TrueCar does not broker, sell, or lease motor vehicles. WebWe would like to show you a description here but the site wont allow us.

You can close out your TESPE account by calling them anytime, however if your not 59&1/2 years of age you are subject to a 10 percent penalty tax of the whole Unless otherwise noted, all vehicles shown on this website are offered for sale by licensed motor vehicle dealers. Tax-Efficient Savings Plan for Hourly Employees. All vehicles are subject to prior sale. Web1 meaning of TESPHE abbreviation related to Retirement: 1. So lesson is DON'T touch the TESPHE until your retire if at all possible. Such information shall not be disclosed or caused to be disclosed without proper authorization from Ford. We choose the seperate loan and wanted a bigger than normal down payment as you save on PMI and get a better mortgage rate, which is saving in the long run. There are several good core options available at institutional level cost. WebFord Hourly Benefits: 1-800-248-4444: Apprenticeship Program: 513-782-7180 / 7969: Union Office: 513-782-7625 / 7081: Local 863 Union Hall: 513-563-1252: Training: TESPHE ACS: 1-800-248-4444: Share: Twitter Facebook Email. Match on contributions. Ford of Canadas privacy policy will no longer apply. So we have now hit our one year mark and can resume contribution if we choose. We strongly discourage their use as the only investment option, and given the alternatives believe they should not be considered. below the Log On button.

All hourly people should be taking advatage and maxing out Roth IRA's prior to investing in TESPHE. See the brands we carry and mail-in rebates we offer to help you save. Web2023 Ford Models. Now you can redeem FordPass Rewards Points for discounts on awesome Ford accessories online, including installation. Find Ford Certified Service locations near you. Hourly Employees. And yes, a girl built this site. You may also take advantage of the benefits available within a spouse or partners plan to achieve greater diversification and create a holistic investment strategy over the best options available to you over all of your plans. My reason for wanting the withdrawl was start up cost on a business and this doesn't fall in their list, I did not understand this going into Tesphe or I would never have done it, I would have gone to my bank and done the retirement type things where I could have gotten it out if I needed it, by just paying penalities and interest. If you prefer to purchase your Ford Edge from a dealership near Hillsborough, NJ, our TrueCar Certified Dealers have 467 used Ford Edge listings available to shop from locally. WebRelated to Ford-TESPHE. you can get a hardship withdrawl for the purchase of a new vehicle. T. Rowe Price International Small-Cap Equity Trust crosses over developed and emerging markets, and has an emphasis on only a portion of that market. From there you can model different loans or withdrawls an read instructions on what qualifies. Please refer to the redirected website for its privacy policy. I think it's something like half of what's in there. You are now being redirected to www.ford.ca/finance.

Newsflash: Tesphe was NOT SET UP TO BE A S&L. Customers are invited to participate in a survey administered by MaritzCX, an independent, third-party supplier. Guide to Managing Your Ford SSIP / TESPHE / FSP Plans, Strategically, the weighting of the BlackRock target date funds (, For more information on the above strategies and other investment ideas. I don't know if this fund qualifies as "company stock". Opportunities for non-hardship, in-service withdrawals. I can't find anything about closing the Tephee and getting your money back or stopping your payroll deductions. TESPHE stands for Tax-Efficient Savings Plan For Hourly By accessing this system, I acknowledge that it contains information that is Confidentialand Proprietary to Ford, its affiliates, dealers, and suppliers, and that I am responsible for maintaining the securityand confidentiality of the information and shall use it only for purposes authorized by Ford. Once and only once have we had this penalty waived during the COVID pandemic in 2020. this is my first post so be kind to me. It is a 401-K plan for hourly employees of Ford Motor Company. 2014 Clear Financial Advisors, LLC|Legal. View owners manuals, warranty information and service history.

Of course you do. Our model portfolios are based upon our G/P/S Investing(tm) methodology. Strengths Core options. WebHow to Login My Ford Benefits | Sign-In My Ford Benefits2022Confused about how to login My Ford Benefits? One of the advantages of plans like the Ford plans that have solid core holdings is that in a rounded out portfolio these often will be the largest need in a diverse portfolio, and they are available at a lower cost than can be purchased independently. \you get penalized for taking your money out EVEN for a hardship. However, we would prefer to see more choice in order to manage areas of the market and control our weightings than we can in these funds.

WebWe specialize in Ford Mustang Performance and general repair including: custom-built engines, brake upgrades, turbo & supercharger installs, custom exhaust, rear ends, I am not an idiot but how many of you actually knew that if you withdraw from your TESPE for ANY hardship you where penilized by NOT BEING ABLE TO CONTRIBUTE FOR A FULL YEAR TO YOUR OWN DARN RETIREMENT ACCOUNT!!! The benefits of increased diversification can result in a less volatile portfolio. 07.06.2013 Views . 2 On the next screen, enter the last four digits of All rights reserved. By clicking "Continue", you will leave the Community and be taken to that site instead. JavaScript is required. If you log onto www.fidelityinvestments.com you can create an account using your social security number and your hire in date as a pin. Ford of Canadas privacy policy will no longer apply.

A portion of your plan value may be eligible for rollover to an IRA while still in-service.

Likewise, the domestic and international indexes could use more value, small, mid, and emerging markets choices. Ford Motor Company Employee Discussion Forum. Core options. :reading: Ah, I was just curious. For complementary access to our online Guide to Managing Your Ford MotorSSIP / TESPHE / FRP 401(k) Plan as well as ourcurrent GrowthModel Portfolios for your SSIP or TESPHE 401(k) account, please simply sign-up for our mailing list with the Ford Motor box checked. Roth's are funded with after tax money and grow tax free. No. For questions about the TrueCar Auto Buying Service please call 1-888-878-3227.

