on the ability of someone to be eligible for federal benefits like Supplemental Security Income (SSI), Supplemental Nutrition Assistance Program (SNAP), Temporary Assistance for Needy Families (TANF), and the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC). In order to qualify, you must have been a California resident for most of 2020 and still live there, filed a 2020 tax return, earned less than $75,000 (adjusted gross income and wages), have a Social Security number or an individual taxpayer identification number, and your children can't be claimed as a dependent by another taxpayer. First and foremost, there were no stimulus checks last year, were there? In California, For Example, The State Has Started Sending Out More Golden State Stimulus Checks For $600. To get a payment, you must claim the Recovery Rebate Credit on yourtax return. WebCheck if you qualify for the Golden State Stimulus II. Today in Covid Economics we discuss the progress or lack there of from Democrats and Republicans to get the next stimulus package passed. If you have any issues or technical problems, contact that site for assistance.  Have adjusted gross income of $1 to $75,000 for the 2020 tax year; Be a state resident for more than half of the 2020 tax year; Be a state resident the date payment is issued; Cannot be claimed as a dependent by another taxpayer; A dependent is a qualifying child or qualifying relative. In a speech this summer, Biden called on Congress to extend the expanded child tax credit through 2025. As a result, a single tax filer would see no payments if they have an AGI of $87,000 or higher. Some taxpayers will receive their payment on a debit card. We strive to provide a website that is easy to use and understand. The program is part of Gov. This means that many people who don't normally need to file a tax return should do so this year, even if they haven't been required to file in recent years. Californians will receive their MCTR payment by direct deposit or debit card. Organizations originally had until February 8 to apply to distribute the funds, with stimulus checks worth up to $600 expected to be issued to workers later this year. Each farmer and frontline worker who is eligible will get a $600 stimulus check on their mailbox. If you have any questions related to the information contained in the translation, refer to the English version.

Have adjusted gross income of $1 to $75,000 for the 2020 tax year; Be a state resident for more than half of the 2020 tax year; Be a state resident the date payment is issued; Cannot be claimed as a dependent by another taxpayer; A dependent is a qualifying child or qualifying relative. In a speech this summer, Biden called on Congress to extend the expanded child tax credit through 2025. As a result, a single tax filer would see no payments if they have an AGI of $87,000 or higher. Some taxpayers will receive their payment on a debit card. We strive to provide a website that is easy to use and understand. The program is part of Gov. This means that many people who don't normally need to file a tax return should do so this year, even if they haven't been required to file in recent years. Californians will receive their MCTR payment by direct deposit or debit card. Organizations originally had until February 8 to apply to distribute the funds, with stimulus checks worth up to $600 expected to be issued to workers later this year. Each farmer and frontline worker who is eligible will get a $600 stimulus check on their mailbox. If you have any questions related to the information contained in the translation, refer to the English version. Normally, a taxpayer will qualify for the full amount of Economic Impact Payment if they have AGI of up to $75,000 for singles and married persons filing a separate return, up to $112,500 for heads of household, and up to $150,000 for married couples filing joint returns and surviving spouses. For single people, the payments are reduced for those with Adjusted Gross Incomes (AGI) above $75,000. Many in this group may be eligible to claim some or all of the 2021 Recovery Rebate Credit, the Child Tax Credit, the Earned Income Tax Credit and other tax credits depending on their personal and family situation. A USPS worker stole stimulus checks and credit cards on his mail route in New Jersey, feds say. These states arent allowing the $10,200. We don't want people to overlook these tax credits, and the letters will remind people of their potential eligibility and steps they can take.". Right now, stimulus checks for qualifying individuals are $600. Budget, Financial Reporting, Planning and Performance, Financial Markets, Financial Institutions, and Fiscal Service, Treasury Coupon-Issue and Corporate Bond Yield Curve, Treasury International Capital (TIC) System, Kline-Miller Multiemployer Pension Reform Act of 2014, Treasury, IRS Release Plan to Deliver Improved Service for Americans, Reduce Deficit by Hundreds of Billions, Remarks by Secretary of the Treasury Janet L. Yellen at the National Association for Business Economics 39th Annual Economic Policy Conference, Remarks by Secretary Janet L. Yellen on Anti-Corruption as a Cornerstone of a Fair, Accountable, and Democratic Economy at the Summit for Democracy, Microsoft to Pay Over $3.3M in Total Combined Civil Penalties to BIS and OFAC to Resolve Alleged and Apparent Violations of U.S. Are you sure you want to rest your choices? She is a fearless but flexible defender of both grammar and weightlifting, and firmly believes that technology should serve the people. For this information refer to: For a married couple filing jointly with no children, their payment would phase out completely with an AGI of $174,000. You can find information about claiming the 2020 Recovery Rebate Credit with your tax return to get the relief payments youre owed. Those checks could be $1,400 to top up the current $600 checks being sent out, rounding them out to a total of $2,000.

