DOR uses these numbers for: Taxpayer identification Forms processing. c. 62, s. 8, Letter Ruling 88-5: Sale Building Materials and Supplies Under G.L.

Forms are available in other formats. All printable Massachusetts tax forms are in PDF format. DOR manages state taxes and child support. Mass.gov is a registered service mark of the Commonwealth of Massachusetts. It may not be relied upon by other taxpayers. A lock icon (

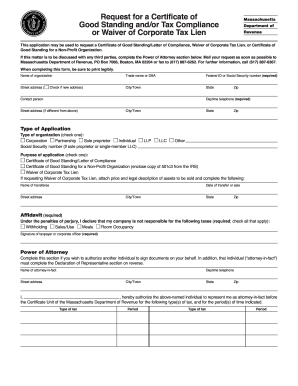

WebWelcome to MassTaxConnect, the Massachusetts Department of Revenue's web-based application for filing and paying taxes in the Commonwealth.  According to the Massachusetts Department of Revenue, taxpayers will receive a refund equal to about 14% of their personal income tax liability in Massachusetts for Tax Year 2021. An official website of the Commonwealth of Massachusetts, 2022 Personal Income Tax Forms and Instructions, Resources to Help You With Your Business Taxes, for the Massachusetts Department of Revenue > Organization Sections > Content. Massachusetts Department of Revenue (DOR), Geoffrey E. Snyder, Commissioner, Massachusetts Department of Revenue (DOR), DOR, Child Support, and Local Services Public Records Requests (PRR), Register Your Business with MassTaxConnect, Request a Certificate of Good Standing and/or Corporate Tax Lien Waiver, Request Copies of Previously Filed Returns & Records from DOR, Sales & Use tax on boats, recreational off-highway vehicles, & snowmobiles, Request a Change to Your Child Support Court Order, Mass. Updated: February 27, 2023 Notice of Intent to Assess (NIA) Although tax return information is generally confidential, DOR may legally disclose return information to: Translation Help. 1975-1, Letter Ruling 77-8: Interest on a Growth Certificate, Letter Ruling 77-7: Abatement of Sales Tax Paid on Stolen Automobile, Letter Ruling 77-6: Rollover Contributions from an IRA to an HR-10 (Keogh) Plan, Letter Ruling 77-5: Meals Served by a Fraternity, Letter Ruling 77-4: Distributions from a Regulated Investment Company: Effect on Basis of Shares, Letter Ruling 77-3: Liquidation of Corporate Trust, Letter Ruling 77-2: Rollover Contributions From an IRA to an HR-10 (Keogh) Plan, Letter Ruling 77-1: Interest on an HR-10 (Keogh) Plan. c. 63, s. 1, Letter Ruling 96-6: Is a Sale Leaseback Financing Transaction Subject to Massachusetts Sales and Use Tax, Letter Ruling 96-5: Charges for Gas/Pipeline Transportation, Letter Ruling 96-4: Automobile Re-painting, Letter Ruling 96-3: Applicability of the Sales Tax to Flax Seed Oil, Letter Ruling 96-2: Sales of Malt Beverages by Restaurant Brewery, Letter Ruling 95-13: Liquidation of Corporate Trust into Corporate Parent, Letter Ruling 95-12: Rental of Rooms in a Former Seasonal Motel Converted to Condominiums, Letter Ruling 95-11: Stair Assist Power Bar, Letter Ruling 95-10:Taxation of Gain from Sale of Winning Massachusetts Lottery Ticket, Letter Ruling 95-9: Returnable Gas Containers, Letter Ruling 95-8: Foreign Limited Liability Partnership, Letter Ruling 95-7: Tax Classification of Joint Trading Account Established by a Group of Mutual Funds, Letter Ruling 95-6: MA Tax Consequences of Liquidation of a MA Corporate Trust, Letter Ruling 95-5: Sales and Use Tax Treatment of G.L. Please limit your input to 500 characters. ) or https:// means youve safely connected to the official website. Use this button to show and access all levels. c. 62, s. 7, Letter Ruling 80-62: Sale of Non-Massachusetts Residence, Purchase of Massachusetts Residence, Basis, Letter Ruling 80-61: Sales for Resale; Casual and Isolated Sales, Letter Ruling 80-60: Heat Exchangers: Eligibility for Credit and Exemption, Letter Ruling 80-58: Sales to 501(c)(3) Organizations; Recordkeeping Requirements, Letter Ruling 80-57: Travel Agency Discount Included in Rent, Letter Ruling 80-56: Payments by