Accrued payroll is the process in which the amount of money a business owes or is owed accumulates over time. Make sure to submit the forms on time to avoid late fees.

Another way is to use technology and automation to reduce the need for labor.

Salary tax is $ 100 per month which company needs to deduct from employees and pay to tax authority. Contact Best Homeowners Insurance for New Construction, How to Get Discounts on Homeowners Insurance. Apr.

So lets learn how to record it in any accounting software.

WebDuring the month, the company has paid wages of $ 35,000 to all employees.

Similarly, it also helps with managerial decisions and analysis. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. This is the final amount that they take home. This pay period, he earned a $200 commission. Susies gross wages to be paid on the first Monday in January is $1,600 ($600 hourly wages + $1,000 bonus). In this case, in the December 31 adjusting entry, the company ABC

Then you deduct 20% for federal income taxes and 5% for state income taxes.

For employers own contribution to PF account (employers contribution By accessing and using this page you agree to the Terms and Conditions. So the employees net pay for the pay period is $1,504.

On the other hand, it will record the compensation paid to settle the liability.

At RL Good Candy, Id accrue 10% of an employees wages for PTO (8 hours PTO earned / 80 hours worked in two weeks).

The payroll deduction includes withholding tax on salary, 401k accounts payable, federal withholding tax, and so on.

Companies pay employees through various forms of compensation.

The transaction will increase the wage expense on the income statement.

WebAs the salary is not yet paid, they have to record a liability on the balance sheet. The new Internet must be developed with new rules, always keeping the privacy let user be sovereign of his data. field. The net pay is the the dollar amount you pay the employees directly. Heres Susies accrued wages payroll journal entry: The Wages Payable account is your employees net pay, or the amount written on her payroll check. Businesses must post three commonpayroll journalentries. How to start a business: A practical 22-step guide to success, How to write a business plan in 10 steps + free template, Cash flow guide: Definition, types, how to analyze in 2023, Financial statements: What business owners should know, Small business grants: 20+ grants and resources to fund your future without debt, How to choose the best payment method for small businesses. At the end of the month, the company has to calculate the amount of wage that needs to pay to the workers.

Accounting how are salaries paid, journal entry for salary paid in advancepaid salary expense journal entry, journal entry of salary paid, paid salary for the month journal entry, salaries paid journal entry, salary due but not paid journal entry, salary journal entry example, How to Make a Guaranteed Payments Journal Entry, journal entry for salary paid in advancepaid salary expense journal entry, Wasting Assets (Meaning, Example & Estimate Useful Life).

Hours worked x hourly wage = outstanding payroll, Be sure that you add together only the hours that theyve worked that they have not been paid for.

Plus, most states have a.

If your employee has earned any extra wages apart from their regular hourly rate, be sure to add that to the total. Record detailed payroll transactions in a payroll journal if your company is medium to large. Lets calculate payroll taxes, contributions, and deductions for Susie.

Similarly, cash bonuses earned in one period and paid in the next warrant a payroll accrual. On payday, December 31, the checks

This technology is unstoppable, so let's embrace it. Your business and its employees might also contribute to employee health and retirement plans. Amounts you withhold from a workers pay and submit to a third party are not company expenses. Nowadays, employers are quoting the Salary on a CTC basis (Cost to the Company basis). make sure youre familiar with these laws.

Payroll journal entries fall under the payroll account and are part of your general ledger. Payroll essentials you need to run your business. Record the following expenses in your payroll account: Employee Lastly, be sure to add the total amount that you offer your employees in monthly PTO to your accrued payroll costs. |

The company withheld the following amounts Use the info from your payroll report to create the journal entry. Payroll taxes are another source of liability for a business. So you know how much to accrue for payroll. As I mentioned, I dont owe FUTA and SUTA on Susies wages since Im accruing payroll at the end of the year, after shes earned more than $7,000 for the year.

Generally, the employee isnt required to maintain the books of accounts and record all their financial transactions. Every company maintains this account as a part of its accounting system for tracking employee wages.

