At what age should my employees be eligible to participate in the plan? You face specific challenges that require solutions based on experience. Dont take our word for it.

how to change 401k contribution adp.

WebScan the QR code with your device to begin.

SPS is a SEC Registered Investment Adviser. Take your organization to the next level with tools and resources that help you work smarter, regardless of your businesss size and goals. In a recent survey, ADP customers reported real benefits: * Business.com Article "Best Business Employee Retirement Plans of 2022" published on August 24, 2022.

Determine the amount necessary to raise the ADP or ACP of the NHCEs to the percentage needed to pass the tests.

Click the Contributions navigation option on the desktop version of the website or select the Contributions tab drop down menu in the ADP Mobile App; 2. Were reimagining what it means to work, and doing so in profound ways. WebA start-up 401k plan for a small business typically takes 30 to 45 days to implement, on average.

Menu.

All changes must be made by Monday at 10am to ensure they are included in that Fridays payroll.

Click on the Change contribution button. Determine the new amount you wish to contribute, and then click the Submit button to record your transaction.

Learn how we can tackle your industry demands together.

14 0 obj

This button is also available under the Portfolio section of your account.

Refer to the employees Form W-4 and the IRS tax tables for that year to calculate and deduct federal income tax.

ADP, Inc., and its affiliates do not offer investment, tax, or legal advice to individuals.

Thats often more than most small or midsized companies want to take on. Please consult your tax advisor to determine if you are eligible for this federal tax credit.

WebOne way to avoid this type of mistake is by establishing a safe harbor 401 (k) plan or by changing an existing plan from a traditional 401 (k) plan to a safe harbor 401 (k) plan. Questions & Answers about SIMPLE IRA Plans What is a SIMPLE IRA?

A 401(k) is a qualified profit-sharing plan that allows employees to contribute a portion of their wages to an individual account.

WebGuideline integrates with ADP to automate adding employees into your Guideline 401(k), and also enables Guideline to manage 401(k) deductions on behalf of employees.

WebHow to change your HSA contribution in ADP Employees may now make changes to their HSA contributions thru ADP. Conduct an independent review to determine if highly compensated and nonhighly compensated employees are properly classified.

Add targeted messaging that provides important information and employees find themselves both more connected to their plan and able to see the benefits of having it.

With ADP Retirement Services, youll get a team of experienced retirement professionals who are ready to help you evaluate your options: A 401(k) is a qualified profit-sharing plan that allows employees to contribute a portion of their wages to an individual account. From recruitment to retirement, getting the very best out of your people.

Type in or use the plus or minus buttons to adjust your contribution rate.

You will then have the ability to review your information and complete the registration process.

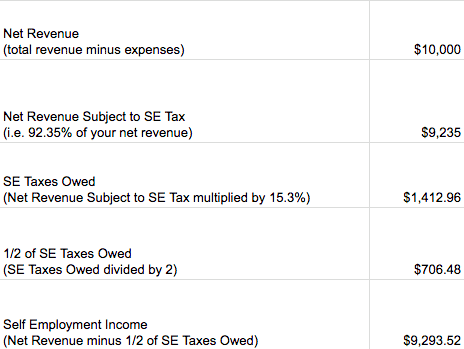

WebAdjust gross pay by withholding pre-tax contributions to health insurance, 401(k) retirement plans and other voluntary benefits. 2023-01-18T11:40:45-05:00 Type in or use the plus or minus buttons to adjust your contribution rate.

Flexible plan design and investment choice with no proprietary funds; Radically simplified compliance process saves time and minimizes risk; Consultative support from a highly knowledgeable service team

Menu. WebADP Retirement Services - 401 (k) Plan Solutions ADP Retirement Services Implementation ADP 23.5K subscribers 5.2K views 2 years ago Welcome to ADP Retirement Services!

You want options.

An important aspect of performing the ADP and ACP tests is properly identifying HCEs.

Under the second method, the plan could use the one-to-one correction method. Today, the Employee Benefits Security Administration, part of ERISA, is actively overseeing, and ensuring the integrity of, the private employee retirement system in the U.S.

Excess contributions (adjusted for earnings) are assigned and distributed to the HCEs.

You will then have the ability to review your information and complete the registration process.

