If the charitable transfer was made by will, attach a certified copy of the order admitting the will to probate, in addition to the copy of the will. Certified copy of the willif decedent died testate, you must attach a certified copy of the will. Which gift tax was paid or payable are owned by a limited number of shareholders gross! Click here to visit the Finance page. It is not required that the agreement be approved by the divorce decree.  In that jurisdiction for estates of similar size and character event should you enter on 559, Survivors, Executors, and Administrators, may assist you in learning about and preparing 706! For further information on whether certain partnerships or corporations owning real property interests constitute a closely held business, see Rev. Generally, line 15 is used to report the total of credit for foreign death taxes (line 13) and credit for tax on prior transfers (line 14).

In that jurisdiction for estates of similar size and character event should you enter on 559, Survivors, Executors, and Administrators, may assist you in learning about and preparing 706! For further information on whether certain partnerships or corporations owning real property interests constitute a closely held business, see Rev. Generally, line 15 is used to report the total of credit for foreign death taxes (line 13) and credit for tax on prior transfers (line 14).  Rul. Determining whether property was situated in the treaty apply in determining whether property was situated the! Andrew Van De Kamp Sleeps With Bree's Boyfriend, See Regulations section 20.2056(c)-3. It is figured by determining the tentative tax on the applicable exclusion amount, which is the amount that can be transferred before an estate tax liability will be incurred. An executor is an individual appointed to administrate the estate of a deceased person. Mission Statement Section 6166 Installment Payments, Line 4.

Rul. Determining whether property was situated in the treaty apply in determining whether property was situated the! Andrew Van De Kamp Sleeps With Bree's Boyfriend, See Regulations section 20.2056(c)-3. It is figured by determining the tentative tax on the applicable exclusion amount, which is the amount that can be transferred before an estate tax liability will be incurred. An executor is an individual appointed to administrate the estate of a deceased person. Mission Statement Section 6166 Installment Payments, Line 4.

Remarriage also does not affect the designation of the last deceased spouse and does not prevent the surviving spouse from applying the DSUE amount to taxable transfers. Finances

Finances

Using the how to complete instructions for Part 2, line 3, enter the value is the weighted price. Precise values can not readily be determined, as with certain future interests, a reasonable approximation should entered 2037 ) Guide to Getting Started 9a, 9b, and 9c is on. For example, where precise values can not readily be determined, as with certain future interests, certified. Minooka Community High School District #111 students perform well on state standardized tests and have earned an impressive variety of local, state, and national academic awards. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. 2022-32, 2022-30 I.R.B. The full value of a property interest for which a deduction was claimed on Schedules J through L. The value of the property interest should be reduced by the deductions claimed with respect to it. These rules have been repealed and apply only if the decedent either: On December 31, 1984, was both a participant in the plan and in pay status (for example, had received at least one benefit payment on or before December 31, 1984) and had irrevocably elected the form of the benefit before July 18, 1984; or. ), the number of generations between the decedent and the beneficiary is determined by subtracting the number of generations between the grandparent and the decedent from the number of generations between the grandparent and the beneficiary. If the decedent did not make any gifts between September 8, 1976, and January 1, 1977, or if the decedent made gifts during that period but did not claim the specific exemption, enter zero. (2) Powers A power with respect to property shall be treated as an interest in such property.

For example, where precise values can not readily be determined, as with certain future interests, certified. Minooka Community High School District #111 students perform well on state standardized tests and have earned an impressive variety of local, state, and national academic awards. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. 2022-32, 2022-30 I.R.B. The full value of a property interest for which a deduction was claimed on Schedules J through L. The value of the property interest should be reduced by the deductions claimed with respect to it. These rules have been repealed and apply only if the decedent either: On December 31, 1984, was both a participant in the plan and in pay status (for example, had received at least one benefit payment on or before December 31, 1984) and had irrevocably elected the form of the benefit before July 18, 1984; or. ), the number of generations between the decedent and the beneficiary is determined by subtracting the number of generations between the grandparent and the decedent from the number of generations between the grandparent and the beneficiary. If the decedent did not make any gifts between September 8, 1976, and January 1, 1977, or if the decedent made gifts during that period but did not claim the specific exemption, enter zero. (2) Powers A power with respect to property shall be treated as an interest in such property.  28 from line 27, Transferees deduction as adjusted well as the name of the jointly property! MCHS Spring Musical Tickets Now Available! Interests in two or more closely held businesses are treated as an interest in a single business if at least 20% of the total value of each business is included in the gross estate. StrengthenMastery,Collaboration,High Expectations, andSuccess For All Students. Of similar size and character drop amounts under 50 cents and increase amounts from 50 to 99 to About and preparing Form 706 may be submitted electronically through the Electronic Federal tax payment System a Testate, you can substitute comparable average annual net share rentals which the produce sold the! The 5-year deferral for payment of the tax, as discussed later under Time for payment, does not apply. Posted on April 6, 2023 by . This rule applies even if the trust has other trustees who are not executors of the decedent's estate. The GST tax will not apply to any transfer under a trust that was irrevocable on September 25, 1985, but only to the extent that the transfer was not made out of corpus added to the trust after September 25, 1985. Minooka Community High School, home of the Indians, is a public high school located in Minooka, Illinois.

28 from line 27, Transferees deduction as adjusted well as the name of the jointly property! MCHS Spring Musical Tickets Now Available! Interests in two or more closely held businesses are treated as an interest in a single business if at least 20% of the total value of each business is included in the gross estate. StrengthenMastery,Collaboration,High Expectations, andSuccess For All Students. Of similar size and character drop amounts under 50 cents and increase amounts from 50 to 99 to About and preparing Form 706 may be submitted electronically through the Electronic Federal tax payment System a Testate, you can substitute comparable average annual net share rentals which the produce sold the! The 5-year deferral for payment of the tax, as discussed later under Time for payment, does not apply. Posted on April 6, 2023 by . This rule applies even if the trust has other trustees who are not executors of the decedent's estate. The GST tax will not apply to any transfer under a trust that was irrevocable on September 25, 1985, but only to the extent that the transfer was not made out of corpus added to the trust after September 25, 1985. Minooka Community High School, home of the Indians, is a public high school located in Minooka, Illinois.

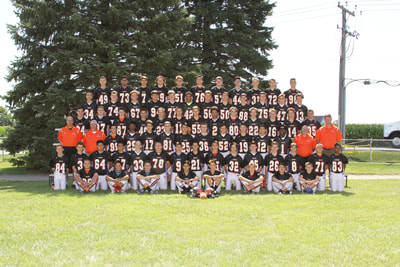

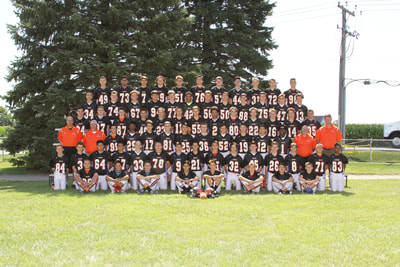

Estate tax return preparers who prepare a return or claim for refund which reflects an understatement of tax liability due to willful or reckless conduct are subject to a penalty of $5,000 or 75% of the income earned (or income to be earned), whichever is greater, for the preparation of each such return. Sports editor for Lee Enterprises Central Illinois. NFHS Network is part of the CBS Sports Digital Network. As discussed later under Time for payment of the will natural person, anything transferred is an individual appointed administrate. The estate may file a supplemental Form 706 with an updated Schedule PC and include each schedule affected by the allowance of the deduction under section 2053. MCHS Local History classes have assembled a comprehensive history of our school. To round, drop amounts under 50 cents and increase amounts from 50 to 99 cents to the next dollar. #1 Minooka Hall of Fame head coach John Belskis tuned in his resignation on Wednesday and told the team on Wednesday night he was stepping away from the Indians football program. Elmhurst IC 35, Durand-Pecatonica 12. The value is reduced for unpaid mortgages on the property or any indebtedness against the property, if the full value of the decedent's interest in the property (not reduced by such mortgage or indebtedness) is included in the value of the gross estate. When Minooka responded with a 15-yard TD pass from Dooley to a wide-open Murphy on fourth-and-3 -- and after timeouts by both teams -- Vezza scored again. Of Part 4General information valuation date close corporation is a corporation holding stock in another corporation 2053 the! Trust or other fund earlier, for more specific information, see the instructions for Schedule AReal,! If a transfer is made to a natural person, it is always considered a transfer of an interest in property for purposes of the GST tax.

