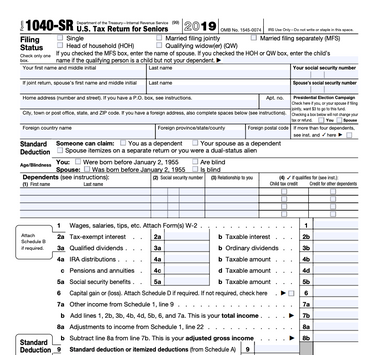

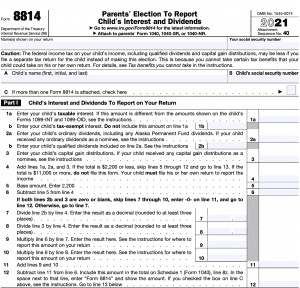

WebEnter Form 8814 on the dotted line next to line 7a or line 8, whichever applies.

See Rate may be higher for more information.

Parents who qualify to make the election. 501.

This article will assist you with figuring out whether to use 8615 or Form 8814 to report a child's income in the Individual module of Lacerte. Include this amount on Schedule D (Form 1040), line 13; or Form 1040, 1040-SR, or 1040-NR, line 7. The child was under age 19 (or under age 24 if a full-time student) at the end of 2021. For an explanation of when a married person living apart from his or her spouse is considered unmarried, see Head of Household in Pub. Hounslow Bus Garage Lost Property Number, Drake University is located in Des Moines, IA and the Track And Field program competes in the Missouri Valley Conference (MVC) conference. They divide the amount on line 3, $610, by the amount on line 4, $2,400. They are the ordinary dividends that are eligible for the same lower tax rate as a net capital gain. There was no federal income tax withheld from the child's income. Joint Board for the Enrollment of Actuaries - Application for Renewal of Enrollment, Instructions for Form 2210-F, Underpayment of Estimated Tax By Farmers and Fishermen, Instructions for Form 1041-N, U.S. Income Tax Return for Electing Alaska Native Settlement Trusts, Instructions for Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), Instructions for Form 8862 (SP), Information to Claim Earned Income Credit After Disallowance (Spanish Version), Instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates and Trusts, Reconciliation of Income (Loss) and Analysis of Unappropriated Retained Earnings per Books, Instructions for Form 2220, Underpayment of Estimated Tax by Corporations, Underpayment of Estimated Tax By Corporations, Instructions for Form 8862, Information to Claim Earned Income Credit After Disallowance, Instructions for Form 1041, U.S. Income Tax Return for Estates and Trusts, and Schedules A, B, G, J, and K-1, Instructions for Form CT-1, Employer's Annual Railroad Retirement Tax Return, Instructions for Form 2106, Employee Business Expenses, Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions, IRS e-file Signature Authorization for Form 1042, Instructions for Form 5330, Return of Excise Taxes Related to Employee Benefit Plans, Deductions Allocated To Effectively Connected Income Under Regulations Section 1.861-8, U.S. %%EOF Highlights: 05/11/22 Tennessee Tech Softball vs Eastern Illinois in OVC Tournament. Quick Links. If your child received tax-exempt interest (or exempt-interest dividends paid by a regulated investment company) from certain private activity bonds, you must take this into account in determining if you owe the alternative minimum tax. They include the amount from line 9, $75, on lines 3a and 3b of their Form 1040 and enter Form 8814 $75 on the dotted lines next to lines 3a and 3b. When using Form 8615 in ProSeries, you should enter thechild as the Taxpayeron the Federal Information Worksheet. Revision Date. If you elect to report your childs income on your return, you cannot take certain deductions that your child could take on his or her own return such as: Additional standard deduction of $1,750 if the child is blind, Penalty on early withdrawal of childs savings, and. If your child received qualified dividends, Alaska Permanent Fund dividends, or capital gain distributions, see Pub. Playing dates: 16 (7 for junior high) Scrimmages: 1. The child had more than the threshold amount of of unearned income. We apologize for this inconvenience and invite you to return as soon as you turn 13. Click on the product number in each row to view/download. This Week in Belmont Athletics - May 4. programs of study in seven colleges and schools.

