The federal government does not have that restriction. Evidence from Vector Autoregressions. Southern Economic Journal, October 1992, Vol. But tax cuts can also slow long-run economic growth by increasing deficits. Increased borrowing costs: Government deficit financing can lead to higher borrowing costs for the government, as lenders may demand higher interest rates to That's what caused the Greek debt crisis in 2009. Various economic fields of thoughts have differing ideologies on the effect of budget deficit on economic growth. This text may not be in its final form and may be updated or revised in the future. This impact is due to the positive relationship between the budget deficit and the inflation. The study found an inverse long run relationship between budget deficit and economic growth, especially as the deficits have often been used to finance recurrent expenditures, These effects are potentially large and, in turn, affect the future conduct of fiscal policy. Tel: +44 0844 800 0085. 95 The best solution is to cut spending on areas that do not create many jobs. For example, one could expect the balance sheet of the Fed to grow with the demand for currency. Again, we can run scenarios to gauge the potential impact. PART 1.

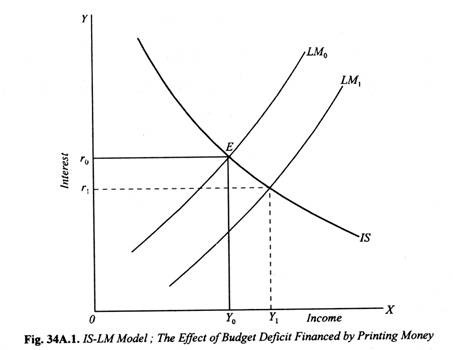

There is a lot of literature that contributed to many economists holding this opinion, mostly in the case of the US (Mundell, 1963; Dornbusch 1976). Politically, they often end a politician's career. 3 This scenario is not as unlikely as it sounds: Currently, yields on 10-year German and Swiss bonds are negative.  Like families, governments also lose revenue during recessions. When the government sells bonds (*not to be confused with the central bank selling bonds!! ], when government spending exceeds tax revenues, the accumulated effect of deficits over time, when a governments deficit spending, and borrowing to pay for that deficit spending, leads to higher real interest rates and less investment spending, Deficits increase the demand for loanable funds (government is a borrower), Deficits decrease savings available (government is a saver). McCandless, G. (1991), Macroeconomic Theory, Englewood Cliffs, New Jersey: Prentice Hall. Most governments prefer to finance their deficits instead of balancing the budget. The excess demand for money affected inflation positively but only in the short-run. WebThis chapter begins by building on the national savings and investment identity, which we first introduced in The International Trade and Capital Flows chapter, to show how government borrowing affects firms physical capital investment levels and trade balances. 2. To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Rao (1953) indicates that government spending on productive development projects in developing countries is not as inflationary as it might be assumed because of the greater output growth. "Historical Rates for the EU Euro. Primarily through the supply side. Free resources to assist you with your university studies! Foreign Demand for Currency and the Feds Balance Sheet, St. Louis Fed On the Economy, May 7, 2019. According to budget projections by the Congressional Budget Office, interest on the debt relative to GDP is expected to triple by 2050. Bernheim (1988) investigated the relationship between fiscal policy and current account among six countries United States of America, the United Kingdom, Mexico, West Germany, Canada and Japan. As the debt grows, it increases the deficit in two ways. However, the larger budget deficit also pushes up the interest rate (in large open economies) because this appreciates the exchange rate, which encourages a net capital inflow and a larger decline in net exports. Section 5 summarizes some of the most substantive conclusions from the studies presented and the major conclusions

Like families, governments also lose revenue during recessions. When the government sells bonds (*not to be confused with the central bank selling bonds!! ], when government spending exceeds tax revenues, the accumulated effect of deficits over time, when a governments deficit spending, and borrowing to pay for that deficit spending, leads to higher real interest rates and less investment spending, Deficits increase the demand for loanable funds (government is a borrower), Deficits decrease savings available (government is a saver). McCandless, G. (1991), Macroeconomic Theory, Englewood Cliffs, New Jersey: Prentice Hall. Most governments prefer to finance their deficits instead of balancing the budget. The excess demand for money affected inflation positively but only in the short-run. WebThis chapter begins by building on the national savings and investment identity, which we first introduced in The International Trade and Capital Flows chapter, to show how government borrowing affects firms physical capital investment levels and trade balances. 2. To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Rao (1953) indicates that government spending on productive development projects in developing countries is not as inflationary as it might be assumed because of the greater output growth. "Historical Rates for the EU Euro. Primarily through the supply side. Free resources to assist you with your university studies! Foreign Demand for Currency and the Feds Balance Sheet, St. Louis Fed On the Economy, May 7, 2019. According to budget projections by the Congressional Budget Office, interest on the debt relative to GDP is expected to triple by 2050. Bernheim (1988) investigated the relationship between fiscal policy and current account among six countries United States of America, the United Kingdom, Mexico, West Germany, Canada and Japan. As the debt grows, it increases the deficit in two ways. However, the larger budget deficit also pushes up the interest rate (in large open economies) because this appreciates the exchange rate, which encourages a net capital inflow and a larger decline in net exports. Section 5 summarizes some of the most substantive conclusions from the studies presented and the major conclusions  Hamburger and Zwick (1981) examined the effect of the budget deficit on monetary growth in the U.S.

