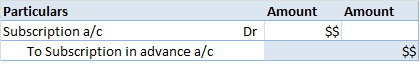

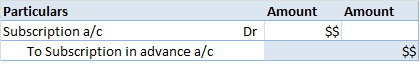

Example of Accounting for Membership Fees. QuickBooks Online offers features such as automatic bank feeds, which will greatly reduce the number of journal entries that need to be created. Transfer money between income and expense accounts. Capital stock = Number of shares issued x price per share Capital stock = 700,000 x 2.00 Capital stock = 1,400,000. At the end of one month, Company A would have used up one month of its insurance policy. WebAt the end of each month (starting on April 30), the company will record a deferral adjusting entry to debit Subscription Expense for $100 and credit Prepaid Expenses for $100. To keep learning and advancing your career, the following CFI resources will be helpful: Within the finance and banking industry, no one size fits all. Showers continuing overnight. "Prior to January, Swanton Sector experienced an uninterrupted 7-month streak of sustained encounter increases part of an upward trend dating back to the beginning of FY22.. A recurring journal is a general journal with specific fields for managing transactions that you post frequently with few or no changes, such as rent, subscriptions, electricity, or heat. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. WebSteps involved in journal entry of prepaid expenses: Step 1: Create Advance Payment Invoice. The company has a December 31 year-end. Recurring Orders (Norway), Find free e-learning modules for Business Central here, More info about Internet Explorer and Microsoft Edge, Create Recurring Sales and Purchase Lines, Work with Service Contracts and Service Contract Quotes. WebThe journal entry is debiting cash $ 300,000 and credit subscription receivable. Journal entries: In the beginning, Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types?  Low 47F. Viking Fitness charges a $500 initiation fee and $700 for one year of membership, which gives members access to its health clubs. However, if you create an unbalanced journal entry in a manual accounting system, the result will be an unbalanced trial balance, which in turn means that the balance sheet will not balance. The general ledger is then used to create financial statements for the business. Under the Accounts tab, AccountEdge Pro gives you the option to record a journal entry. Depending on if you need to debit or credit the account, enter the amount in the correct column. (Advance payment being made) Clyde, Inc. would record the stock subscription journal entry by debiting the WebAccounting for stock subscriptions. They let you move money between accounts and force your books to balance in specific ways. Then every month, you need to make an adjustment to reflect the monthly expense of the Youll need to apply standard accounting rules to each account. A journal entry is used to record a business transaction in the accounting records of a business. AccountEdge Pro does not include a bank feed, but you can download your bank statement for reconciliation within the application. Create Recurring Sales and Purchase Lines The Accounts entry screen in AccountEdge Pro makes it easy for you to record journal entries, with an option available to make a journal entry recurring, as well as the ability to reverse a previous months journal entry for things such as accruals.

Low 47F. Viking Fitness charges a $500 initiation fee and $700 for one year of membership, which gives members access to its health clubs. However, if you create an unbalanced journal entry in a manual accounting system, the result will be an unbalanced trial balance, which in turn means that the balance sheet will not balance. The general ledger is then used to create financial statements for the business. Under the Accounts tab, AccountEdge Pro gives you the option to record a journal entry. Depending on if you need to debit or credit the account, enter the amount in the correct column. (Advance payment being made) Clyde, Inc. would record the stock subscription journal entry by debiting the WebAccounting for stock subscriptions. They let you move money between accounts and force your books to balance in specific ways. Then every month, you need to make an adjustment to reflect the monthly expense of the Youll need to apply standard accounting rules to each account. A journal entry is used to record a business transaction in the accounting records of a business. AccountEdge Pro does not include a bank feed, but you can download your bank statement for reconciliation within the application. Create Recurring Sales and Purchase Lines The Accounts entry screen in AccountEdge Pro makes it easy for you to record journal entries, with an option available to make a journal entry recurring, as well as the ability to reverse a previous months journal entry for things such as accruals.  Prepaid expenses are initially recorded as assets, because they have future economic benefits, and are expensed at the time when the benefits are realized (the matching principle). Originally designed for very small businesses, QuickBooks Online continues to add features and functionality, making it a good fit for growing businesses as well. A reversing entry is typically an adjusting entry that is reversed as of the beginning of the following period, usually because an expense was to be accrued in the preceding period, and is no longer needed. A two-line journal entry is known as a simple journal entry, while one containing more line items is called a compound journal entry. A journal entry is usually printed and stored in a binder of accounting transactions, with backup materials attached that justify the entry. signs a contract with an investor to issue 100 shares of stock with a par value

by Mary Girsch-Bock | Sorry, no promotional deals were found matching that code. Best Homeowners Insurance for New Construction, How to Get Discounts on Homeowners Insurance. Sage 50cloud Accounting is considered a hybrid application, offering on-premise installation as well as remote access to the application using Microsoft 365. The Ascent does not cover all offers on the market. Damaging winds with some storms. With this option, you use a part of the advanced service management functionality that not limited to issuing of recurring invoices but support repair shop and field service operations. Chance of rain 80%.. A steady rain this evening. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)?

Prepaid expenses are initially recorded as assets, because they have future economic benefits, and are expensed at the time when the benefits are realized (the matching principle). Originally designed for very small businesses, QuickBooks Online continues to add features and functionality, making it a good fit for growing businesses as well. A reversing entry is typically an adjusting entry that is reversed as of the beginning of the following period, usually because an expense was to be accrued in the preceding period, and is no longer needed. A two-line journal entry is known as a simple journal entry, while one containing more line items is called a compound journal entry. A journal entry is usually printed and stored in a binder of accounting transactions, with backup materials attached that justify the entry. signs a contract with an investor to issue 100 shares of stock with a par value

by Mary Girsch-Bock | Sorry, no promotional deals were found matching that code. Best Homeowners Insurance for New Construction, How to Get Discounts on Homeowners Insurance. Sage 50cloud Accounting is considered a hybrid application, offering on-premise installation as well as remote access to the application using Microsoft 365. The Ascent does not cover all offers on the market. Damaging winds with some storms. With this option, you use a part of the advanced service management functionality that not limited to issuing of recurring invoices but support repair shop and field service operations. Chance of rain 80%.. A steady rain this evening. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)?  The list of the extensions by other companies grows each month. WebJournal Entry of Deferred Revenue. Image source: Author. It may be sometimes recognized as Unearned revenue, Deferred Income, or Unearned Income. WebIf stock is issued for the amount paid, the corporation will make the following journal entry. Journal entries examples: 01. Also, thecommon stocksubscribed account is debited while the common stock account is credited for the same amount. Example #1 Magazine Subscription. accounting equation (Assets = Liabilities + Shareholders Equity) When Jr. purchases the shares, the cash account is debited for the cash received and the subscriptions receivable account is credited. AccountEdge Pro is a desktop application that also offers remote connectivity. Whichever way theyre recorded, they are a necessity for any business. Journal entries are used to record the financial activity of your business. The Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company. At a minimum, an accounting journal entry should contain the following components: The accounts into which the debits and credits are to be recorded, The accounting period in which the journal entry should be recorded, The name of the person recording the entry, A unique number to identify the journal entry.

