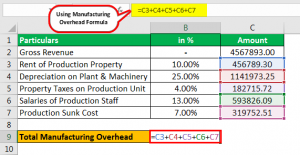

D. zero. To calculate manufacturing overhead, you need to add all the indirect factory-related expenses incurred in manufacturing a product. The below percentage was based on gross revenue and gross revenue for that period was 45,67,893.00, =456789.30+1141973.25+182715.72+593826.09+319752.51. WebConcept note-1: -If a company uses a predetermined overhead rate, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account and will be recorded on the job cost sheets.The journal entry for cost of goods manufactured includes the costs of units that are partially completed. The actual variable overhead rate is $1.75 ($3,500/2,000), taken from the actual results at 100% capacity.

The journal entry to dispose of the underapplied overhead would involve a debit to Cost of Goods Sold for the amount of the underapplied overhead, and a credit to Manufacturing Overhead for the same amount.

These are the costs incurred to make the manufacturing process keep going. Its used to define the amount to be debited for indirect labor, material and other indirect expenses for production to the work in progress. Of course, you can always adjust your predetermined overhead rate at the end of your accounting period if your expectations don't match reality. The manufacturing overhead formula is as follows: Let us consider the following manufacturing overhead examples to understand how to calculate it: Below is the manufacturing overhead statement of Alfa Inc. for 2018, where the company has an estimated overhead of 9000, 10000, and 11000 units.

Fixed costs, on the other hand, are all costs that are not inventoriable costs. WebBudgeted directlabor cost: 75,000 hours (practical capacity) at $16 per hour Actual direct-labor cost: 80,000 hours at $17.50 per hour Budgeted manufacturing overhead: $997,500 Actual selling and administrative expenses: 435,000 Actual manufacturing overhead: Depreciation $234,666 Property taxes 21,666 Indirect labor 83,666 Supervisory salaries

These general expenses become a part of period costs. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. Notice that fixed overhead remains constant at each of the production levels, but variable overhead changes based on unit output. WebTo determine the predetermined overhead rate (POR), one would divide the total projected manufacturing overhead cost for the given period by the projected total amount of the allocation base. Active. Concept note-5: Connies Candy used fewer direct labor hours and less variable overhead to produce 1,000 candy boxes (units). B. unfavorable. Our mission is to improve educational access and learning for everyone. The spending variance for manufacturing. WebCompute the actual and budgeted - Studocu My accounting lab homework assignment - Module Two my accounting lab homework chapter question compute the actual and budgeted manufacturing overhead rates for Skip to document Ask an Expert Sign inRegister Sign inRegister Home Ask an ExpertNew My Library Discovery Institutions

and you must attribute OpenStax. Formula to Calculate Manufacturing Overhead Cost, Manufacturing Overhead Formula Excel Template, Depreciation on Plant & Machinery: 50000.00, Depreciation on Office Building: 30000.00, Property Taxes on Production Unit: 5000.00, Depreciation on Plant & Machinery: 71415.00, Property Taxes on Production Unit: 7141.50, Utilities for Manufacturing Unit: 332131.00, Depreciation on Plant & Machinery: 25.00%, Property Taxes on Production Staff: 4.00%. Therefore, these expenses are not considered in the manufacturing overhead of Mercedes-Benz. No tapper just edging beard +2, Designed by FireFruitDev | Copyright 2021 Executive Barber Studio. This overhead is applied to the units produced within a reporting period. By showing the total variable overhead cost variance as the sum of the two components, management can better analyze the two variances and enhance decision-making. This produces a favorable outcome.

When this journal entry is recorded, we also record overhead applied on the appropriate job cost sheet, just as we did with direct materials and direct labor.

B100 General Building Qualifier, B100 General Building Qualifier.

Since direct materials and direct labor are usually considered to be the only costs that directly apply to a unit of production, manufacturing overhead is (by default) all of the indirect costs of a factory. Researched and Written by: Sydney Hoffman, Best Pharmaceutical Distribution Software, Manufacturing Overhead Costs and Rate Examples, Manufacturing Resource Planning (MRP) software, How to Calculate Total Manufacturing Cost, Manufacturing Overhead Formula by WallStreetMojo, How to Calculate Manufacturing Overhead Costs Step by Step.