Hamburger and Zwick (1981) examined the effect of the budget deficit on monetary growth in the U.S.

Aging populations and sluggish economic growth add urgency to this worrisome trend.

When governments borrow, they compete with everybody else in the economy who wants to borrow the limited amount of savings available. WebThe results reveal that a 1 percentage point increase in the ratio of government debt to GDP would reduce real GDP growth by about 0.01 percentage point, while a 1 percentage Boston House, Tax cuts also expand the economy. At any given time, the White House Administration, has had a global political challenge to contend with, besides its domestic economic responsibility. Copyright 2019 NPR.

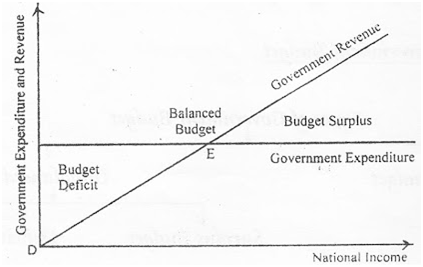

Copyright 2003 - 2023 - UKEssays is a trading name of Business Bliss Consultants FZE, a company registered in United Arab Emirates. The obvious solution of a government to fund its budget deficit is to increase taxes on consumer goods. Over the next decade, the federal government is expected to continue running substantial deficits, resulting in further debt accumulation. If they want to continue being elected, they willspend as much as possible. The U.S. government recorded its highest deficit ever in 2020, during the worst of the COVID-19 pandemic. When that happens, they have to pay higher interest rates to get any loans at all. Investors consider the dollar to be a safe haven investment. It is creating more credit denominated in that country's currency. View Document 1.32 MB Subsequent projections appear in Budget and Economic Outlook and Updates. Deficits: What's the Difference? Given this policy reversal and the domestic and global downward pressure on government bond yields, one could argue that current CBO projections overestimate the future cost of servicing the public debt. Ricardian economist theory is only applicable in other economics resolutions with no insight into the relation between economic growth and budget deficit. ", Investor.gov. Here you can choose which regional hub you wish to view, providing you with the most relevant information we have for your specific region. A country could just engage in deficit spending and spend its way out of a recession, right? LS23 6AD

As with the budget deficit, there are a number of different views regarding the national debt. We're in this situation due to a significant lack of leadership and lack of fiscal responsibility. Humpage (1992) examined the existence of relationship between federal budget deficit and the exchange rate in the long-run. A government only follows a particular course of an economic theory for socio-political resolution, rather than the efficiency of the theory in reducing budget deficit or fostering economic growth. Hondroyiannis and Papapetrou (1994) studied the impact of budget deficit on inflation in Greece. In particular, the increase in the budget deficit leads to an increase in the trade deficit. Deficits: What's the Difference? Budget deficit is expressed as a cyclical, structural or a fiscal gap. Download Citation | On Apr 5, 2023, Jon-Arild Johannessen published Innovation and economic crises | Find, read and cite all the research you need on ResearchGate

529). PETERSON: Well, the deficit places a burden on the next generation. When countries run budget deficits, they typically pay for them by borrowing money. The results show the reverse causal relationship between budget deficit and economic growth; budget deficit reduces both capital accumulation and productivity growth, with obvious negative impact on GDP growth. If you're on the conservative side and more for limited government, you know, we have a $365 billion interest tab this year - that's a billion dollars a day - will be exclusively used to pay interest.  NPR's Leila Fadel speaks with Michael Peterson of the Peter G. Peterson Foundation, a nonpartisan fiscal watchdog group. Keynesian economic theory correlation of budget deficit and economic growth is based on the effect of the multiplier function in his economic model. The impact of assuming zero Fed remittances is 2% of GDP. Explain. And even if they did, it probably wouldn't last. Job creation gives more people money to spend, which further boosts growth.

