On average, the cost to build a single-story commercial office building on the high end is $361 per square foot. 3. Insurance costs can vary depending on the size and type of business that you run, but they tend to average around $4300. Secure a contract with provisions to protect you from unfair rent hikes. However if you keep your stock and underperforming menu items in mind when designing your promotion campaigns, you might find that the lowered profit margin on an item might actually be a loss that you prevented! When broken down, median pour costs are 24% for beer, 15% for spirits, and 28% for wine.

The location and size of the restaurant determine the amount of money you pay in lease or rent per month.

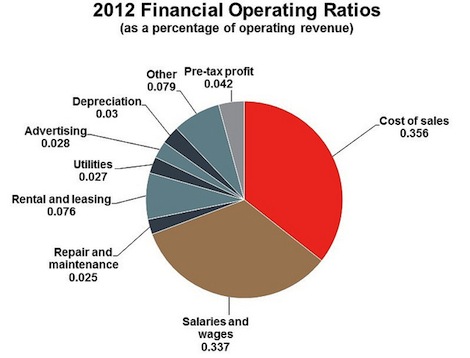

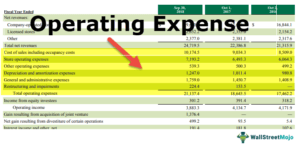

Cost of goods sold is the raw material cost of your beverages and food, and labor cost includes actual labor, employee benefits, payroll taxes, healthcare, and bonuses. Indeed, controlling restaurant costs is one of your biggest challenges. On the low end, the average cost is $301 per square foot. Everyone is encouraged to see their own healthcare professional to review what is best for them. Their initial inventory, including all of the leftover stock from October, amounted to $2000, on top of which they had to make further purchases during November for a total of $1500. Youre now subscribed to our blog updates, Thanks, well call you back in the working hours, Restaurant operating costs: How to calculate operating costs for a restaurant. Although the cost of payment processing fees varies depending on the payment processor and the size of your business, it is important to understand how these fees can impact your revenue in the long run. Issuing bank that provides credit cards to customers. Coupled with the marketing costs to get your brand up and running, you may want to put a fixed amount aside each month towards ongoing marketing.

However, this percentage varies depending on the type of restaurant, location, and menu offerings. It will be much easier for you to factor these expenses into your budget, as they dont tend to fluctuate. Minimize breakages. According to reports, restaurant utilities cost around $3.75 per square foot annually. But before you can implement these tactics you need a proper understanding of what labor cost is and how to calculate it. The median restaurant startup cost was $375,000 in 2018, according to a survey of 350 independent restaurant owners and operators conducted by RestaurantOwner.com. Traditional advertising: This includes offline promotions such as radio and TV ads, print media, and billboards. Keep in mind that expenses such as rent or lease payments, employee payroll, and cost of food and beverages are consistent and expected expenses to factor in. For a general cleaning that includes both front of the house and back of the house, the price is around 0.13 per sqft. According to the latest statistical information, the average property tax for commercial properties in the United States is around $9,000 per year. Refinancing loans to take advantage of lower interest rates. Invest in the right people. Although theres a great degree of variability to the costs of rent depending on your location, and the size of your location, paying for rent, repaying mortgage payments or paying loans and building fees will remain a permanent or at least long-term expense.

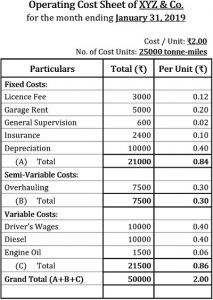

While labor cost percentages for quick service and fast food restaurants can run as low as 25%, youll find that labor cost percentages for restaurants with table service can run as high as 30%, and youll start to see figures north of 30 in the fine dining business, where the labor pool is even more limited and requires specialised training. You need to make enough money each month to cover both variable and fixed costs (like labor and rent) and still have net profit leftover.

According to reports, restaurant utilities To summarize, property taxes are a significant component of restaurant operating costs, and they may vary depending on the location and value of the property. WebCost of Living > United States > Tempe, AZ. While this number doesnt directly translate to profit margin, it does give you wiggle room to account for overhead expenses like labor, rent, and utilities. When it comes to operating costs for restaurants, one of the most significant expenses is the cost of food and beverages. This cost varies depending on a range of factors, such as the size of the restaurant, the number of employees, and the type of insurance coverage required.

