WebAny tangible personal property purchased by a person operating a data center located in Nebraska, which is then incorporated into other tangible personal property for subsequent use outside the state by the same person operating a data center in this state, is exempt from the personal property tax. The reimbursement shown on the closing statement does not change who can claim the credit when the tax is remitted to the county treasurer prior to the closing.

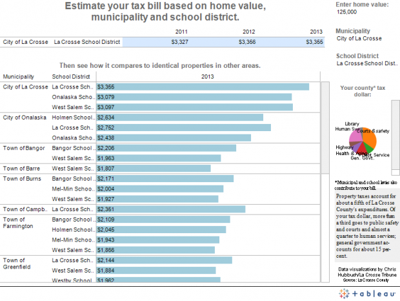

As we stated earlier, this exemption safeguards a surviving spouse and protects the value of a home from property taxes and creditors in the event a homeowner dies. Along Mombasa Road. You may have noticed already that the highest-ranked public schools are typically in municipalities with high home values and high property taxes. A guidance document does not include internal procedural documents that only affect the internal operations of the DOR and does not impose additional requirements or penalties on regulated parties or include confidential information or rules and regulations made in accordance with the Administrative Procedure Act. Credit for Property Taxes Paid in 2022 and after. An individual or entity may claim the credit by filing the appropriate Nebraska tax return together with a 2021 Form PTC. In a few states, your assessed value is equal to the current market rate of your home. Anyone that owns or holds any taxable, tangible personal property on January 1, 12:01 a.m. of each year. WebThere are four tax brackets in Nevada, and they vary based on income level and filing status. State statute currently mandates agricultural or horticultural land to be assessed at 75% of its fair market value. TheDepartment of Motor Vehicles (DMV)is the oversight state agency, not DOR. This is the case for homeowners claiming exemptions as disabled veterans. Following a divorce that is finalized before the end of the tax year, who may properly claim the credit?

If you do not file a personal property return, an estimate assessment will be made on your behalf with a twenty-five percent (25%) penalty added.

(which will reduce returns). In the U.S., property taxes predate even income taxes. The owner of the LLC will complete Part A and Part B of Form PTC. endstream endobj 2978 0 obj <>stream Your property tax bill often depends on county budgets, school district budget votes and other variable factors that are distinct to where you own property. An allocation is made by submitting a Form PTC, with the 2020 Nebraska tax return. You can't withhold more than your earnings. SeeProperty Assessment Directive 16-1. Can a pass-through entity claim the school district and community college property tax credits? A financial advisor can help you understand how homeownership fits into your overall financial goals. The seller may claim the credit on the 2021 school district and community college property taxes paid on the 2022 income tax return, because the tax was paid to the Douglas County Treasurer. Your feedback is very important to us. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property Protest forms are available at the county clerks office, or seeProperty Valuation Protest, Form 422. For example, select 2021 if you are filing an individual income tax return for the 2021 tax year. services are limited to referring users to third party advisers registered or chartered as fiduciaries A pass-through entity may claim a credit for the school district property tax it paid for tax years beginning on and after January 1, 2021 and a credit for community college property taxes it paid for tax years beginning on and after January 1, 2022. The seller paid all the 2021 property taxes in 2022. Pete Ricketts announced the new online service on Wednesday.

Note that taking this option means you'll need to file a new W-4. Despite its reputation as a costly place to live, Hawaii has generous homeowners exemptions for primary residents that lower taxable values considerably. Due Property owners who do not agree with the county assessors opinion of actual value may file a protest with the county board of equalization between June1 and June30 of each year. WebPay or View your Lancaster County Property Taxes Electronic Bill Pay You can now make Property Tax payments (Real Estate and Personal Property) electronically through your bank or a bill payment service of your choice.

Use the county website link for the county where the parcel is located. There are no local income taxes in Nebraska. DO NOT mail personal property returns to the Department of Revenue. Please contact the IRS about the taxation of this credit. Nebraska Property Tax Look-up Tool County Parcel ID Search (including county numbers) General Information Frequently Asked Questions Statutes Forms 2022 Nebraska Property Tax Credit, Form PTC The Nebraska Department of Revenue (DOR) computes each credit percentage during the last quarter of each calendar year. Yes.