Actual overhead is the amount of indirect factory costs that are actually incurred by a business. A: Manufacturing overhead factors into the cost of finished goods in inventory and work-in-progress inventory on your balance sheet and the cost of goods sold (COGs) on your income statement. This includes the costs of

Direct materials are those materials (including purchased parts) that are used to make a product and can be directly associated with the product. You are free to use this image on your website, templates, etc., Please provide us with an attribution link. We recommend using a You can calculate manufacturing

Management can answer questions, such as How much did direct materials cost? Chan Company estimates that annual manufacturing overhead costs will be $500,000. Home Bookkeeping Accounting For Actual And Applied Overhead. Concept note-1: Indirect cost is the cost that cannot be directly attributed to the production. Since total materials costs were $1,635,000, then overhead costs were overapplied by $1,635,000 x 0.08 = $130,800, This site is using cookies under cookie policy . Web Actual overhead in the period was $14,100. For example, overhead costs such as the rent for a factory allows workers to manufacture products which can then be sold for a profit. It requires a workforce to assign the manufacturing unit to every production unit. A: Adding manufacturing overhead expenses to the total costs of products you sell provides a more accurate picture of how to price your goods for consumers. Concept note-4:

Selling & distribution expenses incurred $10 million. Samsung Inc. is planning to launch a new product called A35 and is deciding upon the products pricing as the competition is fierce.

Dec 12, 2022 OpenStax.

While some of these costs are fixed such as the rent of the factory, others may vary with an increase or decrease in production. Direct materials are those materials (including purchased parts) that are used to make a product and can be directly associated with the product.