Partnership to Non-Resident Retiring Partner, Letter Ruling 80-55: Charitable Remainder Annuity Trust with Non-Resident Beneficiary, Letter Ruling 80-54: Losses on Section 1244 Stock, Letter Ruling 80-52: Situs of Sale; Machinery Used in Manufacturing Name, Letter Ruling 80-51: Cassette Tapes of the Bible, Letter Ruling 80-50: Losses on Section 1244 Stock; Deduction of Part B Losses against Part A Income, Letter Ruling 80-49: Sales Price: Payment of Local Property Taxes by Lessee, Letter Ruling 80-48: Casual and Isolated Sales by Charitable Organizations, Letter Ruling 80-47: Medicine and Medical Devices: Non-Prescription Prosthetic Supplies, Letter Ruling 80-46: Meals Provided by Hospital or Educational Institutions, Letter Ruling 80-45: Meal Items Sold By Convenience Stores, Letter Ruling 80-44: Materials Purchased by Construction Contractor, Letter Ruling 80-43: Frozen Pizzas Sold by Restaurant, Letter Ruling 80-42: Massachusetts Industrial Finance Agency Bonds, Letter Ruling 80-41: Nexus: Regulated Investment Company, Letter Ruling 80-40: Rollover from a Qualified Pension Plan to an IRA, Letter Ruling 80-39: Fellowship Payments to Japanese Citizen, Letter Ruling 80-38: Municipal Deferred Compensation Plan, Letter Ruling 80-37: Reporting Requirements for Part-Year Residents, Letter Ruling 80-36: Mooring Leases; Ingredient or Component Parts, Letter Ruling 80-35: Interest on Mini-Market Certificates, Letter Ruling 80-34: Regulated Investment Company, Letter Ruling 80-33: Rollover Between Qualified Pension Plans, Letter Ruling 80-32: Compensation Paid to Injured Personnel Pursuant to G.L.

According to the Massachusetts Department of Revenue, taxpayers will receive a refund equal to about 14% of their personal income tax liability in Massachusetts for Tax Year 2021. An official website of the Commonwealth of Massachusetts, 2022 Personal Income Tax Forms and Instructions, Resources to Help You With Your Business Taxes, for the Massachusetts Department of Revenue > Organization Sections > Content. Massachusetts Department of Revenue (DOR), Geoffrey E. Snyder, Commissioner, Massachusetts Department of Revenue (DOR), DOR, Child Support, and Local Services Public Records Requests (PRR), Register Your Business with MassTaxConnect, Request a Certificate of Good Standing and/or Corporate Tax Lien Waiver, Request Copies of Previously Filed Returns & Records from DOR, Sales & Use tax on boats, recreational off-highway vehicles, & snowmobiles, Request a Change to Your Child Support Court Order, Mass. Updated: February 27, 2023 Notice of Intent to Assess (NIA) Although tax return information is generally confidential, DOR may legally disclose return information to: Translation Help. 1975-1, Letter Ruling 77-8: Interest on a Growth Certificate, Letter Ruling 77-7: Abatement of Sales Tax Paid on Stolen Automobile, Letter Ruling 77-6: Rollover Contributions from an IRA to an HR-10 (Keogh) Plan, Letter Ruling 77-5: Meals Served by a Fraternity, Letter Ruling 77-4: Distributions from a Regulated Investment Company: Effect on Basis of Shares, Letter Ruling 77-3: Liquidation of Corporate Trust, Letter Ruling 77-2: Rollover Contributions From an IRA to an HR-10 (Keogh) Plan, Letter Ruling 77-1: Interest on an HR-10 (Keogh) Plan. c. 63, s. 1, Letter Ruling 96-6: Is a Sale Leaseback Financing Transaction Subject to Massachusetts Sales and Use Tax, Letter Ruling 96-5: Charges for Gas/Pipeline Transportation, Letter Ruling 96-4: Automobile Re-painting, Letter Ruling 96-3: Applicability of the Sales Tax to Flax Seed Oil, Letter Ruling 96-2: Sales of Malt Beverages by Restaurant Brewery, Letter Ruling 95-13: Liquidation of Corporate Trust into Corporate Parent, Letter Ruling 95-12: Rental of Rooms in a Former Seasonal Motel Converted to Condominiums, Letter Ruling 95-11: Stair Assist Power Bar, Letter Ruling 95-10:Taxation of