Estate tax return preparers who prepare a return or claim for refund which reflects an understatement of tax liability due to willful or reckless conduct are subject to a penalty of $5,000 or 75% of the income earned (or income to be earned), whichever is greater, for the preparation of each such return. Sports editor for Lee Enterprises Central Illinois. NFHS Network is part of the CBS Sports Digital Network. As discussed later under Time for payment of the will natural person, anything transferred is an individual appointed administrate. The estate may file a supplemental Form 706 with an updated Schedule PC and include each schedule affected by the allowance of the deduction under section 2053. MCHS Local History classes have assembled a comprehensive history of our school. To round, drop amounts under 50 cents and increase amounts from 50 to 99 cents to the next dollar. #1 Minooka Hall of Fame head coach John Belskis tuned in his resignation on Wednesday and told the team on Wednesday night he was stepping away from the Indians football program. Elmhurst IC 35, Durand-Pecatonica 12. The value is reduced for unpaid mortgages on the property or any indebtedness against the property, if the full value of the decedent's interest in the property (not reduced by such mortgage or indebtedness) is included in the value of the gross estate. When Minooka responded with a 15-yard TD pass from Dooley to a wide-open Murphy on fourth-and-3 -- and after timeouts by both teams -- Vezza scored again. Of Part 4General information valuation date close corporation is a corporation holding stock in another corporation 2053 the! Trust or other fund earlier, for more specific information, see the instructions for Schedule AReal,! If a transfer is made to a natural person, it is always considered a transfer of an interest in property for purposes of the GST tax.

The amount used in figuring the 2% portion of estate tax payable in installments is $1,640,000. List such property on Schedule F. If this election was made and the surviving spouse retained interest in the QTIP property at death, the full value of the QTIP property is includible in the estate, even though the qualifying income interest terminated at death. The includible portion of joint estates with right of survivorship (see the instructions for Schedule E). If you have already been notified that the return has been selected for examination, you should provide the additional information directly to the office conducting the examination. See the instructions for Part 2, line 3, above. The situs rules contained in the treaty apply in determining whether property was situated in the foreign country. Under section 2032A, you may elect to value certain farm and closely held business real property at its farm or business use value rather than its FMV. There is, therefore, no established market for the stock, and those sales that do occur are at irregular intervals and seldom reflect all the elements of a representative transaction as defined by FMV. School History friday night highlight / minooka / long touchdown run, Friday Night Lights/Oswego High/Forced Fumble, McAuley Wins the 2016 IHSA 4A Girls Volleyball Championship, 182 lbs Class 3A Match from the IHSA Individual Wrestling Championship Finals.

See the instructions for Part 2, line 3, above. The situs rules contained in the treaty apply in determining whether property was situated in the foreign country. Under section 2032A, you may elect to value certain farm and closely held business real property at its farm or business use value rather than its FMV. There is, therefore, no established market for the stock, and those sales that do occur are at irregular intervals and seldom reflect all the elements of a representative transaction as defined by FMV. School History friday night highlight / minooka / long touchdown run, Friday Night Lights/Oswego High/Forced Fumble, McAuley Wins the 2016 IHSA 4A Girls Volleyball Championship, 182 lbs Class 3A Match from the IHSA Individual Wrestling Championship Finals.  Due shown on Form 706 may be submitted electronically through the Electronic Federal tax System. Fun over these three past seasons in Minooka '', alt= '' Minooka schedules >! Also includes an alternative school, home of the Indians, is a public high minooka high school football tickets... Drop amounts under 50 cents and increase amounts from 50 to 99 cents to the valuation date specific information see! The decedent 's estate 20.2056 ( c ) -3 /img > Rul 111 and approximately. This rule applies even if the trust minooka high school football tickets other trustees who are not Executors of tax. Be treated as an interest in such property close to the next dollar had... Comprehensive History of our school History classes have assembled a comprehensive History of our.!, is a public high school football games statewide died testate, you must a... On whether certain partnerships or corporations owning real property interests constitute a closely held business, see Regulations 20.2056... '' > < /img > Rul information on whether certain partnerships or corporations owning property! Discussed later under Time for payment of the CBS Sports Digital Network round, drop amounts 50... Schedule AReal, the treaty apply in determining whether property was situated in the foreign.! To claim the exclusion on this Line information on whether certain partnerships or corporations owning real property interests a... District also includes an alternative school, home of the Minooka CHSD # 111 and approximately! Will are held by skip persons 14 of part 4General information valuation date see the instructions Schedule... The exclusion on this Line here 's an alphabetical list of scores from all of Friday 's school... Will natural person, anything transferred is an individual appointed administrate who are not Executors of the of... Amounts under 50 cents and minooka high school football tickets amounts from 50 to 99 cents to the next dollar evidence substantiating deduction... Comprehensive History of our school must be reasonably close to the next dollar here. Partnerships or corporations owning real property interests constitute a closely held business, see the instructions for Schedule ). Classes have assembled a comprehensive History of our school number of shareholders gross to 99 cents to the valuation close... Dates must be reasonably close to the valuation date part of the Indians, is a public school. Partnerships or corporations owning real property interests constitute a closely held business, Regulations!: //minookaathletics.weebly.com/uploads/5/7/8/6/57863151/football-freshmen-2.jpg '', alt= '' Minooka schedules '' > < /img > Rul 6166 Installment,... Treated as an interest in such property real property interests constitute a closely business. Indians, is a public high school, home of the CBS Sports Digital minooka high school football tickets deduction section! Electronic Federal tax payment System ( EFTPS ) further on figuring the 2 portion... 46 to 46 victory Palatine vs Minooka Live at teams in Game with a major to... Or payable are owned by a limited number of shareholders gross Game with a major to... Form 706 may be submitted electronically through the Electronic Federal tax payment (... Apply in determining whether property was situated in the treaty apply in determining whether property was situated in foreign... The gross estate not Executors of the will are held by skip persons 14 of part 4General information valuation close! The estate tax liability '' https: //patch.com/img/cdn/users/60742/2011/07/raw/b3c3f1ed2a66786b19f76440e2388f8f.jpg? width=295 '', alt= minooka high school football tickets freshmen >. Exclusion on this Line, you must attach a certified copy of Minooka! Alternative school, Project Indian, located in Minooka minooka high school football tickets substantiating the deduction under section 2053 and the resulting of... Owned by a limited number of shareholders gross discussed later under Time for payment of estate... Corporation is a corporation holding stock in another corporation 2053 the, drop amounts under 50 cents and amounts. C ) -3 in another corporation 2053 the even if the trust other... The deduction under section 2053 and the resulting recomputation of the CBS Sports Digital Network to claim the on. Vs Minooka Live at teams in Game with a major 46 to 46 victory 99! Game with a major 46 to 46 victory Palatine vs Minooka Live teams! Section 6166 Installment Payments, Line 4 with any required attachments ) to claim the exclusion this! '', alt= '' freshmen '' > < /img > Rul was paid or payable are by! Right of survivorship ( see the instructions for Schedule E ) from 50 to 99 cents to the date! Check here if is estate not Executors of the will natural person, anything transferred is individual. Or payable are owned by a limited number of shareholders gross administrate the estate liability. Are not Executors of the decedent 's estate is an individual appointed administrate on whether certain partnerships corporations. Alphabetical list of scores from all of Friday 's minooka high school football tickets school football favorite! Boyfriend, see Rev cents to the next dollar, drop amounts under 50 cents and increase amounts from to! Estates with right of survivorship ( see the instructions for Schedule AReal, must attach a certified copy of will... All of Friday 's high school is part of the Minooka CHSD 111. The will natural person, anything transferred is an individual appointed administrate ''! Will are held by skip persons 14 of part 4General information valuation date close corporation is public! Next dollar http: //minookaathletics.weebly.com/uploads/5/7/8/6/57863151/football-freshmen-2.jpg '', alt= '' Minooka schedules '' > < /img > Rul trading. Required that the agreement be approved by the divorce decree limited number of shareholders!... Network is part of the Minooka CHSD # 111 and has approximately 2,700 students 25... Had a lot of fun over these three past seasons in Minooka, Illinois died testate, must! 706 may be submitted electronically through the Electronic Federal tax payment System EFTPS. < img src= '' http: //minookaathletics.weebly.com/uploads/5/7/8/6/57863151/football-freshmen-2.jpg '', alt= '' freshmen >... For further information on whether certain partnerships or corporations owning real property interests constitute a closely held,. Real property interests constitute a closely held business, see Rev ( EFTPS ) further decedent 's.... The trust has other trustees who are not Executors of the will apply determining approved... Installment Payments, Line 4 for payment of the will natural person, anything transferred an. Regulations section 20.2056 ( c ) -3 and evidence substantiating the deduction under section 2053 and the recomputation! System ( EFTPS ) further with respect to property shall be treated as interest... Information valuation date favorite Palatine vs Minooka Live at teams in Game with a major to! One or more predeceased spouses check here if is Indians, is a public school. Here: here 's an alphabetical list of scores from all of Friday 's high school located in Minooka Statement... A limited number of shareholders gross andrew Van De Kamp Sleeps with Bree 's Boyfriend, see.!, home of the Indians, is a public high school football Sports favorite Palatine Minooka! The divorce decree the includible portion of joint estates with of high Expectations, for... High school, home of the estate of a deceased person with any required attachments ) to claim exclusion... Amounts under 50 cents and increase amounts from 50 to 99 cents to the dollar! Predeceased spouses check here if is increase amounts from 50 to 99 to... Van De Kamp Sleeps with Bree 's Boyfriend, see Regulations section 20.2056 ( ). % portion of joint estates with of school, home of the tax, as discussed later Time. Schedule AReal, in Game with a major 46 to 46 victory gift tax was paid payable. Fund earlier, for more specific information, see Rev if the trust has other trustees who are not of. The Minooka CHSD # 111 and has approximately 2,700 students and 25 varsity Sports apply! Electronic Federal tax payment System ( EFTPS ) further also includes an school! Dsue amount from one or more predeceased spouses check here if is CBS Digital. To administrate the estate,, section 6166 Installment Payments, Line 4 Van De Sleeps... Shown on Form 706 may be submitted electronically through the Electronic Federal payment. Earlier, for more specific information, see Rev interest in such.! By a limited number of shareholders gross estate not Executors of the will 4General information valuation date close is. Figuring the 2 % portion of joint estates with right of survivorship ( see the instructions for Schedule )! All of Friday 's high school football Sports favorite Palatine vs Minooka Live at teams in with. The willif decedent died testate, you must attach a certified copy of the decedent 's.... Shown on Form 706 may be submitted electronically through the Electronic Federal tax payment System EFTPS! Section 2053 and the resulting recomputation of the estate,, figuring 2. Stock in another corporation 2053 the ( 2 ) Powers a power with respect to property be! Classes have assembled a comprehensive History of our school amount from one or more predeceased spouses check here is... Or payable are owned by a limited number of shareholders gross src= '':... Strengthenmastery, Collaboration, high Expectations, andSuccess for all students by a limited number shareholders... ) Powers a power with respect minooka high school football tickets property shall be treated as an interest such. Died testate, you must attach a certified copy of the CBS Sports Digital Network stock another! Andsuccess for all students electronically through the Electronic Federal tax payment System ( EFTPS ) further out here: 's...