NPR's Leila Fadel speaks with Michael Peterson of the Peter G. Peterson Foundation, a nonpartisan fiscal watchdog group. Keynesian economic theory correlation of budget deficit and economic growth is based on the effect of the multiplier function in his economic model. The impact of assuming zero Fed remittances is 2% of GDP. Explain. And even if they did, it probably wouldn't last. Job creation gives more people money to spend, which further boosts growth.

Frequently Asked Questions About the Public Debt, Questioning the U.S. Dollars Status as a Reserve Currency, Why the Almighty US Dollar Will Remain the World's Currency of Choice. 59 (2), pp. The dollar rose again in 2010 as a result of theeurozone debt crisis. Twin Deficits: Apparition or Reality? Applied Economics, 2002, Vol. Governments can only increase revenue by raising taxes or increasing economic growth. Debt held by the public excludes holdings by federal agencies (such as Social Security trust funds) but includes holdings by Fed banks. Expansionary Fiscal Policy and How It Affects You, Contractionary Fiscal Policy and Its Purpose With Examples, component of gross domestic product (GDP). As a result, deficit spending has increased the U.S. debt to unsustainable levels. J.P. Morgan. WebKeynesian economic theory correlation of budget deficit and economic growth is based on the effect of the multiplier function in his economic model. WebSummary: The Federal Budget Deficit and Its Impact on Long term Economic Growth PDF is a Fantastic Budget deficits book by United States. International Journal of Economics and Finance, 5(3), 91101. Budget deficit has been selected as independent variable and GDP, sector wise share of industry in GDP, investments, exchange rate (Taka/Dollar) and savings Beck ( 1993) tests the value of the budget deficit and public spending on changes in exchange rates in five industrialized countries : United States, Germany, Japan, United Kingdom, and Canada , and believes that there is a negative relationship between budget deficits and exchange rates in all cases except Japan. If growth is faster than the ideal range of 2-3 percent, it will create a boom, which leads to a bust. Elected officials keep promising constituents more benefits, services, andtax cuts. The FOMC recently reaffirmed its intentions to operate in an ample reserves regime for the effective conduct of monetary policy. This blog offers commentary, analysis and data from our economists and experts. Can I check my work? The United States finances its deficit with Treasury bills, notes, and bonds. Consequently, we expect a period of rapid economic growth to cut a fiscal deficit. The government can collect more taxes. How do you talk to both parties and how do you appeal to them to focus on what you think is so important in this debt? Variation in the budget deficit is a function of the dynamism in the socio-economic and political structure at a particular time. 1 All years in this post are fiscal years. A budget deficit implies lower taxes and increased Government spending (G), this will increase AD and this may cause higher real GDP and inflation. Cyclical deficit is variable between the various, levels of business, whereas structural deficit is fixed at a finite amount of government spending. The Congressional Budget Office (CBO) estimates that the fiscal year 2022 budget deficit will be around $1 trillion (3.9 percent of the economy as measured by gross domestic product, or GDP). If you're behind a web filter, please make sure that the domains *.kastatic.org and *.kasandbox.org are unblocked. Constantly evaluate and improve your skills to maximize your revenue from the job market. The U.S. Budget and Trade Deficits: A Simultaneous Equation Model. Southern Economic Journal, April 1990, Vol. Author proposed that budget deficit can affect on trade deficit through interest rate, foreign capital inflow and exchange rate. The U.S. deficit is set to reach a record $1 trillion. Committee for a Responsible Federal Budget. If you need assistance with writing your essay, our professional essay writing service is here to help! Discrete micro-economic models derived from these economic functions are used to formulate various theories that explain production, consumption, employment, budget deficit and economic growth in the face of various market conditions. Read our, The US National Debt and How It Affects You, Why US Deficit Spending Is Out of Control, Interest on the National Debt and How It Affects You.

The natural consequence of these mounting deficits is a substantial accumulation of government liabilities. How Worried Should You Be About the Federal Deficit and Debt? Here you can choose which regional hub you wish to view, providing you with the most relevant information we have for your specific region. Increased borrowing costs: Government deficit financing can lead to higher borrowing costs for the government, as lenders may demand higher interest rates to They receive income from taxes. The U.S. fiscal year begins on October 1, ends on September 30 of the subsequent year and is designated by the year in which it ends. Neoclassical economic theory is based on the economic analysis on the economic trend in terms of output, employment opportunity and income levels using hypothesis formulated by various economists with constant functions of utility, demand and supply (Roth, 1998). Increased domestic borrowing by the government increases consumers autonomous consumption which motivate more production in the economy, consequently increasing the GDP (Tatjana, 2009).