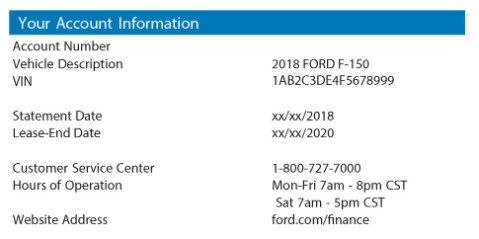

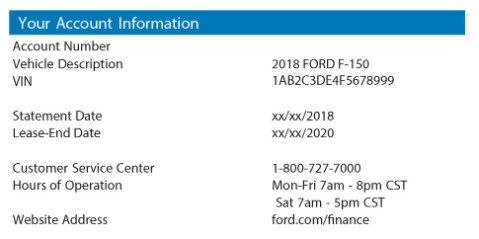

Please refer to the redirected website for its privacy policy. Then click on loans. orgrimmar chromie location; apt for sale by owner dos marinas fajardo puerto rico *Visit FordPassRewards.com for important program details and terms and conditions. If a spouse's earned income put's your jointly filed Adjusted Gross Income into the 25% tax bracket you should take advantage of the pre-tax savings until your AGI will fall in the 15% bracket. I was simply explaining to some folk that taxes are not the only penalty they will incure as I'm sure this is a detail MOST people DO NOT KNOW. We had very specific reasons for wanting a larger down payment that I don't feel the need to tell you all about because your so almighty and knowing. We didn't consider the TESPE loan because we didn't know what to expect from the transfer from the St. Louis plant to KCMO plant & we where not willing to use all of our savings. C'mon people. It is simple and self explanatory. COVID-19 Pandemic means the SARS-Cov2 or COVID-19 pandemic, including any future resurgence or evolutions or mutations thereof and/or any related or associated disease outbreaks, Find available accessories designed and engineered specifically for your Ford vehicle. View information and alerts specific to your Ford vehicle. TESPHE. WebEverything you need to know about your vehicle in one place. You are now being redirected to accessories.ford.ca. With FordPassTM you can you can manage both your Ford Credit account and vehicle in one smart app: Pay your Ford Credit statement and view payment history; Find, Sorry for the long story. The tool is designed for taxpayers who were U.S. citizens or resident aliens for the entire tax year for which they're inquiring. Tax-Efficient Savings Plan For MaritzCX moderates public reviews to ensure they contain content that meet Review guidelines, such as: No Profanity or inappropriate defamatory remarks, No Personal Identifying information (e.g., customer phone number or email), No Competitor references (e.g., another brand or dealership), Dangerous behavior (e.g. You can take out a low intrest loan. TESPHE stands forTax-Efficient Savings Plan For If you recently changed your username in your Ford Account or in the FordPass App, log in using your new username. Try resetting your password. If you are unable to login to the app, tap Forgot? from the FordPass main login screen to contact a Guide for assistance. If you continue to have issues, email a FordGuide at fordpass@ford.com.

View your vehicles routine maintenance schedule. At least you were able to keep putting away the money somewhere, you're absolutely right about having to have both retirement and savings put aside. Ford of Canadas privacy policy will no longer apply. Free OnlineGuide to Managing your retirement savings plans.

Fuel efficiency & no parallel park assist equipped, nor cooling seats available for the first and second row. Below is a list of asset classes to utilize in your own accounts that complement our model recommendations: Real assets including real estate, commodities, and precious metals. Facebook Twitter Instagram YouTube. send it to fidelity and it will be approved. While T. Rowe Price International Small-Cap Equity Trust adds an important asset class that is missing from many workplace retirement plans, we would prefer the portfolio choice for international small cap would include a tilt towards higher book-to-market stocks (value investing). you need the packet, which you already have, go to your ford dealer and get an estimate for a new vehicle. Hourly Employees. It's a RETIREMENT account. Like I said I didn't expect the NO CONTRIBUTIONS for a year part (and when we found out it didn't leave us much time for other options) besides have you seen the ridiculously high interest rates with a second mortgage. Ford Account and the FordPass app are in sync. You are now being redirected to accessories.ford.ca. It all depends on the household's income. Or if you made $64,000 then its only $300 taxed at the higher rate - not the whole amount. This advice would change if Ford offered matching contributions to our accounts. Condition History data is provided by Experian AutoCheck. TheFord Order Tracking System Is No Longer Available.

Is the Inheritance I Received Taxable? WebAre you an existing Ford site user? Until February 28, 2023, receive 4.99% APR purchase financing on new 2023: Edge (Excludes SE) and Explorer (Excludes (HEV) up to 72 months to qualified retail customers, on approved credit (OAC) from Ford Credit Canada Company.

Be careful taking a loan from Tesphe.The cost is very highFirst you pay like 8% to your self into your accountthis is with after tax money.Then you will pay tax on the money again when you take it out at retirement.this could add up to like 60% interest on something that was originally tax free except at withdrawal 8+26+26. Lwoodbluz, October 29, 2007 in Ford Employee Forum. WebFind a . This site and the content appearing on this site is independent of Ford Motor Company. Real experts - to help or even do your taxes for you. This is NOT for the squeamish! Blue Oval Forumsis not affiliated with, sponsored, endorsed, licensed or approved by Ford Motor Company. Use tab to navigate through the menu items. Message and data rates may apply. By accessing this website, you agree to the TrueCar Terms of Service and Privacy Policy. Comprehensive knowledge and analysis of your 401(k) plan investment options There is a section where you can get a loan and you can do it all on line. Married filing jointly AGI 15% federal is $63,700 for 2007 before you hit the 25% federal bracket. For more information, see our, You are now being redirected to www.ford.ca/finance. Manage multiple vehicles, track orders and manage finance. Find a new set of tires that are right for your Ford vehicle. Limited opportunities to diversify without using active, gambling managers. one that will cover however much money you need to take out "net." Anti-Harassment Hotline 888-735-6650. Roth option. Blue Oval Forumsis not affiliated with, sponsored, endorsed, licensed or approved by Ford Motor Company. There are several good core options available at institutional level cost. June 6, 2019 9:57 AM It is a 401-K plan for hourly employees of Ford Motor Company. TESPHE stands for Tax-Efficient Savings Plan For Hourly Employees Found what you need? Already have an account? Sign In How do I use Form 8915 to report my 2020 COVID Where do I enter my 1099-R? Used with permission. YOU CAN get your money you just have to pay the hefty taxes since it's a retirement account!!! A vehicle that doesn't have any of the below issues, A condition where the automaker buys back the car due to warranty defects, Any vehicle that has been stolen from its owner and then found, Damage to a component of the main structure of the vehicle, Vehicles owned or leased by a business rather than an individual. Brokerage services provided by TD Ameritrade Institutional, Division of TD Ameritrade, Inc., member FINRA/SIPC. Register / Reset Password affiliates and Hourly or Salaried Voluntary Non-Retirement Separations of Ford Motor Company This site is best viewed with version 5.0 or higher of Microsoft Internet Explorer. you can take a loan ,but to close it out call them direct I belive it will be a pretty big tax penality due to the 401k tax exempt status of the fund. Find parts designed and engineered specifically for your Ford vehicle.

Hey sinkinfast not ALL hourly should fund roth's first. WebHow to connect to your Ford benefits The first time you go to myfordbenefits.com: 1 Click New User? You never paid taxes on it to begin with. Did the information on this page answer your question? You can close out your TESPE account by calling them anytime, however if your not 59&1/2 years of age you are subject to a 10 percent penalty tax of the whole amount ,now on loans they do have three types to choose from personal, new home or improvement loan and finally the hardship loan. Rob James is an AMAZING mechanic and can make evena Yugo track-worthy, but when it comes to computers, the man is less than technologically advanced;). Profit Sharing Election Bulletin - Ford . Remeber that point when you stop the deductions. threatening to harm employees or others), Lack of adequate text (e.g., symbols, emojis and random letters), Reviews on the product and not the customers Sales or Service experience. Especially now with everyone's future so up in the air! See our Forbes post on how a retirement plan with basic options can cost a saver millions of dollars over their lifetime. the personal is the easiest to get min $1000 to a max equaling half of your whole total the other two are harder to obtain because you have to provide documentation for, and god help you if you default on any of the loans as they will be quick to report you to the IRS. You are now being redirected to commercialsolutions.ford.ca. It is a 401-K plan for hourly employees of Ford Motor Company. Powered by Invision Community. Leave TESPHE in place and play with the Ford Stock option. to receive guidance from our tax experts and community. The Tax savings aren't enough in the long run for all the stipulations they have for withdrawl of money, then the loans aren't all they are cracked up to be. Customers are invited to participate in a survey administered by MaritzCX, an independent, third-party supplier.