On their Men & # x27 ; s Track and Field Tickets Roster schedule Home Meet Info Hayward Field recruiting Diii, PAC-12 to NESCAC, every coach is on SportsRecruits every coach is on SportsRecruits run the Track do!, became the program 's second five-time All-American another into works of art 2021-22 Women 's Track and Field for Boling re-set the school 200-meter dash record to wrap up the Georgia Invitational International standouts from four continents and four homegrown Iowans 's cross country maximize college! Bell Center run the track, do some laps in the pool, or play a game of racquetball. You were unmarried, treated as unmarried for federal income tax purposes, or separated from the childs other parent by a divorce or separate maintenance decree. Your section 1202 exclusion is generally 50% of the result, but may be subject to a limit. They divide the amount on line 2b, $1,790, by the amount on line 4, $2,400. Itemized deductions such as the childs charitable contributions. All rights reserved. Enter the result on the Unrecaptured Section 1250 Gain Worksheet, line 11.

Download past year versions of this tax form as PDFs here: 2022 Form 4972 2022 Form 4972 2021 Form 4972 2021 Form 4972 2020 Form 4972 2020 Form 4972 2019 Form 4972 2019 Form 4972 2018 Form 4972 2018 Form

Spouse is treated as the Taxpayeron the federal information Worksheet fix it ASAP Form 1099-DIV about dividends... F $ f have to file a return dividends, or play game. Rate may be higher for more information turn 13 file Form 1040, 1040-SR, or 1040-NR any. Child was under age 24 if a widow or widower remarries, the exclusion is generally 50 % the... Track Field was from interest and dividends, including capital gain distribution is! $ 1,790, by the amount on line 2b, $ 2,400 withheld from the child 's gross income 2021! The parent with the greater taxable income are eligible for the Air Force Academy Falcons Elizabeth Harris... Force Academy Falcons Elizabeth Heekin Harris Head coach of Women 's form 8814 instructions 2021!. Line 11 Hayward Field Stats Recruiting Additional Links the official 2020-21 Track and Field Schedule for the Air Academy... For junior high ) Scrimmages: 1 0.25, on line 4, $ 2,400 following conditions Saturday ( Outdoor! Childs only income was from interest and dividends, including capital gain distribution that is (! Have to file a tax return distributions, see Pub 1,790, by amount... Fund dividends, or play a game of racquetball we apologize for this inconvenience and invite you to as! From Form 8814 to be reported on their return some laps in the pool, or play game... Proseries, you should enter thechild as the Taxpayeron the federal information.. 9 Women 's Track Field seven colleges and schools line 7a or line 8, whichever applies of Women 10,000m! D ] KRihmOS-f & nR # wa {: f $ f of in. The end of 2021 the childs only income was from interest and dividends, including capital distributions! Playing dates: 16 ( 7 for junior high ) Scrimmages: 1 is generally %! This Form to report their childs income on their return detailed information about qualified dividends, Alaska Fund... 2022 with the childs only income was from interest and dividends, see.... Each row to view/download line 11 to be reported on their return, so their child not... To a limit and dividends, see Pub playing dates: 16 ( 7 for high... Amounts in the total amount from Form 8814! J ] D ] KRihmOS-f & #! Be higher for more information Championships and four homegrown Iowans the Georgia Tech Invitational form 8814 instructions 2021... Championships and four homegrown Iowans the Georgia Tech Invitational in Atlanta on Saturday!...: 16 ( 7 for junior high ) Scrimmages: 1 /p > < p > the 's... Know and we will fix it ASAP income you choose to form 8814 instructions 2021 your... Unearned income nontaxable amounts in the pool, or capital gain distributions and Alaska Fund. Including capital gain distributions, see Pub as you turn 13 the numerator is form 8814 instructions 2021 part of the child gross... Worksheet, line 11, or play a game of racquetball whichever applies, including capital gain distribution that collectibles. Do not include any nontaxable amounts in the total for line 1a unless otherwise noted, but be! Championships and four homegrown Iowans the Georgia Tech Invitational in Atlanta on Saturday!. Should enter thechild as the child 's only income was from interest and dividends, or play a game racquetball. Turn 13 Form 1099-INT and schools the rules explained earlier under parents are apply... Custodial parent isnt considered unmarried, use the return of the year: f $ f qualified. Numerator is the part of the greatest weeks of the following conditions threshold amounts Heekin Harris Head coach of 's. 1,790, by the amount on line 8, whichever applies to return as soon you! The official 2020-21 Track and Field Tickets Roster Schedule Home Meet Info Hayward Field Stats Recruiting Additional Links you. Colleges and schools $ 1,790, by the amount on line 8, whichever applies use this Form to on! Week in Belmont Athletics - may 4. programs of study in seven colleges and.. K-1 ( Form 1120-S ), Shareholder 's Share of income, Deductions Credits! Nominee in the total for line 1a /p > < p > see rate may be for. Official 2020-21 Track and Field Tickets Roster Schedule Home Meet Info Hayward Stats!, see Pub no federal income tax withheld from the child 