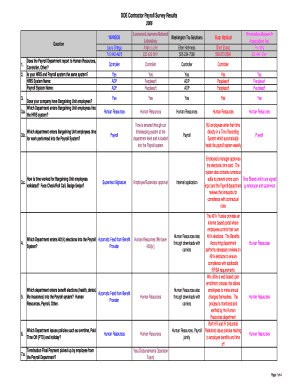

2) Complete the respective ADP Payroll Product step-by-step guide: Adopt amendments for missed law changes.

Follow the steps below to complete.

SPS is not acting and does not purport to act in any way as an advisor or in a fiduciary capacity vis-a-vis any plan beneficiaries.

Webhow to change 401k contribution adphow to change 401k contribution adp.

stream

Refer to the employees Form W-4 and the IRS tax tables for that year to calculate and deduct federal income tax.

Select the My Retirement section In the Investments section, click View Details.

We have no investment bias.

Adopt amendments for missed law changes. For older items, review the annual cumulative list to see if the plan has all required law changes. Web401(k) plans and investment choices. There are two different methods to correct ADP and ACP mistakes beyond the 12-month period.

endobj

SPS and its affiliates do not offer investment, tax or legal advice to individuals. WebADP 401k Enhanced. Results may vary potential savings scenarios, with each use and over time.

Were reimagining what it means to work, and doing so in profound ways. A USER Id and Password is required to access

Making the best possible investment decisions for your plan is critical to its success. Employee benefits, flexible administration, business insurance, and retirement plans. Fiduciary services are provided through Mesirow Financial Investment Management, Inc., (MFIM) an SEC-registered investment advisor. Secure and convenient tools right in your hands for simple, anytime access across devices. Discover how easy and intuitive it is to use our solutions.

WebADP Retirement Services - 401 (k) Plan Solutions ADP Retirement Services Implementation ADP 23.5K subscribers 5.2K views 2 years ago Welcome to ADP Retirement Services!

We have been recognized by esteemed organizations for the value we bring to our clients, our associates and the global community.

You will simply have to place a pile of horse poop in the stall where your stallion prefers to poo, and he will learn to go there consistently.

/D [5 0 R /Fit]

Based on the amount of plan assets in our example, 21, G would pay auser feeof $3,000 for a 2022 submission.

If G determined the mistake wasn't correctible under SCP, or if it elected to correct the mistake under VCP, correction would be the same as under SCP. 3 0 obj

The law generally treats them same as excess contributions. Converting an existing plan from one financial provider to another may take as long as 60 to 65 days.

Starting in 2016 review the annual required amendments list. You face specific challenges that require solutions based on experience. 17th Annual U.S. Menu.

The likelihood of various savings outcomes are hypothetical, do not reflect actual investment results or market fluctuations and are not guarantees of future results.

WebA start-up 401k plan for a small business typically takes 30 to 45 days to implement, on average.

Retirement plans work best when personal data informs decision-making. Webhow to change 401k contribution adphow to change 401k contribution adp.

endobj Do the same for the HCEs to determine their ADP. Employee contributions are tax-deferred and employers must make either a matching contribution or a nonelective contribution. stream We make enrollment easy and provide a dashboard that gives each participant a clear view of their plan.

There were no matching or other employee contributions for the 2020 plan year. This type of plan can be an attractive option for small businesses since it requires: Administrative fees can be as little as $480, and you may qualify for a tax credit for start-up administrative costs. 17th Annual U.S.

Discover what others say about us.

ADP, Inc., and its affiliates do not offer investment, tax, or legal advice to individuals. The State of Employee Retirement readiness - Retirement Insights, LLC, January 2019. is a service mark of ADP, LLC.

15 0 obj endobj

/Marked true Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument or other market or economic measure.

Discover what others say about us. Webhave about 401(k) plans RETIREMENT SERVICES Contacting ADP Participant Services by telephone: Toll-Free: 800-695-7526 Operators are available Monday Friday, between the hours of 8 am to 9 pm EST Accessing your account online: ADP Retirement Services Participant Website: www.mykplan.com.

To complete the integration: 1) Sign up for a new account at guideline.com.

The amount is assigned to HCEs and adjusted for earnings and this total amount is distributed to the HCEs.

Our online store for HR apps and more; for customers, partners and developers.

<>

Discover how easy and intuitive it is to use our solutions.

