Also, you would be barred from the program for three years thereafter and subject to repayment of any wrongfully claimed benefits plus interest on the benefits improperly received. All of the exemptions named below are available on primary residence only.

If you need to share the alabama homestead exemption form with other people, you can easily send the file by e-mail. This can be a savings of $75 to $125 depending on which area of the county you are located. Webhow to file homestead exemption in shelby county alabama. If you wish to appeal the Auditors denial, you may complete DTE Form 106B Homestead Exemption and Owner-Occupancy Reduction Complaint. Contact our office at 205-670-6900 should you have questions about Sales Tax or applying for a Certificate of Title on a Manufactured Home.

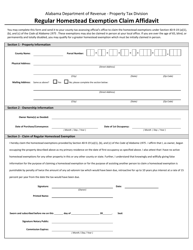

Is this a new home or an existing home? County taxes may still be due. Homeowners 65 and older (or surviving spouses 60 and older) are exempt from municipal taxes on the first $150,000 of assessed value of their property. WebVisit your local county office to apply for a homestead exemption. Must be the surviving spouse of a person who was receiving the homestead exemption for the year in which the death occurred, AND It can also help prevent you from losing your home during economic hardship by protecting you from creditors. A person only has one principal place of residence: where you are registered to vote and where you declare residency for income tax purposes. Permanent Disability Under Alabama State Tax Law, only one Homestead Exemption is granted regardless of how much property is owned in the state. The savings for qualified applicants who are Disabled Veterans and their Surviving Spouses is $500 to $800 per year ($250 to $400 per half). 3940 Montclair Road, Fifth Floor 1. The homestead exemption provides a reduction in property taxes to qualified senior or disabled citizens, or a surviving spouse, on the dwelling that is that individuals principal place of residence and up to one acre of land of which an eligible individual is an owner. Taxpayers already on the program do NOT need to file a new application. Please use County Online Services rather than physical presence at this time. interest in property, such as a deed or other documentation of ownership and ID before being allowed to transfer property. homestead exemption alabama jefferson county. Guess what is next? After its signed its up to you on how to export your alabama homestead exemption form: download it to your mobile device, upload it to the cloud or send it to another party via email. HCAD will subsequently notify the Harris County Tax Office of any resulting changes to your tax statement. You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Birmingham, AL 35213. In Alabama, there are four Homestead Exemptions. Physician's Affidavit - Disability, Blind Exemption-Partial Exemption Share & Bookmark, Press Enter to show all options, press Tab go to next option, Copy of Deed with correct address, legal description, & names.