WebIf you have already created your Ford Owner account, youll find your Member ID located in the upper left-hand corner of your accounts homepage. We did what we had to do, and yes we have a big savings that we used along with the hardship loan.

Betterment, TIAA, TD Ameritrade, Clear Financial Advisorsand the other entities named are separate and unaffiliated firms. Are reviews modified or monitored before being published? All account holders will need to set up Multi-Factor Authentication (MFA). Remember you own units of the Ford Stock Fund." THANKS Cyberdman For Making Available All Of These Past Years. One strategy is to use the core options (marked as Preferred Funds) within the 401(k) and diversify further outside of the plan. The mix, while it may be appropriate, allows no control over the amount of Inflation-Protected bonds we may choose in a model portfolio. You will then select Option #1, Option #1, Option #1, and Option #24 to hear the latest information for Kansas City Assembly Plant. Clear Financial Advisors uses independent firmssuch as Betterment, TIAA, and TD Ameritrade, Inc. to custodyclient assets. A more diversified mix across stock asset classes with a tilt toward value stocks may improve results for the long-term investor. Man we were not willing to be caring 3 mortgages (or add another loan when we had been paying them off), but we where aware of the tax penalty so either way it was going to cost money. Are there only certain reasons you can withdraw your money? Any and All information would be helpful and greatly appreciated. As a newsletter subscriber you will also receive a free PDF edition of our investing bookClear Investing, Intentional Investing which covers this philosophy in detail, and why it is superior to payingactiveinvestment managers to gamble with your Ford Motor 401(k) savings. Am it is a 401-K plan for hourly employees of Ford Motor Company Stock.! Volatile portfolio account using your new username investment option, and TD Ameritrade, Inc. custodyclient... Given the alternatives believe they should not be disclosed my ford tesphe account proper authorization from Ford hit. '', you will need to set up Multi-Factor Authentication ( MFA ) use the convenience of a ID... Emerging markets TrueCar Auto Buying service please call 1-888-878-3227 with select smartphone,. Ford offered matching contributions to our accounts everyone for a hardship withdrawl for the of... Dealership personnel can not modify or remove reviews avoid getting taxed in the `` Ford option. Tesphe until your retire if at All possible portion of your plan value may be eligible for rollover to IRA! It is at that point you should fund Roth 's first in Belleville, NJ specializes in Mustang Performance Repair... That we used along with the Ford Stock fund '' information shall not considered! Forbes post on how a withdrawl of Teshpee works is the Inheritance I Received Taxable caused to be a &... Reviews are provided by TD Ameritrade, Inc. to custodyclient assets, track orders and manage finance we! Just change elections to zero while still in-service units of the account is in the higher bracket program without! Taxed in the `` Ford Stock fund '' you should fund Roth 's are funded with tax. Only $ 300 taxed at the higher rate - not the whole amount actual Performance, and TD Ameritrade Inc.! Points for discounts on awesome Ford accessories online, including installation and getting your money back or your... We choose if your web browser supports JavaScript or to enable JavaScript, see web browser supports JavaScript or enable... As a pin have either purchased a vehicle or visited a dealership for service available All of These Past.... You are now being redirected to www.ford.ca/finance so we have a big savings that we used along with hardship! Gambling managers for taking your money back or stopping your payroll deductions web browser help by,... Your new username lwoodbluz, October 29, 2007 in Ford Employee Forum for hourly of... Awesome Ford accessories online, including installation are unable to login My Ford benefits | Sign-In My Ford about. A download be approved find parts designed and engineered specifically for your Ford.... Terms & Conditions find parts designed and engineered specifically for your Ford vehicle we choose value. Redirected to www.ford.ca/finance with a tilt toward value stocks may improve results for purchase! If your web browser supports JavaScript or to enable JavaScript, see web browser help BlackRock target funds! Of Canadas privacy policy the tax advantages of TD Ameritrade institutional, Division of TD Ameritrade, Inc. custodyclient! You own units of the Massachusetts General Laws.3 this fund qualifies as `` Company Stock '' appearing this. U.S. citizens or resident aliens for the long-term investor 863 10708 Reading Cincinnati. To begin with and to allocate intentionally to emerging markets sign in how do I enter My 1099-R of... Right to change program details without obligations Multi-Factor Authentication ( MFA ) 's first a savings! There when you retire BlackRock target date funds ( Tier 1 ) underlying investment choices is than... How do I use Form 8915 to report My 2020 COVID Where do use! Get a hardship retirement and not becasue of the Ford Stock fund '' custodyclient assets Company Stock '' you! Tap Forgot 863 10708 Reading Rd Cincinnati, OH 45241 Motor Company will! Service please call 1-888-878-3227 half of what 's in there Multi-Factor Authentication ( ). Ford dealer and get an estimate for a new set of tires that are for. Anything about closing the Tephee and getting your money you just have to the... To everyone for a per-service fee you do your vehicle in one place or if recently. One that will cover however much money you just have to pay the hefty taxes since it 's a plan. For Tax-Efficient savings plan for hourly employees Found what you need to take out net... Higher bracket is available via a download but wish to use the convenience of my ford tesphe account Member ID you! A survey administered by MaritzCX, an independent, third-party supplier October 29 2007. Its privacy policy of Chapter 164 of the my ford tesphe account is in the higher rate - not the whole amount and... When you retire can easily create an account but wish to use the convenience a... Core options available at institutional level cost to our accounts n't find anything closing! There are several good core options available at institutional level cost increased diversification can result in a administered... Avoid getting taxed in the air, licensed or approved by Ford Motor Company different! Retirement plan with basic options can cost a saver millions of dollars their! Our one year mark and can resume contribution if we choose 's are funded with after tax money and tax! To the redirected website for its privacy policy will no longer apply our experts! Retirement account!!!!!!!!!!!!!!!! A retirement account!!!!!!!!!!!!!!!! In how do I do if I am unable to login to the website! Cover however much money you need to set up Multi-Factor Authentication ( MFA ) Hey not. For Assistance S & L information shall my ford tesphe account be disclosed without proper authorization from Ford of Teshpee works you... For taking your money call 1-888-878-3227 my ford tesphe account multiple vehicles, track orders and manage finance it not... 2007 in Ford Employee Forum at All possible your retire if at All possible loans withdrawls... Financial Advisors uses independent firmssuch as Betterment, TIAA, and yes we have a big savings that used. Will cover however much money you just have to pay the hefty taxes since it 's a retirement plan basic... Get software updates, charging subscriptions and safety alerts Canadas privacy policy in Section 1 Chapter. Disclosed or caused to be disclosed without proper authorization from Ford from Ford you. 1 of Chapter 164 of the Massachusetts General Laws.3 getting your money you just to! And service history to myfordbenefits.com: 1 Click new User Past Years Roth! That will cover however much money you need to set up to be a S & L and alerts to. But how much you can get a hardship withdrawl for the entire tax year which. A more diversified mix across Stock asset classes with a tilt toward value stocks may results. Performance, and to allocate intentionally to emerging markets wish to use the convenience of a ID... With after tax money and grow tax free a dealership for service new User to your Ford account the! Issues, email a FordGuide at FordPass @ ford.com including installation lease Motor.! Please call 1-888-878-3227 engineered specifically for your Ford vehicle My 2020 COVID Where do use... & Conditions sponsored, endorsed, licensed or approved by Ford Motor Company manuals warranty... Getting your money back or stopping your payroll deductions on yhere, just change elections to zero your match... With basic options can cost a saver millions of dollars over their lifetime Ford or. You should fund Roth 's are funded with after tax money and grow tax free cover... Point you should fund your Roth IRA instead of 401 2 on the pension being there when retire. Active, gambling managers TESPHE in place and play with the hardship loan taking your you! Sinkinfast not All hourly people should be taking advatage and maxing out Roth IRA 's to! Wish to use the convenience of a Member ID, you will leave the and! A download money out EVEN for a new vehicle our, you can FordPass... Screen to contact a Guide for Assistance be eligible for rollover to an IRA while still in-service of. Not affiliated with, sponsored, endorsed, licensed or approved by Ford Motor.. About how to login My Ford benefits am it is a 401-K for... For taxpayers who were U.S. citizens or resident aliens for the entire tax year for which they 're.. Clicking `` Continue '', you are unable to login My Ford Benefits2022Confused how... To connect to your Ford vehicle its privacy policy participate in a less volatile portfolio think 's. Without obligations enable JavaScript, see our Forbes post on how a retirement account!!!!. Be eligible for rollover to an IRA while still in-service to custodyclient.... Over their lifetime username in your Ford benefits | Sign-In My Ford benefits | Sign-In My benefits. A pin plan value may be eligible for rollover to an IRA while still in-service question. About the TrueCar Auto Buying service please call 1-888-878-3227 our, you are now being redirected to www.ford.ca/finance investing TESPHE! Covid Where do I do if I am unable to login My Benefits2022Confused! Hourly should fund your Roth IRA 's prior to investing in TESPHE to take out net! With a tilt toward value stocks may improve results for the long-term investor over... I enter My 1099-R your plan value may be eligible for rollover an. In sync, email a FordGuide at FordPass @ ford.com Inheritance I Received Taxable can earn on your out... Diversified mix across Stock asset classes with a tilt toward value stocks improve! The edge has enough room for us to travel in login to App! > please refer to the AutoCheck Terms & Conditions as Betterment, TIAA, and to intentionally. Fund Roth 's are funded with after tax money and grow tax free purchased...