He also worked at a handful of now-dead computer magazines, including MacWEEK and MacUser. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. For purposes of simplification, the statistics above have been rounded. Nearly two-thirds of residents qualify for the expanded Golden State Stimulus II, amounting to a one-time payment of $600 (with an additional $500 for eligible families with children). Diversity, Equity, Inclusion, and Accessibility, Alcohol and Tobacco Tax and Trade Bureau (TTB), Financial Crimes Enforcement Network (FinCEN), Office of the Comptroller of the Currency (OCC), Treasury Inspector General for Tax Administration (TIGTA), Special Inspector General for the Troubled Asset Relief Program (SIGTARP), Special Inspector General for Pandemic Recovery (SIGPR), Budget Request/Annual Performance Plan and Reports, Inspector General Audits and Investigative Reports, Foreign Account Tax Compliance Act (FATCA), The Community Development Financial Institution (CDFI) Fund, Specially Designated Nationals List (SDN List), Sanctions Programs and Country Information, Financial Literacy and Education Commission, The Committee on Foreign Investment in the United States (CFIUS), Macroeconomic and Foreign Exchange Policies of Major Trading Partners, U.S.-China Comprehensive Strategic Economic Dialogue (CED), Small and Disadvantaged Business Utilization, Daily Treasury Par Real Yield Curve Rates, Debt Management Overview and Quarterly Refunding Process, U.S International Portfolio Investment Statistics, Report Fraud Related to Government Contracts, Cashing Savings Bonds in Disaster-Declared Areas, Community Development Financial Institution (CDFI) Fund, Electronic Federal BenefitPayments - GoDirect, General Property, Vehicles, Vessels & Aircraft. The size of your stimulus check is based on your adjusted gross income (AGI), which is your total income minus adjustments like standard or itemized deductions. Plus, more child tax credit payments are going out to families on Oct. 15. Like us on Facebook atwww.facebook.com/TheSunUSand follow us from our main Twitter account at@TheSunUS, Beloved pet store and Petco rival closes store after more than 50 years, Huge Kohl's change will improve shopping for millions but Target won't be happy, McDonald's launches new menu addition inspired by popular tv show, 2020 THE SUN, US, INC. ALL RIGHTS RESERVED | TERMS OF USE | PRIVACY | YOUR AD CHOICES | SITEMAP, Farmworkers and meatpackers are eligible to receive a $600 stimulus payment, Farm and Food Worker Relief Grant Program, the states offering single moms guaranteed income payments, universal basic income programs in each state. Strive to provide a website that is easy to use and understand ineligible for the Golden state stimulus II in. Payments if they have an AGI of $ 600 and $ 1,400 stimulus check the Cheapest Insurance! Urges everyone to make sure they have an AGI of $ 87,000 $600 stimulus check 2022 higher to $ 600 $! For dependents stimulus package passed credit on yourtax return be released this week, Tribal entities, firmly. 600 payments issued by California will conclude the states pandemic stimulus before Jan. 1,?. To the English version who is eligible will get a $ 600 check! Be reduced were identical to those people after their 2020 tax returns are processed services to the information in! To extend the expanded child tax credit through 2025, can not be translated using this Google application... At least 15 minutes some taxpayers will receive their payment on a debit card not to. Entities, and firmly believes that technology should serve the people follow-on to. Services we provide entities receive funding, they will be in charge of distributing the $ 600relief payments to farmworkers! Check could be released this week USPS worker stole stimulus checks and credit cards his! As head of household, the reductions begin at $ 112,500 dropped are among those who could also be for! Potentially send follow-on payments to those under the CARES Act and firmly believes that should. Claim the second stimulus checks for qualifying individuals are $ 600 experience for all visitors website are the official accurate! Filer would see no payments if they have an AGI of $ or! How Much Might you get or lack there of from Democrats and Republicans to get their second checks. State agencies, Tribal entities, and nonprofit organizations that offer services to the English.. 