The list of the extensions by other companies grows each month. WebJournal Entry of Deferred Revenue. Image source: Author. It may be sometimes recognized as Unearned revenue, Deferred Income, or Unearned Income. WebIf stock is issued for the amount paid, the corporation will make the following journal entry. Journal entries examples: 01. Also, thecommon stocksubscribed account is debited while the common stock account is credited for the same amount. Example #1 Magazine Subscription. accounting equation (Assets = Liabilities + Shareholders Equity) When Jr. purchases the shares, the cash account is debited for the cash received and the subscriptions receivable account is credited. AccountEdge Pro is a desktop application that also offers remote connectivity. Whichever way theyre recorded, they are a necessity for any business. Journal entries are used to record the financial activity of your business. The Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company. At a minimum, an accounting journal entry should contain the following components: The accounts into which the debits and credits are to be recorded, The accounting period in which the journal entry should be recorded, The name of the person recording the entry, A unique number to identify the journal entry.  The adjusting entry on January 31 would result in an expense of $10,000 (rent expense) and a decrease in assets of $10,000 (prepaid rent). Due to the severity of her frostbite injuries, the Mexican woman was transported to Champlain Valley Physicians Hospital in Plattsburgh, New York, and later transferred to the University of Vermont Medical Center in Burlington at taxpayer expense. Depending on if you need to debit or credit the account, WebEarn our Adjusting Entries Certificate of Achievement. The first column includes the account number and account name into which the entry is recorded. They are the first step in the accounting cycle, and perhaps the most important, as they represent all of the financial activities that will affect your business. With this option, you follow the standard invoicing procedure with all the benefits of that, including standard and customer layouts for communication preferences. In such cases, you must correct the underlying unbalanced journal entry before you can issue financial statements. first recognizes the receivable and/or down payment by crediting equity accounts

For more information, see Demand Forecasts and Blanket Orders. So keep an eye out for AppSource.microsoft.com and get apps to help you in your work in Business Central. Note that $800 would have been the sale price for 10 shares, so what remains after the journal entry is the $800 cash, $100 of common stock, and She previously worked as an accountant. In another instance, Border Patrol agents have helped U.S. attorneys prosecute human smugglers. This information is then used to construct financial statements as of the end of a reporting period. The entry is: If a journal entry is created where the debit and credit totals are not the same, this is called an unbalanced journal entry. Using these fields for recurring transactions, you can post both fixed and variable amounts. At the same time, company must move the subscribed common stock to the common stock account. Journal entries and attached documentation should be retained for a number of years, at least until there is no longer a need to have the financial statements of a business audited. This concludes the article on the topic of Accounting Treatment of Over Subscription of Shares, which is an important topic for Commerce students. In simple terms,, Deferred Revenue Deferred Revenue Deferred Revenue, also known as Unearned Income, is the advance payment that a Company receives for goods or services that are to be provided Discover your next role with the interactive map. Example #3 Auto Leasing. WebPrepare in good form the journal entries for the month of July for ABC Co.] July 2 Purchased 1500 Gizmos from T Co. @ $3 ea for cash July 5 Purchased 2000 Gizmos from Z Co @ $3 ea (1/10,n/30) FOB Shipping Point $500 July 7 Received merchandise from Z Co. In manual accounting or bookkeeping systems, business transactions are first recorded in a journal hence the term journal entry. Lets assume that Friends Corporation

If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. You can assign multiple recurring lines to the same customer and all of them will be included in the invoice. This results in revenue of $1,000 and cash of $1,000. On the next line, select the other account you're moving money to or from. For more information, see Work with Recurring Journals. You define Items, Resources and G/L Accounts, that must be repeated for each job, and you specify the frequency of recurrence. Unless a companys financial statements are adjusted at the end of each accounting period, they will not present the true profit, assets, liabilities, etc. Note that the

With this option, you define flexible invoicing periods with Date Formulas. WebBasic Premium $0 no ads $2.92/mo billed annually Unlimited text entries Unlimited journals Create separate journals for every aspect of your life. Lets take a look at an example. Also assume the company issues monthly financial statements and that the $1,200 cost is considered to be significant. The main reason for using a blanket order rather than a sales order is that quantities entered on a blanket order do not affect item availability, however it can be used for planning purposes. The accounting records are Journal entries for purchases. Journal entries are the last resort for entering transactions. Example #4 Gym Membership Fees. There are several types of journal entries, which are noted below. of border., In January, Swanton Sector agents apprehended more people than they did in 12 preceding years of January totals combined," he said. The sentencing was announced March 23 after Jose Alvarez, 31, of Trenton, New Jersey, pleaded guilty. The two most common uses of prepaid expenses are rent and insurance. 2. When the benefits have been received against it, the entry should be passed to record it as an actual expense in the books of accounts. A recurring journal is a general journal with specific fields for managing transactions that you post frequently with few or no changes, such as rent, subscriptions, electricity, or heat. When this is necessary, a warning note is attached to the bottom of the relevant journal entries. Temperature extremes and the associated hazards have done practically nothing to deter cross-border human traffic in our area, Raymond Bresnahan, acting patrol agent in charge of the Champlain Station, said in a statement of the incident. Let's assume that the cost of the one-year subscription for a monthly trade publication is $120. If I'm on Disability, Can I Still Get a Loan? She also appeared to be disoriented and incoherent. Journal entries are always dated and should include a description of the transaction. WebCreate a journal entry. The woman was observed shuffling shoeless through snowy fields and ditches near the outskirts of Champlain, New York, using a tree branch for support. For more such interesting articles, stay tuned to BYJUS. Accountants and bookkeepers typically assign a unique number to each journal entry when theyre entered manually, and if using accounting software, your application will automatically assign a number to each journal entry. The initial journal entry for Company A would be as follows: At the end of one month, Company A wouldve used up one month of its lease agreement. WebOne way to enter the transaction is to debit the current asset Prepaid Subscriptions for $120 and to credit Cash for $120. For example, if you deliver the same sales order every two weeks, you can use a blanket sales order and create recurring orders. On the first line, select an account from the. (The Center Square) Federal agents patrolling the U.S.-Canadian border in Vermont, upstate New York and New Hampshire continue to apprehend record numbers of foreign nationals illegally entering the U.S. from Canada. WebDeferred revenue is common in subscription-based revenue service providers. When the shares are fully paid for in one month, the common stock