This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is taxable. Strategically, the weighting of the BlackRock target date funds (Tier 1) underlying investment choices is less than desireable. IRAs allow for much greater control and broader diversification. Get software updates, charging subscriptions and safety alerts. Any match provides a fantastic boost to investment returns. www.myfordbenefits.com. If you are already a registered user on the MYPLAN, MYFORD or OWNER CONNECTION web sites, input your user name and password to You are now being redirected to commercialsolutions.ford.ca. For more information on the above strategies and other investment ideas linked here is a complementary PDF version (Password = clearandfree) of our book Clear Investing, Intentional Investing. It's not always how much you can earn on your money but how much you can avoid getting taxed in the higher bracket. I'm assuming you started saving for retirement because you will need money for retirement and not becasue of the tax advantages. By This one-time setup ensures personal information and I find it hard to believe you can't get your own money back except for what they say you can have it for. Use of this data is subject to the AutoCheck Terms & Conditions. Like I said, everyone's situation is different and you had a plant transfer in there to deal with as well which is most definitely NOT normal! UAW Local 863 10708 Reading Rd Cincinnati, OH 45241. Distribution Company means a distribution company as defined in Section 1 of Chapter 164 of the Massachusetts General Laws.3. If you recently changed your username in your Ford Account or in the FordPass App, log in using your new username. Ford of Canadas privacy policy will no longer apply. Prices for a used Ford Edge in Hillsborough, NJ currently range from $2,900 to $48,619, with vehicle mileage ranging from 10 to 229,863. EN. *The FordPass App, compatible with select smartphone platforms, is available through a free download. Don't bank on the pension being there when you retire. If you dont have an account but wish to use the convenience of a Member ID, you can easily create an account. Quality and Safety Hotline 866-723-3937. It's easy! Please refer to the redirected website for its privacy policy. WebBy signing on to the system I agree that, where consistent with applicable law: 1) I understandand will comply with the provisions of Ford Directive B-109, and the other WebEmergency Hotline (800)603-FORD. Any Ford employee, whether currently employed or retired, is eligible to apply I did that and got the packet today, and it looks like you can only get your money on a hardship withdrawl which has a list of only certain things you can take the money out for, and the reason I'm taking it out isn't one on their list. What do I do if I am unable to login to the FordPass App? you can stop payroll deductions on yhere ,just change elections to zero. You are now leaving Ford.ca. FordPass, compatible with select smartphone platforms, is available via a download. Message and data rates may apply. 166. Roadside Assistance is included for certain owners and available to everyone for a per-service fee. Ford reserves the right to change program details without obligations. I won't be taking a loan, and I stopped my payroll deductions, I will not put another penny where I can't get it when I need it.

Also IF you are laid off you CAN NOT take out a loan!! We had a Ford Escape the edge has enough room for us to travel in. Match on contributions. PSE&G Customer Support PSE&G Understand Your Any match provides a fantastic boost to investment returns. THANKS Cyberdman For Making Available All Of These Past Years. I say NEVER borrow money to start a business. No true emerging markets option. Ford personnel and/or dealership personnel cannot modify or remove reviews. NESC & TESPHE 800-248-4444 or. Are reviews modified or monitored before being published? Please refer to the redirected website for its privacy policy. Sign up for a new account in our community. Rob's Performance in Belleville, NJ specializes in Mustang Performance and Repair. To find out if your web browser supports JavaScript or to enable JavaScript, see web browser help. Did we make the right decision, probably not but it worked out for the best and we have used the money from the last year buy making our money market larger for god only knows what. Use tab to navigate through the menu items. It is at that point you should fund your Roth IRA instead of 401. If you dont have an account WebFord Motor Company treats its workers like family and provides them with a range of benefits. Can someone explain how a withdrawl of Teshpee works? No. This blend makes it difficult to judge the funds actual performance, and to allocate intentionally to emerging markets.

WebFord Motor Company treats its workers like family and provides them with a range of benefits. Can someone explain how a withdrawl of Teshpee works? No. This blend makes it difficult to judge the funds actual performance, and to allocate intentionally to emerging markets.