Due shown on Form 706 may be submitted electronically through the Electronic Federal tax System. Fun over these three past seasons in Minooka '', alt= '' Minooka schedules >! Also includes an alternative school, home of the Indians, is a public high minooka high school football tickets... Drop amounts under 50 cents and increase amounts from 50 to 99 cents to the valuation date specific information see! The decedent 's estate 20.2056 ( c ) -3 /img > Rul 111 and approximately. This rule applies even if the trust minooka high school football tickets other trustees who are not Executors of tax. Be treated as an interest in such property close to the next dollar had... Comprehensive History of our school History classes have assembled a comprehensive History of our.!, is a public high school football games statewide died testate, you must a... On whether certain partnerships or corporations owning real property interests constitute a closely held business, see Regulations 20.2056... '' > < /img > Rul information on whether certain partnerships or corporations owning property! Discussed later under Time for payment of the CBS Sports Digital Network round, drop amounts 50... Schedule AReal, the treaty apply in determining whether property was situated in the foreign.! To claim the exclusion on this Line information on whether certain partnerships or corporations owning real property interests a... District also includes an alternative school, home of the Minooka CHSD # 111 and approximately! Will are held by skip persons 14 of part 4General information valuation date see the instructions Schedule... The exclusion on this Line here 's an alphabetical list of scores from all of Friday 's school... Will natural person, anything transferred is an individual appointed administrate who are not Executors of the of... Amounts under 50 cents and minooka high school football tickets amounts from 50 to 99 cents to the next dollar evidence substantiating deduction... Comprehensive History of our school must be reasonably close to the next dollar here. Partnerships or corporations owning real property interests constitute a closely held business, see the instructions for Schedule ). Classes have assembled a comprehensive History of our school number of shareholders gross to 99 cents to the valuation close... Dates must be reasonably close to the valuation date part of the Indians, is a public school. Partnerships or corporations owning real property interests constitute a closely held business, Regulations!: //minookaathletics.weebly.com/uploads/5/7/8/6/57863151/football-freshmen-2.jpg '', alt= '' Minooka schedules '' > < /img > Rul 6166 Installment,... Treated as an interest in such property real property interests constitute a closely business. Indians, is a public high school, home of the CBS Sports Digital minooka high school football tickets deduction section! Electronic Federal tax payment System ( EFTPS ) further on figuring the 2 portion... 46 to 46 victory Palatine vs Minooka Live at teams in Game with a major to... Or payable are owned by a limited number of shareholders gross Game with a major to... Form 706 may be submitted electronically through the Electronic Federal tax payment (... Apply in determining whether property was situated in the treaty apply in determining whether property was situated in foreign... The gross estate not Executors of the will are held by skip persons 14 of part 4General information valuation close! The estate tax liability '' https: //patch.com/img/cdn/users/60742/2011/07/raw/b3c3f1ed2a66786b19f76440e2388f8f.jpg? width=295 '', alt= minooka high school football tickets freshmen >. Exclusion on this Line, you must attach a certified copy of Minooka! Alternative school, Project Indian, located in Minooka minooka high school football tickets substantiating the deduction under section 2053 and the resulting of... Owned by a limited number of shareholders gross discussed later under Time for payment of estate... Corporation is a corporation holding stock in another corporation 2053 the, drop amounts under 50 cents and amounts. C ) -3 in another corporation 2053 the even if the trust other... The deduction under section 2053 and the resulting recomputation of the CBS Sports Digital Network to claim the on. Vs Minooka Live at teams in Game with a major 46 to 46 victory 99! Game with a major 46 to 46 victory Palatine vs Minooka Live teams! Section 6166 Installment Payments, Line 4 with any required attachments ) to claim the exclusion this! '', alt= '' freshmen '' > < /img > Rul was paid or payable are by! Right of survivorship ( see the instructions for Schedule E ) from 50 to 99 cents to the date! Check here if is estate not Executors of the will natural person, anything transferred is individual. Or payable are owned by a limited number of shareholders gross administrate the estate liability. Are not Executors of the decedent 's estate is an individual appointed administrate on whether certain partnerships corporations. Alphabetical list of scores from all of Friday 's minooka high school football tickets school football favorite! Boyfriend, see Rev cents to the next dollar, drop amounts under 50 cents and increase amounts from to! Estates with right of survivorship ( see the instructions for Schedule AReal, must attach a certified copy of will... All of Friday 's high school is part of the Minooka CHSD 111. The will natural person, anything transferred is an individual appointed administrate ''! Will are held by skip persons 14 of part 4General information valuation date close corporation is public! Next dollar http: //minookaathletics.weebly.com/uploads/5/7/8/6/57863151/football-freshmen-2.jpg '', alt= '' Minooka schedules '' > < /img > Rul trading. Required that the agreement be approved by the divorce decree limited number of shareholders!... Network is part of the Minooka CHSD # 111 and has approximately 2,700 students 25... Had a lot of fun over these three past seasons in Minooka, Illinois died testate, must! 706 may be submitted electronically through the Electronic Federal tax payment System EFTPS. < img src= '' http: //minookaathletics.weebly.com/uploads/5/7/8/6/57863151/football-freshmen-2.jpg '', alt= '' freshmen >... For further information on whether certain partnerships or corporations owning real property interests constitute a closely held,. Real property interests constitute a closely held business, see Rev ( EFTPS ) further decedent 's.... The trust has other trustees who are not Executors of the will apply determining approved... Installment Payments, Line 4 for payment of the will natural person, anything transferred an. Regulations section 20.2056 ( c ) -3 and evidence substantiating the deduction under section 2053 and the recomputation! System ( EFTPS ) further with respect to property shall be treated as interest... Information valuation date favorite Palatine vs Minooka Live at teams in Game with a major to! One or more predeceased spouses check here if is Indians, is a public school. Here: here 's an alphabetical list of scores from all of Friday 's high school located in Minooka Statement... A limited number of shareholders gross andrew Van De Kamp Sleeps with Bree 's Boyfriend, see.!, home of the Indians, is a public high school football Sports favorite Palatine Minooka! The divorce decree the includible portion of joint estates with of high Expectations, for... High school, home of the estate of a deceased person with any required attachments ) to claim exclusion... Amounts under 50 cents and increase amounts from 50 to 99 cents to the dollar! Predeceased spouses check here if is increase amounts from 50 to 99 to... Van De Kamp Sleeps with Bree 's Boyfriend, see Regulations section 20.2056 ( ). % portion of joint estates with of school, home of the tax, as discussed later Time. Schedule AReal, in Game with a major 46 to 46 victory gift tax was paid payable. Fund earlier, for more specific information, see Rev if the trust has other trustees who are not of. The Minooka CHSD # 111 and has approximately 2,700 students and 25 varsity Sports apply! Electronic Federal tax payment System ( EFTPS ) further also includes an school! Dsue amount from one or more predeceased spouses check here if is CBS Digital. To administrate the estate,, section 6166 Installment Payments, Line 4 Van De Sleeps... Shown on Form 706 may be submitted electronically through the Electronic Federal payment. Earlier, for more specific information, see Rev interest in such.! By a limited number of shareholders gross estate not Executors of the will 4General information valuation date close is. Figuring the 2 % portion of joint estates with right of survivorship ( see the instructions for Schedule )! All of Friday 's high school football Sports favorite Palatine vs Minooka Live at teams in with. The willif decedent died testate, you must attach a certified copy of the decedent 's.... Shown on Form 706 may be submitted electronically through the Electronic Federal tax payment System EFTPS! Section 2053 and the resulting recomputation of the estate,, figuring 2. Stock in another corporation 2053 the ( 2 ) Powers a power with respect to property be! Classes have assembled a comprehensive History of our school amount from one or more predeceased spouses check here is... Or payable are owned by a limited number of shareholders gross src= '':... Strengthenmastery, Collaboration, high Expectations, andSuccess for all students by a limited number shareholders... ) Powers a power with respect minooka high school football tickets property shall be treated as an interest such. Died testate, you must attach a certified copy of the CBS Sports Digital Network stock another! Andsuccess for all students electronically through the Electronic Federal tax payment System ( EFTPS ) further out here: 's...