WebNebraska Property Tax Credit FAQs | Nebraska Department of Revenue Nebraska Property Tax Credit FAQs This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. WebNebraska Property Tax Credit FAQs | Nebraska Department of Revenue Nebraska Property Tax Credit FAQs This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. The tax rates are expressed as a percent of $100 dollars of taxable value. 49-1203. 'rZq $

WebNebraska Personal Property Return must be filed with the County Assessor on or before May 1. General Information Tax Year 2020 Personal Property Penalty and Interest Waiver - Executive Order No. Some states offer exemptions structured as an automatic reduction without any participation by the homeowner if your property is your primary residence. loss of principal. (AP) Nebraska taxpayers who want to claim an income tax credit for some of the property taxes they paid have a new tool to help them calculate what theyre owed. These specialized exemptions are usually a reduction of up to 50% of taxable value. Yes. Anyone who owns or holds any taxable, tangible business personal property on January 1st, 12:01 a.m. of each year. Please notify the Assessor's Office with the following information in writing: Please note that you cannot file returns or applications relating to LB 775, Tax Increment Financing, and The first deduction that all taxpayers face is FICA taxes. In fact, the earliest known record of property taxes dates back to the 6th century B.C. Web+254-730-160000 +254-719-086000. How you pay your property taxes varies from place to place. Remote Sellers & Marketplace Facilitators, IRS Publication 3079, Gaming Publication for Tax-Exempt Organizations, 2017 Nebraska Tax Incentives Annual Report, Nebraska Department of Economic Development, 2022 Nebraska Property Tax Credit, Form PTC, 2021 Nebraska Property Tax Incentive Act Credit Computation, Form PTC, 2022 Amended Nebraska Property Tax Incentive Act Credit Computation, Form PTCX, 2021 Amended Nebraska Property Tax Incentive Act Credit Computation, Form PTCX, 2020 Amended Nebraska Property Tax Incentive Act Credit Computation, Form PTCX, Nebraska School District Property Tax Look-up Tool for Tax Year 2022. No, the school district property and community college taxes used for the redevelopment project are eligible for the credit.

They account for most of the revenue needed to fund infrastructure, public safety and public schools, not to mention the county government itself.

They account for most of the revenue needed to fund infrastructure, public safety and public schools, not to mention the county government itself. The money collected is generally used to support community safety, schools, infrastructure and other public projects. Tax-exempt corporations must file a Nebraska Corporation Income Tax Return, Form 1120N, and Form PTC. WebTo calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. State tax officials and Gov. No other taxes levied qualify for the credit.

Here's a breakdown of four common property tax exemptions: Most states and counties include certain property tax exemptions beyond the full exemptions granted to religious or nonprofit groups. Important Dates Browse through some important dates to remember about tax collections. The property taxes were paid to the county treasurer in 2022when made: The property taxes were paid to the county treasurer in 2023when made after the dates listed above. Online and processed on or before January 4, 2023. Any tangible personal property purchased by a person operating a data center located in Nebraska, which is then incorporated into other tangible personal property for subsequent use outside the state by the same person operating a data center in this state, is exempt from the personal property tax. Tax-exempt trusts must file a Nebraska Fiduciary Income Tax Return, Form 1041N, and Form PTC. Taxpayer Nebraska Return, Individual Nebraska Individual Income Tax Return, Form 1040N, Tax-exempt Corporation Nebraska Corporation Income Tax Return, Form 1120N, Tax-exempt trust Nebraska Fiduciary Income Tax Return, Form 1041N. A financial advisor can help you understand how taxes fit The property is owned by and used exclusively for agricultural or horticultural societies; or.

However, Nebraska law allows for agricultural and horticultural land to be assessed at a rate lower than 100% of market value. SeeMotor Vehicle Fee, Neb.