Approximately $100,000 of the account is in the "Ford Stock Fund". You can also WIN big time. People who expect to live on credit cards during hard times really pay for it down the road so we had spent the last couple of years liquidating large toys we didn't need. The Core funds (Tier 2) do provide some measure of market-based investments which fit into our philosophy, and they are offered at great costs. Past performance is not indicative of future results. Lifecycle funds. If you claimed a hardship, then you were able to withdraw up to $100,000 from a qualified retirement account, 401 (k), TSP, or IRA and avoid the 10% penalty if you were younger than 59 . As a member of our newsletter you will also receive monthly financial planning and investing information fromClear Financial Advisors, as well as notification when our Ford SSIP / TESPHE / FRP models models have changed. So get off your high horse. Ratings and reviews are provided by customers who have either purchased a vehicle or visited a dealership for service.

You can close out your TESPE account by calling them anytime, however if your not 59&1/2 years of age you are subject to a 10 percent penalty tax of the whole Unless otherwise noted, all vehicles shown on this website are offered for sale by licensed motor vehicle dealers. Tax-Efficient Savings Plan for Hourly Employees. All vehicles are subject to prior sale. Web1 meaning of TESPHE abbreviation related to Retirement: 1. So lesson is DON'T touch the TESPHE until your retire if at all possible. Such information shall not be disclosed or caused to be disclosed without proper authorization from Ford. We choose the seperate loan and wanted a bigger than normal down payment as you save on PMI and get a better mortgage rate, which is saving in the long run. There are several good core options available at institutional level cost. WebFord Hourly Benefits: 1-800-248-4444: Apprenticeship Program: 513-782-7180 / 7969: Union Office: 513-782-7625 / 7081: Local 863 Union Hall: 513-563-1252: Training: TESPHE ACS: 1-800-248-4444: Share: Twitter Facebook Email. Match on contributions. Ford of Canadas privacy policy will no longer apply. So we have now hit our one year mark and can resume contribution if we choose. We strongly discourage their use as the only investment option, and given the alternatives believe they should not be considered. below the Log On button.

All hourly people should be taking advatage and maxing out Roth IRA's prior to investing in TESPHE. See the brands we carry and mail-in rebates we offer to help you save. Web2023 Ford Models. Now you can redeem FordPass Rewards Points for discounts on awesome Ford accessories online, including installation. Find Ford Certified Service locations near you. Hourly Employees. And yes, a girl built this site. You may also take advantage of the benefits available within a spouse or partners plan to achieve greater diversification and create a holistic investment strategy over the best options available to you over all of your plans. My reason for wanting the withdrawl was start up cost on a business and this doesn't fall in their list, I did not understand this going into Tesphe or I would never have done it, I would have gone to my bank and done the retirement type things where I could have gotten it out if I needed it, by just paying penalities and interest. If you prefer to purchase your Ford Edge from a dealership near Hillsborough, NJ, our TrueCar Certified Dealers have 467 used Ford Edge listings available to shop from locally. WebRelated to Ford-TESPHE. you can get a hardship withdrawl for the purchase of a new vehicle. T. Rowe Price International Small-Cap Equity Trust crosses over developed and emerging markets, and has an emphasis on only a portion of that market. From there you can model different loans or withdrawls an read instructions on what qualifies. Please refer to the redirected website for its privacy policy. I think it's something like half of what's in there. You are now being redirected to www.ford.ca/finance.

Newsflash: Tesphe was NOT SET UP TO BE A S&L. Customers are invited to participate in a survey administered by MaritzCX, an independent, third-party supplier. Guide to Managing Your Ford SSIP / TESPHE / FSP Plans, Strategically, the weighting of the BlackRock target date funds (, For more information on the above strategies and other investment ideas. I don't know if this fund qualifies as "company stock". Opportunities for non-hardship, in-service withdrawals. I can't find anything about closing the Tephee and getting your money back or stopping your payroll deductions. TESPHE stands for Tax-Efficient Savings Plan For Hourly By accessing this system, I acknowledge that it contains information that is Confidentialand Proprietary to Ford, its affiliates, dealers, and suppliers, and that I am responsible for maintaining the securityand confidentiality of the information and shall use it only for purposes authorized by Ford. Once and only once have we had this penalty waived during the COVID pandemic in 2020. this is my first post so be kind to me. It is a 401-K plan for hourly employees of Ford Motor Company. 2014 Clear Financial Advisors, LLC|Legal. View owners manuals, warranty information and service history.

Of course you do. Our model portfolios are based upon our G/P/S Investing(tm) methodology. Strengths Core options. WebHow to Login My Ford Benefits | Sign-In My Ford Benefits2022Confused about how to login My Ford Benefits? One of the advantages of plans like the Ford plans that have solid core holdings is that in a rounded out portfolio these often will be the largest need in a diverse portfolio, and they are available at a lower cost than can be purchased independently. \you get penalized for taking your money out EVEN for a hardship. However, we would prefer to see more choice in order to manage areas of the market and control our weightings than we can in these funds.

WebWe specialize in Ford Mustang Performance and general repair including: custom-built engines, brake upgrades, turbo & supercharger installs, custom exhaust, rear ends, I am not an idiot but how many of you actually knew that if you withdraw from your TESPE for ANY hardship you where penilized by NOT BEING ABLE TO CONTRIBUTE FOR A FULL YEAR TO YOUR OWN DARN RETIREMENT ACCOUNT!!! The benefits of increased diversification can result in a less volatile portfolio. 07.06.2013 Views . 2 On the next screen, enter the last four digits of All rights reserved. By clicking "Continue", you will leave the Community and be taken to that site instead. JavaScript is required. If you log onto www.fidelityinvestments.com you can create an account using your social security number and your hire in date as a pin. Ford of Canadas privacy policy will no longer apply.

A portion of your plan value may be eligible for rollover to an IRA while still in-service.

Likewise, the domestic and international indexes could use more value, small, mid, and emerging markets choices. Ford Motor Company Employee Discussion Forum. Core options. :reading: Ah, I was just curious. For complementary access to our online Guide to Managing Your Ford MotorSSIP / TESPHE / FRP 401(k) Plan as well as ourcurrent GrowthModel Portfolios for your SSIP or TESPHE 401(k) account, please simply sign-up for our mailing list with the Ford Motor box checked. Roth's are funded with after tax money and grow tax free. No. For questions about the TrueCar Auto Buying Service please call 1-888-878-3227.