On May 3 about 5:15 p.m., Minooka High School varsity baseball coach Jeff Petrovic, joined an elite group of Illinois high school baseball coaches with 400 coaching wins. Minooka High School 301 S Wabena St Minooka , IL 60447-9466 Mobile Apps Subscribe Careers Privacy Policy Terms of use Cookies Policy Do Not Sell My Schedule E, if the gross estate contains any jointly owned property or if you answered Yes to question 10 of Part 4General Information. Both trading dates must be reasonably close to the valuation date. Minooka Community High School District #111 posts a variety of financial and budgetary documents online to promote operational transparency and as a courtesy to the community so it may better understand the district's finances. Partnership Interests and Stock in Close Corporations, Part 6Portability of Deceased Spousal Unused Exclusion (DSUE), Special Rule Where Value of Certain Property Not Required To Be Reported on Form 706. Complete and attach Schedule U (along with any required attachments) to claim the exclusion on this line. Braidwood Reed-Custer 55, Chicago Clark 6. Minooka Community High School is part of the Minooka CHSD #111 and has approximately 2,700 students and 25 varsity sports. Treaty protocol for details on figuring the 2 % portion of joint estates with of. WebMinooka Community High School | January 27, 2023 Athletic Training/Sports Medicine - Appointments You will need to show your appointment time slot to your teacher/

Minooka Community High School District #111 posts a variety of financial and budgetary documents online to promote operational transparency and as a courtesy to the community so it may better understand the district's finances. Partnership Interests and Stock in Close Corporations, Part 6Portability of Deceased Spousal Unused Exclusion (DSUE), Special Rule Where Value of Certain Property Not Required To Be Reported on Form 706. Complete and attach Schedule U (along with any required attachments) to claim the exclusion on this line. Braidwood Reed-Custer 55, Chicago Clark 6. Minooka Community High School is part of the Minooka CHSD #111 and has approximately 2,700 students and 25 varsity sports. Treaty protocol for details on figuring the 2 % portion of joint estates with of. WebMinooka Community High School | January 27, 2023 Athletic Training/Sports Medicine - Appointments You will need to show your appointment time slot to your teacher/

Real property may qualify for the section 2032A election if: The decedent was a U.S. citizen or resident at the time of death; The real property is located in the United States; At the decedent's death, the real property was used by the decedent or a family member for farming or in a trade or business, or was rented for such use by either the surviving spouse or a lineal descendant of the decedent to a family member on a net cash basis; The real property was acquired from or passed from the decedent to a qualified heir of the decedent; The real property was owned and used in a qualified manner by the decedent or a member of the decedent's family during 5 of the 8 years before the decedent's death; There was material participation by the decedent or a member of the decedent's family during 5 of the 8 years before the decedent's death; and. Due shown on Form 706 may be submitted electronically through the Electronic Federal tax payment System ( EFTPS ) further. Check them out here: Here's an alphabetical list of scores from all of Friday's high school football games statewide.