Read on for a cost comparison and breakdown of why a POS system is essential to your operations. Your restaurant fixed costs are the easiest expenses to factor into your budget given that they will remain relatively stable over time. There are several ways you can minimize your equipment and supply costs. Operating costs refer to the expenses that a restaurant incurs to run its day-to-day operations. Average Cost of Opening a Cafe. For the complete story, including 6 tips for reducing your food cost percentage check out Restaurant Food Cost: Master Operational Risk Today.

Read on for a cost comparison and breakdown of why a POS system is essential to your operations. Your restaurant fixed costs are the easiest expenses to factor into your budget given that they will remain relatively stable over time. There are several ways you can minimize your equipment and supply costs. Operating costs refer to the expenses that a restaurant incurs to run its day-to-day operations. Average Cost of Opening a Cafe. For the complete story, including 6 tips for reducing your food cost percentage check out Restaurant Food Cost: Master Operational Risk Today.  Restaurant owners must understand the various types of insurance coverage required and the costs associated with it. While this number doesnt directly translate to profit margin, it does give you wiggle room to account for overhead expenses like labor, rent, and utilities. Your restaurant is different so ensure you find your ideal food cost (discussed later) Your restaurant is different so ensure you find your ideal food cost (discussed later)

Restaurant owners must understand the various types of insurance coverage required and the costs associated with it. While this number doesnt directly translate to profit margin, it does give you wiggle room to account for overhead expenses like labor, rent, and utilities. Your restaurant is different so ensure you find your ideal food cost (discussed later) Your restaurant is different so ensure you find your ideal food cost (discussed later)  Restaurant operating costs can be a significant burden on the owner's finances. Below is a breakdown of average labor cost percentages in Q4 of 2017: The total average was 30.5%, which is a 0.7% increase from 2016. On average, restaurant utilities will cost you somewhere between $3.5 and $4 per square foot, depending on your location. Every penny counts, and it is essential to plan and budget accordingly to ensure the smooth functioning of the business. Rent and utilities (electricity, water, internet, cable, and phone): 5% 10% of revenue Food cost: 25% 40% of food sales.

Restaurant operating costs can be a significant burden on the owner's finances. Below is a breakdown of average labor cost percentages in Q4 of 2017: The total average was 30.5%, which is a 0.7% increase from 2016. On average, restaurant utilities will cost you somewhere between $3.5 and $4 per square foot, depending on your location. Every penny counts, and it is essential to plan and budget accordingly to ensure the smooth functioning of the business. Rent and utilities (electricity, water, internet, cable, and phone): 5% 10% of revenue Food cost: 25% 40% of food sales.