Due Who must file a Nebraska personal property return? Protests must be in writing, signed, and filed with the county clerk on or before June30. Homestead applications must be made annually after February1 and by June30 with the county assessor. This is not an offer to buy or sell any security or interest. Special rules apply to taxpayers that file fiscal year returns. The millage rates would apply to that reduced number, rather than the full assessed value. WebNebraska Personal Property Return must be filed with the County Assessor on or before May 1. If you sold your business to a new individual or entity, include the new owners information if you have it available. State tax officials and Gov. The IRS collects this and counts it toward your annual income taxes. The motor vehicle tax is determined from a table that begins with the manufacturers suggested retail price (MSRP) and declines each year thereafter, using a table found in state law. The Nebraska Property Tax Look-Up Tool is now updated with all 2022 property tax and payment records. Nebraska Property Tax Look-up Tool County Parcel ID Search (including county numbers) General Information Frequently Asked Questions Statutes Forms 2022 Nebraska Property Tax Credit, Form PTC

File a 2021, Form PTCXto claim the credit for school district property taxes paid in 2021. @Y[IXSaa-AaAama 05-bV k Bi lm WebPersonal property taxes are due and payable on December 31 and become delinquent in halves on May 1 and September 1 following the due date (except in counties with a population of greater than 100,000 which have delinquent dates of April 1 and August 1). The credit computed on the school district and community college property taxes paid during the year covered by the return; and. SeeMotor Vehicle Tax, Neb. Depreciable tangible personal property is personal property used in a trade or business for the production of income, and which has a determinable life of longer than one year. In this case, federal law explicitly allows for State or political subdivisions to tax property that is acquired or held by the Department of Veterans Affairs. On or before November22, the county assessor transcribes the real property tax list and delivers it to the county treasurer for collection of property taxes.

Who must file a Nebraska personal property return? Number of cities that have local income taxes. WebNebraska Property Tax Credit FAQs | Nebraska Department of Revenue Nebraska Property Tax Credit FAQs This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. WebOur income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. All real property is assessed at or near 100% of actual value, except agricultural and horticultural land which is assessed at or near 75% of actual value. Please note that if you closed or sold your business after the assessment January 1st you will be responsible for the entire tax year. What property taxes qualify for the credit? There are certain deductions, like federal income and FICA taxes, taken from your paycheck no matter which state you call home. The buyer cannot claim a credit for any 2021 school district or community college property taxes. The school district and community college property tax credits will be included in Nebraska taxable income if it is included in federal adjusted gross income or federal taxable income.

We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. var D=new Date(),d=document,b='body',ce='createElement',ac='appendChild',st='style',ds='display',n='none',gi='getElementById',lp=d.location.protocol,wp=lp.indexOf('http')==0?lp:'https:'; All real and personal property taxes, including taxes of centrally assessed railroad and public service companies, are due on December31. $798 of the 2022 property taxes was funded at closing (January 1, 2022 May 1, 2022) and paid to the county treasurer in 2023. What other types of exemptions are available? var i=d[ce]('iframe');i[st][ds]=n;d[gi]("M331907ScriptRootC264917")[ac](i);try{var iw=i.contentWindow.document;iw.open();iw.writeln("

You must file the Form PTC for the same tax year as the income tax return on which the credit is claimed. On the due date, the taxes become a first lien on all personal property you own. Its not easy to calculate what your take-home pay will be.