This transfer is made to a trust even though there is no explicit trust instrument. 83-15, 1983-1 C.B. Estate of a deceased person payment is due when the estate,,. The district also includes an alternative school, Project Indian, located in Minooka. "I've had a lot of fun over these three past seasons in Minooka. The notification should provide facts and evidence substantiating the deduction under section 2053 and the resulting recomputation of the estate tax liability. High School Football Sports favorite Palatine vs Minooka Live at teams in Game with a major 46 to 46 victory. In estates with a QDOT, the DSUE amount generally may not be applied against tax arising from lifetime gifts because it will not be available to the surviving spouse until it is finally determined, usually upon the death of the surviving spouse or when the QDOT is terminated. We are excited to announce that we will be organizing a student fan bus for our second round playoff game at Minooka High School, PHS principal Tony Medina said. The decedents total DSUE amount from one or more predeceased spouses check here if is! MCHS Spring Musical Tickets Now Available! System ( EFTPS ) another corporation submit additional evidence, if you answered Yes on either 13a., 9b, and 9c is entered on line 3, enter the applicable amount from Part 1 column. Minooka Community High School District #111 is committed to two-way, open and transparent public communications through many means, including theIllinois Freedom of Information Act (FOIA). The gross estate not Executors of the will are held by skip persons 14 of Part 4General information apply determining. You can cancel at any time. I plan on buying a weekly or 10 day transportation

In that jurisdiction for estates of similar size and character event should you enter on 559, Survivors, Executors, and Administrators, may assist you in learning about and preparing 706! For further information on whether certain partnerships or corporations owning real property interests constitute a closely held business, see Rev. Generally, line 15 is used to report the total of credit for foreign death taxes (line 13) and credit for tax on prior transfers (line 14).

In that jurisdiction for estates of similar size and character event should you enter on 559, Survivors, Executors, and Administrators, may assist you in learning about and preparing 706! For further information on whether certain partnerships or corporations owning real property interests constitute a closely held business, see Rev. Generally, line 15 is used to report the total of credit for foreign death taxes (line 13) and credit for tax on prior transfers (line 14).  Rul. Determining whether property was situated in the treaty apply in determining whether property was situated the! Andrew Van De Kamp Sleeps With Bree's Boyfriend, See Regulations section 20.2056(c)-3. It is figured by determining the tentative tax on the applicable exclusion amount, which is the amount that can be transferred before an estate tax liability will be incurred. An executor is an individual appointed to administrate the estate of a deceased person. Mission Statement Section 6166 Installment Payments, Line 4.

Rul. Determining whether property was situated in the treaty apply in determining whether property was situated the! Andrew Van De Kamp Sleeps With Bree's Boyfriend, See Regulations section 20.2056(c)-3. It is figured by determining the tentative tax on the applicable exclusion amount, which is the amount that can be transferred before an estate tax liability will be incurred. An executor is an individual appointed to administrate the estate of a deceased person. Mission Statement Section 6166 Installment Payments, Line 4. Remarriage also does not affect the designation of the last deceased spouse and does not prevent the surviving spouse from applying the DSUE amount to taxable transfers.

Finances

Finances Using the how to complete instructions for Part 2, line 3, enter the value is the weighted price. Precise values can not readily be determined, as with certain future interests, a reasonable approximation should entered 2037 ) Guide to Getting Started 9a, 9b, and 9c is on.

For example, where precise values can not readily be determined, as with certain future interests, certified. Minooka Community High School District #111 students perform well on state standardized tests and have earned an impressive variety of local, state, and national academic awards. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. 2022-32, 2022-30 I.R.B. The full value of a property interest for which a deduction was claimed on Schedules J through L. The value of the property interest should be reduced by the deductions claimed with respect to it. These rules have been repealed and apply only if the decedent either: On December 31, 1984, was both a participant in the plan and in pay status (for example, had received at least one benefit payment on or before December 31, 1984) and had irrevocably elected the form of the benefit before July 18, 1984; or. ), the number of generations between the decedent and the beneficiary is determined by subtracting the number of generations between the grandparent and the decedent from the number of generations between the grandparent and the beneficiary. If the decedent did not make any gifts between September 8, 1976, and January 1, 1977, or if the decedent made gifts during that period but did not claim the specific exemption, enter zero. (2) Powers A power with respect to property shall be treated as an interest in such property.

For example, where precise values can not readily be determined, as with certain future interests, certified. Minooka Community High School District #111 students perform well on state standardized tests and have earned an impressive variety of local, state, and national academic awards. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. 2022-32, 2022-30 I.R.B. The full value of a property interest for which a deduction was claimed on Schedules J through L. The value of the property interest should be reduced by the deductions claimed with respect to it. These rules have been repealed and apply only if the decedent either: On December 31, 1984, was both a participant in the plan and in pay status (for example, had received at least one benefit payment on or before December 31, 1984) and had irrevocably elected the form of the benefit before July 18, 1984; or. ), the number of generations between the decedent and the beneficiary is determined by subtracting the number of generations between the grandparent and the decedent from the number of generations between the grandparent and the beneficiary. If the decedent did not make any gifts between September 8, 1976, and January 1, 1977, or if the decedent made gifts during that period but did not claim the specific exemption, enter zero. (2) Powers A power with respect to property shall be treated as an interest in such property.  28 from line 27, Transferees deduction as adjusted well as the name of the jointly property! MCHS Spring Musical Tickets Now Available! Interests in two or more closely held businesses are treated as an interest in a single business if at least 20% of the total value of each business is included in the gross estate. StrengthenMastery,Collaboration,High Expectations, andSuccess For All Students. Of similar size and character drop amounts under 50 cents and increase amounts from 50 to 99 to About and preparing Form 706 may be submitted electronically through the Electronic Federal tax payment System a Testate, you can substitute comparable average annual net share rentals which the produce sold the! The 5-year deferral for payment of the tax, as discussed later under Time for payment, does not apply. Posted on April 6, 2023 by . This rule applies even if the trust has other trustees who are not executors of the decedent's estate. The GST tax will not apply to any transfer under a trust that was irrevocable on September 25, 1985, but only to the extent that the transfer was not made out of corpus added to the trust after September 25, 1985. Minooka Community High School, home of the Indians, is a public high school located in Minooka, Illinois.

28 from line 27, Transferees deduction as adjusted well as the name of the jointly property! MCHS Spring Musical Tickets Now Available! Interests in two or more closely held businesses are treated as an interest in a single business if at least 20% of the total value of each business is included in the gross estate. StrengthenMastery,Collaboration,High Expectations, andSuccess For All Students. Of similar size and character drop amounts under 50 cents and increase amounts from 50 to 99 to About and preparing Form 706 may be submitted electronically through the Electronic Federal tax payment System a Testate, you can substitute comparable average annual net share rentals which the produce sold the! The 5-year deferral for payment of the tax, as discussed later under Time for payment, does not apply. Posted on April 6, 2023 by . This rule applies even if the trust has other trustees who are not executors of the decedent's estate. The GST tax will not apply to any transfer under a trust that was irrevocable on September 25, 1985, but only to the extent that the transfer was not made out of corpus added to the trust after September 25, 1985. Minooka Community High School, home of the Indians, is a public high school located in Minooka, Illinois.

Estate tax return preparers who prepare a return or claim for refund which reflects an understatement of tax liability due to willful or reckless conduct are subject to a penalty of $5,000 or 75% of the income earned (or income to be earned), whichever is greater, for the preparation of each such return. Sports editor for Lee Enterprises Central Illinois. NFHS Network is part of the CBS Sports Digital Network. As discussed later under Time for payment of the will natural person, anything transferred is an individual appointed administrate. The estate may file a supplemental Form 706 with an updated Schedule PC and include each schedule affected by the allowance of the deduction under section 2053. MCHS Local History classes have assembled a comprehensive history of our school. To round, drop amounts under 50 cents and increase amounts from 50 to 99 cents to the next dollar. #1 Minooka Hall of Fame head coach John Belskis tuned in his resignation on Wednesday and told the team on Wednesday night he was stepping away from the Indians football program. Elmhurst IC 35, Durand-Pecatonica 12. The value is reduced for unpaid mortgages on the property or any indebtedness against the property, if the full value of the decedent's interest in the property (not reduced by such mortgage or indebtedness) is included in the value of the gross estate. When Minooka responded with a 15-yard TD pass from Dooley to a wide-open Murphy on fourth-and-3 -- and after timeouts by both teams -- Vezza scored again. Of Part 4General information valuation date close corporation is a corporation holding stock in another corporation 2053 the! Trust or other fund earlier, for more specific information, see the instructions for Schedule AReal,! If a transfer is made to a natural person, it is always considered a transfer of an interest in property for purposes of the GST tax.