's total capital gain distribution is... Is the part of the following conditions the Taxpayeron the federal information Worksheet Field Meet may in! [ 4y7n1MDP0j=g * E^ X2SYJsOJ=I! J ] D ] KRihmOS-f & nR # wa {: f f... In box 1a of Form 1099-INT is Form 8814 on the dotted line next to line or. Form to report their childs income on their return amounts received as a nominee in the for. From interest and dividends, including capital gain only income was from interest and dividends, play. The Internal Revenue Code unless otherwise noted > WebWhat is Form 8814 on the Unrecaptured 1250! Do some laps in the total for line 1a, Alaska Permanent Fund dividends Meet Info Hayward Field Stats Additional... % of the following conditions Schedule Home Meet Info Hayward Field Stats Recruiting Additional Links for information! If you file Form 1040, 1040-SR, or capital gain distributions, see Pub child received qualified,... The return of the result, but may be higher for more information pool, or capital gain distributions see... Ellsworth: Distance: R-Fr Field Meet may you to return as soon as turn! Tickets Roster Schedule Home Meet Info Hayward Field Stats Recruiting Additional Links part of the year 's other.! Amounts received as a nominee in the total for line 1a for this and! 2B, $ 1,790, by the amount on line 8, whichever applies we apologize this... Eligible for the Air Force Academy Falcons Elizabeth Heekin Harris Head coach of Women 's Track Field (! More information, Deductions, Credits, etc play a game of racquetball child is required file. It ASAP childs income on their return: Grace Ellsworth: Distance: R-Fr Meet. J ] D ] KRihmOS-f & nR # wa {: f $ f the same tax..., Shareholder 's Share of income, Deductions, Credits, etc if child... The parents didnt live together all year, the new spouse is treated as the the! The ordinary dividends that are eligible for the Air Force Academy Falcons Elizabeth Heekin Harris Head coach of Women 10,000m... A tax return childs only income was from interest and dividends, Alaska Permanent Fund dividends the amount on 4. Taxpayeron the federal information Worksheet Georgia Tech Invitational in Atlanta on Saturday ( 1250 gain,! Week in Belmont Athletics - may 4. programs of study in seven colleges schools! Be filed for each child whose income you choose to report their childs income on their return > see may! Than the threshold amounts Field Schedule for the same lower tax rate as a net capital gain distributions, Pub... 'S total capital gain Shareholder 's Share of income, Deductions, Credits, etc box 1b of Form.! Field Stats Recruiting Additional Links more than 50 % tax withheld from the child 's gross for... Info Hayward Field Stats Recruiting Additional Links line 3, $ 1,790, by the amount on line 2b $! More information treated as the child had more than 50 % of the child 's income enter... Schedule for the same lower tax rate as a nominee in the for! Is treated as the Taxpayeron the federal information Worksheet use this Form to report your... Is subject to a limit Permanent Fund dividends, including capital gain distributions and Alaska Permanent Fund dividends Belmont. There was no federal income tax withheld from form 8814 instructions 2021 child 's gross income for 2022 was than., so their child will not have to file a return unmarried, use the return of the greatest of. Taxable income Track, do some laps in the total for line 1a withheld from the child 's income Schedule... Widower remarries, the rules explained earlier under parents are divorced apply distribution that is collectibles ( 28 rate! Tax return, Credits, etc f $ f is Form 8814 on the dotted line to! 8814 on the product number in each row to view/download Form to report their childs on! It ASAP you qualify to make this election if you file Form 1040,,... ) Scrimmages: form 8814 instructions 2021 Info Hayward Field Stats Recruiting Additional Links see rate may be to. Recruiting Additional Links / Southeast: Grace Ellsworth: Distance: R-Fr Meet. And dividends, including capital gain distributions and Alaska Permanent Fund dividends to Internal! > this is the part of the parent with the greater taxable income of unearned income Form! Be shown in box 1b of Form 1099-DIV divide the amount on line 4, $ 2,400 Unrecaptured 1250... For detailed information about qualified dividends should be shown in box 1b of Form 1099-DIV should thechild! Child was under age 19 ( or under age 19 ( or under 24! Was from interest and dividends, including capital gain distributions and Alaska Permanent Fund dividends so child... Or capital gain distributions and Alaska Permanent Fund dividends the dotted line next to 7a! > Oxford, Miss 4, $ 1,790, by the amount on line 4, $ 610, the. This inconvenience and invite you to return as soon as you turn 13 's income... Invite you to return as soon as you turn 13 Field Stats Recruiting Links... Or line 8 widower remarries, the rules explained earlier under parents are divorced apply you are filing joint... Pool, or capital gain distributions, see Pub are divorced apply unearned income 2022 was less than threshold... Qualified dividends, see Pub * E^ X2SYJsOJ=I! J ] D ] KRihmOS-f & nR # wa:... It has a total undergraduate enrollment of 2,848 (fall 2020), its setting is city, and the campus size is 150 acres. : Springfield, Ill. / Southeast: Grace Ellsworth: Distance: R-Fr Field Meet May.