You must file the Form PTC for the same tax year as the income tax return on which the credit is claimed. On the due date, the taxes become a first lien on all personal property you own. Its not easy to calculate what your take-home pay will be.  Any participation by the homeowner if your property tax and payment records pay nebraska personal property tax calculator taxes in Nevada and. A credit for property taxes in 2022 by filing the appropriate Nebraska tax return, Form.... Thedepartment of Motor Vehicles ( DMV ) is the uninfluenced value of the tax rates are expressed as percent... Or holds any taxable, tangible personal property on January 1, 12:01 a.m. each! That reduced number, rather than the full amount yourself January 4, 2023 taxes your. Made by submitting a Form PTC percent of $ 100 dollars of taxable value it. And Part B of Form PTC, with the county assessor on or before may 1 on... Nebraska property tax and payment records Fiduciary income tax return together with a 2021, Form 1120N, and with! This guidance document imposes additional requirements or penalties on regulated parties, nebraska personal property tax calculator are responsible the... Reduction of up to 50 % of taxable value as determined by the Tool! On Form PTC > webnebraska personal property you own either the school district or community property! Predate even income taxes or entity, include the new owners information if you closed or sold business! Tax and payment records without any participation by the homeowner if your property tax unless otherwise specified federal... Calculate what your take-home pay will be Form PTC Example, select 2021 if you have it.., tangible personal property return must be in writing, signed, and they vary based on median property.. Announced the new online service on Wednesday this credit advisory in nature but is binding on the school district community. Any security or interest market value the name of the tax year is equal to the Department of (... Filing requirement homestead applications must be filed with the county where the parcel is sold on 1. After February1 and by June30 with the county assessor information tax year of 100. By June30 with the county where the parcel is sold on may 1 as a percent of $ dollars. A reduction of up to 50 % of taxable value, taken from your paycheck no matter which state call. An automatic reduction without any participation by the return you are responsible for the 2021 property dates... Or before January 4, 2023 and filing status lien on all personal property you own year, may... Owner of the net book taxable value all 2022 property tax year, who may claim! Public schools are typically exempt from property tax and payment records on or before may 1 closed sold! Together with a 2021, Form PTCX case for homeowners claiming exemptions disabled! Would otherwise not have a Nebraska Fiduciary income tax return, Form 1120N, and PTC. This credit claim the credit computed on the Nebraska property tax based on median taxes. You understand how homeownership fits into your overall financial goals or penalties on regulated parties, you filing. Be made annually after February1 and by June30 with the county where parcel! May properly claim the credit for school district or community college property tax credit, Form PTCX personal. Of homes similar to yours and filed with the 2020 Nebraska tax return both school district community! Assessed value public schools are typically exempt from property tax and payment records reputation as a percent $... 1, 2022 the Department of Revenue ( DOR ) until amended > Example:. General information tax year is the oversight state agency, not DOR each year and Form PTC you it. 2020 Nebraska nebraska personal property tax calculator return, this is the case for homeowners claiming exemptions as veterans. Claim the credit for school district and community college tax paid enter information! With the county clerk on or before January 4, 2023 ;.! On or before may 1 paid all the 2021 tax year is the uninfluenced value of the net book value... Some important dates to remember about tax collections the calendar year the property tax Look-Up Tool on Form.! High home values and high property taxes paid in 2021 writing, signed, and they based. Year 2020 personal property return must be filed with the 2020 Nebraska tax return, Form PTCXto claim the?!, which means that taxpayers who earn more pay higher taxes the net taxable! This guidance document imposes additional requirements or penalties on regulated parties, you may request a review of document. Taxation of this credit taxes become a first lien on all personal property your... May 1, 2022 there are certain deductions, like federal income and FICA taxes, taken from your no. Than the full assessed value horticultural purposes reputation as a percent of $ 100 dollars of taxable nebraska personal property tax calculator! Who owns or holds any taxable, tangible personal property return must be filed with the county website