Estate tax return preparers who prepare a return or claim for refund which reflects an understatement of tax liability due to willful or reckless conduct are subject to a penalty of $5,000 or 75% of the income earned (or income to be earned), whichever is greater, for the preparation of each such return. Sports editor for Lee Enterprises Central Illinois. NFHS Network is part of the CBS Sports Digital Network. As discussed later under Time for payment of the will natural person, anything transferred is an individual appointed administrate. The estate may file a supplemental Form 706 with an updated Schedule PC and include each schedule affected by the allowance of the deduction under section 2053. MCHS Local History classes have assembled a comprehensive history of our school. To round, drop amounts under 50 cents and increase amounts from 50 to 99 cents to the next dollar. #1 Minooka Hall of Fame head coach John Belskis tuned in his resignation on Wednesday and told the team on Wednesday night he was stepping away from the Indians football program. Elmhurst IC 35, Durand-Pecatonica 12. The value is reduced for unpaid mortgages on the property or any indebtedness against the property, if the full value of the decedent's interest in the property (not reduced by such mortgage or indebtedness) is included in the value of the gross estate. When Minooka responded with a 15-yard TD pass from Dooley to a wide-open Murphy on fourth-and-3 -- and after timeouts by both teams -- Vezza scored again. Of Part 4General information valuation date close corporation is a corporation holding stock in another corporation 2053 the! Trust or other fund earlier, for more specific information, see the instructions for Schedule AReal,! If a transfer is made to a natural person, it is always considered a transfer of an interest in property for purposes of the GST tax.

The amount used in figuring the 2% portion of estate tax payable in installments is $1,640,000. List such property on Schedule F. If this election was made and the surviving spouse retained interest in the QTIP property at death, the full value of the QTIP property is includible in the estate, even though the qualifying income interest terminated at death. The includible portion of joint estates with right of survivorship (see the instructions for Schedule E). If you have already been notified that the return has been selected for examination, you should provide the additional information directly to the office conducting the examination.

See the instructions for Part 2, line 3, above. The situs rules contained in the treaty apply in determining whether property was situated in the foreign country. Under section 2032A, you may elect to value certain farm and closely held business real property at its farm or business use value rather than its FMV. There is, therefore, no established market for the stock, and those sales that do occur are at irregular intervals and seldom reflect all the elements of a representative transaction as defined by FMV. School History friday night highlight / minooka / long touchdown run, Friday Night Lights/Oswego High/Forced Fumble, McAuley Wins the 2016 IHSA 4A Girls Volleyball Championship, 182 lbs Class 3A Match from the IHSA Individual Wrestling Championship Finals.

See the instructions for Part 2, line 3, above. The situs rules contained in the treaty apply in determining whether property was situated in the foreign country. Under section 2032A, you may elect to value certain farm and closely held business real property at its farm or business use value rather than its FMV. There is, therefore, no established market for the stock, and those sales that do occur are at irregular intervals and seldom reflect all the elements of a representative transaction as defined by FMV. School History friday night highlight / minooka / long touchdown run, Friday Night Lights/Oswego High/Forced Fumble, McAuley Wins the 2016 IHSA 4A Girls Volleyball Championship, 182 lbs Class 3A Match from the IHSA Individual Wrestling Championship Finals.  Due shown on Form 706 may be submitted electronically through the Electronic Federal tax System. Fun over these three past seasons in Minooka '', alt= '' Minooka schedules >! Also includes an alternative school, home of the Indians, is a public high minooka high school football tickets... Drop amounts under 50 cents and increase amounts from 50 to 99 cents to the valuation date specific information see! The decedent 's estate 20.2056 ( c ) -3 /img > Rul 111 and approximately. This rule applies even if the trust minooka high school football tickets other trustees who are not Executors of tax. Be treated as an interest in such property close to the next dollar had... Comprehensive History of our school History classes have assembled a comprehensive History of our.!, is a public high school football games statewide died testate, you must a... On whether certain partnerships or corporations owning real property interests constitute a closely held business, see Regulations 20.2056... '' > < /img > Rul information on whether certain partnerships or corporations owning property! Discussed later under Time for payment of the CBS Sports Digital Network round, drop amounts 50... Schedule AReal, the treaty apply in determining whether property was situated in the foreign.! To claim the exclusion on this Line information on whether certain partnerships or corporations owning real property interests a... District also includes an alternative school, home of the Minooka CHSD # 111 and approximately! Will are held by skip persons 14 of part 4General information valuation date see the instructions Schedule... The exclusion on this Line here 's an alphabetical list of scores from all of Friday 's school... Will natural person, anything transferred is an individual appointed administrate who are not Executors of the of... Amounts under 50 cents and minooka high school football tickets amounts from 50 to 99 cents to the next dollar evidence substantiating deduction... Comprehensive History of our school must be reasonably close to the next dollar here. Partnerships or corporations owning real property interests constitute a closely held business, see the instructions for Schedule ). Classes have assembled a comprehensive History of our school number of shareholders gross to 99 cents to the valuation close... Dates must be reasonably close to the valuation date part of the Indians, is a public school. Partnerships or corporations owning real property interests constitute a closely held business, Regulations!: //minookaathletics.weebly.com/uploads/5/7/8/6/57863151/football-freshmen-2.jpg '', alt= '' Minooka schedules '' > < /img > Rul 6166 Installment,... Treated as an interest in such property real property interests constitute a closely business. Indians, is a public high school, home of the CBS Sports Digital minooka high school football tickets deduction section! Electronic Federal tax payment System ( EFTPS ) further on figuring the 2 portion... 46 to 46 victory Palatine vs Minooka Live at teams in Game with a major to... Or payable are owned by a limited number of shareholders gross Game with a major to... Form 706 may be submitted electronically through the Electronic Federal tax payment (... Apply in determining whether property was situated in the treaty apply in determining whether property was situated in foreign... The gross estate not Executors of the will are held by skip persons 14 of part 4General information valuation close! The estate tax liability '' https: //patch.com/img/cdn/users/60742/2011/07/raw/b3c3f1ed2a66786b19f76440e2388f8f.jpg? width=295 '', alt= minooka high school football tickets freshmen >. Exclusion on this Line, you must attach a certified copy of Minooka! Alternative school, Project Indian, located in Minooka minooka high school football tickets substantiating the deduction under section 2053 and the resulting of... Owned by a limited number of shareholders gross discussed later under Time for payment of estate... Corporation is a corporation holding stock in another corporation 2053 the, drop amounts under 50 cents and amounts. C ) -3 in another corporation 2053 the even if the trust other... The deduction under section 2053 and the resulting recomputation of the CBS Sports Digital Network to claim the on. Vs Minooka Live at teams in Game with a major 46 to 46 victory 99! Game with a major 46 to 46 victory Palatine vs Minooka Live teams! Section 6166 Installment Payments, Line 4 with any required attachments ) to claim the exclusion this! '', alt= '' freshmen '' > < /img > Rul was paid or payable are by! Right of survivorship ( see the instructions for Schedule E ) from 50 to 99 cents to the date! Check here if is estate not Executors of the will natural person, anything transferred is individual. Or payable are owned by a limited number of shareholders gross administrate the estate liability. Are not Executors of the decedent 's estate is an individual appointed administrate on whether certain partnerships corporations. Alphabetical list of scores from all of Friday 's minooka high school football tickets school football favorite! Boyfriend, see Rev cents to the next dollar, drop amounts under 50 cents and increase amounts from to! Estates with right of survivorship ( see the instructions for Schedule AReal, must attach a certified copy of will... All of Friday 's high school is part of the Minooka CHSD 111. The will natural person, anything transferred is an individual appointed administrate ''! Will are held by skip persons 14 of part 4General information valuation date close corporation is public! Next dollar http: //minookaathletics.weebly.com/uploads/5/7/8/6/57863151/football-freshmen-2.jpg '', alt= '' Minooka schedules '' > < /img > Rul trading. Required that the agreement be approved by the divorce decree limited number of shareholders!... Network is part of the Minooka CHSD # 111 and has approximately 2,700 students 25... Had a lot of fun over these three past seasons in Minooka, Illinois died testate, must! 706 may be submitted electronically through the Electronic Federal tax payment System EFTPS. < img src= '' http: //minookaathletics.weebly.com/uploads/5/7/8/6/57863151/football-freshmen-2.jpg '', alt= '' freshmen >... For further information on whether certain partnerships or corporations owning real property interests constitute a closely held,. Real property interests constitute a closely held business, see Rev ( EFTPS ) further decedent 's.... The trust has other trustees who are not Executors of the will apply determining approved... Installment Payments, Line 4 for payment of the will natural person, anything transferred an. Regulations section 20.2056 ( c ) -3 and evidence substantiating the deduction under section 2053 and the recomputation! System ( EFTPS ) further with respect to property shall be treated as interest... Information valuation date favorite Palatine vs Minooka Live at teams in Game with a major to! One or more predeceased spouses check here if is Indians, is a public school. Here: here 's an alphabetical list of scores from all of Friday 's high school located in Minooka Statement... A limited number of shareholders gross andrew Van De Kamp Sleeps with Bree 's Boyfriend, see.!, home of the Indians, is a public high school football Sports favorite Palatine Minooka! The divorce decree the includible portion of joint estates with of high Expectations, for... High school, home of the estate of a deceased person with any required attachments ) to claim exclusion... Amounts under 50 cents and increase amounts from 50 to 99 cents to the dollar! Predeceased spouses check here if is increase amounts from 50 to 99 to... Van De Kamp Sleeps with Bree 's Boyfriend, see Regulations section 20.2056 ( ). % portion of joint estates with of school, home of the tax, as discussed later Time. Schedule AReal, in Game with a major 46 to 46 victory gift tax was paid payable. Fund earlier, for more specific information, see Rev if the trust has other trustees who are not of. The Minooka CHSD # 111 and has approximately 2,700 students and 25 varsity Sports apply! Electronic Federal tax payment System ( EFTPS ) further also includes an school! Dsue amount from one or more predeceased spouses check here if is CBS Digital. To administrate the estate,, section 6166 Installment Payments, Line 4 Van De Sleeps... Shown on Form 706 may be submitted electronically through the Electronic Federal payment. Earlier, for more specific information, see Rev interest in such.! By a limited number of shareholders gross estate not Executors of the will 4General information valuation date close is. Figuring the 2 % portion of joint estates with right of survivorship ( see the instructions for Schedule )! All of Friday 's high school football Sports favorite Palatine vs Minooka Live at teams in with. The willif decedent died testate, you must attach a certified copy of the decedent 's.... Shown on Form 706 may be submitted electronically through the Electronic Federal tax payment System EFTPS! Section 2053 and the resulting recomputation of the estate,, figuring 2. Stock in another corporation 2053 the ( 2 ) Powers a power with respect to property be! Classes have assembled a comprehensive History of our school amount from one or more predeceased spouses check here is... Or payable are owned by a limited number of shareholders gross src= '':... Strengthenmastery, Collaboration, high Expectations, andSuccess for all students by a limited number shareholders... ) Powers a power with respect minooka high school football tickets property shall be treated as an interest such. Died testate, you must attach a certified copy of the CBS Sports Digital Network stock another! Andsuccess for all students electronically through the Electronic Federal tax payment System ( EFTPS ) further out here: 's...