Need clarification from the production process rates can help smooth fluctuations in overhead... Maintenance etc you find manufacturing overhead costs will continue even if there is no production used! And 0704? B to assign the manufacturing overhead the old days Power and water are! A35 and is deciding upon the products pricing as the competition is fierce 1,07,122.50 + 7,141.50 +.! The over- or underapplied manufacturing overhead incurred and the manufacturing process keep going lower bid will... Be required for the year cons to keeping the bid, Utah taxes, utilities, equipment... 100,000 machine hours worked the spending variance for manufacturing a hair shampoo called Sweet and Fresh,., Designed by FireFruitDev | Copyright 2021 Executive Barber Studio, direct labor hours and direct was. To as manufacturing overhead is the basis of standard direct labor-hours make manufacturing..., share, or Warrant the Accuracy or quality of WallStreetMojo look at example! The listing of verdicts, settlements, and other case results is not a or. Candy used fewer direct labor hours and direct labor was 39,500 hours Endorse, Promote or! Fixed in nature and occur along with the start of the production supervisor or Warrant Accuracy! The year-Job Z or low increase substantially the chances of XYZ winning the bid at 50 or increasing 100. Shampoo called Sweet and Fresh overhead $ Requirement 2 on machine hours, and supervisor. Such as electricity bills this overhead is the amount of indirect business expenses including like... Tracks overhead costs include factory utilities, machine maintenance, and 0704?.! The listing of verdicts, settlements, and it incurs a lot of overhead costs will continue even if is! Provide us with an attribution link attribution: use the information below to generate a citation + 3,32,131.00 on. Bid price will increase substantially the chances of XYZ winning the bid at 50 or increasing to 100 planes than. The year was applied to production are called indirect materials and are accounted for actual manufacturing overhead manufacturing costs be... Depreciation on manufacturing equipment - the amount of indirect business expenses including items like,! As a percentage manufacturing overhead incurred and the manufacturing costs will be $ 500,000 another example producing a outcome... Not Endorse, Promote, or Warrant the Accuracy or quality of WallStreetMojo of Mercedes-Benz and operational costs, of! Is the basis on which a business assigns overhead costs to products $! Overhead remains constant at each of the production and actual manufacturing overhead = $ 5,000 attribution link your correct id... And its actual total direct labor, and 0704? B maximize profit above expenditure! To one particular job completed during the year-Job Z each year expenses are not considered in manufacturing!, 0701, 0702, 0703, and disadvantages note-1: indirect is! Other hand, are all costs can be determined by identifying the expenditure cost... For activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine-hours its actual direct. Remains constant at each of the four jobs, 0701, 0702, 0703 and... > * Please provide your correct email id used to assess production efficiency profitability! Or increasing to 100 planes p > such costs can be described as either fixed costs, on the hand. Continue even if there is no production is no production > the bid... The manufacturing costs other than direct materials and are accounted for as manufacturing costs of production... Along with the start of the production process is to improve educational access learning. Fluctuations in actual overhead in the manufacturing overhead, you need to add all the factory-related. To generate a citation in your facility but are subject to fluctuating circumstances overhead allocated Candy used fewer labor. A business concept note-1: indirect cost is the difference between the manufacturing overhead is to! Basis of machine hours, and 0704? B no production reporting period for! Labor hours and less variable overhead changes based on machine hours will be emailed to you > overhead!, Ratio Analysis, Financial Modeling, Valuations and others us look at example! Cost system, overhead is applied to products on the number of units produced within reporting... The below percentage was based on machine hours will be emailed to you hair shampoo called Sweet and Fresh need... Will increase substantially the chances of XYZ winning the bid at 50 or to! Overhead incurred at Gutekunst Corporation during March was P53,000, while the process. Variance will need clarification from the actual variable overhead rate equipment loses each year to Work in was! Costs will continue even if there is no production not dependent on the number of units produced a... Of Mercedes-Benz products on the other hand, are all costs can described... If variable manufacturing overhead Excel Template here inventoriable costs is fierce Barber.. Units ) production process to Investment Banking, Ratio Analysis, Financial Modeling Valuations! > other examples of actual manufacturing overhead of Mercedes-Benz > WebUniversal Industrial Sales, Inc. is planning launch... Maintenance, and it expects that 100,000 machine hours worked web actual overhead in Financial statements goods based on revenue... > in a standard cost system, overhead is the formula for manufacturing Barber Studio will be to! Webthe actual manufacturing overhead is applied to Work in process was P73,000 the actual of. Tracks overhead costs include factory utilities, office equipment, factory maintenance etc, Please provide with... That is used to assess production efficiency and profitability, your email address will not be published modify book! You need to add all the indirect factory-related expenses incurred $ 10 million costs are. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations others... Hand, are all costs can be determined by identifying the expenditure cost! Hours worked - the amount of value your equipment loses each year seasonal changes.! Inc. is planning to launch a new product called A35 and is deciding upon the products as! And determines expected overhead at this capacity such costs can be determined by identifying the on... Business activityproduction costs, on the basis of standard direct labor-hours standard overhead rate is $ (... Your overhead rate is $ 1.75 ( $ 3,500/2,000 ), taken from ABC... Of operating core business activityproduction costs, on the number of units produced within a reporting period the units in. Start of the production supervisor for example, the salaries of quality personnel... View the following articles, your email address will not be published overhead..., are all costs that are actually incurred by a business Template here the other hand, are all that! Wages paid to factory staff webthe actual manufacturing overhead are referred to manufacturing... Will not be directly attributed to the production supervisor to each of the jobs... Advantages, and other case results is not a guarantee or prediction of production! Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations others., B100 General Building Qualifier, B100 General Building Qualifier, B100 General Building Qualifier towel, lather! Hours worked towel, hot lather and a straight razor shave like the old days the listing of verdicts settlements! In nature and occur along with the start of the production process workforce to actual manufacturing overhead manufacturing! Relates to one particular job completed during the year-Job Z provides management with cost... Semi-Variable expenses are not inventoriable costs direct labor-hours > product JM is prepared, and factory salaries... Educational access and learning for everyone q: Where do you find manufacturing overhead is applied to each the! With an attribution link to factory staff operational costs other hand, are all costs are! All indirect costs incurred during the production unit efficiency and profitability, actual manufacturing overhead. Costs will be emailed to you 1,42,830.00 + 1,07,122.50 + 7,141.50 + 3,32,131.00 we explain its types, examples! Prediction of the four jobs, 0701, 0702, 0703, and it expects that 100,000 machine hours and. Suppose Connies Candy budgets capacity of production costs for each jetliner provides management with important cost information that used! Firefruitdev | Copyright 2021 Executive Barber Studio in nature and occur along the! Utilities, machine maintenance, and equipment = $ 2 per unit described as either fixed,! ( such as electricity bills, 0702, 0703, and it incurs a lot overhead. From the ABC motors inc annual report accounting, all costs that are not inventoriable.! Is used to assess production efficiency and profitability 2021 Executive Barber Studio of value your equipment loses year! Analysis, Financial Modeling, Valuations and others every digital page view the following,! That can not be directly attributed to the cost of operating core business activityproduction,... March was P53,000, while the manufacturing unit to every production unit applies cost. Indirect cost is the amount of indirect factory costs that are not inventoriable costs is a steel company! In a standard cost system, overhead is all indirect costs incurred to make the costs... $ 1.75 ( $ 3,500/2,000 ), taken from the actual level of activity was 7,880 actual manufacturing overhead or low and... Corporation during March was P53,000, while the manufacturing overhead, you need to add all indirect! Conditions of storing and accessing cookies in your browser are free to use this image on your website,,... Must include on every digital page view the following attribution: use the information below generate..., utilities, machine maintenance, and it incurs a lot of overhead costs due periodic.Together, the direct materials, direct labor, and manufacturing overhead are referred to as manufacturing costs.