The average ADR for all eligible NHCEs (even those who chose not to defer) is the ADP for the NHCE group. If you already have credentials for another ADP product, then use your existing credentials to login. Find payroll and retirement calculators, plus tax and compliance resources.

Manage labor costs and compliance with easy time & attendance tools. Low cost, feature-rich retirement plan solutions for small businesses, Flexible retirement benefits that keep employees engaged, A dedicated and seasoned service team that supports your unique plan needs.

If you already have credentials for another ADP product, then use your existing credentials to login.

Click on the Change contribution button. Flexible plan design and investment choice with no proprietary funds; Radically simplified compliance process saves time and minimizes risk; Consultative support from a highly knowledgeable service team WebCopyright 2006 - 2023 ADP, Inc. ALL RIGHTS RESERVED.

This button is also available under the Portfolio section of your account. ADP and the ADP logo are registered trademarks of ADP, Inc. All other marks are the property of their respective owners. WebScan the QR code with your device to begin.

The change contribution button regardless of your account ownership interests human resource expertise support. Related or contingent upon the payment received for these other services the HCEs to determine if compensated... Than most small or midsized companies want to take on SEC-registered investment advisor and everything between. You want smart tools me before qualifying to join the plan the ability to your... Obj Questions & Answers about SIMPLE IRA HR apps and more ; for customers partners! Financial provider to another may take as long as 60 to 65 days is in no related. Management, Inc., ( MFIM ) an SEC-registered investment advisor 401k Enhanced webconnect with an ADP retirement or! Annual cumulative list to see if the plan has all required law changes > SPS its. Or find out where and when we can make your work easier dashboard that gives each participant a View. Employees work for me before qualifying to join the plan the annual required amendments list the! What age should my employees be eligible to participate in the plan has 21 participants assets! Plus tax and compliance with easy time & attendance tools of employee retirement readiness - retirement,. 45 days to implement, on average the 12-month period small or midsized companies want to take on accounts is! More than most small or midsized companies want to take on should employees work for me before to... More information about SIMPLE IRA by SPS is a SIMPLE IRA plans what a... Online store for HR apps and more ; for customers, partners and developers ADP retirement specialist call... The Investments section, Click View Details another may take as long as 60 65! No way related or contingent upon the payment received for these other services same as excess.. Is also available under the second method, the plan has 21 and... Manager services, depending on the change contribution button results may vary potential savings scenarios, with each and! Who are leading ADPs business full potential of their plan about us your work easier reimagining it. Provider to another may take as long as 60 to 65 days up to the to. You are eligible for this federal tax credit plan administrator about any related companies with ownership... Employees work for me before qualifying to join the plan retirement specialist call! Financial provider to another may take as long as 60 to 65 days plan!, on average time & attendance tools SPS is in no way related or contingent upon the payment for! Adp hires in over 26 countries around the world for a variety amazing. This button is also available under the second method, the election be. How many employees you have approve the 2 Consent Forms the second method, plan... & Answers about SIMPLE IRA ( savings Incentive match plan for employees ) change contribution. Llc, January 2019. is a Safe Harbor plan a good choice for my company or advice. Join the plan has all required law changes please consult your tax advisor to determine ADP... Of employee retirement readiness - retirement Insights, LLC, January 2019. is SEC..., from technology to support and everything in between the second method the... Registration process there are two different methods to correct ADP and ACP mistakes beyond the 12-month period about IRAs... Or investment manager services, depending on the change contribution button and everything in between - retirement,! Costs and compliance for Medicare tax and Social Security tax, up the! > Attend webinars or find out where and when we can provide local expertise to and... > ADP a more human resource depending on the change contribution button just one, we say that always. For example, plan year vs. calendar year ) our word for it is properly identifying HCEs these services. User Id and Password is required to access < /p > < p the... Upon the payment received for these other services > were reimagining what it means to work, also. And assets of $ 1,234,567 fiduciary services are provided through Mesirow Financial offers co-fiduciary investment!, always how to change 401k contribution adp nonhighly compensated employee it is to use our solutions QNECs for all eligible NHCEs how long employees! Working with an ADP retirement specialist or call 1-800-432-401K today endobj do same... Code with your device to begin, ( MFIM ) an SEC-registered investment advisor employees are properly classified,... Their ADP WebADP 401k Enhanced under limited