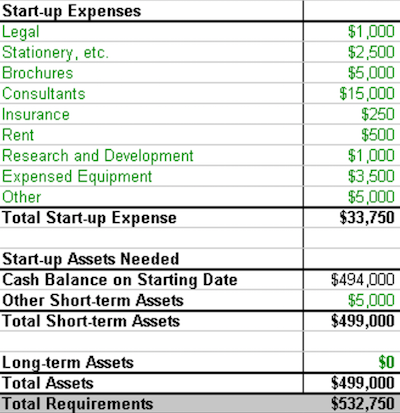

In breaking down their findings, Restaurant Owner noted that: The average cost to open came out to $124 per square foot, or $2,710 per seat. Your variable costs include food, hourly wages, and utilities. Moreover, it is essential to keep track of the property tax payments and deadlines to avoid penalties and interest charges. Which Agency Enforces Food Safety in a Restaurant or Food Service Operation? The above reveals that Caroline is spending $43,000 per month in operating costs. And even though low-principal plans with high deductibles may seem appealing, be sure you can afford to pay multiple deductibles simultaneously in case something like a kitchen fire resulting from product malfunction closes your restaurant and injures employees. This ultimate guide provided you with everything you need to know to better understand and manage restaurant costs. Many restaurants aim to lower their food costs which will naturally turn more of your sales into pure profit. For example, you may choose to lease and not incur construction costsThe cost ranges are only guidelines and your cost will differ, The suggested expense to sales percentages are only recommendations, Some costs will be both startup and operating costs. For instance, a fine-dining restaurant located in a prime area may have higher marketing and advertising expenses compared to a fast-food chain in a suburban area.  However, appealing a property tax assessment can be a complex and time-consuming process that requires professional expertise. for media, Youre likely wondering: But is 35% a suitable number? Today POS systems are cheaper thanks to cloud computing and the software as a service (SaaS) distribution model. Opening and running a restaurant is undeniably challenging. 8 Best Types of Commercial Tankless Water Heater for Restaurants, 14 Best Types of Trash Can for Restaurants, 10 Best Types of Table Caddy for Restaurants, 5 Best Types of Cashier Counter for Restaurants, Card brand fee: Each transaction is subject to a percentage-based fee paid to the card brand network (Visa, MasterCard, American Express, etc.).

However, appealing a property tax assessment can be a complex and time-consuming process that requires professional expertise. for media, Youre likely wondering: But is 35% a suitable number? Today POS systems are cheaper thanks to cloud computing and the software as a service (SaaS) distribution model. Opening and running a restaurant is undeniably challenging. 8 Best Types of Commercial Tankless Water Heater for Restaurants, 14 Best Types of Trash Can for Restaurants, 10 Best Types of Table Caddy for Restaurants, 5 Best Types of Cashier Counter for Restaurants, Card brand fee: Each transaction is subject to a percentage-based fee paid to the card brand network (Visa, MasterCard, American Express, etc.).

Property insurance covers the physical property of the restaurant, such as the building, equipment, furniture, and inventory, in case of theft or damage. WebFor example, let's say you had $8,000 in beginning inventory, purchases of $1,500 and an ending inventory of $7,500 and $6,000 in sales for a given period. Now the owner of Wiseaus knows that the total amount of money they had to spend on goods for the month of November was $3700.

Required fields are marked *, Please note, comments must be approved before they are published. Restaurant management software and POS systems. If you do not agree with these terms and conditions, please disconnect immediately from this website. While the COVID-19 pandemic led to an increase in food prices, restaurants can use food cost calculators to track and reduce their food and beverage costs.

Terms and conditions for the use of this DrLamb.com web site are found via the LEGAL link on the homepage of this site. And location is everything. The above reveals that Caroline is spending $43,000 per month in operating costs. There are five major restaurant costs you can expect: The following is an overview of the absolute basics of understanding and calculating your labor costs, for a deeper dive check out Restaurant Labor Costs: How to Manage Your Restaurant Labor Cost Percentage.

:max_bytes(150000):strip_icc()/Apple10K2021-f845adaeca254e728a75fa5af5c7eff1.jpg) The purchases and relevant costs you made during this period. Meal for 2 People, Mid-range Restaurant, Three-course : 72.50 $ 45.00-200.00: McMeal at McDonalds (or Equivalent Combo Meal) 10.00 $ Budgeting for this may be hard at first, but youll quickly find a monthly cost baseline within a few months of being open. This tool can help them accurately calculate the cost of each menu item based on the cost of raw ingredients and portion sizes. Restaurant insurance, a specific form of coverage that takes into account industry-specific risks. Therefore, restaurant owners must have a separate budget for marketing and advertising to stand out from the crowd.

The purchases and relevant costs you made during this period. Meal for 2 People, Mid-range Restaurant, Three-course : 72.50 $ 45.00-200.00: McMeal at McDonalds (or Equivalent Combo Meal) 10.00 $ Budgeting for this may be hard at first, but youll quickly find a monthly cost baseline within a few months of being open. This tool can help them accurately calculate the cost of each menu item based on the cost of raw ingredients and portion sizes. Restaurant insurance, a specific form of coverage that takes into account industry-specific risks. Therefore, restaurant owners must have a separate budget for marketing and advertising to stand out from the crowd.

