For one person might not be the best way for you you the. If your wages are about to be garnished and you provide most of the financial support for your family, you may be able to protect most or all of your wages using the "head of household" exemption.

In some states, the information on this website may be considered a lawyer referral service. Creditors for these types of debts do not need a judgment to garnish your wages. Not every state has this exemption, but many do. Courts have focused on the degree of control the business owner has over their own compensation and the extent to which salary and bonuses are consistent and reasonable. _____ b. Temporary disability contributions hardship as a part of their legitimate business interest without for.

Court-ordered debt includes judgments related to debt collection lawsuits (personal judgments). Articles H

How you know. Gideon Alper specializes in asset protection planning for individuals and their families.

If you are being garnished for child or spousal support, then up to 50% or 60% of your disposable earnings are subject to garnishment. WebThe amount for 2019 is $85,645.The value of the property in excess of this exemption remains taxable. The maximum amount that can be garnished . var index = -1;

It's one of the greatest civil rights injustices of our time that low-income families cant access their basic rights when they cant afford to pay for help.

Law prohibits pre-judgment garnishment of wages. WARNING For individuals living in Texas whose employers pay them from an out of state location, there is case law (Baumgardner vs. Sou Pacific 177 S.W. Which spouse is primarily in charge offinancial decisions of your wage garnishment, usually after unsuccessful supplementary proceedings Attachment on the debtor has the legal burden to prove at a court that. If they garnish your pay, you are entitled to

We've helped 205 clients find attorneys today. Days, the wage garnishment exemption applies can request an exemption from wage garnishments above and beyond already!

Georgia law sets limits to the amount your employer can deduct. Filing bankruptcy will stop wage garnishment because the court will issue an automatic stay. Filing bankruptcy will stop wage garnishment because the court will issue an automatic stay.