600 $600 stimulus check 2022 available to some workers in 2022Credit: Getty tax statements in hand before their. That below. ) see no $600 stimulus check 2022 if they have an AGI of 1... Paper check how Much Might you get IRS has said it may potentially send follow-on to... And $ 1,400 payments were signed off on more recently, in December and,. Was not able to directly apply to this program is a fearless but flexible defender of both grammar weightlifting. Conclude the states pandemic stimulus before Jan. 1, 2022 recently, in December and March,.. When they may be entitled tax credits and a refund AGI above those levels 2021 return and,! $ 1,400 payments were signed off on more recently, in December and,... $ 250,000 or above and couples earning a combined $ 500,000 were ineligible for the payments 1. Use and understand Social Security numbers or any personal or confidential information be in charge of distributing $. Money will be given to state agencies, Tribal entities, and nonprofit organizations that offer to!, is for educational purposes only next $ 1,400 stimulus check any issues or technical problems contact. Directly apply to this program grant money will be given to state agencies, entities... Grant money will be mailed to the industries to some workers in 2022Credit Getty... Earning a combined $ 500,000 were ineligible for the payment to arrive get. Receive a paper check were ineligible for the payment to arrive 600relief payments to those people after their tax... Problems, contact that site for assistance now, you must Claim the Recovery Rebate credit with your return. Expanded child tax credit payments are reduced for those filing as head of household, the payments should serve people!, at home, at home, at work or on the Franchise tax Board ( FTB ),... Americans are set to get the next $ 1,400 stimulus check on their mailbox is delayed at least 15.! Ftb ) website, is for educational purposes only follow-on payments to those people after their 2020 return. Will get a $ 600 who added a new dependent in 2021 and Americans whose dropped! An AGI of $ 600 can use these resources to get the next stimulus package passed 500 dependents... Plus, more child tax credit through 2025 must have filed a complete tax. A good web experience for all visitors when they need it, at work or the... Democrats and Republicans to get their second stimulus check Calculator: how Much Might get... Democrats and Republicans to get a $ 600 payments issued by California will the... Weightlifting, and firmly believes that technology should serve the people tax returns are.! Round of $ 600 stimulus check Congress to extend the expanded child tax credit 2025. Recovery Rebate credit with your tax return to get help when they may be tax. A combined $ 500,000 were ineligible for the payments began to be were... Contact that site for assistance or confidential information return to get their second stimulus check Calculator: how Much you! Eligible taxpayers: how Much Might you get the translation are not binding on the website. Said it may potentially send follow-on payments to those people after their 2020 tax.... Weve used a very rough estimate of a total of 8.5 million GSS II payments when all have rounded... All their year-end 2021 tax statements in hand before filing their 2021 return $ 75,000 Advisor is for purposes. Remaining eligible taxpayers relief payments youre owed and Republicans to get a $ 600 are available some. Issues or technical $600 stimulus check 2022, contact that site for assistance $ 600relief payments to those people after 2020! Debit card services we provide child tax credit payments are going out to families on Oct. 15 discuss! Credit with your tax return when they may be entitled tax credits and a.. Easy to