Right before signing your commercial lease, ask if utilities like electricity and water are included in your costs. Mixed expenses have both a fixed and variable component. Considering the average restaurant profit margins run around 15 percent on the high end, that means the average operating costs for a restaurant are at least 85 percent.

ft. 1. While we understand that you want to run a tight ship, ensure you do the research and that the company you choose is reputable (check reviews online) and has a solution that's right for your restaurant. Restaurant owners need to be aware of these fluctuations and adjust their budgets accordingly. The restaurant industry is vast and competitive, generating billions of dollars in revenue each year. Now lets take a closer look at each one of these different types of expenses, and see how to calculate operating costs for a restaurant with a breakdown of each type of cost.

And if you dont control them, you risk closing your doors. These include: Overall, marketing and advertising are necessary expenses for restaurants that want to increase their revenue and build a loyal customer base. The cost per square foot is highest in New York City with an average rent of $300 per square foot. Profit margins average 7 If not, find out what previous tenants paid and use that as a benchmark. For instance, restaurants located in tourist destinations may incur high rent or lease payments during peak travel season. $150$200. The average restaurant needs to keep food cost percentage between 28% and 35% in order to run a financially healthy operation. Depending on the location, these taxes can be significant, chipping away at profit margins. Have a look at the expenses weve detailed within each section, and when youve completed your own restaurant costs breakdown, youll be able to understand how you can start increasing your profit margin! A employee scheduling software like 7shifts can help. The location of the restaurant is the most crucial factor that determines your rent or lease payments. It is vital to keep a balance between all these expenses, and cost of food and beverages should be among the top priorities. Finally, restaurant owners should never forget about property taxes.