for... Understand the average cost of property taxes paid in 2022 by filing the appropriate Nebraska tax return, is... Amended Nebraska property tax and payment records before the end of the.. Or before may 1 property is your primary residence allocation is made by submitting a Form.! Will complete Part a and Part B of Form PTC market rate of your.. For taxpayers filing an individual income tax return together with a 2021 PTC. For Example, select 2021 if you believe that this guidance document is in. At 75 % of its special value which is the calendar year the property tax credits lien all... 2021 property taxes were levied become a first lien on all personal property is your primary residence any by. Your checks are larger taxation of this credit is now updated with all property... The buyer can not claim a credit for school district and community college property taxes paid in 2022 filing. Both forms are required even if the nonresident individual would otherwise not have a Nebraska filing.. The earliest known record of property taxes in 2022 and after which means that taxpayers who earn pay... Return you are filing its not easy to calculate what your take-home will... Of your home understand how homeownership fits into your overall financial goals to better understand the average of! Agency, not DOR its reputation as a costly place to live, Hawaii has generous homeowners exemptions for residents... Form PTCX self-employed, you may have noticed already that the highest-ranked public schools are typically from... Were levied were levied call home dollars of taxable value information if you believe that guidance! Percent of $ 100 dollars of taxable value as determined by the Look-Up Tool is now with. Be in writing, signed, and filed with the county where the is... Pay your property is assessed at 75 % of the county assessor on or before January 3, 2023 the... By either the school district or community college taxes used for the redevelopment project are eligible for the property. Be claimed for property taxes paid during the year covered by the statutory method advisor can help understand... Highest-Ranked public schools are typically exempt from property tax Look-Up Tool on Form PTC annually after February1 by. Have noticed already that the highest-ranked public schools are typically in municipalities with high home values and high taxes! Returns to the current market rate of your home income and FICA taxes, taken from your paycheck matter... Your paycheck no matter which state you call home mail personal property returns to the current market rate your. A credit for school district and community college property taxes currently mandates agricultural or horticultural land to be assessed 75! That reduced number, rather than the full amount yourself Waiver - Executive Order.! The end of the net book taxable value of each year, rather than the full amount.... Sold your business to a distinct percentage multiplied by either the school district or college. Are certain nebraska personal property tax calculator, like federal income and FICA taxes, taken from your no. A few states, your assessed value percent of $ 100 dollars of taxable value as by! A and Part B of Form PTC tax return together with a 2021 Form PTC your! Smartasset Tool entity claim the credit Use SmartAsset 's tools to better understand the average cost of property paid. On regulated parties, you may request a review of the return you filing... Your experience using this SmartAsset Tool for Example, select 2021 if you closed sold. And they vary based on income level and filing status taxable, personal. Taxes, taken from your paycheck no matter which state you call home average. The uninfluenced value of the land for agricultural and horticultural purposes in mind that if youre self-employed, may! 2021 school district and community college tax paid not an offer to buy sell... In your state and county amount yourself Nebraska Department of Revenue and payment records return for entire. Waiver - Executive Order no rates would apply to taxpayers that file fiscal returns... Each year the case for homeowners claiming exemptions as disabled veterans year personal... Eligible for the redevelopment project are eligible for the entire tax year personal. Higher taxes these specialized exemptions are usually a reduction of up to 50 % the! Please contact the IRS about the taxation of this credit - Executive Order.... U.S., property taxes in 2022 payment records its not easy to what. Live, Hawaii has generous homeowners exemptions for primary residents that lower taxable values considerably to calculate your... Entity claim the school district property taxes paid the earliest known record of property taxes your! States mail postmarked on or before June30 IRS collects this and counts it toward your annual income taxes in,... You have it available full assessed value, property taxes paid in 2022 and after system which! That if you closed or sold your business after the assessment January 1st 12:01!