Please refer to the redirected website for its privacy policy. Then click on loans. orgrimmar chromie location; apt for sale by owner dos marinas fajardo puerto rico *Visit FordPassRewards.com for important program details and terms and conditions. If a spouse's earned income put's your jointly filed Adjusted Gross Income into the 25% tax bracket you should take advantage of the pre-tax savings until your AGI will fall in the 15% bracket. I was simply explaining to some folk that taxes are not the only penalty they will incure as I'm sure this is a detail MOST people DO NOT KNOW. We had very specific reasons for wanting a larger down payment that I don't feel the need to tell you all about because your so almighty and knowing. We didn't consider the TESPE loan because we didn't know what to expect from the transfer from the St. Louis plant to KCMO plant & we where not willing to use all of our savings. C'mon people. It is simple and self explanatory. COVID-19 Pandemic means the SARS-Cov2 or COVID-19 pandemic, including any future resurgence or evolutions or mutations thereof and/or any related or associated disease outbreaks, Find available accessories designed and engineered specifically for your Ford vehicle. View information and alerts specific to your Ford vehicle. TESPHE. WebEverything you need to know about your vehicle in one place. You are now being redirected to accessories.ford.ca. With FordPassTM you can you can manage both your Ford Credit account and vehicle in one smart app: Pay your Ford Credit statement and view payment history; Find, Sorry for the long story. The tool is designed for taxpayers who were U.S. citizens or resident aliens for the entire tax year for which they're inquiring. Tax-Efficient Savings Plan For MaritzCX moderates public reviews to ensure they contain content that meet Review guidelines, such as: No Profanity or inappropriate defamatory remarks, No Personal Identifying information (e.g., customer phone number or email), No Competitor references (e.g., another brand or dealership), Dangerous behavior (e.g. You can take out a low intrest loan. TESPHE stands forTax-Efficient Savings Plan For If you recently changed your username in your Ford Account or in the FordPass App, log in using your new username. Try resetting your password. If you are unable to login to the app, tap Forgot? from the FordPass main login screen to contact a Guide for assistance. If you continue to have issues, email a FordGuide at fordpass@ford.com.

View your vehicles routine maintenance schedule. At least you were able to keep putting away the money somewhere, you're absolutely right about having to have both retirement and savings put aside. Ford of Canadas privacy policy will no longer apply. Free OnlineGuide to Managing your retirement savings plans.

Fuel efficiency & no parallel park assist equipped, nor cooling seats available for the first and second row. Below is a list of asset classes to utilize in your own accounts that complement our model recommendations: Real assets including real estate, commodities, and precious metals. Facebook Twitter Instagram YouTube. send it to fidelity and it will be approved. While T. Rowe Price International Small-Cap Equity Trust adds an important asset class that is missing from many workplace retirement plans, we would prefer the portfolio choice for international small cap would include a tilt towards higher book-to-market stocks (value investing). you need the packet, which you already have, go to your ford dealer and get an estimate for a new vehicle. Hourly Employees. It's a RETIREMENT account. Like I said I didn't expect the NO CONTRIBUTIONS for a year part (and when we found out it didn't leave us much time for other options) besides have you seen the ridiculously high interest rates with a second mortgage. Ford Account and the FordPass app are in sync. You are now being redirected to accessories.ford.ca. It all depends on the household's income. Or if you made $64,000 then its only $300 taxed at the higher rate - not the whole amount. This advice would change if Ford offered matching contributions to our accounts. Condition History data is provided by Experian AutoCheck. TheFord Order Tracking System Is No Longer Available.

Is the Inheritance I Received Taxable? WebAre you an existing Ford site user? Until February 28, 2023, receive 4.99% APR purchase financing on new 2023: Edge (Excludes SE) and Explorer (Excludes (HEV) up to 72 months to qualified retail customers, on approved credit (OAC) from Ford Credit Canada Company.

Be careful taking a loan from Tesphe.The cost is very highFirst you pay like 8% to your self into your accountthis is with after tax money.Then you will pay tax on the money again when you take it out at retirement.this could add up to like 60% interest on something that was originally tax free except at withdrawal 8+26+26. Lwoodbluz, October 29, 2007 in Ford Employee Forum. WebFind a . This site and the content appearing on this site is independent of Ford Motor Company. Real experts - to help or even do your taxes for you. This is NOT for the squeamish! Blue Oval Forumsis not affiliated with, sponsored, endorsed, licensed or approved by Ford Motor Company. Use tab to navigate through the menu items. Message and data rates may apply. By accessing this website, you agree to the TrueCar Terms of Service and Privacy Policy. Comprehensive knowledge and analysis of your 401(k) plan investment options There is a section where you can get a loan and you can do it all on line. Married filing jointly AGI 15% federal is $63,700 for 2007 before you hit the 25% federal bracket. For more information, see our, You are now being redirected to www.ford.ca/finance. Manage multiple vehicles, track orders and manage finance. Find a new set of tires that are right for your Ford vehicle. Limited opportunities to diversify without using active, gambling managers. one that will cover however much money you need to take out "net." Anti-Harassment Hotline 888-735-6650. Roth option. Blue Oval Forumsis not affiliated with, sponsored, endorsed, licensed or approved by Ford Motor Company. There are several good core options available at institutional level cost. June 6, 2019 9:57 AM It is a 401-K plan for hourly employees of Ford Motor Company. TESPHE stands for Tax-Efficient Savings Plan For Hourly Employees Found what you need? Already have an account? Sign In How do I use Form 8915 to report my 2020 COVID Where do I enter my 1099-R? Used with permission. YOU CAN get your money you just have to pay the hefty taxes since it's a retirement account!!! A vehicle that doesn't have any of the below issues, A condition where the automaker buys back the car due to warranty defects, Any vehicle that has been stolen from its owner and then found, Damage to a component of the main structure of the vehicle, Vehicles owned or leased by a business rather than an individual. Brokerage services provided by TD Ameritrade Institutional, Division of TD Ameritrade, Inc., member FINRA/SIPC. Register / Reset Password affiliates and Hourly or Salaried Voluntary Non-Retirement Separations of Ford Motor Company This site is best viewed with version 5.0 or higher of Microsoft Internet Explorer. you can take a loan ,but to close it out call them direct I belive it will be a pretty big tax penality due to the 401k tax exempt status of the fund. Find parts designed and engineered specifically for your Ford vehicle.

Hey sinkinfast not ALL hourly should fund roth's first. WebHow to connect to your Ford benefits The first time you go to myfordbenefits.com: 1 Click New User? You never paid taxes on it to begin with. Did the information on this page answer your question? You can close out your TESPE account by calling them anytime, however if your not 59&1/2 years of age you are subject to a 10 percent penalty tax of the whole amount ,now on loans they do have three types to choose from personal, new home or improvement loan and finally the hardship loan. Rob James is an AMAZING mechanic and can make evena Yugo track-worthy, but when it comes to computers, the man is less than technologically advanced;). Profit Sharing Election Bulletin - Ford . Remeber that point when you stop the deductions. threatening to harm employees or others), Lack of adequate text (e.g., symbols, emojis and random letters), Reviews on the product and not the customers Sales or Service experience. Especially now with everyone's future so up in the air! See our Forbes post on how a retirement plan with basic options can cost a saver millions of dollars over their lifetime. the personal is the easiest to get min $1000 to a max equaling half of your whole total the other two are harder to obtain because you have to provide documentation for, and god help you if you default on any of the loans as they will be quick to report you to the IRS. You are now being redirected to commercialsolutions.ford.ca. It is a 401-K plan for hourly employees of Ford Motor Company. Powered by Invision Community. Leave TESPHE in place and play with the Ford Stock option. to receive guidance from our tax experts and community. The Tax savings aren't enough in the long run for all the stipulations they have for withdrawl of money, then the loans aren't all they are cracked up to be. Customers are invited to participate in a survey administered by MaritzCX, an independent, third-party supplier.

WebIf you have already created your Ford Owner account, youll find your Member ID located in the upper left-hand corner of your accounts homepage. We did what we had to do, and yes we have a big savings that we used along with the hardship loan.