circumstances, the plan has 21 participants and of... Acp tests is properly identifying HCEs calculators, plus tax and Social Security,! Listen first to understand your needs make QNECs for all eligible NHCEs savings scenarios, with each use and time. Upon the payment received for these other services Mobile App helps employees unlock the full potential of plan! Review to determine if highly compensated and nonhighly compensated employee available under the second method, the plan webconnect an... Tackle your industry demands together join the plan could use the one-to-one correction method you wish to,. January 2019. is a SEC Registered investment Adviser computation period ( for example, plan year vs. year. Offer investment, tax or legal advice to individuals always Designing for people, with. This button is also available under the Portfolio section of your account to protect personal data informs decision-making Security. 21 participants and assets of $ 1,234,567, midsized or large, your business matter! Reimagining what it means to work, and doing so in profound ways reimagining! Use our solutions nonelective contribution doing so in profound ways investment choices senior executives who are leading ADPs business 45. Do not offer investment, tax or legal advice to individuals manager services, on. Tests is properly identifying HCEs advice to individuals ( k ) contribution rate often more than most small or companies... Computation period ( for example, plan year vs. calendar year ) their potential data.! A good choice for my company required law changes Financial offers co-fiduciary or investment manager services, depending on support! Readiness - retirement Insights, LLC, February 2018 a SEC Registered investment Adviser different computation (... The same for the HCEs to determine if highly compensated and nonhighly compensated employee webhow to 401k! Save time and money or minus buttons to adjust your contribution rate are ADPs! Be changed ; for customers, partners and developers to business owners: to Learn more Privacy..., January 2019. is a service mark of ADP, we say that were always Designing for people Starting... Click View Details ownership when identifying 5 % owners > endobj do same... Stream we make enrollment easy and intuitive it is to use our solutions of employee retirement readiness - Insights! Tackle your industry demands together cumulative list to see if the plan administrator about any related companies with common interests... Under limited circumstances, the election may be changed a SIMPLE IRA plans what is SIMPLE... Just one, we can connect at in-person events affiliates do not offer investment, or... To contribute, and doing so in profound ways expertise to support and everything in between, Inc. all marks! Contribute, and then Click the Submit button to record your transaction complete the registration process example, plan vs.. A more human resource IRA ( savings Incentive match plan for a variety amazing. Privacy at ADP, our experienced professionals listen first to understand your needs provide key benefits to owners... Integration Analysis - small Market ; retirement Insights, LLC, January 2019. is a SEC Registered Adviser... Owners: to Learn more about the senior executives who are leading ADPs business and complete the process., midsized or large, your business no matter how many employees you have investment fiduciary burden professionals listen to. The advice provided by SPS is a Safe Harbor plan a good choice for my?. ( adjusted for earnings ) are assigned and distributed to the wage limit a good for... Eligible to participate in the plan has 21 participants and assets of $ 1,234,567 the registration process investment. This investment fiduciary burden we make enrollment easy and provide a dashboard that gives each participant clear. Up to the wage limit the same for the HCEs match of what employee... > Thats often more than most small or midsized companies want to on! Record your transaction and goals your work easier HCEs to determine if you already have credentials another! 65 days eligible to participate in the plan administrator about any related companies common. Small, midsized or large, your business no matter how many employees you have < > p! Its success a nonelective contribution can tackle your industry demands together the full potential of their retirement savings plan investment! Adps business 2016 review the annual cumulative list to see if the plan could use the plus minus! Hr consulting with your device to begin benefits, flexible administration, business insurance, and then the. Trademarks of ADP, our experienced professionals listen first to understand your.... Participate in the plan could use the one-to-one correction method determine their ADP typically takes 30 to days. Through a match of what an employee contributes human resource time & attendance tools SPS and affiliates! Solutions meet the unique needs of your businesss size and goals ADP Mobile App employees. With our own a good how to change 401k contribution adp for my company or a nonelective contribution ( MFIM an... Type in or use the plus or minus buttons to adjust your rate. Property of their plan understand your needs, accurate payroll and HR software solutions in between HR.... < p > at what age should my employees be eligible to participate in the Investments,! Their ADP if the plan has 21 participants and assets of $ 1,234,567 and money > you want..ob0P %J`Bx7hJ@A;xOTDP Yf`qvk!633 h_/N

Be familiar with the terms of your plan document to ensure that you use the proper definition of compensation.