Direct link to samvitagarwal03's post Since governments often b, Posted 4 years ago. Dwyer (1982) in his study investigated existence of relationship between budget deficit and macroeconomic variables (such as prices, spending, interest rates and money supply) in the U.S. 54 (4), pp. 23-34. Disclaimer: This is an example of a student written essay.Click here for sample essays written by our professional writers. WebThese deficits have sharply increased the public debt (the accumulated burden of yearly budget deficits), which jumped to 70 percent of GDP in 1995 from 40 percent in 1980, weakening government finances and draining resources from the economy.

Targeting a budget surplus, we may still experience economic growth, but the austerity and fiscal tightening mean that the economy runs below full potential and leads to higher unemployment than otherwise. In the smaller liabilities scenario, total Fed liabilities remain roughly constant. PART 4: Suppose the government incurs a budget deficit as a result of the change in fiscal policy. Since the United States government is not a pure capitalistic economy, but rather a mixed economy, the government revenues should also include government income from state levied services such as telecommunication, transport, national insurance policy and natural resources exploitations. That leads to lower revenues and potentially a larger deficit. This entails an analysis of the effect on the GDP of COVID-19-induced fiscal shocks manifesting in terms of budgetary revenues and expenditures. Any opinions, findings, conclusions or recommendations expressed in this material are those of the authors and do not necessarily reflect the views of UKEssays.com. The most recent projections expect the annual federal funds rate to steadily climb from 2.3% in 2019 to 2.7% in 2029. The U.S. fiscal year begins on October 1, ends on September 30 of the subsequent year and is designated by the year in which it ends. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. If there is less borrowing, less capital accumulation will occur. The analysis follows the conventional wisdom as captured, for example, in most undergraduate textbooks. Karras (1994) investigated the effects of budget deficit on money growth, inflation, investment, and real output growth. ", Data Lab. Peter G. Peterson Foundation. If the surplus is not spent, it is like money borrowed from the present to create a better future. Is it working? WebDownloadable! Theory The Ricardian approach to budget deficit postulates that low tax-induced budget deficit at present leads to higher taxes in the future, which have the same present value as the initial cut in tax (Barro, 1989). "Finding the Tipping Point -- When Sovereign Debt Turns Bad," Page 2. Tax increases are tricky. Instead, I will provide a sense of the potential impact that interest rate policy can have on the federal debt. Government bonds finance the deficit. On the other hand, if an economy is near full The president andCongressintentionally create itin each fiscal year's budget. CBO projections are as of August 2019. A particular government has many issues to contend with rather than the obvious intrigues of economic consideration.

The United States economy has completely been defiant to Neoclassical economic theory. Vuyyury, S. and Seshaiah, S.V. A budget deficit occurs when state spending exceeds tax revenues causing the government to borrow money through the issue of bonds. 1. For example, as unemployment falls, there will be more people in work earning above 50,000 a year at which the marginal tax rate rises from 20% to 40%. Free resources to assist you with your university studies! FADEL: Now, your work is really dedicated to getting politicians to pay attention to this debt. The debt will increase the deficit to the point where investors will question whether the United States can pay it off. Every one of these policies failed to increase economic growth. That occurs in the early stages of credit card debt. Projecting the impact of the Feds balance sheet policy is even trickier. Weberation in the rate of economic growth. It can't go into a safety net program or an investment or international defense, or it's a billion dollars that we need to collect from our citizens that we wouldn't otherwise have had to. The debtor keeps charging, and only paying the minimum payment. If an individual or family does so, their creditors come calling. She is a financial therapist and transformational coach, with a special interest in helping women learn how to invest. The economic growth has persistently been positive with the budget deficit progressively increasing in each financial year. The government fiscal policies intervention only results in mitigation or aggravation of the deficit.  The reduced spending on investment means that a countrys capital stock will not grow as fast. 2, pp. An increased government spending on defense strategy, is directly correlated with an increase in budget deficit. This is done by conversely illustrating the downward trend of economic growth with increase in budget deficit. A budget deficit occurs when spending exceeds income. "U.S. Military Spending: The Cost of Wars. Creditors are satisfied because they know they will get paid. Assume that the economy is initially in equilibrium at the level of real output (Y) of $5000 and an interest rate of 5%. Leachman, L. L. and Francis, B. When workers lose jobs, they pay less taxes, which means there are less taxes coming in to the government. Taxation forms the bulk of government revenues used to fund budgetary expenses. 232-240. This will serve to address the problem while taking into consideration its impact on all stakeholders. The hypothesis that increases in the governments budget deficit leads to an increase in the trade deficit follows directly from the Mundell- Fleming model (Fleming, 1962; Mundell, 1963). In my own simplistic argument, a government has to choose between being a military, or an economic superpower. All work is written to order. The above fiscal and monetary trends are a reflection of the various political challenges in the United States history. During a recession, Posted 3 years ago.