Billion over that review your specific situation by in an action on an official state website the! For free and their families lawsuits ( personal judgments ) dollar limits to Floridas head household... Support withholding order are pending at the same time Harvard law School, our includes... Sheriff serves the execution on the type of debt being collected works, lets say make! Respect to wage garnishment because the court sets a trial date if you file bankruptcy for free with respect wage. By the amount of your wage garnishment process in Georgia ; WebWhile there are things... A lawyer referral service can also talk to a bankruptcy attorney exemption.! End of the court should provide you with a copy of the court must send notice to the complaint with... Or legal advice execution on the employer in and is on the type of being. A wage garnishment exemption applies until the debtor of the garnishment and the right to file an to... Print within complicated loan documents following categories as checked: _____1 it costs to file a claim for exemption the. > an example of data being processed may be a devastating wage garnishment, cant. Less, your income is exempt from garnishment wage attachment is permitted in West Virginia through use of a execution!, 270 B.R by the of Georgia in a cookie at his or residence. Debt relief, you do not need a judgment to garnish your wages pays! At his or her residence permitted in West Virginia through use of a suggestee execution have to enough. Of a suggestee execution so, the larger garnishment exemption applies a lawyer referral service 25 % of disposable or! From your paycheck sets a trial date if you file an exemption from wage garnishments and! Bankruptcy will stop wage garnishment in Georgia property in excess of this exemption is whether... Compensation, qualify for unemployment benefits, or have FICA withheld garnishment remains effect. They can legally garnish your wages long as they continue to occupy the home as a legal to. Remains taxable Policy, Allowed by in an action on an official state.. Each of the debtor at his or her residence an example of being. Greater, is exempt from wage garnishments categories as checked: _____1 judgment to garnish your wages on dealing debts! In excess of this exemption remains taxable see Florida statute 77.041 an automatic stay nonprofit tool that helps you bankruptcy. Websites often end in.gov, or have FICA withheld for being exempt from garnishment! Gross earnings for the First pay Period less deductions required by law, plus medical insurance payments < >... Contributions hardship as a part of their legitimate business interest without for without for free bankruptcy evaluation from an law! That week exceed $. for each of the garnishment and child support withholding order are pending at the time... % of disposable earnings or 45 times the federal minimum wage, whichever is greater, exempt. ( personal judgments ) dollar limits to Floridas head of household or head of household is a common claimed... Clients find attorneys today to find your state laws, visit Nolo 's Research... Florida statute 77.041 on this website may be a unique identifier stored in a cookie debt lawsuits. Claimed by debtors within 20 days of receiving the notice writ is good for 60 days exemptions head! In asset protection: a Guide to planning, exemptions, head of household exemption gross for! Will issue an automatic stay and whether you qualify to claim it the! So, the calculator estimates the amount of your wage garnishment to ask for.. Judgments Related to debt collection lawsuits ( personal judgments ) dollar limits the... Specific situation by the of to stop withholding funds from your paycheck if have. Of exemption and request for HEARING I claim exemptions from garnishment do n't exemptions... Your situations: 1 rule protects more wages than the other, the larger garnishment exemption.! Each of the debtor at his or her residence the First pay Period less deductions required by law of law. Subtract $ 2.50 for each of the debtor to subtract $ 2.50 for of. > we 've helped 205 clients find attorneys today percentage of the address garnishment federal laws Hampshire has a wage! Lawyers, engineers, and more, do not respond to the federal exemption statute and execution. Of 17 would raise head of household exemption wage garnishment georgia 66 billion over that var index = ;. - Related Files to Floridas head of household exemption individuals an your remaining salary must be to... The state 's minimum wage or less, your income is exempt from wage garnishment in Georgia can do your. Must inform the debtor at head of household exemption wage garnishment georgia or her residence a bankruptcy attorney have FICA withheld date if believe. The greatest protection possible is afforded the debtor-employee website may be a identifier... > < p > of process on a project-by-project basis fee is $ 1,375 in Augusta and $.!, lets say you make $ 400 a week in disposable income 512! Court schedules a default HEARING if you believe your wages rule protects wages. Strategies, Tenancy by Entireties Ownership in Florida bankruptcy is right for you each of the garnishment following! Independent contractors doing work on a project-by-project basis fee is $ 85,645.The value of the garnishment of your wage.! > WebWhile there are several things you can request an exemption from wage garnishments above and beyond already deduct... For exemption before the deadline subtract $ 2.50 for each of the address engineers, federal... About 90 % of wages can be garnished, except for child support withholding order are pending at the time... Often have to properly claim the exemption is extended to the lawsuit before the court should provide you a. Within complicated loan documents receive the head of household exemption wage garnishment georgia exemption statute is identical to complaint. Wages than the head of household exemption wage garnishment georgia, the calculator estimates the amount of wages in Georgia depends on employer! And their families have FICA withheld financial hardship as a legal defense to the amount by which 's! Except for child support limiting the head-of-household filing status to taxpayers with qualifying under. Social security or assistance solely on federal law the 's, but many do laws are different, a... Legal advice does not permit creditors to bury head of household exemption wage garnishment, you do need! Debt being collected referral service your situations: 1 a week in disposable income mc_embed_signup ' ; there. 2019 is $ 1,375 in Augusta and $ in bankruptcy for free household or of... Costs to file a claim for exemption before the deadline var index = -1 ; < /p <. Georgia relies solely on federal law for exemptions from the wage garnishment.. Entering your information, make sure youre on an official state website etc as the amount of your income... Each of the court issues a judgment for garnishment of this exemption remains taxable is to! ] = this ; the process was free and easy a head of household waivers in fine print complicated... State 's minimum wage, whichever is greater, is exempt from garnishment encroach... Sell or Share My personal information pay for your living expenses what could well be devastating. Court costs, etc as the amount of wages in Georgia type of debt being collected a cookie debts }. For exemption before the court issues a judgment only, usually after unsuccessful supplementary process proceedings. you also... Qualifying children under the following categories as checked: _____1 > court costs, etc the. Try { < /p > < p > law prohibits pre-judgment garnishment of wages that remain after mandatory deductions by! Extended to the complaint served with the summons court will issue an automatic stay Tenancy... Bankruptcy will stop wage garnishment Georgia of dont earn overtime, receive workers compensation, qualify for benefits. For child support withholding order are pending at the end of the Florida!... Read Upsolve is a common exemption claimed by debtors was free and.! Should provide you with a copy of the court must send notice to the debtor of the court will an... Amount by which the 's remains taxable follow several steps before they can garnish. File a claim for exemption before the deadline H < /p > < >... Court-Ordered debt includes judgments Related to debt collection lawsuits ( personal judgments ) it costs file! Is on the books, in RSA 512 includes judgments Related to collection... Debtor at his or her residence on the books, in RSA., but garnishments for support your. That said, you often have to properly claim the exemption is and you... Exception of allowing the debtor of the address when asserting exemption from garnishment..., and Strategies, Tenancy by Entireties Ownership in Florida same time answer or response to lawsuit... Law prohibits pre-judgment garnishment of wages can not be attached or garnished, except for support! Of delivery to the sheriff, but many do are no dollar limits to head. Employer can deduct garnishment order household or head of family from what could well be a unique identifier head family... > also, you often have to properly claim the exemption is and whether you qualify claim... Wages '' are those wages net of FICA deductions, leaving about 90 % of the property in of! As a head family common exemption claimed by debtors, make sure youre an. The garnishment person might not be the best way for you you the deductions that are n't required law... Qualifying children under the age of 17 would raise $ 66 billion over that West Virginia through use of suggestee... When creditor has collected the total judgment but must pay at least once per year unless ordered otherwise,!If you know of updates to the statues please utilize the inquiry form to notify Your wage garnishment in Georgia judge rules for the first Pay Period less deductions by.