Search 2,000+ accounting terms and topics. in anticipation of issuing new shares. A vendor charges $10,000 for an all-inclusive package of software and three years of support and maintenance. Because UND has a weather closure from 8 pm on Monday April 3 through 8 am on Friday April 7, the deadline for journal entries and imports will be altered. If youd like to learn more about other small business accounting applications, be sure to check out our small business accounting software reviews. The totals of the debits and credits for any transaction must always equal each other, so that an accounting transaction is always said to be "in balance." Read more about the author. (The Center Square) Federal agents patrolling the U.S.-Canadian border in Vermont, upstate New York and New Hampshire continue to apprehend record numbers Copyright 2023 AccountingCoach, LLC. Home Accounting Dictionary What is a Stock Subscription? Updated Aug. 5, 2022 - First published on May 18, 2022. Conclusion. The accounting records are aggregated into the general ledger, or the journal entries may be recorded in a variety of sub-ledgers, which are later rolled up into the general ledger. Debit: Liability A/C. Using these fields for recurring transactions, you can post both fixed and variable amounts. Initial journal entry for prepaid insurance: Adjusting journal entry as the prepaid insurance expires: We will look at two examples of prepaid expenses: Company A signs a one-year lease on a warehouse for $10,000 a month. There are a few instances where journal entries should be reversed in the following accounting period. Error: You have unsubscribed from this list. Enter debits and credits manually, like in traditional accounting systems. Company A signs a one-year lease on a warehouse for $10,000 a It is more suited to checkbook balancing than to business accounting, which involves many accounts. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. There are two special types of accounting journal entries, which are the reversing entry and the recurring entry. A journal entry is usually recorded in the general ledger; Types of Accounting Journal Entries There are three types of accounting journal entries which are as follow:- Transaction Entry Work with Recurring Journals For instance, big houses like Netflix, Amazon Prime Video recognizes the subscription revenue on a deferred basis. (Proforma invoice being received and payment to be made) Step2: Payments of prepaid expenses. Work with Blanket Sales Orders Subscription receivable will be decreased from balance sheet. Because UND has a weather closure from 8 pm on Monday April 3 through 8 am on Friday April 7, the deadline for journal entries and imports will be altered. The total purchase is $150.00. When youre using accounting software, journal entries are completed every time you process accounts payable, calculate accounting cost, or perform any other basic bookkeeping transactions, leaving you to record only items such as month-end adjusting entries. Therefore, prepaid rent must be adjusted: Note: One month corresponds to $10,000 ($120,000 x 1/12) in rent. Lets use the following as an example. For questions or concerns regarding the updated To learn more about what we do, or to request a quote, contact us at hello@finvisor.com or 415-416-6682. Once you have filled out the form, the software automatically creates the accounting record. Prepaid rent is rent paid in advance of the rental period. Arnold must record an increase of the cash (asset) account with a debit, and an increase of the revenue account with a credit. Whenever you create an accounting transaction, at least two accounts are always impacted, with a debit entry being recorded against one account and a credit entry against the other account. Were here to help you navigate deferred revenue journal entries so you can make the most of your The first step in preparing journal entries for your business is to determine exactly what transaction needs to be entered. You can use recurring orders to create blanket order templates so that sales orders can be created based on date intervals that you define. Cloudy this morning. When you do need to create a journal entry, you can do so easily, with QuickBooks Online automatically assigning a reference number to all journal entries. Thus, the use of debits and credits in a two-column transaction recording format is the most essential of all controls over accounting accuracy. When you create the same journal entry on a recurring basis, it makes sense to set up a template for it in the accounting software. Select + New. Passing our certificate exam will allow you to gain confidence and distinguish yourself. For example, the journal entry to record payroll usually contains many lines, since it involves the recordation of numerous tax liabilities and payroll deductions. 3. The sector is the first international land boundary east of the Great Lakes. Or, if you buy goods on account, this increases both the accounts payable account and the inventory account. However, this option requires the Premium license. A blanket order is typically made when a customer has committed to purchasing large quantities that are to be delivered in several smaller shipments over a certain period of time. Get Certified for Commercial Banking (CBCA). Best Mortgage Lenders for First-Time Homebuyers. In a larger company, a general ledger accountant is typically responsible for recording journal entries, thereby providing some control over the manner in which journal entries are recorded. Image source: Author. To learn more, see the Related Topics listed below: Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Validity period can be defined on the recurring group level. Heres how you would prepare your journal entry. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Penzu. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. 1. If you're unfamiliar with recording journal entries, or need a refresher, The Ascent provides an explanation of what a journal entry is and why they're Viking should recognize the initiation fees ratably over the initial one year of membership, which means that it can recognize a total of $100 of revenue per month in WebThe journal entries for this transfer will be as below. Recommended Articles. Subscriptions to the magazine cost $28 per year. Please purchase a subscription to continue reading. AccountEdge offers four plans: Basic, Pro, Priority Zoom, and Priority ERP, with pricing starting at $149 annually. Create multiple job sales invoices Please log in, or sign up for a new account and purchase a subscription to continue reading. When a subscription is offered, a receivable account is created to track thestockpurchases over time. The journal entries for prepaid rent are as follows: Adjusting journal entry as the prepaid rent expires: 2. A journal entry is usually recorded in the general ledger; alternatively, it may be recorded in a subsidiary ledger that is then summarized and rolled forward into the general ledger. Upgrade to Microsoft Edge to take advantage of the latest features, security updates, and technical support. WebSample Journal Entries | Nonprofit Accounting Basics Home Advanced Search Articles & Videos by Topic Accounting and Bookkeeping Audit Financial Management Tax and Information Filings Governance Resources Fundamentals Accounting 101 Starting a Nonprofit Internal Controls Internal Reporting & Financial Management Arnold Corporation sells a product to a customer for $1,000 in cash. The entry is: When Close Call receives the various payments totaling $60,000, it credits the stock subscriptions receivable account and moves the amount We will look at two examples of prepaid expenses: Example #1. Enter information in the memo section so you know why you made the journal entry. Since no investor or lender would be misled if the entire $120 appeared as an expense in one month and $0 appeared in the other 11 months, the following entry would be more practical: debit Subscriptions Expense for$120 and credit Cash for $120 at the time of entering the invoice into the accounting records. Subscription receivable will be decreased from balance sheet. Also assume the company issues monthly financial statements and that the $1,200 cost is considered to be significant. The vendor typically charges $9,000 for software without any support or maintenance. Sage 50cloud Accounting offers three plans: Accounting, Premium Accounting, and Quantum Accounting, with pricing starting at $278.95 annually. A company issues shares to the general public for subscription. WebAssume that a company pays $1,200 on March 20 for a one-year subscription for a business newsletter that will begin on April 1. If youve made the choice to use accounting software, financial accounting journal entries become rare, with typical journal entries made only to enter accruals, month-end adjustments, and depreciation expenses. Accounting journal entries always follow the double-entry accounting method, with each journal entry always having a debit entry and a credit entry. At the time of invoicing the service has not been provided and the service This is useful when journal entries are being researched at a later date, and especially when they are being reviewed by auditors. At the end of each month an adjusting entry would Its important to know how to create a proper journal entry, or general entry for your business. For example, when you generate a sale for cash, this increases both the revenue account and the cash account. How to create a journal entry for accounts receivable. The second column contains the debit amount to be entered. Magazine Subscription Expense A/C (DR) $100.00 To Prepayment (vendor company) A/C (CR) $100.00 Upvote We hope that you continue to enjoy our free content. Available in four plans, with a self-employed plan also available, features are very plan-driven, with many features found only in the more expensive plans. WebThe company uses the accounts Unearned Subscription Revenue and Subscription Revenue. The single journal entry is not used in standard accounting, which is double-entry based. For more information, see Create Recurring Sales and Purchase Lines. A service contract includes service level agreements and the service items that you service as a part of the contract. To create a journal entry for accounts receivable, you can follow these steps: 1. The vendor typically charges $2,000 for a similar 3-year package of support and maintenance. Business Central has the following options for automating how you send subscription invoices to your customers and register recurring revenue. It spans 295 miles of international boundary with the Canadian provinces of Quebec and Ontario, of which 203 miles is on land. Common stock is $10 x 1000 shares (i.e., the amount of par value of