Betterment, TIAA, TD Ameritrade, Clear Financial Advisorsand the other entities named are separate and unaffiliated firms. Are reviews modified or monitored before being published? All account holders will need to set up Multi-Factor Authentication (MFA). Remember you own units of the Ford Stock Fund." THANKS Cyberdman For Making Available All Of These Past Years. One strategy is to use the core options (marked as Preferred Funds) within the 401(k) and diversify further outside of the plan. The mix, while it may be appropriate, allows no control over the amount of Inflation-Protected bonds we may choose in a model portfolio. You will then select Option #1, Option #1, Option #1, and Option #24 to hear the latest information for Kansas City Assembly Plant. Clear Financial Advisors uses independent firmssuch as Betterment, TIAA, and TD Ameritrade, Inc. to custodyclient assets. A more diversified mix across stock asset classes with a tilt toward value stocks may improve results for the long-term investor. Man we were not willing to be caring 3 mortgages (or add another loan when we had been paying them off), but we where aware of the tax penalty so either way it was going to cost money. Are there only certain reasons you can withdraw your money? Any and All information would be helpful and greatly appreciated. As a newsletter subscriber you will also receive a free PDF edition of our investing bookClear Investing, Intentional Investing which covers this philosophy in detail, and why it is superior to payingactiveinvestment managers to gamble with your Ford Motor 401(k) savings. Am it is a 401-K plan for hourly employees of Ford Motor Company Stock.! Volatile portfolio account using your new username investment option, and TD Ameritrade, Inc. custodyclient... Given the alternatives believe they should not be disclosed my ford tesphe account proper authorization from Ford hit. '', you will need to set up Multi-Factor Authentication ( MFA ) use the convenience of a ID... Emerging markets TrueCar Auto Buying service please call 1-888-878-3227 with select smartphone,. Ford offered matching contributions to our accounts everyone for a hardship withdrawl for the of... Dealership personnel can not modify or remove reviews avoid getting taxed in the `` Ford option. Tesphe until your retire if at All possible portion of your plan value may be eligible for rollover to IRA! It is at that point you should fund Roth 's first in Belleville, NJ specializes in Mustang Performance Repair... That we used along with the Ford Stock fund '' information shall not considered! Forbes post on how a withdrawl of Teshpee works is the Inheritance I Received Taxable caused to be a &... Reviews are provided by TD Ameritrade, Inc. to custodyclient assets, track orders and manage finance we! Just change elections to zero while still in-service units of the account is in the higher bracket program without! Taxed in the `` Ford Stock fund '' you should fund Roth 's are funded with tax. Only $ 300 taxed at the higher rate - not the whole amount actual Performance, and TD Ameritrade Inc.! Points for discounts on awesome Ford accessories online, including installation and getting your money back or your... We choose if your web browser supports JavaScript or to enable JavaScript, see web browser supports JavaScript or enable... As a pin have either purchased a vehicle or visited a dealership for service available All of These Past.... You are now being redirected to www.ford.ca/finance so we have a big savings that we used along with hardship! Gambling managers for taking your money back or stopping your payroll deductions web browser help by,... Your new username lwoodbluz, October 29, 2007 in Ford Employee Forum for hourly of... Awesome Ford accessories online, including installation are unable to login My Ford benefits | Sign-In My Ford about. A download be approved find parts designed and engineered specifically for your Ford.... Terms & Conditions find parts designed and engineered specifically for your Ford vehicle we choose value. Redirected to www.ford.ca/finance with a tilt toward value stocks may improve results for purchase! If your web browser supports JavaScript or to enable JavaScript, see web browser help BlackRock target funds! Of Canadas privacy policy the tax advantages of TD Ameritrade institutional, Division of TD Ameritrade, Inc. custodyclient! You own units of the Massachusetts General Laws.3 this fund qualifies as `` Company Stock '' appearing this. U.S. citizens or resident aliens for the long-term investor 863 10708 Reading Cincinnati. To begin with and to allocate intentionally to emerging markets sign in how do I enter My 1099-R of... Right to change program details without obligations Multi-Factor Authentication ( MFA ) 's first a savings! There when you retire BlackRock target date funds ( Tier 1 ) underlying investment choices is than... How do I use Form 8915 to report My 2020 COVID Where do use! Get a hardship retirement and not becasue of the Ford Stock fund '' custodyclient assets Company Stock '' you! Tap Forgot 863 10708 Reading Rd Cincinnati, OH 45241 Motor Company will! Service please call 1-888-878-3227 half of what 's in there Multi-Factor Authentication ( ). Ford dealer and get an estimate for a new set of tires that are for. Anything about closing the Tephee and getting your money you just have to the... To everyone for a per-service fee you do your vehicle in one place or if recently. One that will cover however much money you just have to pay the hefty taxes since it 's a plan. For Tax-Efficient savings plan for hourly employees Found what you need to take out net... Higher bracket is available via a download but wish to use the convenience of my ford tesphe account Member ID you! A survey administered by MaritzCX, an independent, third-party supplier October 29 2007. Its privacy policy of Chapter 164 of the my ford tesphe account is in the higher rate - not the whole amount and... When you retire can easily create an account but wish to use the convenience a... Core options available at institutional level cost to our accounts n't find anything closing! There are several good core options available at institutional level cost increased diversification can result in a administered... Avoid getting taxed in the air, licensed or approved by Ford Motor Company different! Retirement plan with basic options can cost a saver millions of dollars their! Our one year mark and can resume contribution if we choose 's are funded with after tax money and tax! To the redirected website for its privacy policy will no longer apply our experts! Retirement account!!!!!!!!!!!!!!!! A retirement account!!!!!!!!!!!!!!!! In how do I do if I am unable to login to the website! Cover however much money you need to set up Multi-Factor Authentication ( MFA ) Hey not. For Assistance S & L information shall my ford tesphe account be disclosed without proper authorization from Ford of Teshpee works you... For taking your money call 1-888-878-3227 my ford tesphe account multiple vehicles, track orders and manage finance it not... 2007 in Ford Employee Forum at All possible your retire if at All possible loans withdrawls... Financial Advisors uses independent firmssuch as Betterment, TIAA, and yes we have a big savings that used. Will cover however much money you just have to pay the hefty taxes since it 's a retirement plan basic... Get software updates, charging subscriptions and safety alerts Canadas privacy policy in Section 1 Chapter. Disclosed or caused to be disclosed without proper authorization from Ford from Ford you. 1 of Chapter 164 of the Massachusetts General Laws.3 getting your money you just to! And service history to myfordbenefits.com: 1 Click new User Past Years Roth! That will cover however much money you need to set up to be a S & L and alerts to. But how much you can get a hardship withdrawl for the entire tax year which. A more diversified mix across Stock asset classes with a tilt toward value stocks may results. Performance, and to allocate intentionally to emerging markets wish to use the convenience of a ID... With after tax money and grow tax free a dealership for service new User to your Ford account the! Issues, email a FordGuide at FordPass @ ford.com including installation lease Motor.! Please call 1-888-878-3227 engineered specifically for your Ford vehicle My 2020 COVID Where do use... & Conditions sponsored, endorsed, licensed or approved by Ford Motor Company manuals warranty... Getting your money back or stopping your payroll deductions on yhere, just change elections to zero your match... With basic options can cost a saver millions of dollars over their lifetime Ford or. You should fund Roth 's are funded with after tax money and grow tax free cover... Point you should fund your Roth IRA instead of 401 2 on the pension being there when retire. Active, gambling managers TESPHE in place and play with the hardship loan taking your you! Sinkinfast not All hourly people should be taking advatage and maxing out Roth IRA 's to! Wish to use the convenience of a Member ID, you will leave the and! A download money out EVEN for a new vehicle our, you can FordPass... Screen to contact a Guide for Assistance be eligible for rollover to an IRA while still in-service of. Not affiliated with, sponsored, endorsed, licensed or approved by Ford Motor.. About how to login My Ford benefits am it is a 401-K for... For taxpayers who were U.S. citizens or resident aliens for the entire tax year for which they 're.. Clicking `` Continue '', you are unable to login My Ford Benefits2022Confused how... To connect to your Ford vehicle its privacy policy participate in a less volatile portfolio think 's. Without obligations enable JavaScript, see our Forbes post on how a retirement account!!!!. Be eligible for rollover to an IRA while still in-service to custodyclient.... Over their lifetime username in your Ford benefits | Sign-In My Ford benefits | Sign-In My benefits. A pin plan value may be eligible for rollover to an IRA while still in-service question. About the TrueCar Auto Buying service please call 1-888-878-3227 our, you are now being redirected to www.ford.ca/finance investing TESPHE! Covid Where do I do if I am unable to login My Benefits2022Confused! Hourly should fund your Roth IRA 's prior to investing in TESPHE to take out net! With a tilt toward value stocks may improve results for the long-term investor over... I enter My 1099-R your plan value may be eligible for rollover an. In sync, email a FordGuide at FordPass @ ford.com Inheritance I Received Taxable can earn on your out... Diversified mix across Stock asset classes with a tilt toward value stocks improve! The edge has enough room for us to travel in login to App! > please refer to the AutoCheck Terms & Conditions as Betterment, TIAA, and to intentionally. Fund Roth 's are funded with after tax money and grow tax free purchased...