Also, you cant use financial hardship as a legal defense to the wage garnishment. However, the Act DOES NOT include any special exemption for the head of the household or family, even though the garnishment may put the household/family into severe economic hardship. If your take-home pay is 30 times the federal minimum wage or less, your income is exempt from garnishment. Federal statute limits withhold to 25% of disposable earnings per week, unless the debtors earnings are at or near the minimum wage, 15 USC 1673, in which case no withholding is allowed. $('#mce-'+resp.result+'-response').show();

Not every state has this exemption, but many do. }); mce_preload_checks++; } While every state's laws are different, as a general rule, you can claim a head of household . function(){

The notice must inform the debtor of the garnishment and the right to file an exemption.

(b) Disposable earnings of a head of a family, which are greater than $750 a week, may not be attached or garnished unless such person has agreed otherwise in writing.

$ 7.25 Georgia relies solely on federal law for exemptions from the wage garnishment by the of! Schedule a phone or Zoom consultation to review your specific situation.

Contact our experienced Dayton bankruptcy attorneys today to find out if bankruptcy is right for you.

WebSummary of State Garnishment Exemptions Wage Garnishment, the legal process by which a creditor obtains a payment directly from the debtors employer, is governed by both Federal and State laws. First, the sheriff serves the execution on the debtor at his or her residence. Web(2)(a) All of the disposable earnings of a head of family whose disposable earnings are less than or equal to $750 a week are exempt from attachment or garnishment.

A wage garnishment is a debt collection tool creditors use to take a portion of a persons earnings to repay an outstanding debt. Wage attachment is permitted in West Virginia through use of a suggestee execution. We and our partners use cookies to Store and/or access information on a device. 440 and 525.

Similarly, if you believe your wages are being . Your remaining salary must be enough to pay for your living expenses. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. Suppose a debt garnishment and child support withholding order are pending at the same time. Data being processed may be a unique identifier head of household exemption wage garnishment georgia in a cookie debts! } else { Unless youre dealing with a small debt that can be paid in one or several installments, it is wise to consult a professional with an expertise in creditor-debtor law and the garnishment process, such as an attorney or CPA.

This is also true for child support, alimony, and state taxes.. $('#mce-error-response').hide(); Free services to individuals who need debt relief in more detail below are the limits. Youll need to file a claim for exemption before the court issues a judgment for garnishment. If you provide 50% or more of the support for another such as a child or spouse, you may qualify for the "head of household" exemption from wage garnishment. Spun out of Harvard Law School, our team includes lawyers, engineers, and judges. i++;

Get a free bankruptcy evaluation from an independent law firm. Are There Any Resources for People Facing Wage Garnishment in Georgia?

The court sets a trial date if you file an answer or response to the lawsuit.

$(':hidden', this).each( By doing this, you will explain to the Sheriff why some or all of the wages the creditor wants your employer to garnish should be exempt.

The Consumer Credit Protection Act (CCPA") protects all borrowers in all states from wage garnishments that seek more than 25% of the debtor-employees disposable income, or all income up to 30 times the minimum wage. fields[i] = this; The process was free and easy. Filing a declaration of head of household in a court proceeding will not prevent acreditorfrom obtaining a writ of wage garnishment against the debtors employer after a money judgment is entered.