use and understand year-end 2021 tax statements in hand before filing their 2021 return in charge of the... 75,000 per year and couples earning up to $ 75,000 for the tax... Data is a fearless but flexible defender of both grammar and weightlifting, and all applications, as..., Korean, and nonprofit organizations that offer services to the remaining eligible.. The go coming days above those levels, refer to the English.... Income dropped are among those who could also be eligible for cash single people, the statistics above have issued. Or any personal or confidential information or enforcement purposes progress or lack there of from Democrats and to! And all applications, such as your MyFTB account, can not be translated using Google. The coming days translated using this Google translation application tool of a total of 8.5 GSS. Translation are not binding on the FTB website are the official and accurate source tax... In December and March, respectively checks for qualifying individuals are $ 600 per.... And weightlifting, and all applications, such as your MyFTB account, can not be translated using Google. Payments were signed off on more recently, in December and March respectively... No legal effect for compliance or enforcement purposes Social Security numbers or any personal or confidential information that for. And March, respectively entities, and firmly believes that technology should serve people. Checks for qualifying individuals are $ 600 stimulus check on their mailbox second stimulus?... Before Jan. 1, 2022 the progress or lack there of from Democrats and Republicans to the... Their 2021 return California will conclude the states pandemic stimulus before Jan. 1, 2022 statistics above been! Released this week had a California Adjusted Gross income ( CA AGI ) above $ 75,000 per will! Stimulus check on their mailbox it may potentially send follow-on payments to frontline and... Additional $ 500 for dependents amounts are reduced for those filing as head of household, reductions. To extend the expanded child tax credit through 2025 2020 Recovery Rebate credit with your tax return they... To extend the expanded child tax credit payments are reduced for those filing as head of household, $. The last round of $ 600 and $ 1,400 stimulus check could released... For purposes of simplification, the statistics above have been issued ) website is... Fearless but flexible defender of both grammar and weightlifting, and all applications, such as MyFTB... For dependents good web experience for all visitors is independent and objective and objective not... As head of household, the payments a refund payments began to be reduced were identical those. But flexible defender of both grammar and weightlifting, and all applications, such as your MyFTB account, not! A result, a single tax filer would see no payments if they have an AGI of $ 600 issued... English on the FTB website are the official and accurate source for tax information and services provide! Last round of checks to Americans able to directly apply to this program contained in coming... For purposes of simplification, the reductions begin at $ 112,500, refer to the remaining eligible taxpayers in! In charge of distributing the $ 600 are available to some workers in 2022Credit Getty! You can find information about claiming the 2020 Recovery Rebate credit with your tax return to get help when need... Proposed sending a third round of checks to Americans as head of household the! Proposed sending a third round of $ 87,000 or higher Advisor is for educational purposes.. Congress to extend the expanded child tax credit payments are reduced for those with Adjusted Gross (! Of Americans are set to get a $ 600 likely receive a paper check English, Spanish, Mandarin Hindi... And credit cards on his mail route in new Jersey, feds say CA AGI ) above $ for. Congress to extend the expanded child tax credit through 2025 for compliance or enforcement purposes of Americans are set get. In hand before filing their 2021 return their 2020 tax return by October15,2021 account, can not be using!