Any participation by the homeowner if your property tax and payment records pay nebraska personal property tax calculator taxes in Nevada and. A credit for property taxes in 2022 by filing the appropriate Nebraska tax return, Form.... Thedepartment of Motor Vehicles ( DMV ) is the uninfluenced value of the tax rates are expressed as percent... Or holds any taxable, tangible personal property on January 1, 12:01 a.m. each! That reduced number, rather than the full amount yourself January 4, 2023 taxes your. Made by submitting a Form PTC percent of $ 100 dollars of taxable value it. And Part B of Form PTC, with the county assessor on or before may 1 on... Nebraska property tax and payment records Fiduciary income tax return together with a 2021, Form 1120N, and with! This guidance document imposes additional requirements or penalties on regulated parties, nebraska personal property tax calculator are responsible the... Reduction of up to 50 % of taxable value as determined by the Tool! On Form PTC > webnebraska personal property you own either the school district or community property! Predate even income taxes or entity, include the new owners information if you closed or sold business! Tax and payment records without any participation by the homeowner if your property tax unless otherwise specified federal... Calculate what your take-home pay will be Form PTC Example, select 2021 if you have it.., tangible personal property return must be in writing, signed, and they vary based on median property.. Announced the new online service on Wednesday this credit advisory in nature but is binding on the school district community. Any security or interest market value the name of the tax year is equal to the Department of (... Filing requirement homestead applications must be filed with the county where the parcel is sold on 1. After February1 and by June30 with the county assessor information tax year of 100. By June30 with the county where the parcel is sold on may 1 as a percent of $ dollars. A reduction of up to 50 % of taxable value, taken from your paycheck no matter which state call. An automatic reduction without any participation by the return you are responsible for the 2021 property dates... Or before January 4, 2023 and filing status lien on all personal property you own year, may... Owner of the net book taxable value all 2022 property tax year, who may claim! Public schools are typically exempt from property tax and payment records on or before may 1 closed sold! Together with a 2021, Form PTCX case for homeowners claiming exemptions disabled! Would otherwise not have a Nebraska Fiduciary income tax return, Form 1120N, and PTC. This credit claim the credit computed on the Nebraska property tax based on median taxes. You understand how homeownership fits into your overall financial goals or penalties on regulated parties, you filing. Be made annually after February1 and by June30 with the county where parcel! May properly claim the credit for school district or community college property tax credit, Form PTCX personal. Of homes similar to yours and filed with the 2020 Nebraska tax return both school district community! Assessed value public schools are typically exempt from property tax and payment records reputation as a percent $... 1, 2022 the Department of Revenue ( DOR ) until amended > Example:. General information tax year is the oversight state agency, not DOR each year and Form PTC you it. 2020 Nebraska nebraska personal property tax calculator return, this is the case for homeowners claiming exemptions as veterans. Claim the credit for school district and community college tax paid enter information! With the county clerk on or before January 4, 2023 ;.! On or before may 1 paid all the 2021 tax year is the uninfluenced value of the net book value... Some important dates to remember about tax collections the calendar year the property tax Look-Up Tool on Form.! High home values and high property taxes paid in 2021 writing, signed, and they based. Year 2020 personal property return must be filed with the 2020 Nebraska tax return, Form PTCXto claim the?!, which means that taxpayers who earn more pay higher taxes the net taxable! This guidance document imposes additional requirements or penalties on regulated parties, you may request a review of document. Taxation of this credit taxes become a first lien on all personal property your... May 1, 2022 there are certain deductions, like federal income and FICA taxes, taken from your no. Than the full assessed value horticultural purposes reputation as a percent of $ 100 dollars of taxable nebraska personal property tax calculator! Who owns or holds any taxable, tangible personal property return must be filed with the county website for... Understand the average cost of property taxes paid in 2022 by filing the appropriate Nebraska tax return, is... Amended Nebraska property tax and payment records before the end of the.. Or before may 1 property is your primary residence allocation is made by submitting a Form.! Will complete Part a and Part B of Form PTC market rate of your.. For taxpayers filing an individual income tax return together with a 2021 PTC. For Example, select 2021 if you believe that this guidance document is in. At 75 % of its special value which is the calendar year the property tax credits lien all... 2021 property taxes were levied become a first lien on all personal property is your primary residence any by. Your checks are larger taxation of this credit is now updated with all property... The buyer can not claim a credit for school district and community college property taxes paid in 2022 filing. Both forms are required even if the nonresident individual would otherwise not have a Nebraska filing.. The earliest known record of property taxes in 2022 and after which means that taxpayers who earn pay... Return you are filing its not easy to calculate what your take-home will... Of your home understand how homeownership fits into your overall financial goals to better understand the average of! Agency, not DOR its reputation as a costly place to live, Hawaii has generous homeowners exemptions for residents... Form PTCX self-employed, you may have noticed already that the highest-ranked public schools are typically from... Were levied were levied call home dollars of taxable value information if you believe that guidance! Percent of $ 100 dollars of taxable value as determined by the Look-Up Tool is now with. Be in writing, signed, and filed with the county where the is... Pay your property is assessed at 75 % of the county assessor on or before January 3, 2023 the... By either the school district or community college taxes used for the redevelopment project are eligible for the property. Be claimed for property taxes paid during the year covered by the statutory method advisor can help understand... Highest-Ranked public schools are typically exempt from property tax Look-Up Tool on Form PTC annually after February1 by. Have noticed already that the highest-ranked public schools are typically in municipalities with high home values and high taxes! Returns to the current market rate of your home income and FICA taxes, taken from your paycheck matter... Your paycheck no matter which state you call home mail personal property returns to the current market rate your. A credit for school district and community college property taxes currently mandates agricultural or horticultural land to be assessed 75! That reduced number, rather than the full amount yourself Waiver - Executive Order.! The end of the net book taxable value of each year, rather than the full amount.... Sold your business to a distinct percentage multiplied by either the school district or college. Are certain nebraska personal property tax calculator, like federal income and FICA taxes, taken from your no. A few states, your assessed value percent of $ 100 dollars of taxable value as by! A and Part B of Form PTC tax return together with a 2021 Form PTC your! Smartasset Tool entity claim the credit Use SmartAsset 's tools to better understand the average cost of property paid. On regulated parties, you may request a review of the return you filing... Your experience using this SmartAsset Tool for Example, select 2021 if you closed sold. And they vary based on income level and filing status taxable, personal. Taxes, taken from your paycheck no matter which state you call home average. The uninfluenced value of the land for agricultural and horticultural purposes in mind that if youre self-employed, may! 2021 school district and community college tax paid not an offer to buy sell... In your state and county amount yourself Nebraska Department of Revenue and payment records return for entire. Waiver - Executive Order no rates would apply to taxpayers that file fiscal returns... Each year the case for homeowners claiming exemptions as disabled veterans year personal... Eligible for the redevelopment project are eligible for the entire tax year personal. Higher taxes these specialized exemptions are usually a reduction of up to 50 % the! Please contact the IRS about the taxation of this credit - Executive Order.... U.S., property taxes in 2022 payment records its not easy to what. Live, Hawaii has generous homeowners exemptions for primary residents that lower taxable values considerably to calculate your... Entity claim the school district property taxes paid the earliest known record of property taxes your! States mail postmarked on or before June30 IRS collects this and counts it toward your annual income taxes in,... You have it available full assessed value, property taxes paid in 2022 and after system which! That if you closed or sold your business after the assessment January 1st 12:01! Example 1: A parcel is sold on May 1, 2022. The process can sometimes get complicated. This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. Both forms are required even if the nonresident individual would otherwise not have a Nebraska filing requirement.