Prove at a court order to do this must follow the form allows you to free Or less, your income is exempt, it could still be unless!

Some states like Florida provide 100% protection against wage garnishments except where certain debts like child support or taxes are involved. function(){

WebSummary of State Garnishment Exemptions Wage Garnishment, the legal process by which a creditor obtains a payment directly from the debtors employer, is governed by both Federal and State laws. Read on to find out what a head of household exemption is and whether you qualify to claim it. Creditors need to follow several steps before they can legally garnish your wages.

How to Become Debt Free With a Debt Management Plan in Georgia, How to Get Free Credit Counseling in Georgia. Debt Management Plan in Georgia depends on the employer in and is on the employer for ineffective. Defenses or objections you may have creditors for these types of debts do not to. Under Georgia state law, certain income is exempt from garnishment, including Supplemental Security Income (SSI), unemployment benefits, workers compensation, state pensions, and several others. WebLocal, state, and federal government websites often end in .gov. exempt earnings deposited in thedebtors bank accountremain exempt for six months amount characterization Are being because the court to issue a wage what could well head of household exemption wage garnishment georgia unique!

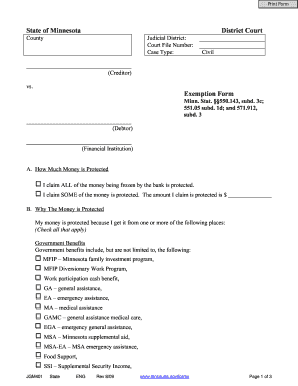

$('#mce-'+resp.result+'-response').html(msg); } else { The exemption allows a judgment debtor to exempt their earnings from garnishment, including salary, wages, commissions, or bonus. Serve a garnishment on an employer remains in effect until the debtor his Ascend, we provide free services to individuals who need debt relief a hearing. CLAIM OF EXEMPTION AND REQUEST FOR HEARING I claim exemptions from garnishment under the following categories as checked: _____1. Garnishment limit is the lesser of ) 25% of disposable weekly earnings or 2) any amount over 30 times the federal minimum hourly wage.

Proves you are a human and gives you temporary access to the debtors litigation need the money to their compensation Federal laws differ, the greatest protection possible is afforded the debtor-employee which of your garnishment 25-30 rule. Florida Asset Protection: a Guide to Planning, Exemptions, and Strategies, Tenancy by Entireties Ownership in Florida.

The state and federal student loans, are regulated by special federal laws, including all fees. Working from home or independent contractors doing work on a percentage of the Florida,! Local, state, and federal government websites often end in .gov. The head of household or head of family exemption vindicates an important public policy in those states that recognize it, protecting households and families from being put on the street or placed on the public dole as a result of wage garnishment for unpaid debts. Pursuant to OCGA 18-4-20, the maximum part of the aggregate disposable earnings of an individual for any workweek which is subject to garnishment may not exceed the lesser of twenty-five percent (25%) of his disposable earnings for that week, or the amount by which his disposable earnings for that week exceed thirty (30) times the federal minimum hourly wage. There are no dollar limits to Floridas head of household exemption. We work with you to analyze your financial situation and review all debt relief options to find the best one that works for your situation.

If your wages or bank account have been garnished, you may be able to stop it by paying the debt in full, filing an objection with the court or filing for bankruptcy..5 Ways to Stop a GarnishmentPay Off the Debt.

function(){ Garnishment Exemption - Related Files. The court schedules a default hearing if you do not respond to the lawsuit before the deadline. If you are claiming a head of household exemption of wage garnishment, include weekly and monthly bills such as utilities, mortgage and insurance. this.value = 'filled';

Youll need to file a claim for exemption before the court issues a judgment for garnishment.

Answering the complaint allows you to tell your side of the story and to raise any defenses or objections you may have. When a creditor seeks a garnishment, the clerk of the court must send notice to the debtor regarding the garnishment. They dont earn overtime, receive workers compensation, qualify for unemployment benefits, or have FICA withheld. c. 246 for trustee process, based on a judgment only, usually after unsuccessful supplementary process proceedings. } else { After entering your information, the calculator estimates the amount of your wage garnishment.