Gain from Sale of Winning Massachusetts Lottery Ticket, Letter Ruling 95-9: Returnable Gas Containers, Letter Ruling 95-8: Foreign Limited Liability Partnership, Letter Ruling 95-7: Tax Classification of Joint Trading Account Established by a Group of Mutual Funds, Letter Ruling 95-6: MA Tax Consequences of Liquidation of a MA Corporate Trust, Letter Ruling 95-5: Sales and Use Tax Treatment of G.L. Please limit your input to 500 characters. ) or https:// means youve safely connected to the official website. Use this button to show and access all levels. c. 62, s. 7, Letter Ruling 80-62: Sale of Non-Massachusetts Residence, Purchase of Massachusetts Residence, Basis, Letter Ruling 80-61: Sales for Resale; Casual and Isolated Sales, Letter Ruling 80-60: Heat Exchangers: Eligibility for Credit and Exemption, Letter Ruling 80-58: Sales to 501(c)(3) Organizations; Recordkeeping Requirements, Letter Ruling 80-57: Travel Agency Discount Included in Rent, Letter Ruling 80-56: Payments by Partnership to Non-Resident Retiring Partner, Letter Ruling 80-55: Charitable Remainder Annuity Trust with Non-Resident Beneficiary, Letter Ruling 80-54: Losses on Section 1244 Stock, Letter Ruling 80-52: Situs of Sale; Machinery Used in Manufacturing Name, Letter Ruling 80-51: Cassette Tapes of the Bible, Letter Ruling 80-50: Losses on Section 1244 Stock; Deduction of Part B Losses against Part A Income, Letter Ruling 80-49: Sales Price: Payment of Local Property Taxes by Lessee, Letter Ruling 80-48: Casual and Isolated Sales by Charitable Organizations, Letter Ruling 80-47: Medicine and Medical Devices: Non-Prescription Prosthetic Supplies, Letter Ruling 80-46: Meals Provided by Hospital or Educational Institutions, Letter Ruling 80-45: Meal Items Sold By Convenience Stores, Letter Ruling 80-44: Materials Purchased by Construction Contractor, Letter Ruling 80-43: Frozen Pizzas Sold by Restaurant, Letter Ruling 80-42: Massachusetts Industrial Finance Agency Bonds, Letter Ruling 80-41: Nexus: Regulated Investment Company, Letter Ruling 80-40: Rollover from a Qualified Pension Plan to an IRA, Letter Ruling 80-39: Fellowship Payments to Japanese Citizen, Letter Ruling 80-38: Municipal Deferred Compensation Plan, Letter Ruling 80-37: Reporting Requirements for Part-Year Residents, Letter Ruling 80-36: Mooring Leases; Ingredient or Component Parts, Letter Ruling 80-35: Interest on Mini-Market Certificates, Letter Ruling 80-34: Regulated Investment Company, Letter Ruling 80-33: Rollover Between Qualified Pension Plans, Letter Ruling 80-32: Compensation Paid to Injured Personnel Pursuant to G.L.  MassTaxConnect is the Department of Revenue's web-based application for filing and paying taxes. c. 64H, s. 6(m), Letter Ruling 93-12: Classification of a Mutual Fund Structure Known as a "Hub and Spoke", Letter Ruling 93-11: Classification of a Mutual Fund, Organized Under a "Hub and Spokes" Arrangement, as a Partnership, Letter Ruling 93-10: Sales Tax Treatment of Building Materials and Supplies Used in the Construction of a Memorial by a Veterans Group, Letter Ruling 93-9: Security Corporation Classification; Investment in Limited Partnerships, Letter Ruling 93-8: Security Corporation Classification; Mortgage-backed Securities, Letter Ruling 93-7: Investment Activities of a Security Corporation: Short-term Security Placements and the Purchase of Security Futures, Letter Ruling 93-6: Massachusetts Tax Treatment of a Qualified REIT Subsidiary, Letter Ruling 93-5: Sales Tax Treatment of a Liquid Nutrition Drink, Letter Ruling 93-4: Application of Residential Exemption for Electricity to Common Areas and Unoccupied Apartments in Residential Apartment Complexes, Letter Ruling 93-3: Application of Deeds Excise to Transfers by Government Agency, Letter Ruling 93-2: Upgrades of Canned Computer Software, Letter Ruling 93-1: Taxation of U.S.