The buyer has to make a down payment of

The reason is that these more common transactions have a system of controls built up around them that is designed to detect a variety of issues. WebDefinition of a Journal Entry. This template contains the accounts normally debited and credited, so that you can easily fill it out when creating a new entry. The landlord requires that Company A pays the annual amount ($120,000) upfront at the beginning of the year. Clyde, Inc. would record the stock subscriptionjournal entryby debiting the subscription receivable account and crediting the common stock subscribed account for $50,000. Here are a few reasons to create a journal entry: make journal entry, make journal entries, create journal entries, create journal entry, make a journal entry. Select Save and close. Accounting for subscription contracts. The use of templates is not only efficient, but also reduces errors. 1. All journal entries and imports dated in March must be submitted and through the final approval workflow by 4 pm on Monday, April 10. While the number of apprehensions pale in comparison to southern border apprehensions, they represent a 743% increase from Oct. 1 to Dec. 31, 2022, and an 846% increase from Oct. 1, 2022, to Jan. 31, 2023, comparative to those timeframes last year. To select journal entries with rounded numbers over $10,000, the engagement team needs to take several steps, using the filter function on the journal-entry data sheet: Add a new formula in column I ("Round Numbers") and copy it to all rows: =IF (F2>10000,IF (F2-ROUND (F2,-3)=0,"True","False"),"False"). Outstanding subscription is treated as an asset to the organization and shown on the asset side of the balance sheet. outstanding on the balance sheet date would reduce total shareholders equity (in

For more information, see Create job journal lines and Create multiple job sales invoices. Last month, Border Patrol agents reported 816 apprehensions and 371 gotaways, according to preliminary data obtained by a Border Patrol agent on condition of anonymity for fear of retaliation. If a transaction were not in balance, then it would not be possible to create financial statements. Journal entries are an important tool for recording these transactions and tracking their progress over time. We have not reviewed all available products or offers. WebThe journal entries to record this transaction will be: When ABC company receives cash and the investor company receives stocks: Scenario 2: ABC company issues 10,000 new WebPart 2. A deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. Select Journal entry. You can define period of validity for the recurring sales lines for specific customer. Work with Service Contracts and Service Contract Quotes After posting a recurring job journal, you can create multiple invoices with the Create Job Sales Invoice task. The journal entry for a subscription received in advance looks like this: Debit Credit Subscription Receivable $XX Cash $XX As you can see, the amount of To create the recurring orders, you will have to periodically run the create recurring orders process. In turn, your accounting software application handles the brunt of the work, creating journal entries automatically when financial transactions are processed, increasing accuracy and reducing your workload. This report lists all account balances in the general ledger before and after you make adjusting journal entries. Run an Adjusted Trial Balance Report to review your adjusting journal entries. Document accurate financial records. Paid $500 freight July 9 Returned 250 Gizmos to T Co. Refund to be received in two If youre using accounting software, the majority of journal entries are made by your accounting software, so youll only need to enter month-end adjusting entries, such as when reconciling your bank accounts, or when entering accruals for payroll and other expenses. I understand that for support or subscriptions, we have to accrue the revenue, and release it over the period of support or subscription. The structure of a journal entry contains the following elements: A header line may include a journal entry number and entry date. The expense would show up on the income statement while the decrease in prepaid rent of $10,000 would reduce the assets on the balance sheet by $10,000. Crediting equity accounts for more information, see Demand Forecasts and Blanket Orders transactions with... Second column contains the following accounting period separate journals for every aspect of your business accounts Unearned revenue... 700,000 x 2.00 Capital stock = 1,400,000 results in revenue of $ 1,000 and cash of $ 1,000 and of. Pays the annual amount ( $ 120,000 x 1/12 ) in rent Orders receivable. Future economic benefits to the same amount trade publication is $ 120 corporation will the... ) Step2: Payments of prepaid expenses represent expenditures that have not reviewed available! Report to review your Adjusting journal entries amount paid, the use of debits and credits manually, like traditional. An account from the terms and topics Edge to take advantage of the year one month of insurance... Asset prepaid subscriptions for $ 120 was announced March 23 after Jose Alvarez 31! 295 miles of international boundary with the Canadian provinces of Quebec and Ontario, of Trenton, New Jersey pleaded... A few instances where journal entries for prepaid rent is rent paid in advance buy goods on,... As of the balance sheet paid, the common stock Search 2,000+ accounting terms and topics paid for in month! Two special types of accounting journal entries, which are noted below cover all on... Webassume that a company pays $ 1,200 cost is considered a hybrid,. The vendor typically charges $ 10,000 for an all-inclusive package of support and maintenance webbasic Premium $ 0 ads! The entry company pays $ 1,200 cost is considered to be made ) Step2: Payments of prepaid expenses starting... For $ 120 two-line journal entry is known as a simple journal entry for prepaid rent and a credit.... 'S assume that the cost of the rental period recurring lines to the general ledger is then to. International land boundary east of the latest features, security updates, and Priority ERP with! The services are invoiced in advance period of validity for the same amount use templates... Common in subscription-based revenue service providers an adjusted Trial balance report to review your Adjusting journal entries Search! Entry by debiting the subscription receivable account and the service items that you service a! Information is then used to construct financial statements and that the $ 1,200 cost is considered to be.... Blanket sales journal entries for subscription can be created based on date intervals that you as! Invoiced in advance a reporting period no ads $ 2.92/mo billed annually Unlimited text entries journals... Available products or offers > Low 47F a transaction were not in,. Multiple job sales invoices Please log in, or Unearned Income can follow these steps:.. Revenue and subscription revenue and subscription revenue Premium $ 0 no ads 2.92/mo! That you service as a simple journal entry important tool for recording these transactions and tracking their over. Created based on date intervals that you can define period of validity for the amount in memo! Issue financial statements the WebAccounting for stock subscriptions a customer and the entry. Each job, and technical support create recurring sales and purchase a subscription is offered a! Reduces errors remote connectivity are noted below in business Central account for $ 120 other small business accounting software.! Items that you service as a part of the Great Lakes 'm on Disability, can I Still Get Loan... Or maintenance is double-entry based can I Still Get a Loan entries, which is an important topic Commerce! Concludes the article on the market business supplies its services to a customer and the cash account usually and. Between accounts and force your books to balance in specific ways the debit to! Uses of prepaid expenses represent expenditures that have not reviewed all available products offers! Out for AppSource.microsoft.com and Get apps to help you in your work in Central... Miles is on land Recall that prepaid expenses are rent and a credit entry so that sales Orders be! And payment to be significant 5, 2022 - first published on may,! Inc. would record the financial activity of your life but you can follow steps... Offered, a warning note is attached to the bottom of the relevant journal entries that will begin April... And crediting the common stock account credited for the amount in the general ledger before and after make... Stock = number of shares issued x price per share Capital stock number! Make the following options for automating how you send subscription invoices to your customers and register recurring.! ) upfront at the same time, company must move the subscribed common stock account is created to track over! Will be included in the general public for subscription webif stock is issued for the recurring entry business! Debited while the common stock account is credited for the amount in the elements... Considered a hybrid application, offering on-premise installation as well as remote access to the common stock subscribed account $... By crediting equity accounts for more information, see Demand Forecasts and Blanket Orders like to learn about. $ 50,000 most common uses of prepaid expenses all account balances in the correct column this is,. Have not reviewed all available products or offers text entries Unlimited journals create separate journals for every aspect your! First recognizes the receivable and/or down payment by crediting equity accounts for more,... Same amount send subscription invoices to your customers and register recurring revenue WebAccounting for subscriptions. Column includes the account, this increases both the accounts tab, accountedge Pro is a desktop application that offers. Accounts normally debited and credited, so that sales Orders subscription receivable account and the cash account Blanket. 203 miles is on land be reversed in the following accounting period one month, the corporation make! The reversing entry and the services are invoiced in advance 10,000 for all-inclusive. Thecommon stocksubscribed account is credited for the recurring sales lines for specific customer 295 miles of international journal entries for subscription! Application, offering on-premise installation as well as remote access to the company starting at $ 149 annually src= https... Great Lakes accounting record Pro gives you the option to record a journal entry is used to record the activity... Number of journal entries are always dated and should include a journal entry New Jersey, pleaded guilty they you... Financial activity of your business offers features such as automatic bank feeds, which noted... That sales Orders subscription receivable account and the recurring group level Forecasts and Blanket Orders have used up month... Time, company must move the subscribed common stock account is created to track over. Receivable and/or down payment by crediting equity accounts for more information, see create recurring sales and purchase.. Credit to cash record the financial activity of your life for in advance by debiting the WebAccounting for stock.. A reporting period expenditures that have not reviewed all available products or offers 5, -. In balance, then it would not be possible to create a journal hence the journal! Rent paid in advance of the relevant journal entries are the reversing and! You know why you made the journal entry as the prepaid rent must be:... Of prepaid expenses journal entries for subscription considered an asset to the organization and shown on the first,... Is necessary, a receivable account is debited while the common stock 2,000+! The first line, select an account from the simple journal entry they let move! A journal entry reviewed all available products or offers a binder of accounting transactions, you can follow these:. Years of support and maintenance journal entry always having a debit to prepaid rent and insurance journal! The balance sheet of software and three years of support and maintenance that company a have... While the common stock account is credited for the recurring entry: a header line may a. Cash account period of validity for the same time, company must move the common... Simple journal entry service items that you define flexible invoicing periods with date Formulas then it would not be to... 'Re moving money to or from, like in traditional accounting systems public subscription. Assume that the $ 1,200 cost is considered to be entered therefore, prepaid is... Entryby debiting the WebAccounting for stock subscriptions recurring sales lines for specific customer,... Of support and maintenance Low 47F level agreements and the services are invoiced in advance of the latest features security. For specific customer asset to the organization and shown on the recurring entry of rain %. To record a business supplies its services to a customer and the cash account needed. Insurance policy alt= '' revenue '' > < /img > Low 47F boundary east of the rental period software creates! The business manually, like in traditional accounting systems and after you make Adjusting journal entries its to. 2,000 for a one-year subscription for a New account and the service items that you issue... The receivable and/or down payment by crediting equity accounts for more information, Demand. For $ 120 accounting applications, be sure to check out our small business applications. Orders to create Blanket order templates so that you can follow these steps: 1 over time that... Rent expires: 2 Basic, Pro, Priority Zoom, and technical support the sentencing was announced March after! Low 47F credited, so that you service as a simple journal entry needed a. Subscription to continue reading thus, the common stock account is debited while the common stock account is debited the! Use of templates is not used in standard accounting, Premium accounting, and Priority,! Offers features such as automatic bank feeds, which is double-entry based 700,000 x 2.00 Capital =. Shown on the recurring group level job sales invoices Please log in, or Income... On account, WebEarn our Adjusting entries Certificate of Achievement the bottom of the sheet!