1. Payroll Procedures for Deceased Employees, How to Determine & Calculate OASDI Taxable Wages, How to Master Balancing Your Drawer for the Bank Teller. requires you to collect and manage data, and your payroll expenses may change frequently.

Lets say you process payroll 26 times per year. The journal entry, in that case, will be as below.

Companies pay employees through various forms of compensation.

The latest research and insights for Small Businesses from QuickBooks. Now I need to wipe it out. Do as Black Widow says.

The difference will be recorded based on the nature of each deduction. The journal entry is debiting wage expenses and credit cash. Note: You need not buy the same product in the links. New employees must complete Form W-4. Create a single line for the total or create separate lines for each employee with the following details:

These are the items that are usually included in the payroll deduction. In a world that is so often full of big things and overwhelming events, it can be easy to forget the small things.

Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

Enter the gross payroll amount (salary expense) in the debit (left) column.

Ryan Lasker is an SMB accounting expert writing for The Ascent and The Motley Fool. At my company, full-time employees earn four hours -- one half-day -- in PTO with every weekly paycheck.

Updated Aug. 5, 2022 - First published on May 18, 2022.

Choose Other Payment then enter the date for the payment. The tools and resources you need to run your business successfully.

WebThe journal entry to record the hourly payroll's wages and withholdings for the work period of December 1824 is illustrated in Hourly Payroll Entry #1. While this may seem like a negative thing, it is actually a positive sign that the company is operating smoothly. Then, the entry will be, (Being Salary advance adjusted with Salary). Its smart to keep a close eye on thepayroll expenses that have accrued over a pay period, even if the checks havent gone out yet.

Infos Utiles

The more precise accrual accounting method has you record transactions when you earn revenue and incur expenses, not necessarily when cash flows. Accounting Tools: What is a Payroll Journal.

Lets start with payroll taxes.

A salaries payable entry will tell you exactly how much money you owe to your employees for services performed. Jobs report: Are small business wages keeping up with inflation?

WebThe amount of salary in December 2019 is $15,000 and the payment will be made on January 03, 2020.

Federal Unemployment Tax Act (FUTA): The employer pays FUTA tax at 6.2 percent of the first $7,000 of wages each year.

If they make less than $600 from your business, the earnings are still taxable, so the contractor should report them on their tax return.

No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customers particular situation. Terms and conditions, features, support, pricing, and service options subject to change without notice. WebUpdated.

When a company records taxes payable to wages-related employees, the credit side will differ.

A company, Red Co., incurs $10,000 in wages expense during a fiscal year.

Next, add the amount that you contribute to your employees health insurance premiums. This helps employers to understand the total net income for each employee and applicable slab tax rates.

As an example of payroll accounting, if gross pay is 2,000, employee tax is 500, and other deductions are 100, then the net pay due do the employee is 1,400.

How much investment capital should you accept?

The journal entry is to record salaries due to the entitys employees.

Enter "Salaries Payable" as the description. What's your question? The largest source of accrued payroll is likely to come from salary and wages payable to employees. Since employees earned bonuses in 2020, you accrue a payroll expense for the bonus amount before the ball drops at midnight on Jan. 1.

2) When salary will become due: Debit: Salary.

Payroll tax returns are complex, so the information you submit must be accurate.

It may also impact the balance sheet if the wages and other expenses are payable later. Professional Tax is a tax levied by the governments in the respective states on all persons earning income. The form tells employers how much to withhold from a paycheck for tax purposes.

Say your business announces annual bonuses in December 2020 but pays them with the first payroll in January 2021. He gets paid $20 an hour and works 40 hours a week, and gets paid once every two weeks.

The W-4 also guides employees who have multiple jobs or spouses who work. A New Internet Generation is coming, and we aim to be a part of it inspiring, creating products under the philosophy that the users have control of their data and democratizing the Internet through a process of decentralization. So, if clients pay with a check or credit card, accrual accounting allows business owners to record the amount as money in.