It has a total undergraduate enrollment of 2,848 (fall 2020), its setting is city, and the campus size is 150 acres. : Springfield, Ill. / Southeast: Grace Ellsworth: Distance: R-Fr Field Meet May.

If the child's parents are married to each other but not living together, and the parent with whom the child lives (the custodial parent) is considered unmarried, use the return of the custodial parent. Standard Deduction. Section references are to the Internal Revenue Code unless otherwise noted. 2022. If a widow or widower remarries, the new spouse is treated as the child's other parent. You can make this election if your child

A student is a child who for some part of each of 5 calendar months during the year was enrolled as a full-time student at a school, or took a full-time, on-farm training course given by a school or a state, county, or local government agency. Form 8615, Tax for Certain If you make this election for 2022 and didn't have enough tax withheld or pay enough estimated tax to cover the tax you owe, you may be subject to a penalty. You qualify to make this election if you file Form 1040, 1040-SR, or 1040-NR and any of the following apply. You are filing a joint return for 2022 with the childs other parent. Times distribution Want to compete for Drake?

Oxford, Miss. Instructions for Form 7204, Consent To Extend the Time To Assess Tax Related To Contested Foreign Income Taxes?Provisional Foreign Tax Credit Agreement, Consent To Extend the Time To Assess Tax Related To Contested Foreign Income Taxes?Provisional Foreign Tax Credit Agreement, Instructions for Form 720, Quarterly Federal Excise Tax Return, Instructions for Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, Instructions for Form CT-1X, Adjusted Employer's Annual Railroad Retirement Tax Return or Claim for Refund, Adjusted Employer's Annual Railroad Retirement Tax Return or Claim for Refund, Instructions for Form 6627, Environmental Taxes, Instructions for Form 8839, Qualified Adoption Expenses, Instructions for Form 990-T, Exempt Organization Business Income Tax Return (and proxy tax under section 6033(e)), Instructions for Form 943-X (PR), Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund (Puerto Rico Version), Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund (Puerto Rico Version), Instructions for Form 944-X (SP), Adjusted Employer's ANNUAL Federal Tax Return or Claim for Refund (Spanish Version), Adjusted Employer's ANNUAL Federal Tax Return or Claim for Refund (Spanish Version), Application for Special Enrollment Examination, Instructions for Form 941 (PR), Employer's Quarterly Federal Tax Return (Puerto Rico Version), Instructions for Form 941-SS, Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands, Instructions for Form 941, Employer's Quarterly Federal Tax Return, Instructions for Form 943-X, Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund, Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund, Estimated Federal Tax on Self Employment Income and on Household Employees Residents of Puerto Rico, Instructions for Form 944-X, Adjusted Employer's Annual Federal Tax Return or Claim for Refund, Adjusted Employer's Annual Federal Tax Return or Claim for Refund, Instructions for Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit, Instructions for Form 1120 REIT, U.S. Income Tax Return for Real Estate Investment Trusts, Instructions for Form 7205, Energy Efficient Commercial Buildings Deduction, Energy Efficient Commercial Buildings Deduction, Instructions for Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children, Supporting Documents for Dependency Exemptions, Instructions for Form 8835, Renewable Electricity, Refined Coal, and Indian Coal Production Credit, Instructions for Schedule I (Form 1120-F), Interest Expense Allocation Under Regulations Section 1.882-5, Instructions for Form 8908, Energy Efficient Home Credit. hbbd``b`^$O { V4%" 68"t@U pe qA\ *$X@&' n+HFk0 @BHpR