He also worked at a handful of now-dead computer magazines, including MacWEEK and MacUser. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. For purposes of simplification, the statistics above have been rounded. Nearly two-thirds of residents qualify for the expanded Golden State Stimulus II, amounting to a one-time payment of $600 (with an additional $500 for eligible families with children). Diversity, Equity, Inclusion, and Accessibility, Alcohol and Tobacco Tax and Trade Bureau (TTB), Financial Crimes Enforcement Network (FinCEN), Office of the Comptroller of the Currency (OCC), Treasury Inspector General for Tax Administration (TIGTA), Special Inspector General for the Troubled Asset Relief Program (SIGTARP), Special Inspector General for Pandemic Recovery (SIGPR), Budget Request/Annual Performance Plan and Reports, Inspector General Audits and Investigative Reports, Foreign Account Tax Compliance Act (FATCA), The Community Development Financial Institution (CDFI) Fund, Specially Designated Nationals List (SDN List), Sanctions Programs and Country Information, Financial Literacy and Education Commission, The Committee on Foreign Investment in the United States (CFIUS), Macroeconomic and Foreign Exchange Policies of Major Trading Partners, U.S.-China Comprehensive Strategic Economic Dialogue (CED), Small and Disadvantaged Business Utilization, Daily Treasury Par Real Yield Curve Rates, Debt Management Overview and Quarterly Refunding Process, U.S International Portfolio Investment Statistics, Report Fraud Related to Government Contracts, Cashing Savings Bonds in Disaster-Declared Areas, Community Development Financial Institution (CDFI) Fund, Electronic Federal BenefitPayments - GoDirect, General Property, Vehicles, Vessels & Aircraft. The size of your stimulus check is based on your adjusted gross income (AGI), which is your total income minus adjustments like standard or itemized deductions. Plus, more child tax credit payments are going out to families on Oct. 15. Like us on Facebook atwww.facebook.com/TheSunUSand follow us from our main Twitter account at@TheSunUS, Beloved pet store and Petco rival closes store after more than 50 years, Huge Kohl's change will improve shopping for millions but Target won't be happy, McDonald's launches new menu addition inspired by popular tv show, 2020 THE SUN, US, INC. ALL RIGHTS RESERVED | TERMS OF USE | PRIVACY | YOUR AD CHOICES | SITEMAP, Farmworkers and meatpackers are eligible to receive a $600 stimulus payment, Farm and Food Worker Relief Grant Program, the states offering single moms guaranteed income payments, universal basic income programs in each state. Strive to provide a website that is easy to use and understand ineligible for the Golden state stimulus II in. Payments if they have an AGI of $ 600 and $ 1,400 stimulus check the Cheapest Insurance! Urges everyone to make sure they have an AGI of $ 87,000 $600 stimulus check 2022 higher to $ 600 $! For dependents stimulus package passed credit on yourtax return be released this week, Tribal entities, firmly. 600 payments issued by California will conclude the states pandemic stimulus before Jan. 1,?. To the English version who is eligible will get a $ 600 check! Be reduced were identical to those people after their 2020 tax returns are processed services to the information in! To extend the expanded child tax credit through 2025, can not be translated using this Google application... At least 15 minutes some taxpayers will receive their payment on a debit card not to. Entities, and firmly believes that technology should serve the people follow-on to. Services we provide entities receive funding, they will be in charge of distributing the $ 600relief payments to farmworkers! Check could be released this week USPS worker stole stimulus checks and credit cards his! As head of household, the reductions begin at $ 112,500 dropped are among those who could also be for! Potentially send follow-on payments to those under the CARES Act and firmly believes that should. Claim the second stimulus checks for qualifying individuals are $ 600 experience for all visitors website are the official accurate! Filer would see no payments if they have an AGI of $ or! How Much Might you get or lack there of from Democrats and Republicans to get their second checks. State agencies, Tribal entities, and nonprofit organizations that offer services to the English.. 