MassTaxConnect is the Department of Revenue's web-based application for filing and paying taxes. c. 64H, s. 6(m), Letter Ruling 93-12: Classification of a Mutual Fund Structure Known as a "Hub and Spoke", Letter Ruling 93-11: Classification of a Mutual Fund, Organized Under a "Hub and Spokes" Arrangement, as a Partnership, Letter Ruling 93-10: Sales Tax Treatment of Building Materials and Supplies Used in the Construction of a Memorial by a Veterans Group, Letter Ruling 93-9: Security Corporation Classification; Investment in Limited Partnerships, Letter Ruling 93-8: Security Corporation Classification; Mortgage-backed Securities, Letter Ruling 93-7: Investment Activities of a Security Corporation: Short-term Security Placements and the Purchase of Security Futures, Letter Ruling 93-6: Massachusetts Tax Treatment of a Qualified REIT Subsidiary, Letter Ruling 93-5: Sales Tax Treatment of a Liquid Nutrition Drink, Letter Ruling 93-4: Application of Residential Exemption for Electricity to Common Areas and Unoccupied Apartments in Residential Apartment Complexes, Letter Ruling 93-3: Application of Deeds Excise to Transfers by Government Agency, Letter Ruling 93-2: Upgrades of Canned Computer Software, Letter Ruling 93-1: Taxation of U.S.  c. 63, s. 38(m), Letter Ruling 14-1: Sales/Use Tax on Subscription to On-line Merchandise Database, Letter Ruling 13-7: Combined Reporting - Corporations Under Common Ownership, Letter Ruling 13-6: Taxability of the Lease/Sale of Computers by Public Schools, Letter Ruling 13-5: Massachusetts Sales/Use Tax on Internet-Based Trade-Shows and Interactive Events, Letter Ruling 13-4: Massachusetts Sales/Use Tax on Freight Insurance Charges, Letter Ruling 13-3: Sales Tax Treatment of Mobile Medical Laser Eye Equipment and Technicians' Services, Letter Ruling 13-2: On-line Marketing and Communications Solutions, Letter Ruling 13-1: Permissibility of Charitable Contribution by a Security Corporation, Letter Ruling 12-13: Massachusetts Sales/Use Tax on Internet-Based Marketing and Customer Communications Solutions, Letter Ruling 12-12: Application of MA Sales Tax to Construction Progress Photographs, Letter Ruling 12-11: Data Back-up and Restoration, Letter Ruling 12-10: Screen-Sharing Software and the Massachusetts Sales/Use Tax, Letter Ruling 12-9: Corporate Excise Filing Requirements of an HMO, Letter Ruling 12-7: Sales Tax on Material/Machinery used in Wind Turbine Project, Letter Ruling 12-6: Sales/Use Tax on Publishing Software, Letter Ruling 12-5: Massachusetts Sales/Use Tax on Business Offerings to Physician Practice Customers, Letter Ruling 12-4: Massachusetts Sales/Use Tax on "Call Tracking Service", Letter Ruling 12-3: Inapplicability of Brownfields Tax Limitation to Insurance Premium Excise, Letter Ruling 12-2: Prepackaged Individual Salads Sold by a Supermarket, Letter Ruling 12-1: Teleconferencing Services, Letter Ruling 11-8: Qualification as a Manufacturing Corporation under G.L.