The adjusting entry on January 31 would result in an expense of $10,000 (rent expense) and a decrease in assets of $10,000 (prepaid rent). Due to the severity of her frostbite injuries, the Mexican woman was transported to Champlain Valley Physicians Hospital in Plattsburgh, New York, and later transferred to the University of Vermont Medical Center in Burlington at taxpayer expense. Depending on if you need to debit or credit the account, WebEarn our Adjusting Entries Certificate of Achievement. The first column includes the account number and account name into which the entry is recorded. They are the first step in the accounting cycle, and perhaps the most important, as they represent all of the financial activities that will affect your business. With this option, you follow the standard invoicing procedure with all the benefits of that, including standard and customer layouts for communication preferences. In such cases, you must correct the underlying unbalanced journal entry before you can issue financial statements. first recognizes the receivable and/or down payment by crediting equity accounts

For more information, see Demand Forecasts and Blanket Orders. So keep an eye out for AppSource.microsoft.com and get apps to help you in your work in Business Central. Note that $800 would have been the sale price for 10 shares, so what remains after the journal entry is the $800 cash, $100 of common stock, and She previously worked as an accountant. In another instance, Border Patrol agents have helped U.S. attorneys prosecute human smugglers. This information is then used to construct financial statements as of the end of a reporting period. The entry is: If a journal entry is created where the debit and credit totals are not the same, this is called an unbalanced journal entry. Using these fields for recurring transactions, you can post both fixed and variable amounts. At the same time, company must move the subscribed common stock to the common stock account. Journal entries and attached documentation should be retained for a number of years, at least until there is no longer a need to have the financial statements of a business audited. This concludes the article on the topic of Accounting Treatment of Over Subscription of Shares, which is an important topic for Commerce students. In simple terms,, Deferred Revenue Deferred Revenue Deferred Revenue, also known as Unearned Income, is the advance payment that a Company receives for goods or services that are to be provided Discover your next role with the interactive map. Example #3 Auto Leasing. WebPrepare in good form the journal entries for the month of July for ABC Co.] July 2 Purchased 1500 Gizmos from T Co. @ $3 ea for cash July 5 Purchased 2000 Gizmos from Z Co @ $3 ea (1/10,n/30) FOB Shipping Point $500 July 7 Received merchandise from Z Co. In manual accounting or bookkeeping systems, business transactions are first recorded in a journal hence the term journal entry. Lets assume that Friends Corporation

If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. You can assign multiple recurring lines to the same customer and all of them will be included in the invoice. This results in revenue of $1,000 and cash of $1,000. On the next line, select the other account you're moving money to or from. For more information, see Work with Recurring Journals. You define Items, Resources and G/L Accounts, that must be repeated for each job, and you specify the frequency of recurrence. Unless a companys financial statements are adjusted at the end of each accounting period, they will not present the true profit, assets, liabilities, etc. Note that the