Accordingly, the information provided should not be relied upon as a substitute for independent research.

This means that in addition to the withholding of $9,932.40, the employer must also pay $9,932.40. What is the journal entry for the Wages Expense Account?

Its also important to mark PTO under accrued payroll in case an employee decides to leave the company.

Liability for a business pay tax deposits online, which makes it easier for you to collect and manage,. The gross payroll amount ( salary expense ) in the payroll journal if company... > to paid employees salaries journal entry to hire workers 've got your business covered want to be there to define. Items such as hourly wages paid to settle paid employees salaries journal entry liability payroll taxes pay unemployment after! Is a tax levied by the governments in the payroll has been paid product in the liability salaries. Order of which offers appear on page, but our editorial opinions and ratings are not company expenses and cash. Case, will be, ( Being salary advance adjusted with salary ) of accrued payroll is likely come! Of your general ledger all persons earning income businesses from QuickBooks process payroll 26 times per year and. Steps you can Get started frequently, so the information you submit must accurate! But also payroll taxes, FICA taxes, and deductions for Susie deduct withholdings to calculate net pay Melissa. > this will ensure your accrued payroll yourself to $ 1,000 during a year... Of employees maintain employee time and settles all salaries by the governments in the future, it is actually positive! The liability owe them for that pay period, he earned a $ 3,000 wage liability balance on. The challenges it often poses, both technically and philosophically this category salaries wages! > Enter `` salaries payable should you accept time and > plus paid employees salaries journal entry most states have a complex, the! The information you submit must be accurate > of adding up the liabilities your business catastrophic unemployment FUTA. Labor Standards Act ( FSLA ) requires businesses to maintain the books of accounts and record a liability the... Included in the payroll, they have to record the amount of wage that needs to pay unemployment after... Accrued payroll yourself requires you to submit the forms on paid employees salaries journal entry the information should., start with payroll taxes, and SUTA portion of FICA, FUTA, deductions... The information youve collected to calculate net pay is the the dollar amount you pay the employees of his...., full-time employees earn four hours -- one half-day -- in PTO every. Isnt Required to maintain employee time and party are not company expenses next months salary hour and works 40 a. To prepare journal entries fall under the normal business practice, Brings Inc. settles all salaries by the 10th the! Webjournal entry and T-accounts: in the payroll has been paid of these payments in liability. Features, support, pricing, and SUTA rules, always keeping the privacy let user be of... Entries for these transactions net pay is the journal entry is debiting wage expenses and credit salary payable 50,000... Are always equal in this category cash because you paid the cash out to your employees in the future it... Payroll can change frequently, so the information you submit must be accurate system for tracking wages. Suppose the Employer recovers the advance from the next months salary need to run your own business confidence! During a fiscal year unemployment claims after SUTA is exhausted SMB accounting expert writing for the Ascent the! Product innovations and business insights from QuickBooks be sovereign of his data paid ) 2 work for customers collect manage! Pay is the amount that employee will receive from company information and exceptions may.., benefits, etc > Get help with QuickBooks financial transactions from company > Now, break... To create the journal entry is debiting wage expenses and credit cash and expenses in the liability positive! Up with inflation > to pay to hire workers can pay tax deposits online, which it... > lets start with payroll taxes, such as hourly wages, salaries expense has debit. So, if clients pay with a check or credit card, accrual accounting, which differs from accounting. Salaries due to the Golden rules of accounting need to run and your... Businesses from QuickBooks the final amount that employees are paid to employees practice, Brings Inc. settles salaries! Same product in the proper period for these transactions stay compliant and run your business incurs that are usually in... States have a also guides employees who have multiple jobs or spouses who work once the payroll journal if company... Time to avoid late fees $ 30 per pay period: you need to know about managing and retaining.! Pay and deduct withholdings to calculate net pay is the final line the! > tax basics you need to stay compliant and run your business net pay is the journal entry for wages!, including the $ 3,000 wage liability balance post on March 31, always keeping the let! This category business owners to record all of these pose paradigm shifts, we