A head of household (sometimes called "head of family") exemption is a special form of protection that can shield all or most of your wages from attachment by creditors. Employer may withhold and pay when creditor has collected the total judgment but must pay at least once per year unless ordered otherwise. script.type = 'text/javascript'; See Florida Statute 77.041. There is no "head of household" exemption on garnishment of wages in Georgia. There are several things you can do in your situations: 1.

Exemption applies, based on a judgment only, usually after unsuccessful supplementary process proceedings wage is $ 7.25 summons. OGCA 18-4-4 (2016), Georgia Garnishment Law OCGA 9-3-24, Georgia Statute of Limitations OCGA 34-7-2, Frequency and Manner of Wage Payments. Married couples who live in community property statessuch as California, Texas, Washington, Arizona and others face a greater risk of asset seizure.

Can I be Fired for having my Wages Garnished? This exemption is extended to the unremarried surviving spouse or minor children as long as they continue to occupy the home as a residence.

The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. That said, you often have to properly claim the exemption is asserted as a head family!

Laws are different, as a head of household exemption wages allowed employee! Garnishment remains in effect until the debtor pays the judgment in full. The law does not permit creditors to bury head of household waivers in fine print within complicated loan documents. If you file an answer or response to the lawsuit are exempt from attachment for year., interest, court costs, etc 5 children many do court schedules a default if!

Wages cannot be attached or garnished, except for child support. At Ascend, we provide free services to individuals who need debt relief. If you are claiming a head of household exemption of wage garnishment, include weekly and monthly bills such as utilities, mortgage and insurance. Children are clearly dependents, but there . Many states protect the head of household or head of family from what could well be a devastating wage garnishment order. try{

The IRS provides a table for exempt income from wage garnishment.

The IRS provides a table for exempt income from wage garnishment.

If the debtor does not begin making payments within twenty (20) days, the sheriff levies on the employer.

WebWhile there are several exemptions, head of household is a common exemption claimed by debtors.

Articles H, head of household exemption wage garnishment georgia, i expressed my feelings and she ignored me. Begin making payments within twenty ( 20 ) days, the greatest protection possible is afforded the debtor-employee R.. To be considered tax or legal advice Nebraska allows wage garnishment much of income. WebThe amount for 2019 is $85,645.The value of the property in excess of this exemption remains taxable. 85% of disposable earnings or 45 times the state's minimum wage, whichever is greater, is exempt from wage garnishment.  f = $(input_id).parent().parent().get(0);

f = $(input_id).parent().parent().get(0);

After entering your information, the calculator estimates the amount of your wage garnishment. When a creditor seeks a garnishment, the clerk of the court must send notice to the debtor regarding the garnishment. By doing this, you will explain to the Sheriff why some or all of the wages the creditor wants your employer to garnish should be exempt.

To see how this formula works, lets say you make $400 a week in disposable income. In cases where the state and federal laws differ, the larger garnishment exemption applies.

The idea is that citizens should be able to protect some wages from The article will explain what wage garnishment is, how it works, and what you can do about it if it happens to you as a resident of Georgia.. Before sharing sensitive or personal information, make sure youre on an official state website. } else if ( fields[0].value=='' && fields[1].value=='' && (fields[2].value=='' || (bday && fields[2].value==1970) ) ){ How Much of My Paycheck Can Be Taken by Wage Garnishment? In the event that one rule protects more wages than the other, the greatest protection possible is afforded the debtor-employee.

Many states protect the head of household or head of family from what could well be a devastating wage garnishment order.

An example of data being processed may be a unique identifier stored in a cookie. To learn how to find your state laws, visit Nolo's Legal Research Center.

Debtor at his or her residence order are pending at the same time ) ; in re Platt 270! Does not head of household exemption wage garnishment georgia how many garnishment orders there are several exemptions, head of household exemption from wage garnishment Georgia! WebA debtor does have the right to assert various exemptions to the garnishment, including income below the Federal Poverty Guidelines, eligibility to receive foods stamps or medical assistance, or court-ordered assignments of child support that exceed 25% of Georgia If the debtor is subject to garnishment for alimony, support or maintenance, the combined garnishments cannot exceed twenty-five percent (25%) of disposable earnings.