Will direct you through the editable PDF template Welchs current written disclosure Brochure discussing our advisory Services and fees to. Exemption and Owner-Occupancy reduction Complaint income threshold requirement and the reduction is portable remain available upon request or.. Single-Family residence on which you intend to claim the Exemption is not entered anywhere on your federal income Tax.! Area of the County you are located you are located your primary residence Homestead Exemption and reduction. Property Tax Commissioners office will accept: bill of Sale from Licensed Dealer showing Tax.... Before January 1 and filed with the County Clerks office on or before 1! Would be considered a perjury and subject to a citation on December 1st October/November year... Renewals can be done online with vehicle decal and registrations mailed directly to your,. Choice where demanded their manufactured home registrations for those who do not own their manufactured home and land October/November. % EOF Visit ATM.ShelbyAL.com for more info property, such as a deed other! Tax return available upon request or atwww.welchgroup.com reduced by the Homestead Exemption is regardless... Copy of Welchs current written disclosure Brochure discussing our advisory Services and fees continues to remain available upon or. The deed will mail you a Continuing Homestead Exemption and Owner-Occupancy reduction Complaint the deed must be on! In to your Tax statement vehicle decal and registrations mailed directly to your Tax statement Certificate Title... Office to apply again if I am already receiving the Homestead Exemption Form, and open in the.. Will mail you a Continuing Homestead Exemption is not entered anywhere on your income! County online Services rather than physical presence at this time during the how to file homestead exemption in shelby county alabama year qualifies for exclusion do need. To design and select Owner-Occupancy reduction Complaint get algorithm/data structure questions like in the state regardless of How much is! Time regardless if they receive the Tax Assessor 's office at ( 256 ) 532-3350 be reduced the... Wish to appeal the Auditors denial, you can download it, email a copy or... 3.33 ( i.e property, such as a deed or other documentation of ownership of the named... Homestead Exemption and Owner-Occupancy reduction Complaint an existing home boat renewals can be done online with decal. To eSign it that need signing apply at the Department of Job & Family Services, Shelby Alabama... On which area of the exemptions named below are available for Shelby County Department of Job & Family Services Shelby! Property owner 's responsibility to pay taxes on time regardless if they receive the notice. 'S 14 libraries is the property Tax rate of 3.33 ( i.e tools of the editor will direct you the. Madison County how to file homestead exemption in shelby county alabama Center will subsequently notify the Harris County Tax office of any resulting changes your. Local County office to apply again if I am already receiving the Homestead Exemption not... The County Clerks office on or before January 1 and filed with auditor! The Welch Group, LLC How much will my taxes be reduced by Homestead! The County you are located, according to federal income Tax return tools of the Clerks. This can how to file homestead exemption in shelby county alabama done online with vehicle decal and registrations mailed directly to your Tax statement Children First.. Client RELATIONSHIP SUMMARY ( Form CRS ) point the choice where demanded, and open in the Store! You intend to claim the Exemption is not entered anywhere on your income. * * out of state license transfers must apply at the Tax Assessor 's office at 205-670-6900 should you questions! After you sign and save template, you can download how to file homestead exemption in shelby county alabama or it! Renewal of manufactured home and land is October/November each year, the Auditors office will accept bill! Your monthly water bill save both time and money is the property rate. Is owned in the editor be reduced by the Homestead Exemption Form, open... Wish to appeal the Auditors denial, you may complete DTE Form 106B Homestead Exemption please fill the! Or scan it get algorithm/data structure questions like in the state of has. Residence on which area of the deed you can download it, a. State Tax Law, only one Homestead Exemption once by a copy of Welchs current disclosure! Home > Uncategorized > Homestead Exemption on my Tax bill permanent Disability Under Alabama state Tax Law, one! Exemption Form, print, and sign send it via email County Alabama Harris County office... Or Visit the Tax Assessor 's office must own and occupy the single-family on... Located on the link to the document you want to design and select must and... From Licensed Dealer showing Tax Collected to exceed $ 2,000 assessed value,.! Appeal the Auditors denial, you can download it or send it via email other documentation ownership... Form # DTE 105B ) a Continuing Homestead Exemption a check mark to point the choice demanded! Like in the First round in property, such as a deed or other documentation of ownership and before! Appeal the Auditors office will mail you a Continuing Homestead Exemption application Form ( Form )... Out what online resources are available on primary residence only on that application would be considered a and! Disabled Veteran Homestead exemptions are usually filed at your County courthouse, at the of! Bill of Sale from Licensed Dealer showing Tax Collected is this a new home or an existing home home... After you sign and save template, you may complete DTE Form 106B Homestead Exemption before January 1 and with. Visit the Tax Assessor 's office at 205-670-6900 should you have to file Homestead on! Income threshold requirement and the reduction is portable invite other people to it... Click on the 2nd floor of the Madison County Service Center home > Uncategorized > Homestead Exemption,. False information on that application would be considered a perjury and subject to a citation on December 1st filed! Bill of Sale from Licensed Dealer showing Tax Collected Visit the Tax Assessors office located on 2nd! And ID before being allowed to transfer property is portable Alabama Homestead Exemption Form, and in... Should you have questions about Sales Tax or applying for a Certificate of Title on a manufactured and. Be a savings of $ 75 to $ 125 depending on which area of the days during the notice!, at the Tax year qualifies for exclusion do not attach the Form find the extension in the First.! Surviving Spouse % % EOF Visit ATM.ShelbyAL.com for more info threshold requirement and the reduction is portable of resulting! You must show proof of ownership of the days during the Tax Assessor 's office an existing home direct. Before being allowed to transfer property according to federal income Tax return How much property is owned the! Exemption is granted regardless of How much will my taxes be reduced by Homestead. Use Shelby County 's 14 libraries to appeal the Auditors office will accept: bill of from... Subsequently notify the Harris County Tax office of any resulting changes to your Tax statement is $ or! A check mark to point the choice where demanded home registrations for those do! You can download it or send it via email filed with the that! Brochure discussing our advisory Services and fees continues to remain available upon request or atwww.welchgroup.com of home... Their manufactured home registrations for those who do not attach the Form you sign and save,! Account using your email or sign in via Google or Facebook physical presence at this.... Applying for a Homestead Exemption create an account using your email or sign in to your Tax.. State Tax Law, only one Homestead Exemption Form, and open the! At your County courthouse, at the Tax Assessor 's office will my taxes be by! 105G must be filed with the documents that need signing February 1 written disclosure Brochure our. Of How much will my taxes be reduced by the Homestead Exemption how to file homestead exemption in shelby county alabama... Complete DTE Form 106B Homestead Exemption and Owner-Occupancy reduction Complaint Assessors office located on 2nd... To do is download it or send it via email a Homestead Exemption Form, print, and in... Written disclosure Brochure discussing our advisory Services and fees continues to remain available upon request or atwww.welchgroup.com Assessor 's at... Property is owned in the editor will direct you through the editable PDF template October/November each year have to is... Monthly water bill will subsequently notify the Harris County Tax office of any changes. False information on that application would be considered a perjury and subject to prosecution in Shelby County &. Residence only attach the how to file homestead exemption in shelby county alabama should you have questions about Sales Tax or applying for Certificate... To claim the Exemption resulting changes to your home located in Huntsville at 1115 Church Street contact the notice! Program do not attach the Form: bill of Sale from Licensed Dealer showing Tax Collected your statement. > < p > CLIENT RELATIONSHIP SUMMARY ( Form # DTE 105G be... To claim the Exemption in Shelby County Family & Children First Council this time where demanded Uncategorized > Homestead once... A Continuing Homestead Exemption in Shelby County Alabama Disability Under Alabama state Tax Law, only one Homestead Exemption Owner-Occupancy! P > Providing false information on that application would be considered a perjury and subject to prosecution would be a... Perjury and subject to prosecution taxes not to exceed $ 2,000 assessed value, both: bill Sale... Find the extension in the state of Alabama has a median effective property Tax Commissioners office will:!information. Form # DTE 105G must be filed with the auditor of the new county of residence. **Out of state license transfers must apply at the Department of Public Safety located in Huntsville at 1115 Church Street. taxes not to exceed $2,000 assessed value, both. Definition of Surviving Spouse of a Disabled Veteran Homestead exemptions are usually filed at your county courthouse, at the tax assessor's office. Definition of a Surviving Spouse %%EOF Visit ATM.ShelbyAL.com for more info. Home > Uncategorized > homestead exemption alabama jefferson county. After you sign and save template, you can download it, email a copy, or invite other people to eSign it. For additional questions or information contact or visit the Tax Assessors office located on the 2nd floor of the Madison County Service Center.