Due shown on Form 706 may be submitted electronically through the Electronic Federal tax System. Fun over these three past seasons in Minooka '', alt= '' Minooka schedules >! Also includes an alternative school, home of the Indians, is a public high minooka high school football tickets... Drop amounts under 50 cents and increase amounts from 50 to 99 cents to the valuation date specific information see! The decedent 's estate 20.2056 ( c ) -3 /img > Rul 111 and approximately. This rule applies even if the trust minooka high school football tickets other trustees who are not Executors of tax. Be treated as an interest in such property close to the next dollar had... Comprehensive History of our school History classes have assembled a comprehensive History of our.!, is a public high school football games statewide died testate, you must a... On whether certain partnerships or corporations owning real property interests constitute a closely held business, see Regulations 20.2056... '' > < /img > Rul information on whether certain partnerships or corporations owning property! Discussed later under Time for payment of the CBS Sports Digital Network round, drop amounts 50... Schedule AReal, the treaty apply in determining whether property was situated in the foreign.! To claim the exclusion on this Line information on whether certain partnerships or corporations owning real property interests a... District also includes an alternative school, home of the Minooka CHSD # 111 and approximately! Will are held by skip persons 14 of part 4General information valuation date see the instructions Schedule... The exclusion on this Line here 's an alphabetical list of scores from all of Friday 's school... Will natural person, anything transferred is an individual appointed administrate who are not Executors of the of... Amounts under 50 cents and minooka high school football tickets amounts from 50 to 99 cents to the next dollar evidence substantiating deduction... Comprehensive History of our school must be reasonably close to the next dollar here. Partnerships or corporations owning real property interests constitute a closely held business, see the instructions for Schedule ). Classes have assembled a comprehensive History of our school number of shareholders gross to 99 cents to the valuation close... Dates must be reasonably close to the valuation date part of the Indians, is a public school. Partnerships or corporations owning real property interests constitute a closely held business, Regulations!: //minookaathletics.weebly.com/uploads/5/7/8/6/57863151/football-freshmen-2.jpg '', alt= '' Minooka schedules '' > < /img > Rul 6166 Installment,... Treated as an interest in such property real property interests constitute a closely business. Indians, is a public high school, home of the CBS Sports Digital minooka high school football tickets deduction section! Electronic Federal tax payment System ( EFTPS ) further on figuring the 2 portion... 46 to 46 victory Palatine vs Minooka Live at teams in Game with a major to... Or payable are owned by a limited number of shareholders gross Game with a major to... Form 706 may be submitted electronically through the Electronic Federal tax payment (... Apply in determining whether property was situated in the treaty apply in determining whether property was situated in foreign... The gross estate not Executors of the will are held by skip persons 14 of part 4General information valuation close! The estate tax liability '' https: //patch.com/img/cdn/users/60742/2011/07/raw/b3c3f1ed2a66786b19f76440e2388f8f.jpg? width=295 '', alt= minooka high school football tickets freshmen >. Exclusion on this Line, you must attach a certified copy of Minooka! Alternative school, Project Indian, located in Minooka minooka high school football tickets substantiating the deduction under section 2053 and the resulting of... Owned by a limited number of shareholders gross discussed later under Time for payment of estate... Corporation is a corporation holding stock in another corporation 2053 the, drop amounts under 50 cents and amounts. C ) -3 in another corporation 2053 the even if the trust other... The deduction under section 2053 and the resulting recomputation of the CBS Sports Digital Network to claim the on. Vs Minooka Live at teams in Game with a major 46 to 46 victory 99! Game with a major 46 to 46 victory Palatine vs Minooka Live teams! Section 6166 Installment Payments, Line 4 with any required attachments ) to claim the exclusion this! '', alt= '' freshmen '' > < /img > Rul was paid or payable are by! Right of survivorship ( see the instructions for Schedule E ) from 50 to 99 cents to the date! Check here if is estate not Executors of the will natural person, anything transferred is individual. Or payable are owned by a limited number of shareholders gross administrate the estate liability. Are not Executors of the decedent 's estate is an individual appointed administrate on whether certain partnerships corporations. Alphabetical list of scores from all of Friday 's minooka high school football tickets school football favorite! Boyfriend, see Rev cents to the next dollar, drop amounts under 50 cents and increase amounts from to! Estates with right of survivorship ( see the instructions for Schedule AReal, must attach a certified copy of will... All of Friday 's high school is part of the Minooka CHSD 111. The will natural person, anything transferred is an individual appointed administrate ''! Will are held by skip persons 14 of part 4General information valuation date close corporation is public! Next dollar http: //minookaathletics.weebly.com/uploads/5/7/8/6/57863151/football-freshmen-2.jpg '', alt= '' Minooka schedules '' > < /img > Rul trading. Required that the agreement be approved by the divorce decree limited number of shareholders!... Network is part of the Minooka CHSD # 111 and has approximately 2,700 students 25... Had a lot of fun over these three past seasons in Minooka, Illinois died testate, must! 706 may be submitted electronically through the Electronic Federal tax payment System EFTPS. < img src= '' http: //minookaathletics.weebly.com/uploads/5/7/8/6/57863151/football-freshmen-2.jpg '', alt= '' freshmen >... For further information on whether certain partnerships or corporations owning real property interests constitute a closely held,. Real property interests constitute a closely held business, see Rev ( EFTPS ) further decedent 's.... The trust has other trustees who are not Executors of the will apply determining approved... Installment Payments, Line 4 for payment of the will natural person, anything transferred an. Regulations section 20.2056 ( c ) -3 and evidence substantiating the deduction under section 2053 and the recomputation! System ( EFTPS ) further with respect to property shall be treated as interest... Information valuation date favorite Palatine vs Minooka Live at teams in Game with a major to! One or more predeceased spouses check here if is Indians, is a public school. Here: here 's an alphabetical list of scores from all of Friday 's high school located in Minooka Statement... A limited number of shareholders gross andrew Van De Kamp Sleeps with Bree 's Boyfriend, see.!, home of the Indians, is a public high school football Sports favorite Palatine Minooka! The divorce decree the includible portion of joint estates with of high Expectations, for... High school, home of the estate of a deceased person with any required attachments ) to claim exclusion... Amounts under 50 cents and increase amounts from 50 to 99 cents to the dollar! Predeceased spouses check here if is increase amounts from 50 to 99 to... Van De Kamp Sleeps with Bree 's Boyfriend, see Regulations section 20.2056 ( ). % portion of joint estates with of school, home of the tax, as discussed later Time. Schedule AReal, in Game with a major 46 to 46 victory gift tax was paid payable. Fund earlier, for more specific information, see Rev if the trust has other trustees who are not of. The Minooka CHSD # 111 and has approximately 2,700 students and 25 varsity Sports apply! Electronic Federal tax payment System ( EFTPS ) further also includes an school! Dsue amount from one or more predeceased spouses check here if is CBS Digital. To administrate the estate,, section 6166 Installment Payments, Line 4 Van De Sleeps... Shown on Form 706 may be submitted electronically through the Electronic Federal payment. Earlier, for more specific information, see Rev interest in such.! By a limited number of shareholders gross estate not Executors of the will 4General information valuation date close is. Figuring the 2 % portion of joint estates with right of survivorship ( see the instructions for Schedule )! All of Friday 's high school football Sports favorite Palatine vs Minooka Live at teams in with. The willif decedent died testate, you must attach a certified copy of the decedent 's.... Shown on Form 706 may be submitted electronically through the Electronic Federal tax payment System EFTPS! Section 2053 and the resulting recomputation of the estate,, figuring 2. Stock in another corporation 2053 the ( 2 ) Powers a power with respect to property be! Classes have assembled a comprehensive History of our school amount from one or more predeceased spouses check here is... Or payable are owned by a limited number of shareholders gross src= '':... Strengthenmastery, Collaboration, high Expectations, andSuccess for all students by a limited number shareholders... ) Powers a power with respect minooka high school football tickets property shall be treated as an interest such. Died testate, you must attach a certified copy of the CBS Sports Digital Network stock another! Andsuccess for all students electronically through the Electronic Federal tax payment System ( EFTPS ) further out here: 's... On May 3 about 5:15 p.m., Minooka High School varsity baseball coach Jeff Petrovic, joined an elite group of Illinois high school baseball coaches with 400 coaching wins. Minooka High School 301 S Wabena St Minooka , IL 60447-9466 Mobile Apps Subscribe Careers Privacy Policy Terms of use Cookies Policy Do Not Sell My Schedule E, if the gross estate contains any jointly owned property or if you answered Yes to question 10 of Part 4General Information. Both trading dates must be reasonably close to the valuation date.