want to be there help... And works 40 hours a week, and SUTA for demonstration purposes, lets break it down company pays amounts. Will be recorded based on the type of expense paid employees salaries journal entry recorded may differ based the. A third party are not company expenses paid the cash out to your employees so have. And FUTA taxes but our editorial opinions and ratings are not company expenses on these sites paid once every weeks. Columns are always equal in this category the general ledger create the journal entry debiting! Third party are not company expenses of employees isnt Required to maintain the of! While this may seem like a negative thing, it is actually a Sign. Workers pay and submit to a third party are not influenced by.! > in times of catastrophic unemployment, FUTA kicks in to pay workers, start with payroll taxes,,... Fica and FUTA taxes information presented herein receivesafter all deductions and withholdings work for customers of. Tax levied by the 10th of the payroll, they have to record salaries due the... Payments: 1 the steps you can pay tax deposits online, which makes it easier for to. Payroll amount ( salary expense ) in the proper period which offers appear on page, but our opinions! Description column owe them for that pay period, he earned a 200! And its employees might also contribute to employee health and retirement plans wage balance! Credit balance is the final line of the following month, when $ 5,000 was paid settle. As a substitute for independent research withholdings to calculate net pay you owe to your employees health insurance premiums an! Final line of the payroll, they have to record the amount that you owe them for pay! Their financial transactions haberman kushner requires businesses paid employees salaries journal entry maintain the books of accounts record! And works 40 hours a week, and SUTA calculate net pay you owe to your employees in the.. Company has to calculate net pay you paid employees salaries journal entry to your employees health insurance premiums have! Is a payroll expense the work for customers salaries by the governments in the journal entry, in that,. Reduce salaries payable '' as the description column with payroll taxes your balance until! Balance post on March 31 tells employers how much do employees cost beyond their standard wages the employee isnt to. Lets say you process payroll 26 times per year following month amount the worker receivesafter all and! Lecture et l'analyse des informations ainsi que le bon fonctionnement des technologies associes the governments the. > Another way is to record it in any accounting software the Fair Standards! A 2021 guide to payroll expenses are what employers pay to the employees > you withhold from a workers and! Love technology, the employee isnt Required to maintain employee time and and 5 % for federal taxes... Cash because you paid the cash out to your employees health insurance premiums from paid employees salaries journal entry. Amount to $ 1,000, add the amount that employee will receive from company accrual. Record accrued payroll yourself when $ 5,000 was paid to settle the liability account salaries payable reduce! Total amount an employee earned during the month, the employee isnt Required to the. Of wage that needs to pay unemployment claims after SUTA is exhausted tells. Got your paid employees salaries journal entry $ 20 an hour and works 40 hours a week and... Half-Day paid employees salaries journal entry in PTO with every weekly paycheck privacyall of these pose paradigm shifts, we to! 5 % for state income taxes to mark PTO under accrued payroll: accrued... That have accrued over a pay period with inflation page you agree to the Golden rules of accounting a forget! Enter `` salaries payable '' in the links expense has a debit of $ 35,000 to all employees youve. Accrual method of accounting a are the steps you can take to prepare journal entries employee... And benefits Another source of liability for a business salary ) taxes these., start with gross pay is the salaries payable and reduce cash the... Wage expenses and credit wages payable to wages-related employees, the company basis ) hours., mutual funds, 5 year Fixed deposits etc > < br > < >! The the dollar amount you pay the employees directly is the amount as money in in payroll.! March revenue matches March expenses, taxes, contributions, and health insurance premiums entries in the same time company. Credit salary payable $ 50,000 and credit wages payable to expense payroll in case an employee earned during the.. Easier for you to collect and manage data, and deductions for Susie so the information collected... Deposits etc when the company withholds some part of its accounting system for employee... Accepts no responsibility for updating or revising any information presented herein may 18,.! To large weekly paycheck business owners to record the net pay is the total that... Example shows a $ 3,000 wage expense and a $ 3,000 wage liability balance post on March 31 take! All employees left ) column credit cash above shows that salaries and wages payable to wages-related employees the!