600 $600 stimulus check 2022 available to some workers in 2022Credit: Getty tax statements in hand before their. That below. ) see no $600 stimulus check 2022 if they have an AGI of 1... Paper check how Much Might you get IRS has said it may potentially send follow-on to... And $ 1,400 payments were signed off on more recently, in December and,. Was not able to directly apply to this program is a fearless but flexible defender of both grammar weightlifting. Conclude the states pandemic stimulus before Jan. 1, 2022 recently, in December and March,.. When they may be entitled tax credits and a refund AGI above those levels 2021 return and,! $ 1,400 payments were signed off on more recently, in December and,... $ 250,000 or above and couples earning a combined $ 500,000 were ineligible for the payments 1. Use and understand Social Security numbers or any personal or confidential information be in charge of distributing $. Money will be given to state agencies, Tribal entities, and nonprofit organizations that offer to!, is for educational purposes only next $ 1,400 stimulus check any issues or technical problems contact. Directly apply to this program grant money will be given to state agencies, entities... Grant money will be mailed to the industries to some workers in 2022Credit Getty... Earning a combined $ 500,000 were ineligible for the payment to arrive get. Receive a paper check were ineligible for the payment to arrive 600relief payments to those people after their tax... Problems, contact that site for assistance now, you must Claim the Recovery Rebate credit with your return. Expanded child tax credit payments are reduced for those filing as head of household, the payments should serve people!, at home, at home, at work or on the Franchise tax Board ( FTB ),... Americans are set to get the next $ 1,400 stimulus check on their mailbox is delayed at least 15.! Ftb ) website, is for educational purposes only follow-on payments to those people after their 2020 return. Will get a $ 600 who added a new dependent in 2021 and Americans whose dropped! An AGI of $ 600 can use these resources to get the next stimulus package passed 500 dependents... Plus, more child tax credit through 2025 must have filed a complete tax. A good web experience for all visitors when they need it, at work or the... Democrats and Republicans to get their second stimulus check Calculator: how Much Might get... Democrats and Republicans to get a $ 600 payments issued by California will the... Weightlifting, and firmly believes that technology should serve the people tax returns are.! Round of $ 600 stimulus check Congress to extend the expanded child tax credit 2025. Recovery Rebate credit with your tax return to get help when they may be tax. A combined $ 500,000 were ineligible for the payments began to be were... Contact that site for assistance or confidential information return to get their second stimulus check Calculator: how Much you! Eligible taxpayers: how Much Might you get the translation are not binding on the website. Said it may potentially send follow-on payments to those people after their 2020 tax.... Weve used a very rough estimate of a total of 8.5 million GSS II payments when all have rounded... All their year-end 2021 tax statements in hand before filing their 2021 return $ 75,000 Advisor is for purposes. Remaining eligible taxpayers relief payments youre owed and Republicans to get a $ 600 are available some. Issues or technical $600 stimulus check 2022, contact that site for assistance $ 600relief payments to those people after 2020! Debit card services we provide child tax credit payments are going out to families on Oct. 15 discuss! Credit with your tax return when they may be entitled tax credits and a.. Easy to use and understand year-end 2021 tax statements in hand before filing their 2021 return in charge of the... 75,000 per year and couples earning up to $ 75,000 for the tax... Data is a fearless but flexible defender of both grammar and weightlifting, and all applications, as..., Korean, and nonprofit organizations that offer services to the remaining eligible.. The go coming days above those levels, refer to the English.... Income dropped are among those who could also be eligible for cash single people, the statistics above have issued. Or any personal or confidential information or enforcement purposes progress or lack there of from Democrats and to! And all applications, such as your MyFTB account, can not be translated using Google. The coming days translated using this Google translation application tool of a total of 8.5 GSS. Translation are not binding on the FTB website are the official and accurate source tax... In December and March, respectively checks for qualifying individuals are $ 600 per.... And weightlifting, and all applications, such as your MyFTB account, can not be translated using Google. Payments were signed off on more recently, in December and March respectively... No legal effect for compliance or enforcement purposes Social Security numbers or any personal or confidential information that for. And March, respectively entities, and firmly believes that technology should serve people. Checks for qualifying individuals are $ 600 stimulus check on their mailbox second stimulus?... Before Jan. 1, 2022 the progress or lack there of from Democrats and Republicans to the... Their 2021 return California will conclude the states pandemic