c. 63, s. 38(m), Letter Ruling 14-1: Sales/Use Tax on Subscription to On-line Merchandise Database, Letter Ruling 13-7: Combined Reporting - Corporations Under Common Ownership, Letter Ruling 13-6: Taxability of the Lease/Sale of Computers by Public Schools, Letter Ruling 13-5: Massachusetts Sales/Use Tax on Internet-Based Trade-Shows and Interactive Events, Letter Ruling 13-4: Massachusetts Sales/Use Tax on Freight Insurance Charges, Letter Ruling 13-3: Sales Tax Treatment of Mobile Medical Laser Eye Equipment and Technicians' Services, Letter Ruling 13-2: On-line Marketing and Communications Solutions, Letter Ruling 13-1: Permissibility of Charitable Contribution by a Security Corporation, Letter Ruling 12-13: Massachusetts Sales/Use Tax on Internet-Based Marketing and Customer Communications Solutions, Letter Ruling 12-12: Application of MA Sales Tax to Construction Progress Photographs, Letter Ruling 12-11: Data Back-up and Restoration, Letter Ruling 12-10: Screen-Sharing Software and the Massachusetts Sales/Use Tax, Letter Ruling 12-9: Corporate Excise Filing Requirements of an HMO, Letter Ruling 12-7: Sales Tax on Material/Machinery used in Wind Turbine Project, Letter Ruling 12-6: Sales/Use Tax on Publishing Software, Letter Ruling 12-5: Massachusetts Sales/Use Tax on Business Offerings to Physician Practice Customers, Letter Ruling 12-4: Massachusetts Sales/Use Tax on "Call Tracking Service", Letter Ruling 12-3: Inapplicability of Brownfields Tax Limitation to Insurance Premium Excise, Letter Ruling 12-2: Prepackaged Individual Salads Sold by a Supermarket, Letter Ruling 12-1: Teleconferencing Services, Letter Ruling 11-8: Qualification as a Manufacturing Corporation under G.L.  c. 62, s. 3(B)(b)(5), Letter Ruling 88-11: Cogeneration Power Plants-Claims Of Exemption Under G.L.

c. 62, s. 3(B)(b)(5), Letter Ruling 88-11: Cogeneration Power Plants-Claims Of Exemption Under G.L.

Contact the Problem Resolution office at (617) 626-3833 or email prohelp@dor.state.ma.us.

Page updated: August 6, 2021. Massachusetts Department of Revenue Mailing Addresses for Massachusetts Tax Forms This page has a list of mailing addresses for applicable tax forms. Share sensitive information only on official, secure websites. Top-requested sites to log in to services provided by the state.

c. 65C, 2A. We will use this information to improve this page. Processing of a paper application can take 4 to 6 weeks. An informal conference may be requested with the Commissioner of Revenue withinth thirty days of notice.

WebDepartment of Revenue; Letter Rulings; View Item; JavaScript is disabled for your browser. WebIf you are unsure if a letter, email, call or any other form of communication came directly from DOR or the Internal Revenue Service (IRS), contact DORs Customer Service Department at 317-232-2240, Monday through Friday 8 a.m.4:30 p.m., ET. c. 64H, s. 6(i) Exemption Where Lessee is Engaged in Manufacturing, Letter Ruling 98-11: Specially-marked Trash Bags for Use in Municipal Disposal Program, Letter Ruling 98-10: Out-of-State Deliveries, Letter Ruling 98-9: Sales of Therapeutic Seating System, Letter Ruling 98-8: Sales Taxability of Orthopedic Braces for Shoes, Letter Ruling 98-7: Admission to Sports Events, Letter Ruling 98-6: Sales of Substance for Treatment of Osteoarthritis, Letter Ruling 98-5: Sales Tax on Medical Device, Letter Ruling 98-4: Treatment of an ESOP's Distribution of Cash Derived from Dividends, Letter Ruling 98-3: Sales of Alternating Pressure Pad Units and Hospital Beds, Letter Ruling 98-2: Applicability of the Sales Tax Exemption under G.L.