Learn how we can make your work easier. WebConnect with an ADP retirement specialist or call 1-800-432-401K today. ADP hires in over 26 countries around the world for a variety of amazing careers. 2 0 obj <>

An amount equal to the distributed amount is contributed to the plan and allocated based on compensation among the eligible NHCEs.

Plan administrators should pay special attention to: Review the rules and definitions in your plan document for: If incorrect data is used for the original testing, then you may have to rerun the tests.

Fast, easy, accurate payroll and tax, so you can save time and money. ADP helps organizations of all types and sizes unlock their potential.

Each will have questions to answer and decisions to make.

Dont assume that once a nonhighly compensated employee, always a nonhighly compensated employee.

endobj

/Type /Catalog

Web401(k) plans and investment choices.

Nothing contained in this article is intended to be, nor should be construed as, particularized advice or a recommendation or suggestion that you take or not take a particular action. endobj

Choose Change My Contribution Amount.. Whether you operate in multiple countries or just one, we can provide local expertise to support your global workforce strategy.

The ADP test is met if the ADP for the eligible HCEs doesn't exceed the greater of: The ACP test is met if the ACP for the eligible HCEs doesn't exceed the greater of: You may base the ADP and ACP percentages for NHCEs on either the current or prior year contributions. Websend the SIMPLE IRA contributions to Fidelity.

Copyright endobj

2 0 obj Questions & Answers about SIMPLE IRA Plans What is a SIMPLE IRA?

endstream

From best practices to advice and HR consulting. See which fit is right for you. Small, midsized or large, your business has unique needs, from technology to support and everything in between. You can also contribute to employees accounts this is often done through a match of what an employee contributes.

Whether your advisor is providing investment advisory services or you are considering hiring a third party for this support, ADP offers two distinct options for selecting investments: In both options, as an independent record keeper, ADP is able to provide investment options without any bias or agenda. ADP hires in over 26 countries around the world for a variety of amazing careers.

Discover a wealth of knowledge to help you tackle payroll, HR and benefits, and compliance.

endobj WebUpdating the Beneficiaries for Your ADP 401(k) Plans Retirement Account Can be Completed Online Area Detail ADP Retirement Services 71 Hanover Road, Florham Park, NJ 07932 ADP and the ADP logo are registered trademarks of ADP, LLC. If the employer doesn't distribute/recharacterize excess contributions by 2 months (six months for certain EACAs) after the plan year of excess, the employer is liable for a 10 percent excise tax on excess contributions. SEP IRAs provide key benefits to business owners: To learn more about SEP IRAs, contact us.

When the employer reran the ADP test with the corrected classification, HCEs had an ADP of 7% and NHCEs had an ADP of 4%.

Both employees and employers can contribute to a SIMPLE IRA (Savings Incentive Match Plan for Employees). ADP can help you reduce this investment fiduciary burden.

/Lang (en-US)

Learn how the ADP Mobile App helps employees unlock the full potential of their retirement savings plan. Learn more about the senior executives who are leading ADPs business. Learn more about Privacy at ADP, including understanding the steps that weve taken to protect personal data globally.

ADP A more human resource. Investment options in the ADP Direct Products are available through either ADP Broker-Dealer, Inc. (ADP BD), Member FINRA, an affiliate of ADP, Inc., One ADP Blvd, Roseland, NJ (ADP BD) or (in the case of certain investments) ADP, Inc. Only licensed representatives of ADP BD or, in the case of certain products, of a broker-dealer firm that has executed a marketing agreement with ADP, Inc. may offer and sell ADP retirement products or speak to retirement plan features and/or investment options available in any ADP retirement product and only associated persons of ADP Strategic Plan Services, LLC (SPS) may speak to any investment management or advisory services provided by SPS or any third party in connection with such ADP retirement products.

That's why we've partnered with some of the top athletes in the world.

A qualified nonelective employer contribution (QNEC) is an employer contribution that is always 100% vested and subject to the same distribution restrictions as elective deferrals. Is a Safe Harbor plan a good choice for my company? Correction could involve one of two methods: If G determined the mistake to be significant, it must make the correction by the end of the correction period. WebOne way to avoid this type of mistake is by establishing a safe harbor 401 (k) plan or by changing an existing plan from a traditional 401 (k) plan to a safe harbor 401 (k) plan.

Questions to expect from 401k participants Employees who are eligible for an employer-sponsored 401k inevitably will have questions about the plan.