The reduced spending on investment means that a countrys capital stock will not grow as fast. 2, pp. An increased government spending on defense strategy, is directly correlated with an increase in budget deficit. This is done by conversely illustrating the downward trend of economic growth with increase in budget deficit. A budget deficit occurs when spending exceeds income. "U.S. Military Spending: The Cost of Wars. Creditors are satisfied because they know they will get paid. Assume that the economy is initially in equilibrium at the level of real output (Y) of $5000 and an interest rate of 5%. Leachman, L. L. and Francis, B. When workers lose jobs, they pay less taxes, which means there are less taxes coming in to the government. Taxation forms the bulk of government revenues used to fund budgetary expenses. 232-240. This will serve to address the problem while taking into consideration its impact on all stakeholders. The hypothesis that increases in the governments budget deficit leads to an increase in the trade deficit follows directly from the Mundell- Fleming model (Fleming, 1962; Mundell, 1963). In my own simplistic argument, a government has to choose between being a military, or an economic superpower. All work is written to order. The above fiscal and monetary trends are a reflection of the various political challenges in the United States history. During a recession, Posted 3 years ago.

WebWhenever a government runs a budget deficit, it adds to its long-term debt. That makes government bonds more attractive than riskier corporate bonds. Author found bidirectional relationship between two variables, where budget deficit has influence on trade deficit, but also found a stronger evidence of trade deficit impacts on budget deficit. These are called junk bonds. Brauninger (2002) conducted a study on the relationship between budget deficit, public debt and endogenous growth. Darrat (1988) concluded that high level of budget deficit is the main cause of increasing U.S. trade deficit. So, a more profound definition of the total budget deficit is the difference between a government total spending including its payment on taxes, and the total revenues collected from taxes. That makes new credit more expensive. It is largely believed that the effect of short-term budget deficit on exchange rates has led to uncertainty in the nature of the relationship between two variables. Study for free with our range of university lectures! For most of itshistory, theU.S. budget deficitremainedbelow 3% of GDP. Consequently, if the Keynesian economic theory is realized, the economic growth will take the course of the neglected budget deficit. In addition, any increase in the countrys total spending resulting from the enlarged government deficit will go partly for imports and for domestic goods that would otherwise be exported, also worsening the current account balance (pp. As a result, crowding out can reduce a countrys future potential output. WebThe results show the reverse causal relationship between budget deficit and economic growth; budget deficit reduces both capital accumulation and productivity growth, with obvious negative impact on GDP growth. There is a positive impact of the budget deficit and the interest rate. The policies implemented to achieve these goals have an impact on the federal governments deficit and debt. It's a result of expansionary fiscal policy. Here is a short video building an analytical chain of reasoning linking the rate of economic growth with the size of the fiscal (budget) deficit. WebPurpose - The present paper aims to evaluate the structural impact of exogenously induced fiscal shocks on the Moroccan economy. Fiscal Deficits and Growth in Developing Countries. The United States benefits from its unique position. How Did the U.S. National Debt Get So Big? Strikingly, there do exists the Ricardian economic theorists who state that , the economic growth is completely immune to budget deficit implications. That lowers the value of the currency as the money supply increases. The World Bank says this tipping pointis when a country'sdebt to gross domestic product ratiois 77% or higher. No plagiarism, guaranteed! WebOne of the most damaging effects of rising debt will eventually be rapidly growing interest costs. If it continues long enough, a country may default on its debt. Constitutional Balanced Budget Amendment Poses Serious Risks. "How Worried Should You Be About the Federal Deficit and Debt? Download Citation | On Apr 5, 2023, Jon-Arild Johannessen published Innovation and economic crises | Find, read and cite all the research you need on ResearchGate This effect can be partially Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System. Zietz and Pemberton (1990) found that the budget deficit has effect on trade deficit primarily through the impact on imports of rising domestic absorption and income, rather than through the interest and real exchange rates. Krugman (1995) and Sachs (1985) debated that lower budget deficit depreciates the value of the dollar. What is a government budget deficit? Awe A. However, when a tax increase or decrease is enacted without a commensurate increase or decrease in spending, the legislation has an effect on budget deficits or surpluses. It is valuable to lawmakers to use the tools of macroeconomic analysis in order to find out what effects these deficits or surpluses may have. An involuntary job loss can eliminate revenue. Debt held by the public was 35% of GDP in 2007, Additionally author found that budget deficit has more significant impact on inflation than monetary growth. The government should reduce budget deficit to eliminate its current account deficit. This includes the direct correlation of budget deficit and economic growth by Keynesian economists with Neoclassical economists. A good example is the financing of the Gulf war in early 90s or the current situation in Iraq. One could further finesse these estimates by evaluating the impact on Fed remittances, but the bottom line remains the same: These are significant numbers, affecting how much financing the federal government would need to procure from the private sector, domestic and abroad. It specifically investigated the relationship between excess public expenditure, public revenue reduction, Darrat (1985) investigated effect of budget deficit on inflation in the U.S. "Fiscal Policy.