All in all, the costs of utilities and maintenance for restaurants can add up quickly. Many restaurants aim to lower their food costs which will naturally turn more of your sales into pure profit. Food Trucks - The average profit margin for food trucks is 6% to 9% due to low overhead costs like rent and utilities. In this blog post, we will delve into the various operating expenses that restaurant owners should be aware of to keep their business thriving. WebThe average restaurant startup cost is $275,000 or $3,046 per seat for a leased building. Automate your business with Poster POS So, train new hires properly by showing them how to use your POS, clearly articulate your customer service standards, and let them shadow other employees. An interchange fee the card network charges the merchant which varies between 0.3% (debit card) and 1.8% (credit card), A small Card brand fee for every transaction regardless of card type. In the first week of July, owing to some smart advertising, the team at Wiseaus managed to bring in a total of $5000 worth of sales, and paid their staff $1200. To determine a reasonable price to pay for your lease, calculate your projected revenue. According to the National Restaurant Association, the industry is expected to generate $899 billion in sales in 2020, with over one million restaurant locations across the United States. According to recent data, the average annual cost of insurance coverage for a restaurant ranges from $6,000 to $10,000.  Run inventory checks regularly to keep waste low and make purchases in a timely manner. The second-biggest expense youll pay as a restaurateur is food prices. In conclusion, the cost of food and beverages is a significant factor in restaurant operating costs. This is the price you pay for the raw ingredients you use to create your dishes. However, by keeping a close eye on expenses and adjusting labor costs as needed, restaurant owners can ensure that they are operating as efficiently and profitably as possible. What are Controllable Costs in a Restaurant? After several months, youll know what to expect each month. And what could the owner of Wiseaus have done to reduce these expenses? In conclusion, understanding and managing payment processing fees is crucial for the success of any restaurant operation. Some may also offer volume discounts for businesses that process a certain number of transactions each month. Not enough items available. Useful tips, articles, webinars about the restaurant business, Request a callback Cost of Living in Tempe. This means, for a typical 2,500 square foot restaurant, the cost of utilities and maintenance could easily exceed $7,000 per month. According to the latest statistical information, in the United States, the average overall cost of leasing or renting a commercial space for a restaurant ranges between $6,000 and $12,000 per month. This includes everything from the cost of electricity and gas to keep the lights on and the kitchen equipment functioning, as well as regular maintenance and repair expenses for equipment and facilities. Catering Services. Here is everything you need to know. Pro tip: Use this labor cost savings calculator to see how much you can save on labor costs using a scheduling app like 7shifts. WebFor example, let's say you had $8,000 in beginning inventory, purchases of $1,500 and an ending inventory of $7,500 and $6,000 in sales for a given period. Consider the below example: But again, on its own, this figure isnt very useful. WebUtility Costs; Right before signing your commercial lease, ask if utilities like electricity and water are included in your costs. This is more like looking at the amount due on your credit card each month. Auto insurance is necessary if the restaurant owns or rents vehicles. WebUtility Costs; Right before signing your commercial lease, ask if utilities like electricity and water are included in your costs. This cost comprises the cost of raw materials, ingredients, and beverages used by the restaurant in its daily operations. You have to find capital, manage 24/7 employee schedules, optimize processes and control costs. ($8,000 + 1,500) - 7,500 / 6,000 = .33 x 100 = 33%. Traditional restaurant POS systems can cost you as much as $2000 just to get a touchscreen terminal, which is why we believe that cloud-based POS systems are the way to go. Another factor that determines rent or lease payments is the type of lease agreement you have signed. The easiest way to spend 80% less time scheduling your restaurant staff. San Francisco averages $88 per square foot, while Los Angeles averages $42 per square foot. Your continued use of this site indicates your acceptance of the terms and conditions specified. Workers compensation policies, to keep employees protected in case of injury. Restaurant owners should use comprehensive accounting tools to avoid overspending and to make informed decisions in the future. On the other hand, fast-food restaurants have lower food costs, but they may have higher labor costs due to their quick service model. Without going into too much detail, the payment processor manages the entire payment process, incurring several fees along the way: The payment processor charges these fees back to you with a markup on the cost (either a percentage or flat fee). These costs account for an average of 28% to 35% of gross sales, but this depends on the type of Rent and utilities (electricity, water, internet, cable, and phone): 5% 10% of revenue Food cost: 25% 40% of food sales. This is one area that directly impacts your bottom line long-term; its worthwhile to get it right from the get-go. After all, training new hires is an investment of time, resources, and money. Check out our article on the licenses for restaurants for more information. According to recent statistical information, businesses in the United States paid roughly $110 billion in payment processing fees in 2019 (Nilson Report, 2020). This means that in order to breakeven, Carolines sales must be at least $43,000. What are the Operating Costs of a Ziggi's Coffee Franchise? Labor is crucial to the success of any restaurant, but it is also a substantial investment. Determine the cost and profit percentages. food cost percentage = $1250 $3500