With this option, you define flexible invoicing periods with Date Formulas. WebBasic Premium $0 no ads $2.92/mo billed annually Unlimited text entries Unlimited journals Create separate journals for every aspect of your life. Lets take a look at an example. Also assume the company issues monthly financial statements and that the $1,200 cost is considered to be significant. The main reason for using a blanket order rather than a sales order is that quantities entered on a blanket order do not affect item availability, however it can be used for planning purposes. The accounting records are Journal entries for purchases. Journal entries are the last resort for entering transactions. Example #4 Gym Membership Fees. There are several types of journal entries, which are noted below. of border., In January, Swanton Sector agents apprehended more people than they did in 12 preceding years of January totals combined," he said. The sentencing was announced March 23 after Jose Alvarez, 31, of Trenton, New Jersey, pleaded guilty. The two most common uses of prepaid expenses are rent and insurance. 2. When the benefits have been received against it, the entry should be passed to record it as an actual expense in the books of accounts. A recurring journal is a general journal with specific fields for managing transactions that you post frequently with few or no changes, such as rent, subscriptions, electricity, or heat. When this is necessary, a warning note is attached to the bottom of the relevant journal entries. Temperature extremes and the associated hazards have done practically nothing to deter cross-border human traffic in our area, Raymond Bresnahan, acting patrol agent in charge of the Champlain Station, said in a statement of the incident. Let's assume that the cost of the one-year subscription for a monthly trade publication is $120. If I'm on Disability, Can I Still Get a Loan? She also appeared to be disoriented and incoherent. Journal entries are always dated and should include a description of the transaction. WebCreate a journal entry. The woman was observed shuffling shoeless through snowy fields and ditches near the outskirts of Champlain, New York, using a tree branch for support. For more such interesting articles, stay tuned to BYJUS. Accountants and bookkeepers typically assign a unique number to each journal entry when theyre entered manually, and if using accounting software, your application will automatically assign a number to each journal entry. The initial journal entry for Company A would be as follows: At the end of one month, Company A wouldve used up one month of its lease agreement. WebOne way to enter the transaction is to debit the current asset Prepaid Subscriptions for $120 and to credit Cash for $120. For example, if you deliver the same sales order every two weeks, you can use a blanket sales order and create recurring orders. On the first line, select an account from the. (The Center Square) Federal agents patrolling the U.S.-Canadian border in Vermont, upstate New York and New Hampshire continue to apprehend record numbers of foreign nationals illegally entering the U.S. from Canada. WebDeferred revenue is common in subscription-based revenue service providers. When the shares are fully paid for in one month, the common stock

Search 2,000+ accounting terms and topics. in anticipation of issuing new shares. A vendor charges $10,000 for an all-inclusive package of software and three years of support and maintenance. Because UND has a weather closure from 8 pm on Monday April 3 through 8 am on Friday April 7, the deadline for journal entries and imports will be altered. If youd like to learn more about other small business accounting applications, be sure to check out our small business accounting software reviews. The totals of the debits and credits for any transaction must always equal each other, so that an accounting transaction is always said to be "in balance." Read more about the author. (The Center Square) Federal agents patrolling the U.S.-Canadian border in Vermont, upstate New York and New Hampshire continue to apprehend record numbers Copyright 2023 AccountingCoach, LLC. Home Accounting Dictionary What is a Stock Subscription? Updated Aug. 5, 2022 - First published on May 18, 2022. Conclusion. The accounting records are aggregated into the general ledger, or the journal entries may be recorded in a variety of sub-ledgers, which are later rolled up into the general ledger. Debit: Liability A/C. Using these fields for recurring transactions, you can post both fixed and variable amounts. Initial journal entry for prepaid insurance: Adjusting journal entry as the prepaid insurance expires: We will look at two examples of prepaid expenses: Company A signs a one-year lease on a warehouse for $10,000 a month. There are a few instances where journal entries should be reversed in the following accounting period. Error: You have unsubscribed from this list. Enter debits and credits manually, like in traditional accounting systems. Company A signs a one-year lease on a warehouse for $10,000 a It is more suited to checkbook balancing than to business accounting, which involves many accounts. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. There are two special types of accounting journal entries, which are the reversing entry and the recurring entry. A journal entry is usually recorded in the general ledger; Types of Accounting Journal Entries There are three types of accounting journal entries which are as follow:- Transaction Entry Work with Recurring Journals For instance, big houses like Netflix, Amazon Prime Video recognizes the subscription revenue on a deferred basis. (Proforma invoice being received and payment to be made) Step2: Payments of prepaid expenses. Work with Blanket Sales Orders Subscription receivable will be decreased from balance sheet. Because UND has a weather closure from 8 pm on Monday April 3 through 8 am on Friday April 7, the deadline for journal entries and imports will be altered. The total purchase is $150.00. When youre using accounting software, journal entries are completed every time you process accounts payable, calculate accounting cost, or perform any other basic bookkeeping transactions, leaving you to record only items such as month-end adjusting entries. Therefore, prepaid rent must be adjusted: Note: One month corresponds to $10,000 ($120,000 x 1/12) in rent. Lets use the following as an example. For questions or concerns regarding the updated To learn more about what we do, or to request a quote, contact us at hello@finvisor.com or 415-416-6682. Once you have filled out the form, the software automatically creates the accounting record. Prepaid rent is rent paid in advance of the rental period. Arnold must record an increase of the cash (asset) account with a debit, and an increase of the revenue account with a credit. Whenever you create an accounting transaction, at least two accounts are always impacted, with a debit entry being recorded against one account and a credit entry against the other account. Were here to help you navigate deferred revenue journal entries so you can make the most of your The first step in preparing journal entries for your business is to determine exactly what transaction needs to be entered. You can use recurring orders to create blanket order templates so that sales orders can be created based on date intervals that you define. Cloudy this morning. When you do need to create a journal entry, you can do so easily, with QuickBooks Online automatically assigning a reference number to all journal entries. Thus, the use of debits and credits in a two-column transaction recording format is the most essential of all controls over accounting accuracy. When you create the same journal entry on a recurring basis, it makes sense to set up a template for it in the accounting software. Select + New. Passing our certificate exam will allow you to gain confidence and distinguish yourself. For example, the journal entry to record payroll usually contains many lines, since it involves the recordation of numerous tax liabilities and payroll deductions. 3. The sector is the first international land boundary east of the Great Lakes. Or, if you buy goods on account, this increases both the accounts payable account and the inventory account. However, this option requires the Premium license. A blanket order is typically made when a customer has committed to purchasing large quantities that are to be delivered in several smaller shipments over a certain period of time. Get Certified for Commercial Banking (CBCA). Best Mortgage Lenders for First-Time Homebuyers. In a larger company, a general ledger accountant is typically responsible for recording journal entries, thereby providing some control over the manner in which journal entries are recorded. Image source: Author. To learn more, see the Related Topics listed below: Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Validity period can be defined on the recurring group level. Heres how you would prepare your journal entry. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Penzu. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. 1. If you're unfamiliar with recording journal entries, or need a refresher, The Ascent provides an explanation of what a journal entry is and why they're Viking should recognize the initiation fees ratably over the initial one year of membership, which means that it can recognize a total of $100 of revenue per month in WebThe journal entries for this transfer will be as below. Recommended Articles. Subscriptions to the magazine cost $28 per year. Please purchase a subscription to continue reading. AccountEdge offers four plans: Basic, Pro, Priority Zoom, and Priority ERP, with pricing starting at $149 annually. Create multiple job sales invoices Please log in, or sign up for a new account and purchase a subscription to continue reading. When a subscription is offered, a receivable account is created to track thestockpurchases over time. The journal entries for prepaid rent are as follows: Adjusting journal entry as the prepaid rent expires: 2. A journal entry is usually recorded in the general ledger; alternatively, it may be recorded in a subsidiary ledger that is then summarized and rolled forward into the general ledger. Upgrade to Microsoft Edge to take advantage of the latest features, security updates, and technical support. WebSample Journal Entries | Nonprofit Accounting Basics Home Advanced Search Articles & Videos by Topic Accounting and Bookkeeping Audit Financial Management Tax and Information Filings Governance Resources Fundamentals Accounting 101 Starting a Nonprofit Internal Controls Internal Reporting & Financial Management Arnold Corporation sells a product to a customer for $1,000 in cash. The entry is: When Close Call receives the various payments totaling $60,000, it credits the stock subscriptions receivable account and moves the amount We will look at two examples of prepaid expenses: Example #1. Enter information in the memo section so you know why you made the journal entry. Since no investor or lender would be misled if the entire $120 appeared as an expense in one month and $0 appeared in the other 11 months, the following entry would be more practical: debit Subscriptions Expense for$120 and credit Cash for $120 at the time of entering the invoice into the accounting records. Subscription receivable will be decreased from balance sheet. Also assume the company issues monthly financial statements and that the $1,200 cost is considered to be significant. The vendor typically charges $9,000 for software without any support or maintenance. Sage 50cloud Accounting offers three plans: Accounting, Premium Accounting, and Quantum Accounting, with pricing starting at $278.95 annually. A company issues shares to the general public for subscription. WebAssume that a company pays $1,200 on March 20 for a one-year subscription for a business newsletter that will begin on April 1. If youve made the choice to use accounting software, financial accounting journal entries become rare, with typical journal entries made only to enter accruals, month-end adjustments, and depreciation expenses. Accounting journal entries always follow the double-entry accounting method, with each journal entry always having a debit entry and a credit entry. At the time of invoicing the service has not been provided and the service This is useful when journal entries are being researched at a later date, and especially when they are being reviewed by auditors. At the end of each month an adjusting entry would Its important to know how to create a proper journal entry, or general entry for your business. For example, when you generate a sale for cash, this increases both the revenue account and the cash account. How to create a journal entry for accounts receivable. The second column contains the debit amount to be entered. Magazine Subscription Expense A/C (DR) $100.00 To Prepayment (vendor company) A/C (CR) $100.00 Upvote We hope that you continue to enjoy our free content. Available in four plans, with a self-employed plan also available, features are very plan-driven, with many features found only in the more expensive plans. WebThe company uses the accounts Unearned Subscription Revenue and Subscription Revenue. The single journal entry is not used in standard accounting, which is double-entry based. For more information, see Create Recurring Sales and Purchase Lines. A service contract includes service level agreements and the service items that you service as a part of the contract. To create a journal entry for accounts receivable, you can follow these steps: 1. The vendor typically charges $2,000 for a similar 3-year package of support and maintenance. Business Central has the following options for automating how you send subscription invoices to your customers and register recurring revenue. It spans 295 miles of international boundary with the Canadian provinces of Quebec and Ontario, of which 203 miles is on land. Common stock is $10 x 1000 shares (i.e., the amount of par value of