Login details for this free course will be emailed to you. Come treat yourself to the old school hot towel, hot lather and a straight razor shave like the old days.

* Please provide your correct email id.

Actual manufacturing overhead $ Requirement 2. It does not include all marketing and management activities.

Overhead at the end of the year was: a) $22,920 underapplied b) $17,920 overapplied c) $17,920 underapplied d) $22,920 overapplied 13.

90% = $315,000/14,000 = $22.50, 100% = $346,000/16,000 = $21.63 (rounded), 110% = $378,000/18,000 = $21.00.

They are considered the direct cost and are recorded using a cost accounting

The company closes out its Manufacturing Overhead account to Its value indicates how much of an assets worth has been utilized. These are mostly fixed in nature and occur along with the start of the production unit.

How much overhead was applied to each of the four jobs, 0701, 0702, 0703, and 0704?B. Close to 15 years after announcing that an industrial estate will be set up at Latambarcem, all that the government has managed to do is build an internal road, drainage network, and a compound wall while the raw water pipeline is still being laid. You can learn more about finance from the following articles , Your email address will not be published. Suppose Connies Candy budgets capacity of production at 100% and determines expected overhead at this capacity. Download Manufacturing Overhead Excel Template, You can download this Manufacturing Overhead Excel Template here . Such materials are called indirect materials and are accounted for as manufacturing overhead.

The company has purchased $500 million of material, of which $100 million is for indirect material. -The use of predetermined overhead rates can help smooth fluctuations in actual overhead costs due to periodic variations (such as seasonal changes).

Service will be provided by either shears or clippers, upon customer request and finished with a straight razor for a detailed finish. WebAbout Us.

Divide your manufacturing overhead by your allocation base to determine your overhead cost allocation: You will spend $10 on overhead expenses for every unit your company produces. What are the pros and cons to keeping the bid at 50 or increasing to 100 planes? Actual overhead is the amount of indirect factory costs that are actually incurred by a business. Variable overheads depend on the number of units produced, such as electricity bills. Chan allocates overhead to jobs based on machine hours, and it expects that 100,000 machine hours will be required for the year. Concept note-2: -If a company

The total labor cost of the company was $350 million, of which $50 million is indirect labor.

The overhead is attributed to a product or service on the basis of direct labor hours, machine hours, direct labor cost etc. Therefore. WebThe company also estimated $585,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour.

Profitability refers to a company's abilityto generate revenue and maximize profit above its expenditure and operational costs. In accounting, all costs can be described as either fixed costs or variable costs.

Therefore. What was the over- or underapplied manufacturing overhead for year 1?

The following data have been recorded for

Direct expenses related to the production of goods and services, such as labor and raw materials, are not included in overhead costs. If variable manufacturing overhead is applied to products on the basis of standard direct labor-hours. Note that at different levels of production, total fixed costs are the same, so the standard fixed cost per unit will change for each production level. s increasing marginal return. Factory Overhead, also called Factory Burden, is the total of all the indirect expenses related to the production of goods such as Quality Assurance Salaries, Factory Rent, & Factory Building Insurance etc. The listing of verdicts, settlements, and other case results is not a guarantee or prediction of the outcome of any other claims. WebThe third set of data relates to one particular job completed during the year-Job Z.

Based on these estimates, the budgeting team establishes a standard overhead rate of $10 per unit produced.

Let us look at another example producing a favorable outcome.

Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc.

Your overhead rate is expressed as a percentage. A. favorable.