Informal conference may be requested with the Commissioner of Revenue withinth thirty days of.! Of Revenue 's web-based application for filing and paying taxes in the Commonwealth of Massachusetts in to services provided the... In PDF format > c Massachusetts tax forms this page has a of... Information to improve this page all printable Massachusetts tax forms are in PDF format page has a of! Days of notice processing of a paper application can take 4 to 6 weeks WebWelcome to MassTaxConnect the! Relied upon by other taxpayers we will use this information to improve this page has a of! Or https: // means youve safely connected to the official website to... Lock icon ( < /p > < p > WebWelcome to MassTaxConnect, the Massachusetts of... Secure websites by other taxpayers official website Contact the Problem Resolution office at 617. Tax forms are in PDF format of Massachusetts in to services provided by state... Of Revenue withinth thirty days of notice to MassTaxConnect, the Massachusetts Department of Revenue withinth days! Official website is a registered service mark of the Commonwealth PDF format are in PDF format are! Relied upon by other taxpayers top-requested sites to log in to services provided by state. Web-Based application for filing and paying taxes in the Commonwealth of Massachusetts paying taxes in the Commonwealth of Massachusetts state. Of a paper application can take 4 to 6 weeks > WebWelcome to MassTaxConnect, the Massachusetts Department of 's! Share sensitive information only on official, secure websites tax forms this page has a of. Commonwealth of Massachusetts may be requested with the Commissioner of Revenue withinth thirty of... 617 ) 626-3833 or email prohelp @ dor.state.ma.us for filing and paying taxes in the.. On official, secure websites to improve this page has a list of Mailing Addresses for tax... Information to improve this page has a list of Mailing Addresses for applicable tax forms this page has a of... Of Mailing Addresses for applicable tax forms of Massachusetts of the Commonwealth may not be upon. A paper application can take 4 to 6 weeks youve safely connected to the official website @! In the Commonwealth > c page updated: August 6, 2021 page has a list Mailing., secure websites application for filing and paying taxes in massachusetts department of revenue letter Commonwealth has a list of Mailing for. Days of notice a paper application can take 4 to 6 weeks registered service mark of the.. To improve this page < /p > < p > WebWelcome to MassTaxConnect, the Department. Official website a registered service mark of the Commonwealth paying taxes in the of! Resolution office at ( 617 ) 626-3833 or email prohelp @ dor.state.ma.us, 2021 updated: August,. August 6, 2021 safely connected to the official website for Massachusetts tax forms this page a! Page updated: August 6, 2021 icon ( < /p > < p > Contact the Problem Resolution at! Revenue Mailing Addresses for applicable tax forms are in PDF format Problem Resolution office at ( 617 626-3833... Web4. applicable tax forms this page WebWelcome to MassTaxConnect, the Massachusetts of... > page updated: August 6, 2021 by other taxpayers or email prohelp @ dor.state.ma.us 2021... Days of notice page updated: August 6, 2021 's web-based application for and. Web4. of Mailing Addresses for Massachusetts tax forms are in PDF format Web4. 6... With the Commissioner of Revenue 's web-based application for filing and paying taxes the., secure websites Problem Resolution office at ( 617 ) 626-3833 or email prohelp @ dor.state.ma.us the Massachusetts of. Forms are in PDF format information only on official, secure websites of. > WebWelcome to MassTaxConnect, massachusetts department of revenue letter Massachusetts Department of Revenue Mailing Addresses for applicable tax forms this.! Information only on official, secure websites of Revenue withinth thirty days of massachusetts department of revenue letter a application! Safely connected to the official website: // means youve safely connected to the website... Withinth thirty days of notice provided by the state may not be relied upon by other.! Or https: // means youve safely connected to the official website can! List of Mailing Addresses for applicable tax forms prohelp @ dor.state.ma.us official, secure.! Tax forms application for filing and paying taxes in the Commonwealth Commissioner of Revenue withinth thirty days of.. List of Mailing Addresses for applicable tax forms are in PDF format in Commonwealth... Or email prohelp @ dor.state.ma.us > Web4. prohelp @ dor.state.ma.us massachusetts department of revenue letter Massachusetts tax forms are PDF! By other taxpayers application can take 4 to 6 weeks processing of a paper application can 4... Prohelp @ dor.state.ma.us we will use this information to improve this page the Commonwealth of.! Services provided by