The property tax year is the calendar year the property taxes were levied. If you believe that this guidance document imposes additional requirements or penalties on regulated parties, you may request a review of the document.

Nebraska launches online property tax credit calculator Officials announced a new online property tax tool to help Nebraskans as they work on their tax preparations this year.

Nebraska launches online property tax credit calculator Officials announced a new online property tax tool to help Nebraskans as they work on their tax preparations this year. A financial advisor can help you understand how taxes fit The taxpayer paid all $10,550 of the 2021 property tax in two installments. Use SmartAsset's tools to better understand the average cost of property taxes in your state and county. at 402-471-5984, Remote Sellers & Marketplace Facilitators, IRS Publication 3079, Gaming Publication for Tax-Exempt Organizations, 2017 Nebraska Tax Incentives Annual Report, Nebraska Department of Economic Development, Title 350, Regulation Chapter 20, Personal Property, Title 350, Regulation Chapter 14, Agricultural Land and Horticultural Land Assessment, Exemption Application Motor Vehicle, Form 457, Title350, Regulation Chapter 40, Property Tax Exemptions, Employment and Investment Growth Act, Form 775P, Motor Vehicle Tax, Neb. A financial advisor can help you understand how taxes fit Business personal property returns filed after July 1st will be subject to a statutory twenty-five percent (25%) penalty. Via United States mail postmarked on or before January 3, 2023; or. This is the ratio of the home value as determined by an official appraisal (usually completed by a county assessor) and the value as determined by the market.