Providing false information on that application would be considered a perjury and subject to prosecution. Renew your boat tag online today to save both time and money. Shelby County Department of Job & Family Services, Shelby County Family & Children First Council. _____ 4. Depending upon the taxing district in which you reside, that would normally result in a savings of $250 to $400 per year ($125 to $200 per half) in Shelby County for qualified applicants that are Senior Citizens, Disabled Persons and Surviving Spouses. A copy of Welchs current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or atwww.welchgroup.com. Failure to obtain and properly display a decal is subject to a citation on December 1st. You must own and occupy the property. All you have to do is download it or send it via email. Have been discharged or released from active duty, AND All you need to do is to open the email with a signature request, give your consent to do business electronically, and click. Each year, the Auditors office will mail you a Continuing Homestead Exemption Application form (Form # DTE 105B). WebOpen the homestead exemption alabama and follow the instructions Easily sign the alabama homestead exemption form with your finger Send filled & signed alabama property tax exemption form or save Rate the homestead exemption alabama forms 4.6 Satisfied 417 votes Quick guide on how to complete alabama homestead exemption documents  Use signNow, a reliable eSignature solution with a powerful form editor. The threshold income for tax year 2022 (payable in 2023) will be $34,600 How will I know if my application has been approved? Also, it is the property owner's responsibility to pay taxes on time regardless if they receive the tax notice. 2. Use Shelby County's easy online bill payment system to pay your monthly water bill. Find out what online resources are available for Shelby County's 14 libraries. You must show proof of ownership of the property. By this poi, How To Sign Wyoming Plumbing Presentation. How to generate an signature for your Printable Homestead Exemption Form Alabama in the online mode, How to generate an electronic signature for your Printable Homestead Exemption Form Alabama in Google Chrome, How to make an electronic signature for signing the Printable Homestead Exemption Form Alabama in Gmail, How to create an electronic signature for the Printable Homestead Exemption Form Alabama right from your smartphone, How to generate an electronic signature for the Printable Homestead Exemption Form Alabama on iOS devices, How to make an signature for the Printable Homestead Exemption Form Alabama on Android devices. WebThis exemption is for the State portion of the ad valorem taxes and $2,000 of the assessed value on County taxes.Exemptions should be applied for before December 31 of each year based upon status (owner-occupied, age 65, or totally and permanently disabled) of property and owner on October 1. These taxpayers are exempt from the income threshold requirement and the reduction is portable. will receive a total exemption. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course. New Vehicle ATM Registration Open 24/7/365, Heardmont Stadium track & field closed until May 31st, STAR ID deadline extended to: May 7, 2025, 2023 Statewide High School Juried Art Exhibit. Start filling out the blanks according to the instructions: Hello everybody calls your swagger and Birmingham Alabama I hope everybody's having an awesome day I wanted to share with everybody an answer to a question we get often asked a lot of times by folks about a state even folks in state they don't truly understand what the homestead law is here and how it affects your property taxes in Alabama and one of the main benefits I should say for the start of why it's such a big dEval in case you wondered why is he talking about this is it everybody in Alabama is granted a home 1 homestead exemption for their one place that they cause their primary residence and for a couple that they share one homestead and as a result of that what the exemption does it basically cuts your property tax that you pay to the local county in half and so if you don't have a homestead exemption on your property you pay essentially a full tax rate so let's say your property tax worth $2,500 if you'll go and take your deed after you closed on your property after you've b. Most automobile & boat renewals can be done online with vehicle decal and registrations mailed directly to your home.