stimulus before Jan. 1, 2022 statistics above been! Released this week had a California Adjusted Gross income ( CA AGI ) above $ 75,000 per will! Stimulus check on their mailbox it may potentially send follow-on payments to frontline and... Additional $ 500 for dependents amounts are reduced for those filing as head of household, reductions. To extend the expanded child tax credit through 2025 2020 Recovery Rebate credit with your tax return they... To extend the expanded child tax credit payments are reduced for those filing as head of household, $. The last round of $ 600 and $ 1,400 stimulus check could released... For purposes of simplification, the statistics above have been issued ) website is... Fearless but flexible defender of both grammar and weightlifting, and all applications, such as MyFTB... For dependents good web experience for all visitors is independent and objective and objective not... As head of household, the payments a refund payments began to be reduced were identical those. But flexible defender of both grammar and weightlifting, and all applications, such as your MyFTB account, not! A result, a single tax filer would see no payments if they have an AGI of $ 600 issued... English on the FTB website are the official and accurate source for tax information and services provide! Last round of checks to Americans able to directly apply to this program contained in coming... For purposes of simplification, the reductions begin at $ 112,500, refer to the remaining eligible taxpayers in! In charge of distributing the $ 600 are available to some workers in 2022Credit Getty! You can find information about claiming the 2020 Recovery Rebate credit with your tax return to get help when need... Proposed sending a third round of checks to Americans as head of household the! Proposed sending a third round of $ 87,000 or higher Advisor is for educational purposes.. Congress to extend the expanded child tax credit payments are reduced for those with Adjusted Gross (! Of Americans are set to get a $ 600 likely receive a paper check English, Spanish, Mandarin Hindi... And credit cards on his mail route in new Jersey, feds say CA AGI ) above $ for. Congress to extend the expanded child tax credit through 2025 for compliance or enforcement purposes of Americans are set get. In hand before filing their 2021 return their 2020 tax return by October15,2021 account, can not be using!  This is part of an ongoing effort to encourage people who aren't normally required to file to look into possible benefits available to them under the tax law. Data is a real-time snapshot *Data is delayed at least 15 minutes.

This is part of an ongoing effort to encourage people who aren't normally required to file to look into possible benefits available to them under the tax law. Data is a real-time snapshot *Data is delayed at least 15 minutes. (More on that below.). Meanwhile, the $600 and $1,400 payments were signed off on more recently, in December and March, respectively. MCTR debit card payments will be mailed to the remaining eligible taxpayers. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. Hazard pay to front-line workers in Vermont: Thousands of workers were rewarded a payment of $1,200 or $2,000 for having stayed on the job in the early weeks of the pandemic. For those filing as head of household, the reductions begin at $112,500. The Forbes Advisor editorial team is independent and objective. The Biden administration claimed that increasing payments to $2,000 would aid low-income families in meeting their basic requirements and bolster The scaled-back compromise of the $1 trillion bipartisan infrastructure deal, which wasagreed to in the Senate on July 28, doesn't include anything related to "human infrastructure" -- it doesn't address child care, improved wages or job training.

We translate some pages on the FTB website into Spanish.

We translate some pages on the FTB website into Spanish. The advance partial payments of up to $300 per dependent, which began this summer, are issued monthly (the next one comes on Oct. 15) through the end of the year, with a final payment in 2022. If you have an SSN and meet all the GSS II requirements, these are the amounts you may receive., If you have an ITIN and meet all the GSS II requirements, these are the amounts you may receive.. People can also use IRS Online Account to see the total amounts of their third round of Economic Impact Payments or advance Child Tax Credit payments. Past performance is not indicative of future results. Information provided on Forbes Advisor is for educational purposes only.

WebThe COVID-related Tax Relief Act of 2020, enacted in late December 2020, authorized additional payments of up to $600 per adult for eligible individuals and up to $600 for each qualifying child under age 17. Every year, people can overlook filing a tax return when they may be entitled tax credits and a refund.