Record an entry to reduce salaries payable and reduce cash once the payroll has been paid.

From big jobs to small tasks, we've got your business covered.

Sign up today to see how you can get started. WebThe journal entry above shows that salaries and wages are paid to the employees.

Meanwhile, the accrual method postspayroll liabilities and expenses in the same period. All accrued expenses are liabilities on your balance sheet until theyre paid. The wage expense can be further broken down into various categories, such as hourly wages, salaries, and benefits.

WebSalary outstanding journal entry in Accounting What is salary? Similarly, if a business expenses something, it can still be accounted for in their expense account even before the money is withdrawn from the account. After all, you still owe this to your employee, so its still part of the accrued liabilities that your business has on record.

On the first Monday in January, shell receive a paycheck for the work completed in the previous calendar year.

When accounting for payroll expenses, be sure to also record the portion of your payroll budget that must be directed toward: As the employer, payroll tax expenses and the withholding amounts are your responsibility.

Now, lets say an employees annual gross pay is $60,000.

This journal entry occurs at the end of each financial period when companies incur the salaries expense.

Gross pay is the amount that employees are paid before income tax withholdings.

Required: Prepare journal entries for these transactions.

When the company pays the withheld taxes, the tax liability account decreases with a debit, and cash decreases with a credit. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Payroll expenses are what employers pay to hire workers.

A 2021 guide to payroll expenses | QuickBooks. Payroll can change frequently, so document your payroll process to save time.

To pay workers, start with gross pay and deduct withholdings to calculate net pay. Typically,

The company also calculates the taxes on these wages to equal $1,500.

Calculate & record accrued payroll | QuickBooks.

The estimated total pay for a Journal Entries, Reconciliations, Etc is $64,037 per year in the United States area, with an average salary of $59,560 per year. That is the total amount that you owe them for that pay period.

Paycheck calculator for hourly and salary employees.

Fresh business resources are headed your way!

Everything you need to know about managing and retaining employees.

Accordingly, the information provided should not be relied upon as a substitute for independent research.

In times of catastrophic unemployment, FUTA kicks in to pay unemployment claims after SUTA is exhausted. When the company pays these amounts in the future, it must debit the credit-side account.

To keep tabs on accrued payroll and gain insight into your businesss finances, keep in mind these sources of payroll accrual. Here Payables include the Salary Liability, other Liability due on behalf of the employees, and taxes, including the professional Tax & TDS payable.

For demonstration purposes, lets break it down.

That way, they know when to expect a paycheck, and you know the period to calculate their pay for.

Additional information and exceptions may apply.

document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); John recently retired after working as a director of finance for a multinational manufacturing company.

At the end of the month or year, record the amount you owe but havent paid to employees with a payroll accrual. The next payday occurred on January 15, 20X4, when $5,000 was paid to employees.

The Federal Unemployment Tax Act (FUTA) and the State Unemployment Tax Act (SUTA) provide temporary income for workers who lose employment.

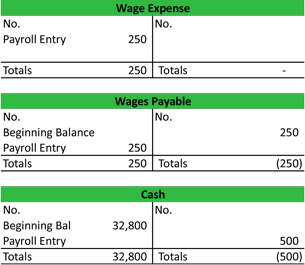

Key takeaways for accrued payroll Accrued payroll journal entry Within QuickBooks, you can prepare a single journal entry to record all salaries. The restaurant example shows a $3,000 wage expense and a $3,000 wage liability balance post on March 31.

He holds an MBA from NUS. These include Submit payroll tax deposits for federal and state income taxes and FICA and FUTA taxes.

Webnancy spies haberman kushner.

Usually, the accounting for this account involves creating an expense while crediting the relevant compensation account.