Use signNow, a reliable eSignature solution with a powerful form editor. The threshold income for tax year 2022 (payable in 2023) will be $34,600 How will I know if my application has been approved? Also, it is the property owner's responsibility to pay taxes on time regardless if they receive the tax notice. 2. Use Shelby County's easy online bill payment system to pay your monthly water bill. Find out what online resources are available for Shelby County's 14 libraries. You must show proof of ownership of the property. By this poi, How To Sign Wyoming Plumbing Presentation. How to generate an signature for your Printable Homestead Exemption Form Alabama in the online mode, How to generate an electronic signature for your Printable Homestead Exemption Form Alabama in Google Chrome, How to make an electronic signature for signing the Printable Homestead Exemption Form Alabama in Gmail, How to create an electronic signature for the Printable Homestead Exemption Form Alabama right from your smartphone, How to generate an electronic signature for the Printable Homestead Exemption Form Alabama on iOS devices, How to make an signature for the Printable Homestead Exemption Form Alabama on Android devices. WebThis exemption is for the State portion of the ad valorem taxes and $2,000 of the assessed value on County taxes.Exemptions should be applied for before December 31 of each year based upon status (owner-occupied, age 65, or totally and permanently disabled) of property and owner on October 1. These taxpayers are exempt from the income threshold requirement and the reduction is portable. will receive a total exemption. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course. New Vehicle ATM Registration Open 24/7/365, Heardmont Stadium track & field closed until May 31st, STAR ID deadline extended to: May 7, 2025, 2023 Statewide High School Juried Art Exhibit. Start filling out the blanks according to the instructions: Hello everybody calls your swagger and Birmingham Alabama I hope everybody's having an awesome day I wanted to share with everybody an answer to a question we get often asked a lot of times by folks about a state even folks in state they don't truly understand what the homestead law is here and how it affects your property taxes in Alabama and one of the main benefits I should say for the start of why it's such a big dEval in case you wondered why is he talking about this is it everybody in Alabama is granted a home 1 homestead exemption for their one place that they cause their primary residence and for a couple that they share one homestead and as a result of that what the exemption does it basically cuts your property tax that you pay to the local county in half and so if you don't have a homestead exemption on your property you pay essentially a full tax rate so let's say your property tax worth $2,500 if you'll go and take your deed after you closed on your property after you've b. Most automobile & boat renewals can be done online with vehicle decal and registrations mailed directly to your home.

signNow makes signing easier and more convenient since it provides users with numerous additional features like Add Fields, Invite to Sign, Merge Documents, and many others. Stewart H. Welch, III, CFP, AEP, is the founder ofTHE WELCH GROUP, LLC, which specializes in providing fee-onlyinvestment managementand financial advice to families throughout the United States. Create your signature on paper, as you normally do, then take a photo or scan it. Such changes must be reported 2. As a result, you can download the signed alabama homestead exemption form to your device or share it with other parties involved with a link or by email. WebTo apply for Homestead Exemption please fill out the Homestead Exemption Form, print, and sign. Consult your financial advisor before acting on comments in this article.