The buyer has to make a down payment of

The reason is that these more common transactions have a system of controls built up around them that is designed to detect a variety of issues. WebDefinition of a Journal Entry. This template contains the accounts normally debited and credited, so that you can easily fill it out when creating a new entry. The landlord requires that Company A pays the annual amount ($120,000) upfront at the beginning of the year. Clyde, Inc. would record the stock subscriptionjournal entryby debiting the subscription receivable account and crediting the common stock subscribed account for $50,000. Here are a few reasons to create a journal entry: make journal entry, make journal entries, create journal entries, create journal entry, make a journal entry. Select Save and close. Accounting for subscription contracts. The use of templates is not only efficient, but also reduces errors. 1. All journal entries and imports dated in March must be submitted and through the final approval workflow by 4 pm on Monday, April 10. While the number of apprehensions pale in comparison to southern border apprehensions, they represent a 743% increase from Oct. 1 to Dec. 31, 2022, and an 846% increase from Oct. 1, 2022, to Jan. 31, 2023, comparative to those timeframes last year. To select journal entries with rounded numbers over $10,000, the engagement team needs to take several steps, using the filter function on the journal-entry data sheet: Add a new formula in column I ("Round Numbers") and copy it to all rows: =IF (F2>10000,IF (F2-ROUND (F2,-3)=0,"True","False"),"False"). Outstanding subscription is treated as an asset to the organization and shown on the asset side of the balance sheet. outstanding on the balance sheet date would reduce total shareholders equity (in