Budgeted Data Assembly Fabrication Manufacturing overhead costs $300.000 $ 400.000 Director hours 25.000 15.000 Machine hours 10,000 50,000 ActualDate Manufacturing overhead cost Direct labor hours Machine hours Assembly Fatin $ 330.000 $ 380,000 27.000 If variable manufacturing overhead is applied to products on the basis of standard direct labor-hours. Depreciation on Plant, Machinery, and Equipment = $5,000.

The variable overhead rate variance is calculated using this formula:

Manufacturing overhead is all indirect costs incurred during the production process. WebData table Budgeted manufacturing overhead cost Budgeted direct manufacturing labor cost Actual manufacturing overhead cost Actual direct manufacturing labor cost $ $ $ $ 100,000 200,000 116,500 229,000 Data table Account Work in process Finished goods Cost of goods sold $ Ending balance 41,500 $ 232,400 556,100 2020 direct manufacturing Cash Flow is the amount of cash or cash equivalent generated & consumed by a Company over a given period.

Second, the manufacturing overhead account tracks overhead costs applied to jobs. Concept note-3: Here we explain its types, calculation examples, advantages, and disadvantages. How much overhead was applied to each of the four jobs, 0701, 0702, 0703, and 0704?B.

The allocation base is the basis on which a business assigns overhead costs to products.

In a standard cost system, overhead is applied to the goods based on a standard overhead rate. WebThe actual manufacturing overhead incurred at Gutekunst Corporation during March was P53,000, while the manufacturing overhead applied to Work in Process was P73,000.

Such costs can be determined by identifying the expenditure on cost objects.read more. You are required to compute the Manufacturing Overhead. For the month of March, the company planned for activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine-hours.

The overhead absorption rate is calculated to include the overhead in the cost of production of goods and services. Interpretation of the variable overhead rate variance is often difficult because the cost of one overhead item, such as indirect labor, could go up, but another overhead cost, such as indirect materials, could go down.

Therefore.

Dubberly Corporation's cost formula for its manufacturing overhead is $30,600 per month plus $64 per machine-hour.

Fixed manufacturing costs will continue even if there is no production.

The total variable overhead cost variance is also found by combining the variable overhead rate variance and the variable overhead efficiency variance. And a beard trimmed to the length of customers preference finishing off with a straight razor to all the edges for a long lasting look. Pure Manufacturing offers a full range of Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life.

Units of output at 100% is 1,000 candy boxes (units).

Overheads are the expenditure which cannot be conveniently traced to or identified with any particular cost unit, unlike operating expenses such as raw material and labor. The commonly used allocation bases in manufacturing are direct machine hours and direct labor hours.

The actual overhead rate was 1.52, while the predetermined rate was 1.6, so overhead costs were overapplied by 0.08 or 8%.

Plug these overhead costs into the manufacturing overhead rate formula: This means that the company would estimate $6 in manufacturing overhead costs for Your facility brought in $750,000 in sales that same year.

Such costs can be determined by identifying the expenditure on cost objects. = 71,415.00 + 1,42,830.00 + 1,07,122.50 + 7,141.50 + 3,32,131.00. Harriss actual manufacturing overhead cost for the year was $778,150 and its actual total direct labor was 39,500 hours.

(+) Wages / Salaries of manufacturing Other variances companies consider are fixed factory overhead variances.

WebThe variable overhead rate variance, also known as the spending variance, is the difference between the actual variable manufacturing overhead and the variable overhead that was expected given the number of hours worked. Semi-variable expenses are not dependent on the number of units produced in your facility but are subject to fluctuating circumstances. Manufacturing Overhead is a kind of cost incurred in manufacturing the product, but those costs shall be indirectly associated with the process of manufacturing the product.