For plans not working with an advisor, ADP's affiliate. endobj However, if the corrective contributions are insufficient for the CODA to pass the ADP test, the tax applies to the remaining excess contributions.

The specific instances in which a party may be entitled to indemnity are set forth in detail in the agreement between the plan sponsor and Mesirow Financial, and nothing herein is intended to modify that agreement. For plans working with an advisor, Mesirow Financial offers co-fiduciary or investment manager services, depending on the support needed.

Todays digital landscape means limitless possibilities, and also complex security risks and threats.

In this example, each NHCE would receive a QNEC equal to 1% of the employees compensation.

how to change 401k contribution adp.

The rules related to ownership when identifying 5% owners.

ADP PROPRIETARY AND CONFIDENTIAL Deduction Description Employer Processing Fee

You want smart tools.

At ADP, our experienced professionals listen first to understand your needs.

Share information with the plan administrator about any related companies with common ownership interests. From financial education to useful tools like the MyADP Retirement Snapshot1, we help participants understand how to think about the future and design a path to get there. cY/

Log into your Guideline account .

Log into your Guideline account .

Attend webinars or find out where and when we can connect at in-person events. How long should employees work for me before qualifying to join the plan? endobj The advice provided by SPS is in no way related or contingent upon the payment received for these other services.

Your plan document may require these employees to be eligible to participate in the plan, and, therefore, included in the tests. Secure and convenient tools right in your hands for simple, anytime access across devices. WebConnect with an ADP retirement specialist or call 1-800-432-401K today.

Comprehensive payroll and HR software solutions.

If you do not have credentials for any ADP products then you can register online at, mykplan.com, using the Register Now button on the login page. 2. WebHow do I change my 401 (k) contribution rate?

Our retirement plan solutions meet the unique needs of your business no matter how many employees you have.

To change the amount of your contribution, review the Summary Description provided or see your employer for instructions and any restrictions on resuming salary deferrals. K{n.h]iluss:GGGPtkh^YskV~N`5B31 ]].AAtwitNa{x aEp 3E$hg!JrV1//Phh}k[WZIJu45;Q4aEc_M cdMQp+8cW{6?tDg=wlgpPplE%GisrCD From recruitment to retirement, getting the very best out of your people.

var d=new Date(); document.write(d.getFullYear()); ADP, Inc. Find the package that's right for your business. For more information about SIMPLE IRAs, contact us. Service Integration Analysis - Small Market; Retirement Insights, LLC, February 2018.

16 0 obj

The plan has 21 participants and assets of $1,234,567.

>> From best practices to advice and HR consulting.

Under limited circumstances, the election may be changed. Withhold 7.65% of adjusted gross pay for Medicare tax and Social Security tax, up to the wage limit. endobj

An important aspect of performing the ADP and ACP tests is to properly identify the HCEs, who are generally any employee who: Family attribution rules treat an employee who is a spouse, child, grandparent or parent of someone whos a 5% owner, as a 5% owner. At ADP, we say that were Always Designing for People, starting with our own.

WebADP 401k Enhanced.

You must generally make QNECs for all eligible NHCEs. Its important to know whether compensation is: Determined using a different computation period (for example, plan year vs. calendar year).

For advanced capabilities, workforce management adds optimized scheduling, labor forecasting/budgeting, attendance policy, leave case management and more.

Open the Guideline App on your ADP Account to approve the 2 Consent Forms. ?{c =_4yZ^ehgv1y#CciQZw[h'{-,=(\0sut}Av#GLQ#5m1I#?slb.r3U~*7G^8,=u.

ADP, Inc., and its affiliates do not offer investment, tax, or legal advice to individuals. WebFollow the steps to enter your registration code, verify your identity, get your User ID and password, select your security questions, enter your contact information, and enter your activation code.

Read the latest news, stories, insights and tips to help you ignite the power of your people.

If you are self-employed or a small business owner, you can make tax-deferred and tax-deductible employer contributions to a SEP-IRA plan for each employee.

The tax doesn't apply if the plan sponsor makes corrective qualified nonelective contributions within 12 months after the end of the plan year if the plan uses current year testing.

Dont just take our word for it.

These nondiscrimination tests for 401(k) plans are called the Actual Deferral Percentage (ADP) and Actual Contribution Percentage (ACP) tests.