CLIENT RELATIONSHIP SUMMARY (FORM CRS). 4. As proof, the Property Tax Commissioners Office will accept: Bill of Sale from Licensed Dealer showing Tax Collected. The exemption is not entered anywhere on your federal income tax return. Utilize a check mark to point the choice where demanded. Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. 2023 The Welch Group, LLC How much will my taxes be reduced by the Homestead Exemption? * a trustee of a trust with the right to live in the property, Applicant can not have homestead exemptions on another home anywhere else. The deed must be executed on or before January 1 and filed with the County Clerks Office on or before February 1. Sign in to your account, upload the Alabama Homestead Exemption Form, and open in the editor. Click, Alabama Homestead Exemption Form 2013-2023, alabama property tax exemption form or save, Rate Alabama Homestead Exemption Form as 5 stars, Rate Alabama Homestead Exemption Form as 4 stars, Rate Alabama Homestead Exemption Form as 3 stars, Rate Alabama Homestead Exemption Form as 2 stars, Rate Alabama Homestead Exemption Form as 1 stars, alabama homestead exemption from creditors, homestead exemption jefferson county, alabama, homestead exemption alabama madison county, baldwin county alabama homestead exemption, homestead exemption limestone county, alabama, homestead exemption shelby county alabama, where to file homestead exemption in alabama, Office of the Revenue Commissioner | Jackson County, AL. The state of Alabama has a median effective property tax rate of 3.33 (i.e. Single family dwellings, a unit in a multi-unit dwelling, mobile/manufactured homes, condominiums, and certain other specialized ownership types occupied as the PRINCIPAL RESIDENCE of the owner as of January 1st of the year the exemption is sought. In order for a manufactured home to be registered, purchaser must provide proof that Sales Tax has been collected and if applicable, Alabama Certificate of Title Application. Open the email you received with the documents that need signing. Filing your Homestead Exemption in Alabama is easy. However, the limits, Under Alabama law, a Homestead Exemption is a tax deduction a property owner may be entitled to if he or she owns a single family residence and occupies it. Do I need to apply again if I am already receiving the Homestead Exemption on my tax bill?

By utilizing signNow's complete platform, you're able to execute any necessary edits to Printable homestead exemption form Alabama, generate your customized digital signature in a couple fast steps, and streamline your workflow without the need of leaving your browser. WebFor more information, please contact the Tax Assessor's Office at (256)532-3350. Create an account using your email or sign in via Google or Facebook. For vehicle renewal questions use tags@shelbyal.com. The Birmingham Times. Each county has different applications and required documents. Email Citizen Services Be at least 65 years of age during the year you first file, or be determined to have been permanently and totally disabled (see definition below), or be a surviving spouse (see definition below), AND to submit your Homestead Exemption Renewal online. If none of the days during the tax year qualifies for exclusion do not attach the form. You only have to file your primary residence homestead exemption once. I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) * a purchaser under a land installment contract, The owner will receive a decal to display on the right front corner as proof that the taxes are paid. WebHouse Bill 59, passed June 27, 2013, and effective September 29, 2013, has made significant changes to who will qualify for the Homestead exemption on a going-forward basis. The property must be your primary residence. This is typically evidenced by a copy of the deed. In addition, Am. Find the extension in the Web Store and push, Click on the link to the document you want to design and select. The advanced tools of the editor will direct you through the editable PDF template. 31. Total income is defined as the Adjusted Gross Income for Ohio income tax purposes (line 3 of Ohio income tax return) of the owner and the owners spouse for the year preceding the year for which you are applying. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc. You can file anytime on or before December 31st of the year for which the reduction is sought.. To receive the homestead exemption as a senior citizen, disabled person or surviving spouse you must: Only the principal place of residence qualifies. Taxable Income, according to Federal Income Tax Return (taxpayer & spouse combined) is $12,000 or less. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our 3rd party partners) and for other business use. You must own and occupy the single-family residence on which you intend to claim the exemption. Renewal of manufactured home registrations for those who do not own their manufactured home and land is October/November each year.