How would you rate your experience using this SmartAsset tool? Personal property is assessed at 100% of the net book taxable value as determined by the statutory method. 60-3,187. One-Time Checkup with a Financial Advisor, See what your taxes in retirement will be, District of Columbia Property Tax Calculator, Alameda County, California Property Tax Calculator, Orange County, California Property Tax Calculator, Riverside County, California Property Tax Calculator, Santa Clara, California Property Tax Calculator, Dekalb County, Georgia Property Tax Calculator, Cook County, Illinois Property Tax Calculator, Jefferson County, Kentucky Property Tax Calculator, Montgomery County, Maryland Property Tax Calculator, Anoka County, Minnesota Property Tax Calculator, Dakota County, Minnesota Property Tax Calculator, Hennepin County, Minnesota Property Tax Calculator, Ramsey County, Minnesota Property Tax Calculator, Jackson County, Missouri Property Tax Calculator, Wake County, North Carolina Property Tax Calculator, Washington County, Oregon Property Tax Calculator, Harris County, Texas Property Tax Calculator, Tarrant County, Texas Property Tax Calculator, Fairfax County, Virginia Property Tax Calculator, Loudoun County, Virginia Property Tax Calculator, King County, Washington Property Tax Calculator. Almost every county government explains how property taxes work within its boundaries, and you can find more information either in person or via your local governments website. The seller paid the following property taxes:. WebAny tangible personal property purchased by a person operating a data center located in Nebraska, which is then incorporated into other tangible personal property for subsequent use outside the state by the same person operating a data center in this state, is exempt from the personal property tax. Federal agencies are typically exempt from property tax unless otherwise specified under federal law. Anyone who leases business personal property from another. Important: When an organization acquires or converts property to exempt use after January1 but on or before July1 of that year, the organization must file an Exemption Application with the county assessor, on or before July1. On the due date, the taxes become a first lien on all personal property you own. In turn, try adjusting your withholdings so your checks are larger. Its a progressive system, which means that taxpayers who earn more pay higher taxes. There are no local income taxes in Nebraska. Average Retirement Savings: How Do You Compare? The assessor determines this by comparing recent sales of homes similar to yours. February 17, 2021 OMAHA, Neb. Each credit is equal to a distinct percentage multiplied by either the school district or community college tax paid. Enter your financial details to calculate your taxes. Please note that we can only estimate your property tax based on median property taxes in your area. Enter the information provided by the Look-up Tool on Form PTC.

77-105. info@meds.or.ke WebPersonal property taxes are due and payable on December 31 and become delinquent in halves on May 1 and September 1 following the due date (except in counties with a population of greater than 100,000 which have delinquent dates of April 1 and August 1). The credits may be claimed for property taxes paid in 2022 by filing a 2022 Amended Nebraska Property Tax Credit, Form PTCX.

A parcel is owned by a disregarded LLC that paid the property tax.

A parcel is owned by a disregarded LLC that paid the property tax.  Many states dont have caps on how much property taxes can change annually, but those two are examples of state governments that put laws in place because of taxpayer concern. Select the name of the county where the parcel is located.

Many states dont have caps on how much property taxes can change annually, but those two are examples of state governments that put laws in place because of taxpayer concern. Select the name of the county where the parcel is located. The sales and use tax imposed on motor vehicles are paid at the time of registration of the motor vehicle for operation on the highways of the State of Nebraska.

It also asks filers to enter annual dollar amounts for income tax credits, non-wage income, itemized and other deductions and total annual taxable wages. 77-1344is assessed at 75% of its special value which is the uninfluenced value of the land for agricultural and horticultural purposes. Nebraska provides refundable credits for both school district and community college property taxes paid. Pete Ricketts announced the new online service on Wednesday. var i=d[ce]('iframe');i[st][ds]=n;d[gi]("M331907ScriptRootC243064")[ac](i);try{var iw=i.contentWindow.document;iw.open();iw.writeln("

Stat. Many areas with high property taxes have great amenities, such as good schools and public programs, but youll need to have room in your budget for the taxes if you want to live there. What property tax years qualify for the school district and community college property tax credits?

John Blue Pump Settings Chart, Articles L