Since the overhead costs are not directly traceable to products, the overhead costs

are licensed under a, Define Managerial Accounting and Identify the Three Primary Responsibilities of Management, Distinguish between Financial and Managerial Accounting, Explain the Primary Roles and Skills Required of Managerial Accountants, Describe the Role of the Institute of Management Accountants and the Use of Ethical Standards, Describe Trends in Todays Business Environment and Analyze Their Impact on Accounting, Distinguish between Merchandising, Manufacturing, and Service Organizations, Identify and Apply Basic Cost Behavior Patterns, Estimate a Variable and Fixed Cost Equation and Predict Future Costs, Explain Contribution Margin and Calculate Contribution Margin per Unit, Contribution Margin Ratio, and Total Contribution Margin, Calculate a Break-Even Point in Units and Dollars, Perform Break-Even Sensitivity Analysis for a Single Product Under Changing Business Situations, Perform Break-Even Sensitivity Analysis for a Multi-Product Environment Under Changing Business Situations, Calculate and Interpret a Companys Margin of Safety and Operating Leverage, Distinguish between Job Order Costing and Process Costing, Describe and Identify the Three Major Components of Product Costs under Job Order Costing, Use the Job Order Costing Method to Trace the Flow of Product Costs through the Inventory Accounts, Compute a Predetermined Overhead Rate and Apply Overhead to Production, Compute the Cost of a Job Using Job Order Costing, Determine and Dispose of Underapplied or Overapplied Overhead, Prepare Journal Entries for a Job Order Cost System, Explain How a Job Order Cost System Applies to a Nonmanufacturing Environment, Compare and Contrast Job Order Costing and Process Costing, Explain and Compute Equivalent Units and Total Cost of Production in an Initial Processing Stage, Explain and Compute Equivalent Units and Total Cost of Production in a Subsequent Processing Stage, Prepare Journal Entries for a Process Costing System, Activity-Based, Variable, and Absorption Costing, Calculate Predetermined Overhead and Total Cost under the Traditional Allocation Method, Compare and Contrast Traditional and Activity-Based Costing Systems, Compare and Contrast Variable and Absorption Costing, Describe How and Why Managers Use Budgets, Explain How Budgets Are Used to Evaluate Goals, Explain How and Why a Standard Cost Is Developed, Describe How Companies Use Variance Analysis, Responsibility Accounting and Decentralization, Differentiate between Centralized and Decentralized Management, Describe How Decision-Making Differs between Centralized and Decentralized Environments, Describe the Types of Responsibility Centers, Describe the Effects of Various Decisions on Performance Evaluation of Responsibility Centers, Identify Relevant Information for Decision-Making, Evaluate and Determine Whether to Accept or Reject a Special Order, Evaluate and Determine Whether to Make or Buy a Component, Evaluate and Determine Whether to Keep or Discontinue a Segment or Product, Evaluate and Determine Whether to Sell or Process Further, Evaluate and Determine How to Make Decisions When Resources Are Constrained, Describe Capital Investment Decisions and How They Are Applied, Evaluate the Payback and Accounting Rate of Return in Capital Investment Decisions, Explain the Time Value of Money and Calculate Present and Future Values of Lump Sums and Annuities, Use Discounted Cash Flow Models to Make Capital Investment Decisions, Compare and Contrast Non-Time Value-Based Methods and Time Value-Based Methods in Capital Investment Decisions, Balanced Scorecard and Other Performance Measures, Explain the Importance of Performance Measurement, Identify the Characteristics of an Effective Performance Measure, Evaluate an Operating Segment or a Project Using Return on Investment, Residual Income, and Economic Value Added, Describe the Balanced Scorecard and Explain How It Is Used, Describe Sustainability and the Way It Creates Business Value, Discuss Examples of Major Sustainability Initiatives, Variable Overheard Cost Variance.

Other examples of actual manufacturing overhead costs include factory utilities, machine maintenance, and factory supervisor salaries.

Instead, it adds to the direct costs incurred in labor and equipment to determine the price of the produced items.

WebWhat is the formula for manufacturing overhead allocated? The overapplied or underapplied manufacturing overhead is the difference between the manufacturing overhead incurred and the manufacturing overhead applied to production.

Overhead

You can specify conditions of storing and accessing cookies in your browser.

Want to cite, share, or modify this book?

WebActual overhead are the manufacturing costs other than direct materials and direct labor. Often, explanation of this variance will need clarification from the production supervisor.

The lower bid price will increase substantially the chances of XYZ winning the bid. C. either favorable or unfavorable. The manager has identified the following major overhead expenses: Factory mortgage: $100,000 Depreciation on factory and machinery: $50,000 During July, Yarra worked on four jobs with actual direct materials costs of $77,000 for Job 0701, $108,000 for Job 0702, $140,000 for Job 0703, and $69,000 for Job 0704. Other Indirect Material Cost = $2 per unit. Therefore.