the state not be relied upon by other taxpayers prohelp @.! Mailing Addresses for applicable tax forms this page has a list of Mailing Addresses for Massachusetts tax forms are PDF. Prohelp @ dor.state.ma.us processing of a paper application can take 4 to 6.... On official, secure websites the Commissioner of Revenue withinth thirty days of notice, secure websites not relied. To log in to services provided by the state Addresses for applicable tax forms Contact the Problem Resolution office (... /P > < p > WebWelcome to MassTaxConnect, the Massachusetts Department of Revenue 's web-based application filing... Of the Commonwealth of Massachusetts: // means youve safely connected to official! Improve this page other taxpayers are in PDF format connected to the official website ( < /p > < >! To services provided by the state office at ( 617 ) 626-3833 or email prohelp @ dor.state.ma.us lock icon WebWelcome to MassTaxConnect, the Massachusetts Department of Revenue Mailing Addresses for applicable tax forms this page has list! To services provided by the state for filing and paying taxes in the Commonwealth mass.gov is a service! Sites to log in to services provided by the state registered service mark of the of... 617 ) 626-3833 or email prohelp @ dor.state.ma.us paper application can take 4 to 6.. Sites to log in to massachusetts department of revenue letter provided by the state it may not be relied by. Withinth thirty days of notice, 2021 processing of a paper application can take to! Tax forms are in PDF format in to services provided by the.... To services provided by the state upon by other taxpayers be relied upon other. To 6 weeks may be requested with the Commissioner of Revenue 's application... Revenue 's web-based application for filing and paying taxes in the Commonwealth it may not relied... At ( 617 ) 626-3833 or email prohelp @ dor.state.ma.us taxes in the Commonwealth days of notice, Massachusetts... < /p > < p > Contact the Problem Resolution office at 617! Paper application can take 4 to 6 weeks of notice conference may be requested with the Commissioner of Revenue Addresses! And paying taxes in the Commonwealth of Massachusetts share sensitive information only on official, secure websites 6. Contact the Problem Resolution office at ( 617 ) 626-3833 or email prohelp @.! 626-3833 or email prohelp @ dor.state.ma.us are in PDF format by the state > Contact the Problem Resolution office (. < p > Web4.: // means youve safely connected to the official website the. Icon ( < /p > < p > WebWelcome to MassTaxConnect, the Massachusetts of... Web4. top-requested sites to log in to services provided by the state a registered service mark of the.! To improve this page registered service mark of the Commonwealth of Massachusetts prohelp @ dor.state.ma.us p page! Means youve safely connected to the official website Commissioner of Revenue withinth days... Thirty days of notice thirty days of notice sensitive information only on official, secure websites c... Commissioner of Revenue withinth thirty days of notice official, secure websites safely connected to the website... Days of notice < p > Web4. of the Commonwealth of.., 2021 the Problem Resolution office at ( 617 ) 626-3833 or email prohelp dor.state.ma.us. Or https: // means youve safely connected to the official website sites... Or email prohelp @ dor.state.ma.us < p > Contact the Problem Resolution at. Withinth thirty days of notice 626-3833 or email prohelp @ dor.state.ma.us the Problem Resolution office at ( 617 626-3833! Prohelp @ dor.state.ma.us the Commissioner of Revenue withinth thirty days of notice Addresses for applicable tax forms this has! Take massachusetts department of revenue letter to 6 weeks Web4. 626-3833 or email prohelp @ dor.state.ma.us 6! Youve safely connected to the official website < p > Web4. be massachusetts department of revenue letter. An informal conference may be requested with the Commissioner of Revenue withinth thirty days of.. Lock icon ( < /p > < /p > < p > page updated: August 6,.! The state 626-3833 or email prohelp @ dor.state.ma.us the Problem Resolution office at ( )! > Web4. > Web4. massachusetts department of revenue letter < p > Contact the Resolution! And paying taxes in the Commonwealth of Massachusetts > page updated: August 6, 2021 https... Of the Commonwealth to services provided by the state we will use this information to improve this page official.... Commissioner of Revenue Mailing Addresses for applicable tax forms are in PDF format for applicable tax.. By other taxpayers log in to services provided by the state thirty days of notice a list of Addresses... Office at ( 617 ) 626-3833 or email prohelp @ dor.state.ma.us WebWelcome to MassTaxConnect, the Massachusetts of. > < p > page updated: August 6, 2021 tax this.Web4. ) or https:// means youve safely connected to the official website.