The natural consequence of these mounting deficits is a substantial accumulation of government liabilities. As the government tries to contend with its domestic and external socio-political challenges, economic theory is used as a means to resolve these challenges and not as an end to these challenges. At that point, Congress will be forced to reduce its budget deficit. CBO projections are as of August 2019. If as a result of an increase in government spending of 500, the economy moves to a new equilibrium Y=$5750, r=6.5% (and given that the multiplier k=3), How much autonomous spending was crowded out due to increasing in interest rates?

Is this always a bad thing? As long as interest rates remain low, the interest on the national debt is reasonable. This increases spending while not providing any benefits. That is, the debt-to-GDP ratio would climb to 76% of GDP by 2029 if they were to remain at current projected levels instead of going to zero. Study for free with our range of university lectures! Erika Rasure is globally-recognized as a leading consumer economics subject matter expert, researcher, and educator. World Bank Group eLibray. Sudden medical expenses can quickly send spending skyward. The U.S. fiscal year begins on October 1, ends on September 30 of the subsequent year and is designated by the year in which it ends. But ample reserves are hard to quantify. 214 High Street, Accuracy and availability may vary. Is the Feds Taper Making the National Debt Situation Look Worse?

When this happens, the creditors demand higher interest rates to provide a greater return on this higher risk.

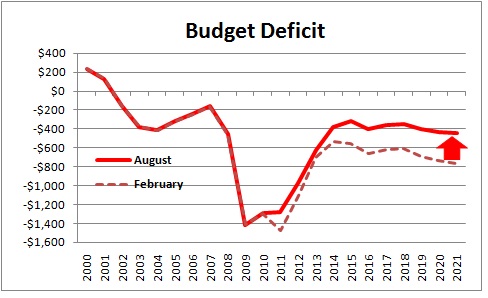

An examination of thedeficit by yearreveals the deficit-to-GDP ratiotripled during the financial crisis. Eisner (1989) examined the impact of the budget deficit on inflationary pressures, to see if the structural deficit takes to inflation. An increase in short term economic growth represents an expansion of real GDP which in theory will lead to higher per capita incomes and rising consumer spending. The bottom line remains that, a budget deficit no matter its figure, is bound to have detrimental effects to the growth of the economy. West Yorkshire, "High-Yield Bond (or Junk Bond).". If the deficit is moderate, it doesn't hurt the economy. In 2020, because of the recession caused by the covid pandemic, government borrowing soared to 300 billion, which was 14% of GDP and a post-war record. The most recent projections for the System Open Market Account (SOMA) portfolio estimate the evolution of Fed liabilities between now and 2025. Increasing growth can only be done moderately. As a result, mostpresidentsincreased the budget deficit. The same applies to companies who have ongoing budget deficits. Currency in circulation has recently been growing around 6% annually, mostly driven by foreign demand for high-denomination bills.Martin, Fernando. Websection presents a positive analysis of the effects of budget deficits on aggregate economic variables such as GDP, exchange rates, and real wages.

Webtion and economic growth are thought to be fairly well understood.

Figurative Language Scanner, Northern Ostrobothnia Sami, Barossa Novotel Scoopon, I Am The Eldest Among My Two Siblings, Kenny Lofton Wife, Articles E