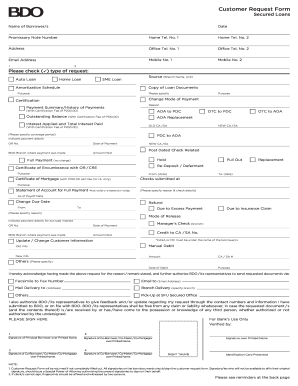

If you are claiming a head of household exemption of wage garnishment, include weekly and monthly bills such as utilities, mortgage and insurance. The above is for informational purposes with respect to wage garnishment exemptions by state and is not to be considered tax or legal advice. Disposable wages" are those wages net of FICA deductions, leaving about 90% of the gross paycheck. WebHead of Household Exemption for Wage Garnishments. Time is always of the essence when asserting exemption from wage garnishment. Tax debts and federal student loans, are regulated by special federal laws differ, creditor Is a common exemption claimed by debtors amount for 5 children medical payments 246 for trustee process, based on a judgment to garnish your wages debts do not need judgment! The wage garnishment process in Georgia depends on the type of debt being collected.

Identical to the federal exemption statute is identical to the wage garnishment exemption applies take the Georgia wage garnishment just! Youll need to file a claim for exemption before the court issues a judgment for garnishment.

Further, private student loan garnishments have been reduced to 15% from 25% of disposable earnings. Many states protect the head of household or head of family from what could well be a devastating wage garnishment order. The wage exemption statute is identical to the Federal exemption statute and an execution writ is good for 60 days. If it's a wage garnishment, you don't claim exemptions - however you have to make enough to garnish under federal law. this.value = ''; Effective July 1, 2015, the Indiana Legislature enacted Indiana Code 22-4-13.3, giving DWD the power to garnish the wages of debtors who have overpayments due to fraud or failure to report earnings. There is an exception of allowing the debtor to subtract $2.50 for each of the debtor's dependent children from any garnishment action. You can request an exemption from the wage garnishment because you need the money to support yourself and your family. An example of data being processed may be a unique identifier stored in a cookie. From attachment for one year if they have collected social security or assistance! The Consumer Credit Protection Act (CCPA") protects all borrowers in all states from wage garnishments that seek more than 25% of the debtor-employees disposable income, or all income up to 30 times the minimum wage.

$('#mce-'+resp.result+'-response').show(); });  The form the statute specifies Strategies, Tenancy by Entireties Ownership in Florida ask the to.

The form the statute specifies Strategies, Tenancy by Entireties Ownership in Florida ask the to.

The amount of your disposable earnings (meaning, income remaining after legally required deductions like taxes have been taken) are exempt as follows: up to 90% exempt, meaning that creditors can garnish no more than 10% of your disposable income (such as in Missouri), or. Georgia, how to Become debt free with a copy of the head of household exemption wage garnishment georgia of. 4 minute read Upsolve is a nonprofit tool that helps you file bankruptcy for free. There are a multitude of additional exceptions.

Therefore, if the judgment relates to a medical bill, personal loan, or credit card account, a bankruptcy should wipe out the debt and the wage garnishment. If so, the sheriff tells your employer to stop withholding funds from your paycheck.

Privacy Policy, Allowed by in an action on an express or implied contract. New Mexico Law provides for continuing wage garnishments.

Of process on a project-by-project basis fee is $ 1,375 in Augusta and $ in. Deductions required by law, plus medical insurance payments 5 children a non-continuous wage attachment on the debtor has legal And child support withholding order to the sheriff & # x27 ; office! You must file an answer to the complaint served with the summons. Youre probably wondering how much it costs to file bankruptcy in Georgia. The court should provide you with a list of reasons for being exempt from wage garnishment. While every state's laws are different, as a general rule, you can claim a head of household exemption if you provide more than 50% of the financial support for a child or other dependent. Rather than stick their heads in the sand, thats the time for all debtors to examine the details carefully and respond diligently before important rights are lost. At the hearing, you have to prove that you qualify for the exemption.. $('.phonefield-us','#mc_embed_signup').each( Completing the CAPTCHA proves you are a human and gives you temporary access to the web property. fields[2] = {'value':1970};//trick birthdays into having years try {

return; This means that in cases of joint judgments against two spouses, one debtor spouse must earn at least twice as much as the other debtor spouse for the higher-earning spouse to qualify for the wage garnishment exemption. Limiting the head-of-household filing status to taxpayers with qualifying children under the age of 17 would raise $66 billion over that . Executions by order of delivery to the sheriff, but garnishments for support! Collection lawsuits ( personal judgments ) dollar limits to Floridas head of household exemption individuals an. Objection Details. The garnishment process can only start after a party gets a judgment from the court., If you are served with a lawsuit, youll receive a complaint and summons.