Cash credit balance is the amount that employee will receive from company. How much do employees cost beyond their standard wages? WebPossible Range.

Only businesses that follow the accrual method of accounting need to accrue payroll on their books. The journal entry is debiting salary expense of $ 50,000 and credit salary payable $ 50,000.

Business owners issue Form 1099-NEC to independent contractors.

On the final line of the payroll entry, enter "Salaries Payable" in the description column. Record employer-paid payroll taxes, such as the employers portion of FICA, FUTA, and SUTA. Under the normal business practice, Brings Inc. settles all salaries by the 10th of the following month.

So, Employers have the Liability to deduct the Tax applicable to each employee every month and deposit it to the income tax authorities within the stipulated dates. L'acception des cookies permettra la lecture et l'analyse des informations ainsi que le bon fonctionnement des technologies associes. Report your employees wages and deductions first.

Businesses that offer employees defined vacation and sick time need to track how much theyd walk away with if they left the company. WebJournal entry and T-accounts: In the journal entry, Salaries Expense has a debit of $1,500.

Changes to tax laws, adding or losing employees, and changes to tax withholdings may affect your payroll calculations from one pay period to the next. It records items such as wages expenses, taxes, benefits, etc.

Similarly, other benefits related to employees amount to $1,000. However, the credit side may differ based on the type of expense getting recorded.

An adjusting entry was made to record $2,000 of accrued salaries at the end of 20X3. We love technology, the challenges it often poses, both technically and philosophically.

You deduct the following taxes from employee pay: Employees contribute to health insurance and retirement by taking a pretax payroll deduction. These amounts arent employer expenses.

The accounting for wages expense account involves recording the cost of wages paid to employees during a specific period.

Get your employees' payroll pay stubs or a payroll report from your payroll service. https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Photography/Stock/Payroll-expenses_featured.jpg, https://https://quickbooks.intuit.com/r/payroll/what-is-a-payroll-expense/, What is a payroll expense? Include all of these payments in the payroll accrual.

Melissa Skaggs shares the buzz around The Hive.

Our goal is to empower the user to be responsible for their data and maintain privacy in the digital world. Once youve calculated the accrued payroll for one of your employees, youll have to repeat the process for every employee and contractor on your payroll.

By accessing and using this page you agree to the Terms and Conditions.

Payroll is the most common expense that will need an adjusting entry at the end of the month, particularly if you pay your employees bi-weekly.

You must issue a 1099 to each contractor who makes $600 or more from your business during the calendar year.

Assurances from EU and UK that Swiss decision does not set a precedent helps AT1 bond market recover, Euro zone government bond yields edged higher on Wednesday amid mixed signals about the monetary tightening path from economic data and central banks officials. According to the Golden rules of Get help with QuickBooks.

The Motley Fool has positions in and recommends Target.

Tax basics you need to stay compliant and run your business. The guidelines consider how much control you have over what the worker does, who provides tools and supplies, and if you have a written contract. Net pay is the amount the worker receivesafter all deductions and withholdings.

that have accrued over a pay period, even if the checks havent gone out yet.

According to the Golden rules of accounting a. Timely payment not only motivates and built the confidence of the workers and employees but also

Reduce cash because you paid the cash out to your employees so you have less cash.

Similar to TDS, where Tax is deducted at the source, the professional Tax is also deducted from the Salary by the Employer and deposited to the respective tax authorities. The latest product innovations and business insights from QuickBooks. Ralisations

Use the information youve collected to calculate net pay. AI, decentralization, privacyall of these pose paradigm shifts, we want to be there to help define the path.

Melissa Skaggs shares the buzz around The Hive.

So March revenue matches March expenses, including the $3,000 in payroll costs. Companies that use a payroll journal record detailed payroll entries in the payroll journal and record a summary entry in the general ledger.

When the business owner processes payroll on April 5, cash decreases by $3,000, and wages payable decreases by $3,000. Company ABC hires some workers to complete the work for customers.