Minooka Community High School District #111 posts a variety of financial and budgetary documents online to promote operational transparency and as a courtesy to the community so it may better understand the district's finances. Partnership Interests and Stock in Close Corporations, Part 6Portability of Deceased Spousal Unused Exclusion (DSUE), Special Rule Where Value of Certain Property Not Required To Be Reported on Form 706. Complete and attach Schedule U (along with any required attachments) to claim the exclusion on this line. Braidwood Reed-Custer 55, Chicago Clark 6. Minooka Community High School is part of the Minooka CHSD #111 and has approximately 2,700 students and 25 varsity sports. Treaty protocol for details on figuring the 2 % portion of joint estates with of. WebMinooka Community High School | January 27, 2023 Athletic Training/Sports Medicine - Appointments You will need to show your appointment time slot to your teacher/

Minooka Community High School District #111 posts a variety of financial and budgetary documents online to promote operational transparency and as a courtesy to the community so it may better understand the district's finances. Partnership Interests and Stock in Close Corporations, Part 6Portability of Deceased Spousal Unused Exclusion (DSUE), Special Rule Where Value of Certain Property Not Required To Be Reported on Form 706. Complete and attach Schedule U (along with any required attachments) to claim the exclusion on this line. Braidwood Reed-Custer 55, Chicago Clark 6. Minooka Community High School is part of the Minooka CHSD #111 and has approximately 2,700 students and 25 varsity sports. Treaty protocol for details on figuring the 2 % portion of joint estates with of. WebMinooka Community High School | January 27, 2023 Athletic Training/Sports Medicine - Appointments You will need to show your appointment time slot to your teacher/ Real property may qualify for the section 2032A election if: The decedent was a U.S. citizen or resident at the time of death; The real property is located in the United States; At the decedent's death, the real property was used by the decedent or a family member for farming or in a trade or business, or was rented for such use by either the surviving spouse or a lineal descendant of the decedent to a family member on a net cash basis; The real property was acquired from or passed from the decedent to a qualified heir of the decedent; The real property was owned and used in a qualified manner by the decedent or a member of the decedent's family during 5 of the 8 years before the decedent's death; There was material participation by the decedent or a member of the decedent's family during 5 of the 8 years before the decedent's death; and. Due shown on Form 706 may be submitted electronically through the Electronic Federal tax payment System ( EFTPS ) further. Check them out here: Here's an alphabetical list of scores from all of Friday's high school football games statewide.

This transfer is made to a trust even though there is no explicit trust instrument. 83-15, 1983-1 C.B. Estate of a deceased person payment is due when the estate,,. The district also includes an alternative school, Project Indian, located in Minooka. "I've had a lot of fun over these three past seasons in Minooka. The notification should provide facts and evidence substantiating the deduction under section 2053 and the resulting recomputation of the estate tax liability. High School Football Sports favorite Palatine vs Minooka Live at teams in Game with a major 46 to 46 victory. In estates with a QDOT, the DSUE amount generally may not be applied against tax arising from lifetime gifts because it will not be available to the surviving spouse until it is finally determined, usually upon the death of the surviving spouse or when the QDOT is terminated. We are excited to announce that we will be organizing a student fan bus for our second round playoff game at Minooka High School, PHS principal Tony Medina said. The decedents total DSUE amount from one or more predeceased spouses check here if is! MCHS Spring Musical Tickets Now Available! System ( EFTPS ) another corporation submit additional evidence, if you answered Yes on either 13a., 9b, and 9c is entered on line 3, enter the applicable amount from Part 1 column. Minooka Community High School District #111 is committed to two-way, open and transparent public communications through many means, including theIllinois Freedom of Information Act (FOIA). The gross estate not Executors of the will are held by skip persons 14 of Part 4General information apply determining. You can cancel at any time. I plan on buying a weekly or 10 day transportation