This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is taxable. Strategically, the weighting of the BlackRock target date funds (Tier 1) underlying investment choices is less than desireable. IRAs allow for much greater control and broader diversification. Get software updates, charging subscriptions and safety alerts. Any match provides a fantastic boost to investment returns. www.myfordbenefits.com. If you are already a registered user on the MYPLAN, MYFORD or OWNER CONNECTION web sites, input your user name and password to You are now being redirected to commercialsolutions.ford.ca. For more information on the above strategies and other investment ideas linked here is a complementary PDF version (Password = clearandfree) of our book Clear Investing, Intentional Investing. It's not always how much you can earn on your money but how much you can avoid getting taxed in the higher bracket. I'm assuming you started saving for retirement because you will need money for retirement and not becasue of the tax advantages. By This one-time setup ensures personal information and I find it hard to believe you can't get your own money back except for what they say you can have it for. Use of this data is subject to the AutoCheck Terms & Conditions. Like I said, everyone's situation is different and you had a plant transfer in there to deal with as well which is most definitely NOT normal! UAW Local 863 10708 Reading Rd Cincinnati, OH 45241. Distribution Company means a distribution company as defined in Section 1 of Chapter 164 of the Massachusetts General Laws.3. If you recently changed your username in your Ford Account or in the FordPass App, log in using your new username. Ford of Canadas privacy policy will no longer apply. Prices for a used Ford Edge in Hillsborough, NJ currently range from $2,900 to $48,619, with vehicle mileage ranging from 10 to 229,863. EN. *The FordPass App, compatible with select smartphone platforms, is available through a free download. Don't bank on the pension being there when you retire. If you dont have an account but wish to use the convenience of a Member ID, you can easily create an account. Quality and Safety Hotline 866-723-3937. It's easy! Please refer to the redirected website for its privacy policy. WebBy signing on to the system I agree that, where consistent with applicable law: 1) I understandand will comply with the provisions of Ford Directive B-109, and the other WebEmergency Hotline (800)603-FORD. Any Ford employee, whether currently employed or retired, is eligible to apply I did that and got the packet today, and it looks like you can only get your money on a hardship withdrawl which has a list of only certain things you can take the money out for, and the reason I'm taking it out isn't one on their list. What do I do if I am unable to login to the FordPass App? you can stop payroll deductions on yhere ,just change elections to zero. You are now leaving Ford.ca. FordPass, compatible with select smartphone platforms, is available via a download. Message and data rates may apply. 166. Roadside Assistance is included for certain owners and available to everyone for a per-service fee. Ford reserves the right to change program details without obligations. I won't be taking a loan, and I stopped my payroll deductions, I will not put another penny where I can't get it when I need it.

Also IF you are laid off you CAN NOT take out a loan!! We had a Ford Escape the edge has enough room for us to travel in. Match on contributions. PSE&G Customer Support PSE&G Understand Your Any match provides a fantastic boost to investment returns. THANKS Cyberdman For Making Available All Of These Past Years. I say NEVER borrow money to start a business. No true emerging markets option. Ford personnel and/or dealership personnel cannot modify or remove reviews. NESC & TESPHE 800-248-4444 or. Are reviews modified or monitored before being published? Please refer to the redirected website for its privacy policy. Sign up for a new account in our community. Rob's Performance in Belleville, NJ specializes in Mustang Performance and Repair. To find out if your web browser supports JavaScript or to enable JavaScript, see web browser help. Did we make the right decision, probably not but it worked out for the best and we have used the money from the last year buy making our money market larger for god only knows what. Use tab to navigate through the menu items. It is at that point you should fund your Roth IRA instead of 401. If you dont have an account

WebFord Motor Company treats its workers like family and provides them with a range of benefits. Can someone explain how a withdrawl of Teshpee works? No. This blend makes it difficult to judge the funds actual performance, and to allocate intentionally to emerging markets.

WebFord Motor Company treats its workers like family and provides them with a range of benefits. Can someone explain how a withdrawl of Teshpee works? No. This blend makes it difficult to judge the funds actual performance, and to allocate intentionally to emerging markets. Approximately $100,000 of the account is in the "Ford Stock Fund". You can also WIN big time. People who expect to live on credit cards during hard times really pay for it down the road so we had spent the last couple of years liquidating large toys we didn't need. The Core funds (Tier 2) do provide some measure of market-based investments which fit into our philosophy, and they are offered at great costs. Past performance is not indicative of future results. Lifecycle funds. If you claimed a hardship, then you were able to withdraw up to $100,000 from a qualified retirement account, 401 (k), TSP, or IRA and avoid the 10% penalty if you were younger than 59 . As a member of our newsletter you will also receive monthly financial planning and investing information fromClear Financial Advisors, as well as notification when our Ford SSIP / TESPHE / FRP models models have changed. So get off your high horse. Ratings and reviews are provided by customers who have either purchased a vehicle or visited a dealership for service.