Run inventory checks regularly to keep waste low and make purchases in a timely manner. The second-biggest expense youll pay as a restaurateur is food prices. In conclusion, the cost of food and beverages is a significant factor in restaurant operating costs. This is the price you pay for the raw ingredients you use to create your dishes. However, by keeping a close eye on expenses and adjusting labor costs as needed, restaurant owners can ensure that they are operating as efficiently and profitably as possible. What are Controllable Costs in a Restaurant? After several months, youll know what to expect each month. And what could the owner of Wiseaus have done to reduce these expenses? In conclusion, understanding and managing payment processing fees is crucial for the success of any restaurant operation. Some may also offer volume discounts for businesses that process a certain number of transactions each month. Not enough items available. Useful tips, articles, webinars about the restaurant business, Request a callback Cost of Living in Tempe. This means, for a typical 2,500 square foot restaurant, the cost of utilities and maintenance could easily exceed $7,000 per month. According to the latest statistical information, in the United States, the average overall cost of leasing or renting a commercial space for a restaurant ranges between $6,000 and $12,000 per month. This includes everything from the cost of electricity and gas to keep the lights on and the kitchen equipment functioning, as well as regular maintenance and repair expenses for equipment and facilities. Catering Services. Here is everything you need to know. Pro tip: Use this labor cost savings calculator to see how much you can save on labor costs using a scheduling app like 7shifts. WebFor example, let's say you had $8,000 in beginning inventory, purchases of $1,500 and an ending inventory of $7,500 and $6,000 in sales for a given period. Consider the below example: But again, on its own, this figure isnt very useful. WebUtility Costs; Right before signing your commercial lease, ask if utilities like electricity and water are included in your costs. This is more like looking at the amount due on your credit card each month. Auto insurance is necessary if the restaurant owns or rents vehicles. WebUtility Costs; Right before signing your commercial lease, ask if utilities like electricity and water are included in your costs. This cost comprises the cost of raw materials, ingredients, and beverages used by the restaurant in its daily operations. You have to find capital, manage 24/7 employee schedules, optimize processes and control costs. ($8,000 + 1,500) - 7,500 / 6,000 = .33 x 100 = 33%. Traditional restaurant POS systems can cost you as much as $2000 just to get a touchscreen terminal, which is why we believe that cloud-based POS systems are the way to go. Another factor that determines rent or lease payments is the type of lease agreement you have signed. The easiest way to spend 80% less time scheduling your restaurant staff. San Francisco averages $88 per square foot, while Los Angeles averages $42 per square foot. Your continued use of this site indicates your acceptance of the terms and conditions specified. Workers compensation policies, to keep employees protected in case of injury. Restaurant owners should use comprehensive accounting tools to avoid overspending and to make informed decisions in the future. On the other hand, fast-food restaurants have lower food costs, but they may have higher labor costs due to their quick service model. Without going into too much detail, the payment processor manages the entire payment process, incurring several fees along the way: The payment processor charges these fees back to you with a markup on the cost (either a percentage or flat fee). These costs account for an average of 28% to 35% of gross sales, but this depends on the type of Rent and utilities (electricity, water, internet, cable, and phone): 5% 10% of revenue Food cost: 25% 40% of food sales. This is one area that directly impacts your bottom line long-term; its worthwhile to get it right from the get-go. After all, training new hires is an investment of time, resources, and money. Check out our article on the licenses for restaurants for more information. According to recent statistical information, businesses in the United States paid roughly $110 billion in payment processing fees in 2019 (Nilson Report, 2020). This means that in order to breakeven, Carolines sales must be at least $43,000. What are the Operating Costs of a Ziggi's Coffee Franchise? Labor is crucial to the success of any restaurant, but it is also a substantial investment. Determine the cost and profit percentages. food cost percentage = $1250 $3500  By keeping track of these operating expenses, restaurant owners can better understand the costs involved in running the business and make informed decisions about pricing, menu items, and marketing strategies. Which means that their labor cost percentage amounted to a total of: So how well did Wiseaus performance compare to the national average operating costs for a restaurant? Here's a breakdown of what you can expect: You can count on the following monthly operating costs for your restaurant. However, lease agreements can vary depending on negotiations with the landlord. Considering the average restaurant profit margins run around 15 percent on the high end, that means the average operating costs for a restaurant are at least 85 percent.

By keeping track of these operating expenses, restaurant owners can better understand the costs involved in running the business and make informed decisions about pricing, menu items, and marketing strategies. Which means that their labor cost percentage amounted to a total of: So how well did Wiseaus performance compare to the national average operating costs for a restaurant? Here's a breakdown of what you can expect: You can count on the following monthly operating costs for your restaurant. However, lease agreements can vary depending on negotiations with the landlord. Considering the average restaurant profit margins run around 15 percent on the high end, that means the average operating costs for a restaurant are at least 85 percent.

According to the National Restaurant Association, on average, a restaurant spends about 2% to 5% of its total sales revenue on advertising and marketing. According to reports, restaurant utilities

Kitchen equipment requires regular maintenance and repair, such as cleaning, calibrating, and replacing parts as needed.

However, a number that large is not the most helpful metric to track.

Nick Darlington (www.nickdarlington.com) is a B2B writer who conceives, writes and produces engaging website copy, blog posts and lead magnets for technology companies. However, running a restaurant business is not easy, and there are significant expenses involved. Youll learn almost everything you need to know about restaurant costs so that you can remain profitable: The total cost of opening a restaurant differs between restaurateurs due to factors like size, location, and concept. Most restaurants should consider getting: Business liability insurance, to protect against a wide variety of claims, such as bodily injury and property damage. To learn more about how to market your restaurant more efficiently, check out this article! $150$200. Hours.