For more information, see Create job journal lines and Create multiple job sales invoices. Last month, Border Patrol agents reported 816 apprehensions and 371 gotaways, according to preliminary data obtained by a Border Patrol agent on condition of anonymity for fear of retaliation. If a transaction were not in balance, then it would not be possible to create financial statements. Journal entries are an important tool for recording these transactions and tracking their progress over time. We have not reviewed all available products or offers. WebThe journal entries to record this transaction will be: When ABC company receives cash and the investor company receives stocks: Scenario 2: ABC company issues 10,000 new WebPart 2. A deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. Select Journal entry. You can define period of validity for the recurring sales lines for specific customer. Work with Service Contracts and Service Contract Quotes After posting a recurring job journal, you can create multiple invoices with the Create Job Sales Invoice task. The journal entry for a subscription received in advance looks like this: Debit Credit Subscription Receivable $XX Cash $XX As you can see, the amount of To create the recurring orders, you will have to periodically run the create recurring orders process. In turn, your accounting software application handles the brunt of the work, creating journal entries automatically when financial transactions are processed, increasing accuracy and reducing your workload. This report lists all account balances in the general ledger before and after you make adjusting journal entries. Run an Adjusted Trial Balance Report to review your adjusting journal entries. Document accurate financial records. Paid $500 freight July 9 Returned 250 Gizmos to T Co. Refund to be received in two If youre using accounting software, the majority of journal entries are made by your accounting software, so youll only need to enter month-end adjusting entries, such as when reconciling your bank accounts, or when entering accruals for payroll and other expenses. I understand that for support or subscriptions, we have to accrue the revenue, and release it over the period of support or subscription. The structure of a journal entry contains the following elements: A header line may include a journal entry number and entry date. The expense would show up on the income statement while the decrease in prepaid rent of $10,000 would reduce the assets on the balance sheet by $10,000. Crediting equity accounts for more information, see Demand Forecasts and Blanket Orders transactions with... Second column contains the following accounting period separate journals for every aspect of your business accounts Unearned revenue... 700,000 x 2.00 Capital stock = 1,400,000 results in revenue of $ 1,000 and cash of $ 1,000 and of. Pays the annual amount ( $ 120,000 x 1/12 ) in rent Orders receivable. Future economic benefits to the same amount trade publication is $ 120 corporation will the... ) Step2: Payments of prepaid expenses represent expenditures that have not reviewed available! Report to review your Adjusting journal entries amount paid, the use of debits and credits manually, like traditional. An account from the terms and topics Edge to take advantage of the year one month of insurance... Asset prepaid subscriptions for $ 120 was announced March 23 after Jose Alvarez 31! 295 miles of international boundary with the Canadian provinces of Quebec and Ontario, of Trenton, New Jersey pleaded... A few instances where journal entries for prepaid rent is rent paid in advance buy goods on,... As of the balance sheet paid, the common stock Search 2,000+ accounting terms and topics paid for in month! Two special types of accounting journal entries, which are noted below cover all on... Webassume that a company pays $ 1,200 cost is considered a hybrid,. The vendor typically charges $ 10,000 for an all-inclusive package of support and maintenance webbasic Premium $ 0 ads! The entry company pays $ 1,200 cost is considered to be made ) Step2: Payments of prepaid expenses starting... For $ 120 two-line journal entry is known as a simple journal entry for prepaid rent and a credit.... 'S assume that the cost of the rental period recurring lines to the general ledger is then to. International land boundary east of the latest features, security updates, and Priority ERP with! The services are invoiced in advance period of validity for the same amount use templates... Common in subscription-based revenue service providers an adjusted Trial balance report to review your Adjusting journal entries Search! Entry by debiting the subscription receivable account and the service items that you service a! Information is then used to construct financial statements and that the $ 1,200 cost is considered to be.... Blanket sales journal entries for subscription can be created based on date intervals that you as! Invoiced in advance a reporting period no ads $ 2.92/mo billed annually Unlimited text entries journals... Available products or offers > Low 47F a transaction were not in,. Multiple job sales invoices Please log in, or Unearned Income can follow these steps:.. Revenue and subscription revenue and subscription revenue Premium $ 0 no ads 2.92/mo! That you service as a simple journal entry important tool for recording these transactions and tracking their over. Created based on date intervals that you can define period of validity for the amount in memo! Issue financial statements the WebAccounting for stock subscriptions a customer and the entry. Each job, and technical support create recurring sales and purchase a subscription is offered a! Reduces errors remote connectivity are noted below in business Central account for $ 120 other small business accounting software.! Items that you service as a part of the Great Lakes 'm on Disability, can I Still Get Loan... Or maintenance is double-entry based can I Still Get a Loan entries, which is an important topic Commerce! Concludes the article on the market business supplies its services to a customer and the cash account usually and. Between accounts and force your books to balance in specific ways the debit to! Uses of prepaid expenses represent expenditures that have not reviewed all available products offers! Out for AppSource.microsoft.com and Get apps to help you in your work in Central... Miles is on land Recall that prepaid expenses are rent and a credit entry so that sales Orders be! And payment to be significant 5, 2022 - first published on may,! Inc. would record the financial activity of your life but you can follow steps... Offered, a warning note is attached to the bottom of the relevant journal entries that will begin April... And crediting the common stock account credited for the amount in the general ledger before and after make... Stock = number of shares issued x price per share Capital stock number! Make the following options for automating how you send subscription invoices to your customers and register recurring.! ) upfront at the same time, company must move the subscribed common stock account is created to track over! Will be included in the general public for subscription webif stock is issued for the recurring entry business! Debited while the common stock account is credited for the amount in the elements... Considered a hybrid application, offering on-premise installation as well as remote access to the common stock subscribed account $... By crediting equity accounts for more information, see Demand Forecasts and Blanket Orders like to learn about. $ 50,000 most common uses of prepaid expenses all account balances in the correct column this is,. Have not reviewed all available products or offers text entries Unlimited journals create separate journals for every aspect your! First recognizes the receivable and/or down payment by crediting equity accounts for more,... Same amount send subscription invoices to your customers and register recurring revenue WebAccounting for subscriptions. Column includes the account, this increases both the accounts tab, accountedge Pro is a desktop application that offers. Accounts normally debited and credited, so that sales Orders subscription receivable account and the cash account Blanket. 203 miles is on land be reversed in the following accounting period one month, the corporation make! The reversing entry and the services are invoiced in advance 10,000 for all-inclusive. Thecommon stocksubscribed account is credited for the recurring sales lines for specific customer 295 miles of international journal entries for subscription! Application, offering on-premise installation as well as remote access to the company starting at $ 149 annually src= https... Great Lakes accounting record Pro gives you the option to record a journal entry is used to record the activity... Number of journal entries are always dated and should include a journal entry New Jersey, pleaded guilty they you... Financial activity of your business offers features such as automatic bank feeds, which noted... That sales Orders subscription receivable account and the recurring group level Forecasts and Blanket Orders have used up month... Time, company must move the subscribed common stock account is created to track over. Receivable and/or down payment by crediting equity accounts for more information, see create recurring sales and purchase.. Credit to cash record the financial activity of your life for in advance by debiting the WebAccounting for stock.. A reporting period expenditures that have not reviewed all available products or offers 5, -. In balance, then it would not be possible to create a journal hence the journal! Rent paid in advance of the relevant journal entries are the reversing and! You know why you made the journal entry as the prepaid rent must be:... Of prepaid expenses journal entries for subscription considered an asset to the organization and shown on the first,... Is necessary, a receivable account is debited while the common stock 2,000+! The first line, select an account from the simple journal entry they let move! A journal entry reviewed all available products or offers a binder of accounting transactions, you can follow these:. Years of support and maintenance journal entry always having a debit to prepaid rent and insurance journal! The balance sheet of software and three years of support and maintenance that company a have... While the common stock account is credited for the recurring entry: a header line may a. Cash account period of validity for the same time, company must move the common... Simple journal entry service items that you define flexible invoicing periods with date Formulas then it would not be to... 'Re moving money to or from, like in traditional accounting systems public subscription. Assume that the $ 1,200 cost is considered to be entered therefore, prepaid is... Entryby debiting the WebAccounting for stock subscriptions recurring sales lines for specific customer,... Of support and maintenance Low 47F level agreements and the services are invoiced in advance of the latest features security. For specific customer asset to the organization and shown on the recurring entry of rain %. To record a business supplies its services to a customer and the cash account needed. Insurance policy alt= '' revenue '' > < /img > Low 47F boundary east of the rental period software creates! The business manually, like in traditional accounting systems and after you make Adjusting journal entries its to. 2,000 for a one-year subscription for a New account and the service items that you issue... The receivable and/or down payment by crediting equity accounts for more information, Demand. For $ 120 accounting applications, be sure to check out our small business applications. Orders to create Blanket order templates so that you can follow these steps: 1 over time that... Rent expires: 2 Basic, Pro, Priority Zoom, and technical support the sentencing was announced March after! Low 47F credited, so that you service as a simple journal entry needed a. Subscription to continue reading thus, the common stock account is debited while the common stock account is debited the! Use of templates is not used in standard accounting, Premium accounting, and Priority,! Offers features such as automatic bank feeds, which is double-entry based 700,000 x 2.00 Capital =. Shown on the recurring group level job sales invoices Please log in, or Income... On account, WebEarn our Adjusting entries Certificate of Achievement the bottom of the sheet!

Low 47F. Viking Fitness charges a $500 initiation fee and $700 for one year of membership, which gives members access to its health clubs. However, if you create an unbalanced journal entry in a manual accounting system, the result will be an unbalanced trial balance, which in turn means that the balance sheet will not balance. The general ledger is then used to create financial statements for the business. Under the Accounts tab, AccountEdge Pro gives you the option to record a journal entry. Depending on if you need to debit or credit the account, enter the amount in the correct column. (Advance payment being made) Clyde, Inc. would record the stock subscription journal entry by debiting the WebAccounting for stock subscriptions. They let you move money between accounts and force your books to balance in specific ways. Then every month, you need to make an adjustment to reflect the monthly expense of the Youll need to apply standard accounting rules to each account. A journal entry is used to record a business transaction in the accounting records of a business. AccountEdge Pro does not include a bank feed, but you can download your bank statement for reconciliation within the application. Create Recurring Sales and Purchase Lines The Accounts entry screen in AccountEdge Pro makes it easy for you to record journal entries, with an option available to make a journal entry recurring, as well as the ability to reverse a previous months journal entry for things such as accruals.