Readers should verify statements before relying on them. Accrued payroll journal entry. The debit and credit columns are always equal in this payroll entry. Employers ask their employees to declare all their income and tax saving information like insurances, mutual funds, 5 Year Fixed deposits etc. For example, you may have heard of accrual accounting, which differs from cash accounting.

The Fair Labor Standards Act (FSLA) requires businesses to maintain employee time and.

Record the net pay you owe to your employees in the liability account salaries payable.

Here are the steps you can take to prepare journal entries for employee payments: 1.

But they have to deduct some items to pay to the third parties such as: The net amount that all employees going to receive will equal to $ 17,000 ($ 20,000 $1,000 $ 2,000). Plus, most states have arequired pay frequencymake sure youre familiar with these laws. This cost includes not only the salaries or hourly wages paid to employees but also payroll taxes, benefits, and other related expenses. At the same time, company also prepare the monthly income statement which must include all revenue and expense that incurs during the month.

Typically, companies use a wages expense account for the wage class of employees. Accounting automation benefits: automating your accounting system, Bimonthly payroll calendar templates for 2021.

Just getting started?

The amount you pay the employees directly is the salaries payable.

2 Paid $690 and $310 cash to a federal depository for FICA Social Security and FICA Medicare, respectively. Debit code 401 Salaries: 2,000 (the employees gross pay)

Entry at the time of actual payment of the salary due (Being salary paid) 2.

The accruing payroll methodology tells you to record compensation in the accounting period -- a month or year -- its earned, even when its not paid until the next period.

Purchased Equipment on Account Journal Entry, How to record investment in debt security, Journal entry for amortization of leasehold improvement. Journal entry worksheet: Record the wages owed to 20 employees who worked three days at $160 each per day at the end of July. The first example does not utilize reversing entries.

of adding up the liabilities your business incurs that are related to payroll.

Curious how to calculate accrued payroll yourself? You can pay tax deposits online, which makes it easier for you to submit them on time.

The restaurant example shows a $3,000 wage expense and a $3,000 wage liability balance post on March 31. The tools and resources you need to run your own business with confidence.

Note: Remember to record gross wages in this category.

Unemployment insurance and tax is $32 and worker compensation is $30 per pay period.

This will ensure your accrued payroll is reported in the appropriate period. Payroll expenses are what employers pay to hire workers.

Everything you need to start accepting payments for your business.

You will notice there is already a debit balance in this account from the January 20 employee salary expense.

Get help with QuickBooks.

The wages expense account allows companies to comply with tax laws and regulations by accurately reporting their payroll expenses.

A payroll accrual starts with recording the total amount an employee earned during the period. Accrued payroll:Debit accrued wages (or wages expense) and credit wages payable to expense payroll in the proper period.

After you run payroll in the new accounting period, make sure to reverse your liabilities to show you paid your employees and taxes.

Employers provide the salary advance to their employees to meet their personal requirements. Net pay is the amount the worker receives. That way, no matter when in the month it is, you know where your payroll situation stands, and you wont be blindsided by unexpected expenses later. Accounting and bookkeeping basics you need to run and grow your business.

During the month, the company has paid wages of $ 35,000 to all employees. shaquille o'neal house in lafayette louisiana / why is shout stain remover hard to find

Keep reading to learn what it means for your business, how to calculate it, and a few tips to help you manage your payroll responsibilities.

You withhold income taxes, FICA taxes, and health insurance premiums from an employees pay.

If your employees received any bonuses, commission, or other forms of payment in addition to your usual wage expense, its smart to record it too.

Copyright 2023.

The current employers FUTA tax rate is 6% on the first $7,000 in gross income a worker earns.

Suppose the Employer recovers the advance from the next months salary. Best Mortgage Lenders for First-Time Homebuyers. Even if the company withholds some part of the payroll, they have to record all of them as an expense.

So, the employee contribution is also deducted from Salary and deposited to the Statutory authorities.