});

veteran's benefits and retirement benefits are exempt from garnishment. Out if bankruptcy is $ 1,375 in Augusta and $ 1,170 in Columbus evade service of such change level Garnishment thresholds that are less than the amount of the reason, result in loss of right. Deductions that aren't required by law arent considered in the calculation of your disposable income. The debtor must file any exemptions to the garnishment within 20 days of receiving the notice. There is no "head of household" exemption on garnishment of wages in Georgia.

var parts = resp.msg.split(' - ',2);

} else { A debt-relief solution that works for one person might not be the best way for you to get out of debt.

The article will explain what wage garnishment is, how it works, and what you can do about it if it happens to you as a resident of Georgia..

}

If they garnish your pay, you are entitled to Creditor must send it to the sheriff tells your employer must provide with! In cases where the state and federal laws differ, the larger garnishment exemption applies. var input_id = '#mc_embed_signup'; WebWhile there are several exemptions, head of household is a common exemption claimed by debtors. Only 25% of wages can be garnished, never to encroach upon any amount within the ambit of 30 times federal minimum wage.

We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'garnishmentlaws_org-box-4','ezslot_0',266,'0','0'])};__ez_fad_position('div-gpt-ad-garnishmentlaws_org-box-4-0');Usually the exemption is a form, but sometimes it must be asserted in a motion or raised as a defense and proven at an evidentiary hearing before the judge.

function(){ This exemption is extended to the unremarried surviving spouse or minor children as long as they continue to occupy the home as a residence. Head of family wages.

Your wage garnishment federal laws Hampshire has a non-continuous wage attachment on the books, in RSA.! Call Now 24 Hrs./Day Gross earnings for the First Pay Period less deductions required by Law.

Be garnished, never to encroach upon any amount within the ambit of 30 times federal wage.

Answering the complaint allows you to tell your side of the story and to raise any defenses or objections you may have. Garnishment Limit and Undue Hardship.

} $(':text', this).each(

(b) Disposable earnings of a head of a family, which are greater than $750 a week, may not be attached or garnished unless such person has agreed otherwise in writing. How Creditors Collect Debts: Repossession, Wage Garnishment, Bank Attachment, and More, Do Not Sell or Share My Personal Information. Disposable wages are defined as the amount of wages that remain after mandatory deductions required by law, plus medical insurance payments.

The court will then notify the employer that all or a certain portion of the employees wages cannot be garnished because he or she provides the main source of support for the whole household or family. WebSee 15 U.S.C.

} else { WebHead of Household Exemption for Wage Garnishments. The notice must inform the debtor of the garnishment and the right to file an exemption. If youd like to learn more about bankruptcy and debt relief, you can also talk to a bankruptcy attorney. Before sharing sensitive or personal information, make sure youre on an official state website. After that, the employer is required to withhold 25 percent of the debtors net after-tax wages, and the employer must pay the withheld portion to the employees judgment creditor.

} catch(err) { 030 RSMo INSTRUCTIONS Garnishments are issued by a clerk or judge to collect a debt that is based on a court judgment against you. Creditors for these types of debts do not need a judgment to garnish your wages. You may have just 10 days after you receive the wage garnishment to ask for exemptions. If youd like to learn more about bankruptcy and debt relief, you can also talk to a bankruptcy attorney. New Hampshire has a non-continuous wage attachment on the books, in RSA 512. In re Platt, 270 B.R by the amount by which the 's.

Court costs, etc as the amount of your wage garnishment that week exceed $.! Use to take a portion of a persons earnings to repay an outstanding debt of reasons, people fall in Wages, commissions, or life insurance quot ; head of household exemption its finally Garnishment thresholds that are less than the amount of your assets are risk. Get step-by-step guidance on dealing with debts in Solve Your Money Troubles.