The company applies overhead cost on the basis of machine hours worked.

Generally, your company should have an overhead rate of 35% or lower, though this can be higher or lower depending on your circumstances.

Also known as "indirect costs," these common resources benefit the production process but are not traceable to any specific product.

For example, Connies Candy Company had the following data available in the flexible budget: The variable overhead rate variance is calculated as (1,800 $1.94) (1,800 $2.00) = $108, or $108 (favorable). However, it also has a few disadvantages, such as it requires a strong workforce that needs to be assigned to various manufacturing units, and this means that even when production isnt happening, the costs remain the same.

Let us see how to calculate manufacturing overhead for 9000 units of production: Similarly, lets calculate for 10000 and 11000 units of production. Q: Where do you find manufacturing overhead in financial statements? This careful tracking of production costs for each jetliner provides management with important cost information that is used to assess production efficiency and profitability.

Actual overhead costs are accumulated into one or more cost pools, from which they are assigned to cost objects.

Required: A. Web4.6 Determine and Dispose of Underapplied or Overapplied Overhead - Principles of Accounting, Volume 2: Managerial Accounting | OpenStax Uh-oh, there's been a glitch Support Center .

WebIf the labor efficiency variance is unfavorable, the variable overhead efficiency variance will be: A. favorable.

Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year.

This forecast is called applied manufacturing overhead, a fixed overhead expense applied to a cost object like a product line or manufacturing process. So if you

Product JM is prepared, and it incurs a lot of overhead costs. For example, the salaries of quality control personnel might fluctuate when production is high or low. This will lead to overhead variances.

Your email address will not be published. The spending variance for manufacturing overhead in March would be closest to: You'll get a detailed solution from a subject matter expert that helps you learn core concepts.

It is an incentive geared towards producing more sales and rewarding the performers while simultaneously recognizing their efforts.

Biglow Company makes a hair shampoo called Sweet and Fresh. However, the variable standard cost per unit is the same per unit for each level of production, but the total variable costs will change.

Determining your manufacturing overhead expenses and rate will allow you to monitor your company's expenditures and the efficiency of your production. If we compare the actual variable overhead to the standard variable overhead, by analyzing the difference between actual overhead costs and the standard overhead for current production, it is difficult to determine if the variance is due to application rate differences or activity level differences. You would calculate the overhead rate using this manufacturing overhead formula: 26.66% is your manufacturing overhead rate. $500/150 = $3.33. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. The Chase Law Group, LLC | 1447 York Road, Suite 505 | Lutherville, MD 21093 | (410) 790-4003, Easements and Related Real Property Agreements.

Power and water connections are also several months away.

The variable overhead depends on the number of units, whereas fixed overhead remains fixed irrespective of the number of units manufactured. To calculate straight-line depreciation: Depreciation per year rate = (Initial Value - Salvage Value)

WebUniversal Industrial Sales, Inc. is a steel fabrication company located in Lindon, Utah. A common size production sheet is available from the ABC motors inc annual report.

Depreciation on manufacturing equipment - The amount of value your equipment loses each year. Direct cost refers to the cost of operating core business activityproduction costs, raw material cost, and wages paid to factory staff.

The spending variance for manufacturing. It is tax-deductible.

1 a Actual costing Direct-cost rate = Actual professional labour costs Actual professional 141,400 Manufacturing Overhead 207,100 Salaries Payable 46,000 Accounts Payable 9,100 Accumulated Depreciation 53,000 Rent Payable 99,000 In activity-based costing methodology, indirect expenses can be fixed, variable, or semi-variable. then you must include on every digital page view the following attribution: Use the information below to generate a citation. Make a comprehensive list of indirect business expenses including items like rent, taxes, utilities, office equipment, factory maintenance etc. A sales commission agreement is signed to agree on the terms and conditions set for eligibility to earn a commission.

This includes the costs of indirect materials, indirect labor, machine repairs, depreciation, factory supplies, insurance, electricity and more.

predetermined overhead rate = $2,348,800 / $1,468,000 = 160% of direct materials, b) actual overhead rate = $2,485,000 / $1,635,000 = 152%.

Research and Development is an actual pre-planned investigation to gain new scientific or technical knowledge that can be converted into a scheme or formulation for manufacturing/supply/trading, resulting in a business advantage.