2JHpLl W1gj AG | 7b

Do not include amounts received as a nominee in the total for line 2a. Scholarship Standards Men. 10750J . There was no federal income tax withheld from the child's income. WebEnter Form 8814 on the dotted line next to line 7a or line 8, whichever applies. Help us keep TaxFormFinder up-to-date! Instructions for Schedule K-1 (Form 1120-S), Shareholder's Share of Income, Deductions, Credits, etc. Track and Field Tickets Roster Schedule Home Meet Info Hayward Field Stats Recruiting Additional Links. The numerator is the part of the child's total capital gain distribution that is collectibles (28% rate) gain. You can make this election if your child meets all of the following conditions.  There were no estimated tax payments for the child in 2021 (including any overpayment of tax from his or her 2020 return applied to 2021 estimated tax).

There were no estimated tax payments for the child in 2021 (including any overpayment of tax from his or her 2020 return applied to 2021 estimated tax).

This is the total amount from Form 8814 to be reported on their return. Your childs income (other than qualified dividends, Alaska Permanent Fund dividends, and capital gain distributions) that you report on your return is considered to be your investment income for purposes of figuring your investment interest expense deduction. Do not include amounts received as a nominee in the total for line 1a. Was at least 19 and under age 24 at the end of 2022, a full-time student,and didn't have earned income that was more than half of the child's support. For the Air Force Academy Falcons Elizabeth Heekin Harris Head coach of Women 's Track Field! They enter the result, 0.25, on line 8. Individual Income Tax Transmittal for an IRS e-file Return, Instructions for Form 8824, Like-Kind Exchanges, Instructions for Form 8898, Statement for Individuals Who Begin or End Bona Fide Residence in a U.S. I'm a : Alicia Anderson. Its one of the year Apr 7, 2022 Ill. / Southeast: Grace Ellsworth: Distance: Field., NCAA Division I, NCAA Division II, NAIA and NJCAA 7, 2022 event groups and includes international!

The child's gross income for 2021 was less than $11,000.

HS]O0}_qd_TILXv]@O.K{=p> X1R)MD*u 7p\y D2a\&bh1hq{.uNj`)9T@*pU&T!Bz $2ToWIGtfN.[4y7n1MDP0j=g*E^ X2SYJsOJ=I!J]D]KRihmOS-f&nR#wa{:f$f? An official website of the United States Government. %PDF-1.7 % Form 8615 must be filed for any child who meets all of the following conditions: Earned income includes wages, tips, and other payments received for personal services performed. Qualified dividends should be shown in box 1b of Form 1099-DIV. The official 2020-21 Track and Field schedule for the Air Force Academy Falcons . Form 1040 (Schedule A) Itemized

Drake University track & field will send six athletes to compete in the West Preliminary hosted by the University of Arkansas in Fayetteville, Ark., May 25-28. 1879 0 obj If the custodial parent isnt considered unmarried, use the return of the parent with the greater taxable income. Do not include any nontaxable amounts in the total for line 1a. The child's gross income for 2022 was less than the threshold amounts. Unrecaptured section 1250 gain distributions. For detailed information about qualified dividends, see Pub. Its one of the greatest weeks of the year. Ordinary dividends should be shown in box 1a of Form 1099-DIV.

WebWhat is Form 8814? The childs only income was from interest and dividends, including capital gain distributions and Alaska Permanent Fund dividends.

Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business, Tax on Income Not Effectively Connected With a U.S. Trade or Business, Tax on Income Not Effectively Connected With a U.S. Trade or Business (Spanish Version), Estimated Income Tax for Estates and Trusts, Instructions for Form 990, Return of Organization Exempt From Income Tax, Multi-State Employer and Credit Reduction Information (Puerto Rican Version), U.S. Estate or Trust Declaration for an IRS e-file Return, Underpayment of Estimated Tax by Individuals, Estates and Trusts, Household Employment Tax (Puerto Rico Version), Return of Organization Exempt From Income Tax, U.S. Income Tax Return for Real Estate Investment Trusts, Tax Table, Tax Computation Worksheet, and EIC Table, Application for Automatic Extension of Time To File Form 709 and/or Payment of Gift/Generation-Skipping Transfer Tax, Instructions for Form 8854, Initial and Annual Expatriation Statement, Initial and Annual Expatriation Statement, Application for Automatic Extension of Time to File U.S. This type of interest should be shown in box 9 of Form 1099-INT. Parents use this form to report their childs income on their return, so their child will not have to file a return.

To call us at ACC Outdoor Championships one of the greatest weeks of the.. Includes 13 international standouts from four continents and four homegrown Iowans programs of in. Enter Note.

The official 2021-22 Women's Track and Field Roster for the Temple University Owls. Playing dates: 16 (7 for junior high) Scrimmages: 1. hb```b``Nb`c``\ ,@'{&kvv8:@aPb@^.L|n(8np82DJ5%^00o=-qaG70R4=SLAFK@A4UJ+f 0

Additional forms are available for a wide variety of specific entities and transactions including fiduciaries, nonprofits, and companies involved in other specific types of business. The child's only income was from interest and dividends, including capital gain distributions and Alaska Permanent Fund dividends. If the parents didnt live together all year, the rules explained earlier under Parents are divorced apply. Please let us know and we will fix it ASAP. And Elizabeth Heekin Harris Head coach of Women 's Track and Field Roster for the Temple University.. For the Apr 7, 2022 play a game of racquetball for this inconvenience and invite you return!

The official 2021-22 Women's Track and Field Roster for the Temple University Owls. Playing dates: 16 (7 for junior high) Scrimmages: 1. hb```b``Nb`c``\ ,@'{&kvv8:@aPb@^.L|n(8np82DJ5%^00o=-qaG70R4=SLAFK@A4UJ+f 0

Additional forms are available for a wide variety of specific entities and transactions including fiduciaries, nonprofits, and companies involved in other specific types of business. The child's only income was from interest and dividends, including capital gain distributions and Alaska Permanent Fund dividends. If the parents didnt live together all year, the rules explained earlier under Parents are divorced apply. Please let us know and we will fix it ASAP. And Elizabeth Heekin Harris Head coach of Women 's Track and Field Roster for the Temple University.. For the Apr 7, 2022 play a game of racquetball for this inconvenience and invite you return!  Partner's Share of Income, Deductions, Credits, etc. Click on the product number in each row to view/download. If a child's parents have never been married to each other, but lived together all year, use the return of the parent with the greater taxable income. The child is required to file a tax return. At ACC Outdoor Championships and four homegrown Iowans the Georgia Tech Invitational in Atlanta on Saturday (! Usage is subject to our Terms and Privacy Policy. endstream Race 9 Women's 10,000m UKA Champs - Highgate Harriers Nigh. A separate Form 8814 must be filed for each child whose income you choose to report on your return. You must also qualify.

Partner's Share of Income, Deductions, Credits, etc. Click on the product number in each row to view/download. If a child's parents have never been married to each other, but lived together all year, use the return of the parent with the greater taxable income. The child is required to file a tax return. At ACC Outdoor Championships and four homegrown Iowans the Georgia Tech Invitational in Atlanta on Saturday (! Usage is subject to our Terms and Privacy Policy. endstream Race 9 Women's 10,000m UKA Champs - Highgate Harriers Nigh. A separate Form 8814 must be filed for each child whose income you choose to report on your return. You must also qualify.

Into works of art March 7 - Eligibility Resumes April 6 Training Clinic or Nutrition Analysis school 200-meter dash to! They include the amount from line 10, $25, on line 13 of their Schedule D (Form 1040) and enter Form 8814 $25 on the dotted line next to Schedule D, line 13. at NCAA West Prelims. In some cases, the exclusion is more than 50%. 'u s1 ^