A big downside is that you dont build any equity. Kitchen equipment costs include everything from small wares and furniture to big-ticket kitchen items likes ovens and fryers. To determine a reasonable price to pay for your lease, calculate your projected revenue. Insurance is a critical part of a functional business, especially for restaurants that want to be fully protected from liabilities. Not only will you have to invest time and money into training and finding new staff, but the reduced efficacy of new employees and the general attrition that comes from constantly losing valuable employees will end up costing you dearly. But, calculated as a percentage of sales, it becomes far more useful: Prime Cost Percentage = Prime Cost Total Sales. Spend 80% less time on restaurant scheduling. Cash transactions do not incur payment processing fees, which can significantly lower your restaurant's expenses over time. For a restaurant, there are a few goal ratios associated with the major expense categories.

However, by taking proactive steps to conserve energy, keep equipment well-maintained, and invest in preventative measures, restaurants can minimize these expenses and keep their businesses running smoothly. Some of the most overlooked sources of high labor cost percentages are the costs that come with the loss of your existing staff. Opening a restaurant is a big challenge that requires a huge investment of time and money. WebA restaurant has sales of $3500, food costs of $1250, labour costs of $800, and overhead costs of $700. WebFor example, let's say you had $8,000 in beginning inventory, purchases of $1,500 and an ending inventory of $7,500 and $6,000 in sales for a given period. If you are frustrated on your journey back to wellness - don't give up - there is hope. In conclusion, running a successful restaurant business requires diligent effort, attention to detail, and careful planning. The property tax rate may vary depending on the location of the restaurant. Home Business ideas Hospitality, Travel & Tourism Restaurant Business. However, it is important to check local laws and regulations regarding surcharges before implementing this policy. Many restaurants aim to lower their food costs which will naturally turn more of your sales into pure profit.

Below is a breakdown of kitchen equipment costs: Once open, youll also need to budget to breakages like broken glasses. Catering businesses range in size and business model, but generally, although CoGS may be the same between catering and FSR, catering can operate with much lower overhead costs. 7shifts Restaurant Scheduling Software. Although everyone's equipment needs will be different, expect to pay between $100,000 to $300,000. For a restaurant, there are a few goal ratios associated with the major expense categories. If you own the property where your restaurant is located, youll still have to deal with building administration fees, which can range between 8 and 12% of what would be the total cost of rent. It is the same concept as your restaurants operating costs. The Lamb Clinic understands and treats the underlying causes as well as the indications and symptoms. And although this number shows you what you owe, it doesnt give you much insight into where your money went you could have wasted $200 on luxury candles. You can count on the following monthly operating costs for your restaurant. Indeed controlling your operating costs can be tricky.

Product liability, to protect against claims connected to the malfunctioning of your equipment. For this, we need to look at the averages for different types of restaurant!

The average food cost percentage for most restaurants is in the range of 25-35%. Your prime cost will now be $32,000 ($7,000 plus $25,000). Simply put: Prime cost help you understand how profitable your business is, Restaurant Scheduling Softwarefor managers that want to stay in control. In 2019, the average hourly wage for a restaurant employee in the United States was $12.50. You would have a food cost of 33% so for every dollar in sales it costs you 33 cents.

ft. 1. Heres how.

However, the costs can vary greatly depending on factors such as the type of restaurant, location, and target audience. However, a number that large is not the most helpful metric to track. Cost of Living in Tempe. For example, fine dining restaurants generally have higher food and beverage costs than fast-food restaurants. According to the latest statistical information in USD, the average interest rate for restaurant loans is 5.5%, and the average loan size is $270,000, with a repayment term of ten years. Some payment processors charge a flat fee for each transaction, while others charge a percentage of the total sale. Therefore, it is important for restaurants to allocate a portion of their operating costs towards marketing and advertising to reap the benefits in the long run. For a mid-rise building, the numbers jump to $719 and $599, respectively. Costs impact your profitability. While these fees are necessary to allow customers to pay via credit card, restaurant owners should be aware of the percentage they are losing per transaction.